ಇತರ ತೆರಿಗೆ ಉಳಿತಾಯ ಹೂಡಿಕೆಗಳ ಮೇಲೆ ELSS ಏಕೆ

ELSS ಇಕ್ವಿಟಿ ಲಿಂಕ್ಡ್ ಸೇವಿಂಗ್ಸ್ ಸ್ಕೀಮ್ ಎಂದೂ ಕರೆಯಲ್ಪಡುವ ನಿಧಿಗಳು ಇಕ್ವಿಟಿ-ವೈವಿಧ್ಯೀಕೃತ ತೆರಿಗೆ ಉಳಿತಾಯ ಮ್ಯೂಚುಯಲ್ ಫಂಡ್ ಆಗಿದ್ದು ಅದು ತನ್ನ ಸ್ವತ್ತುಗಳನ್ನು ಮುಖ್ಯವಾಗಿ ಹೂಡಿಕೆ ಮಾಡುತ್ತದೆಈಕ್ವಿಟಿಗಳು ಅಥವಾ ಷೇರು ಮಾರುಕಟ್ಟೆಗಳಂತಹ ಈಕ್ವಿಟಿ-ಸಂಯೋಜಿತ ಉಪಕರಣಗಳು. ELSSಮ್ಯೂಚುಯಲ್ ಫಂಡ್ಗಳು ನೀಡುತ್ತವೆಮಾರುಕಟ್ಟೆ-ಲಿಂಕ್ಡ್ ರಿಟರ್ನ್ಸ್, ಇದು ಬಾಷ್ಪಶೀಲ ಮತ್ತು ಮಾರುಕಟ್ಟೆ ಪರಿಸ್ಥಿತಿಗಳ ಮೇಲೆ ಅವಲಂಬಿತವಾಗಿದೆ. ಆದಾಗ್ಯೂ,ಆರ್ಥಿಕ ಸಲಹೆಗಾರರು ಸೂಚಿಸುತ್ತದೆಹೂಡಿಕೆ ದೀರ್ಘಾವಧಿಯವರೆಗೆ ELSS ಫಂಡ್ಗಳಲ್ಲಿ, ಈ ELSS ಮ್ಯೂಚುಯಲ್ ಫಂಡ್ಗಳು ದೀರ್ಘಾವಧಿಯವರೆಗೆ ಹೂಡಿಕೆ ಮಾಡಿದಾಗ ಉತ್ತಮ ಆದಾಯವನ್ನು ಗಳಿಸುತ್ತವೆ. ಇತ್ತೀಚಿನ ವರದಿಗಳಲ್ಲಿ, ELSS ಫಂಡ್ಗಳು 3 ವರ್ಷಗಳವರೆಗೆ ಹೂಡಿಕೆ ಮಾಡಿದಾಗ ಸುಮಾರು 20%-30% ಆದಾಯವನ್ನು ಗಳಿಸಿವೆ ಎಂದು ಕಂಡುಬಂದಿದೆ, ಇದು ಇತರ ಮ್ಯೂಚುಯಲ್ ಫಂಡ್ಗಳಿಂದ ಉತ್ಪತ್ತಿಯಾಗುವ ಆದಾಯಕ್ಕಿಂತ ಹೆಚ್ಚು.

ELSS ಮತ್ತು ಇತರೆ ತೆರಿಗೆ ಉಳಿತಾಯ ಹೂಡಿಕೆ ಆಯ್ಕೆಗಳ ಹೋಲಿಕೆ

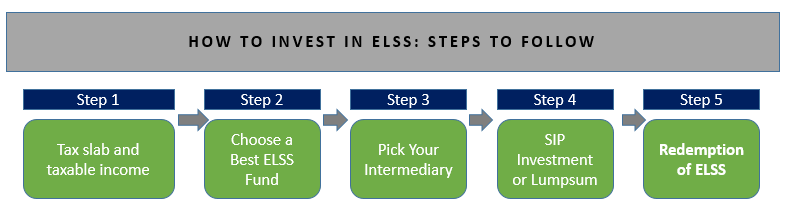

ELSS ಮತ್ತು ಇತರ ತೆರಿಗೆ ಉಳಿತಾಯದ ಹೋಲಿಕೆಯು ಅಧಿಕಾರಾವಧಿ, ಆದಾಯ, ಅರ್ಹತೆಗಳಂತಹ ನಿಯತಾಂಕಗಳನ್ನು ಆಧರಿಸಿದೆಕಡಿತಗೊಳಿಸುವಿಕೆ ಅಡಿಯಲ್ಲಿ80c, ಇತ್ಯಾದಿ

