What is Par Value?

par value is considered the bond’s Face Value. This one is an essential Factor for a fixed-Income instrument or a bond as it comprehends the maturity value.

The Market price of the bond could be below or above Par, based on factors, like the interest rates’ level, the credit status of the bond and more.

Understanding Par Value

For a share, par value is the stock value that is mentioned in the corporate charter. Usually, shares don’t have any par value or may have a minimum par value, such as a cent per share. As far as the equity is concerned, the par value has little relation to the market price of the share.

Par Value of Bonds

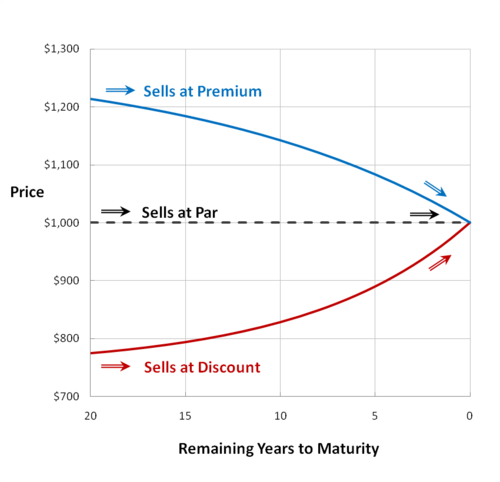

For a bond, one of the essential aspects is the par value. Here, the par value is referred to the money amount that bond issuers affirm to pay bondholders at the time of maturity of the bond. Essentially, a bond is a written promise that the loaned amount to the issuer will be eventually repaid. It is not necessary to issue Bonds at their par value. They could be issued at a discount or at a premium based on the interest rates’ level in the Economy.

A bond that trades above par is referred to as the one trading at a premium. And a bond that is trading below par is at a discount. During the times when the interest rates are on their low or have been trading on the lower side, a massive proportion of bonds will begin trading at a premium or above par. When interest rates are on the higher side, the larger proportion of bonds will be trading at a discount. The bond’s coupon rate, in comparison to the interest rates, in an economy comprehends whether the bond will trade above, below or at its par value.

Talk to our investment specialist

Par Value of Stocks

Some of the states need companies to set up their par values below which shares are not allowed to be sold. To adhere to this regulation, a majority of firms set their stocks’ par value to the lowest possible amount. Also, some states even allow the stock issuance to have no par value at all. For such stocks, there seems to be no arbitrary amount above which a firm is allowed to sell. It is easier for an investor, however, to figure out no-par stocks on the stock certificates as they’ll have “no par value” printed.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.