ನೋಡೋಣ:

| ಪ್ಯಾರಾಮೀಟರ್ | PPF | NSC | FD | ELSS |

|---|---|---|---|---|

| ಅಧಿಕಾರಾವಧಿ | 15 ವರ್ಷಗಳು | 6 ವರ್ಷಗಳು | 5 ವರ್ಷಗಳು | 3 ವರ್ಷಗಳು |

| ಹಿಂತಿರುಗಿಸುತ್ತದೆ | 7.60 % (ವಾರ್ಷಿಕವಾಗಿ ಸಂಯೋಜಿತ) | 7.60 % (ವಾರ್ಷಿಕವಾಗಿ ಸಂಯೋಜಿತ) | 7.00 - 8.00 % (ವಾರ್ಷಿಕವಾಗಿ ಸಂಯೋಜಿತ) | ಯಾವುದೇ ಖಚಿತವಾದ ಡಿವಿವಿಡೆಂಡ್ / ರಿಟರ್ನ್ ಅನ್ನು ಮಾರುಕಟ್ಟೆ ಲಿಂಕ್ ಮಾಡಿದಂತೆ |

| ಕನಿಷ್ಠ ಬಂಡವಾಳ | ರೂ. 500 | ರೂ. 100 | ರೂ. 1000 | ರೂ. 500 |

| ಗರಿಷ್ಠ ಬಂಡವಾಳ | ರೂ. 1.5 ಲಕ್ಷ | ಯಾವುದೇ ಮೇಲಿನ ಮಿತಿಯಿಲ್ಲ | ಯಾವುದೇ ಮೇಲಿನ ಮಿತಿಯಿಲ್ಲ | ಯಾವುದೇ ಮೇಲಿನ ಮಿತಿಯಿಲ್ಲ |

| 80c ಅಡಿಯಲ್ಲಿ ಕಡಿತಕ್ಕೆ ಅರ್ಹವಾದ ಮೊತ್ತ | ರೂ. 1.5 ಲಕ್ಷ | ರೂ. 1.5 ಲಕ್ಷ | ರೂ. 1.5 ಲಕ್ಷ | ರೂ. 1.5 ಲಕ್ಷ |

| ಬಡ್ಡಿ/ರಿಟರ್ನ್ಗಾಗಿ ತೆರಿಗೆ | ತೆರಿಗೆ ಮುಕ್ತ | ಬಡ್ಡಿ ತೆರಿಗೆ ವಿಧಿಸಬಹುದಾಗಿದೆ | ಬಡ್ಡಿ ತೆರಿಗೆ ವಿಧಿಸಬಹುದಾಗಿದೆ | 1 ಲಕ್ಷದವರೆಗಿನ ಲಾಭವು ತೆರಿಗೆಯಿಂದ ಮುಕ್ತವಾಗಿದೆ. 1 ಲಕ್ಷಕ್ಕಿಂತ ಹೆಚ್ಚಿನ ಲಾಭಗಳಿಗೆ 10% ತೆರಿಗೆ ಅನ್ವಯಿಸುತ್ತದೆ |

| ಸುರಕ್ಷತೆ/ರೇಟಿಂಗ್ಗಳು | ಸುರಕ್ಷಿತ | ಸುರಕ್ಷಿತ | ಸುರಕ್ಷಿತ | ಅಪಾಯ |

2022 ರಲ್ಲಿ ಹೂಡಿಕೆ ಮಾಡಲು ಟಾಪ್ 5 ELSS ಫಂಡ್ಗಳು

ನಿವ್ವಳ ಸ್ವತ್ತುಗಳು/AUM ನಡುವೆ ಇರುವ ಫಂಡ್ಗಳ ಪಟ್ಟಿಯನ್ನು ಕೆಳಗೆ ನೀಡಲಾಗಿದೆ100-200 ಕೋಟಿ.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) IDBI Equity Advantage Fund Growth ₹43.39

↑ 0.04 ₹485 9.7 15.1 16.9 20.8 10 HDFC Long Term Advantage Fund Growth ₹595.168

↑ 0.28 ₹1,318 1.2 15.4 35.5 20.6 17.4 BNP Paribas Long Term Equity Fund (ELSS) Growth ₹92.6382

↓ -1.20 ₹911 -6.7 -2.9 10.5 17.8 11.8 4.8 Baroda Pioneer ELSS 96 Growth ₹68.6676

↑ 0.33 ₹210 -6.1 -3.5 17.6 16.7 11.6 JM Tax Gain Fund Growth ₹44.8596

↓ -0.42 ₹216 -9.7 -8.2 4.6 16.4 13.4 2.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 28 Jul 23 Research Highlights & Commentary of 5 Funds showcased

Commentary IDBI Equity Advantage Fund HDFC Long Term Advantage Fund BNP Paribas Long Term Equity Fund (ELSS) Baroda Pioneer ELSS 96 JM Tax Gain Fund Point 1 Lower mid AUM (₹485 Cr). Highest AUM (₹1,318 Cr). Upper mid AUM (₹911 Cr). Bottom quartile AUM (₹210 Cr). Bottom quartile AUM (₹216 Cr). Point 2 Established history (12+ yrs). Oldest track record among peers (25 yrs). Established history (20+ yrs). Established history (11+ yrs). Established history (17+ yrs). Point 3 Top rated. Rating: 3★ (upper mid). Rating: 3★ (lower mid). Not Rated. Rating: 3★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 9.97% (bottom quartile). 5Y return: 17.39% (top quartile). 5Y return: 11.83% (lower mid). 5Y return: 11.62% (bottom quartile). 5Y return: 13.35% (upper mid). Point 6 3Y return: 20.84% (top quartile). 3Y return: 20.64% (upper mid). 3Y return: 17.76% (lower mid). 3Y return: 16.70% (bottom quartile). 3Y return: 16.44% (bottom quartile). Point 7 1Y return: 16.92% (lower mid). 1Y return: 35.51% (top quartile). 1Y return: 10.49% (bottom quartile). 1Y return: 17.56% (upper mid). 1Y return: 4.63% (bottom quartile). Point 8 Alpha: 1.78 (upper mid). Alpha: 1.75 (lower mid). Alpha: 0.43 (bottom quartile). Alpha: 5.69 (top quartile). Alpha: -4.56 (bottom quartile). Point 9 Sharpe: 1.21 (lower mid). Sharpe: 2.27 (upper mid). Sharpe: 0.23 (bottom quartile). Sharpe: 2.51 (top quartile). Sharpe: -0.12 (bottom quartile). Point 10 Information ratio: -1.13 (bottom quartile). Information ratio: -0.15 (bottom quartile). Information ratio: 0.60 (top quartile). Information ratio: -0.09 (lower mid). Information ratio: 0.46 (upper mid). IDBI Equity Advantage Fund

HDFC Long Term Advantage Fund

BNP Paribas Long Term Equity Fund (ELSS)

Baroda Pioneer ELSS 96

JM Tax Gain Fund

Talk to our investment specialist

The Scheme will seek to invest predominantly in a diversified portfolio of equity and equity related instruments with the objective to provide investors with opportunities for capital appreciation and income along with the benefit of income-tax deduction(under section 80C of the Income-tax Act, 1961) on their investments. Investments in this scheme would be subject to a statutory lock-in of 3 years from the date of allotment to be eligible for income-tax benefits under Section 80C. There can be no assurance that the investment objective under the scheme will be realized. Below is the key information for IDBI Equity Advantage Fund Returns up to 1 year are on To generate long term capital appreciation from a portfolio that is predominantly in equity and equity related instruments Research Highlights for HDFC Long Term Advantage Fund Below is the key information for HDFC Long Term Advantage Fund Returns up to 1 year are on The investment objective of the Scheme is to generate long-term capital growth from a diversified and actively managed portfolio of equity and equity related securities along with income tax rebate, as may be prevalent fromtime to time. However, there can be no assurance that the investment objective of the Scheme will be achieved. The Scheme does not guarantee / indicate any returns. Research Highlights for BNP Paribas Long Term Equity Fund (ELSS) Below is the key information for BNP Paribas Long Term Equity Fund (ELSS) Returns up to 1 year are on The main objective of the scheme is to provide the investor long term capital growth as also tax benefit under section 80C of the Income Tax Act, 1961. Research Highlights for Baroda Pioneer ELSS 96 Below is the key information for Baroda Pioneer ELSS 96 Returns up to 1 year are on The investment objective is to generate long-term capital growth from a diversified and actively managed portfolio of equity and equity related securities and to enable investors a deduction from total income, as permitted under the Income Tax Act, 1961 from time to time. However, there can be no assurance that the investment objectives of the Scheme will be realized. The Scheme does not guarantee/indicate any returns. Research Highlights for JM Tax Gain Fund Below is the key information for JM Tax Gain Fund Returns up to 1 year are on 1. IDBI Equity Advantage Fund

IDBI Equity Advantage Fund

Growth Launch Date 10 Sep 13 NAV (28 Jul 23) ₹43.39 ↑ 0.04 (0.09 %) Net Assets (Cr) ₹485 on 30 Jun 23 Category Equity - ELSS AMC IDBI Asset Management Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.39 Sharpe Ratio 1.21 Information Ratio -1.13 Alpha Ratio 1.78 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,657 28 Feb 23 ₹11,985 Returns for IDBI Equity Advantage Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 3.1% 3 Month 9.7% 6 Month 15.1% 1 Year 16.9% 3 Year 20.8% 5 Year 10% 10 Year 15 Year Since launch 16% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for IDBI Equity Advantage Fund

Name Since Tenure Data below for IDBI Equity Advantage Fund as on 30 Jun 23

Equity Sector Allocation

Sector Value Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 2. HDFC Long Term Advantage Fund

HDFC Long Term Advantage Fund

Growth Launch Date 2 Jan 01 NAV (14 Jan 22) ₹595.168 ↑ 0.28 (0.05 %) Net Assets (Cr) ₹1,318 on 30 Nov 21 Category Equity - ELSS AMC HDFC Asset Management Company Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.25 Sharpe Ratio 2.27 Information Ratio -0.15 Alpha Ratio 1.75 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000

Purchase not allowed Returns for HDFC Long Term Advantage Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 4.4% 3 Month 1.2% 6 Month 15.4% 1 Year 35.5% 3 Year 20.6% 5 Year 17.4% 10 Year 15 Year Since launch 21.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for HDFC Long Term Advantage Fund

Name Since Tenure Data below for HDFC Long Term Advantage Fund as on 30 Nov 21

Equity Sector Allocation

Sector Value Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 3. BNP Paribas Long Term Equity Fund (ELSS)

BNP Paribas Long Term Equity Fund (ELSS)

Growth Launch Date 5 Jan 06 NAV (11 Mar 26) ₹92.6382 ↓ -1.20 (-1.27 %) Net Assets (Cr) ₹911 on 31 Jan 26 Category Equity - ELSS AMC BNP Paribas Asset Mgmt India Pvt. Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 2.21 Sharpe Ratio 0.23 Information Ratio 0.6 Alpha Ratio 0.43 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,318 28 Feb 23 ₹11,129 29 Feb 24 ₹15,576 28 Feb 25 ₹16,103 28 Feb 26 ₹19,084 Returns for BNP Paribas Long Term Equity Fund (ELSS)

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month -7.2% 3 Month -6.7% 6 Month -2.9% 1 Year 10.5% 3 Year 17.8% 5 Year 11.8% 10 Year 15 Year Since launch 11.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 4.8% 2023 23.6% 2022 31.3% 2021 -2.1% 2020 23.6% 2019 17.8% 2018 14.3% 2017 -9.3% 2016 42.3% 2015 -6.6% Fund Manager information for BNP Paribas Long Term Equity Fund (ELSS)

Name Since Tenure Sanjay Chawla 14 Mar 22 3.89 Yr. Pratish Krishnan 14 Mar 22 3.89 Yr. Data below for BNP Paribas Long Term Equity Fund (ELSS) as on 31 Jan 26

Equity Sector Allocation

Sector Value Financial Services 32.35% Consumer Cyclical 15.45% Industrials 11.56% Technology 11.49% Basic Materials 8.15% Health Care 6.35% Consumer Defensive 4.21% Energy 3.92% Communication Services 3.13% Utility 1.23% Asset Allocation

Asset Class Value Cash 2.14% Equity 97.84% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Oct 08 | HDFCBANK7% ₹61 Cr 656,320 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 12 | ICICIBANK5% ₹45 Cr 329,900 Reliance Industries Ltd (Energy)

Equity, Since 31 Oct 18 | RELIANCE4% ₹36 Cr 255,800 State Bank of India (Financial Services)

Equity, Since 31 Mar 22 | SBIN3% ₹30 Cr 278,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 May 19 | BHARTIARTL3% ₹29 Cr 144,966 Infosys Ltd (Technology)

Equity, Since 29 Feb 24 | INFY3% ₹26 Cr 158,994 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Apr 20 | LT3% ₹25 Cr 62,520 Tech Mahindra Ltd (Technology)

Equity, Since 31 May 25 | TECHM3% ₹23 Cr 134,100 Sagility Ltd (Healthcare)

Equity, Since 30 Nov 24 | SAGILITY2% ₹23 Cr 4,551,400 TVS Motor Co Ltd (Consumer Cyclical)

Equity, Since 30 Sep 23 | TVSMOTOR2% ₹22 Cr 60,500 4. Baroda Pioneer ELSS 96

Baroda Pioneer ELSS 96

Growth Launch Date 2 Mar 15 NAV (11 Mar 22) ₹68.6676 ↑ 0.33 (0.48 %) Net Assets (Cr) ₹210 on 31 Jan 22 Category Equity - ELSS AMC Baroda Pioneer Asset Management Co. Ltd. Rating Risk Moderately High Expense Ratio 2.55 Sharpe Ratio 2.51 Information Ratio -0.09 Alpha Ratio 5.69 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹12,210 Returns for Baroda Pioneer ELSS 96

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month -3.9% 3 Month -6.1% 6 Month -3.5% 1 Year 17.6% 3 Year 16.7% 5 Year 11.6% 10 Year 15 Year Since launch 8.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for Baroda Pioneer ELSS 96

Name Since Tenure Data below for Baroda Pioneer ELSS 96 as on 31 Jan 22

Equity Sector Allocation

Sector Value Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 5. JM Tax Gain Fund

JM Tax Gain Fund

Growth Launch Date 31 Mar 08 NAV (11 Mar 26) ₹44.8596 ↓ -0.42 (-0.94 %) Net Assets (Cr) ₹216 on 31 Jan 26 Category Equity - ELSS AMC JM Financial Asset Management Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.37 Sharpe Ratio -0.12 Information Ratio 0.46 Alpha Ratio -4.56 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,792 28 Feb 23 ₹12,113 29 Feb 24 ₹17,481 28 Feb 25 ₹18,094 28 Feb 26 ₹20,367 Returns for JM Tax Gain Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month -8.4% 3 Month -9.7% 6 Month -8.2% 1 Year 4.6% 3 Year 16.4% 5 Year 13.4% 10 Year 15 Year Since launch 8.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 2.5% 2023 29% 2022 30.9% 2021 0.5% 2020 32.2% 2019 18.3% 2018 14.9% 2017 -4.6% 2016 42.6% 2015 5.2% Fund Manager information for JM Tax Gain Fund

Name Since Tenure Satish Ramanathan 1 Oct 24 1.34 Yr. Asit Bhandarkar 31 Dec 21 4.09 Yr. Ruchi Fozdar 4 Oct 24 1.33 Yr. Deepak Gupta 11 Apr 25 0.81 Yr. Data below for JM Tax Gain Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Financial Services 28.42% Consumer Cyclical 15.57% Technology 11.47% Industrials 10.28% Basic Materials 8.65% Health Care 8.39% Consumer Defensive 3.74% Real Estate 3.59% Energy 3.45% Communication Services 3.01% Asset Allocation

Asset Class Value Cash 3.43% Equity 96.57% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Dec 11 | HDFCBANK4% ₹9 Cr 98,262 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 10 | LT4% ₹8 Cr 19,647 Reliance Industries Ltd (Energy)

Equity, Since 30 Jun 25 | RELIANCE3% ₹7 Cr 53,400 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Mar 22 | ICICIBANK3% ₹7 Cr 48,500 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Mar 24 | BHARTIARTL3% ₹6 Cr 32,950

↑ 7,500 Karur Vysya Bank Ltd (Financial Services)

Equity, Since 30 Apr 25 | 5900033% ₹6 Cr 199,000 Max Financial Services Ltd (Financial Services)

Equity, Since 31 May 25 | MFSL3% ₹6 Cr 36,400 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 30 Sep 24 | MARUTI3% ₹6 Cr 3,956 CarTrade Tech Ltd (Consumer Cyclical)

Equity, Since 30 Sep 25 | 5433333% ₹5 Cr 20,655

↑ 3,300 Lupin Ltd (Healthcare)

Equity, Since 31 May 25 | LUPIN2% ₹5 Cr 25,000

ಇತರ ತೆರಿಗೆ ಉಳಿತಾಯ ಹೂಡಿಕೆಗಳಿಗಿಂತ ELSS ಹೇಗೆ ಉತ್ತಮವಾಗಿದೆ?

ವಿವಿಧ ಇವೆತೆರಿಗೆ ಉಳಿತಾಯ ಹೂಡಿಕೆ ಭಾರತದಲ್ಲಿನ ಆಯ್ಕೆಗಳಲ್ಲಿ ELSS ಅತ್ಯುತ್ತಮ ಆಯ್ಕೆಗಳಲ್ಲಿ ಒಂದಾಗಿದೆ. ಹೇಗೆ? ಇಲ್ಲಿ ಕೆಲವು ಕಾರಣಗಳನ್ನು ಉಲ್ಲೇಖಿಸಲಾಗಿದೆ.

ದೀರ್ಘಾವಧಿಯಲ್ಲಿ ಹೆಚ್ಚಿನ ಆದಾಯ

ELSS ನಿಧಿಗಳು ಇತರ ತೆರಿಗೆ ಉಳಿತಾಯ ಹೂಡಿಕೆಗಳ ನಡುವೆ ಷೇರು ಮಾರುಕಟ್ಟೆಯಲ್ಲಿ ಹೆಚ್ಚಿನ ಸಂಖ್ಯೆಯ ಆಸ್ತಿಗಳನ್ನು ನಿಯೋಜಿಸುತ್ತವೆ. ಆದ್ದರಿಂದ, ಈ ನಿಧಿಗಳು ಉತ್ತಮವಾಗಿ ಗಳಿಸುತ್ತವೆಹಣದುಬ್ಬರ-ಎಲ್ಲರ ನಡುವೆ ಬೀಟಿಂಗ್ ರಿಟರ್ನ್ಸ್. ದೀರ್ಘಾವಧಿಯವರೆಗೆ ಹೂಡಿಕೆ ಮಾಡಿದರೆ, ELSS ನ ಆದಾಯದ ದರವು ಇತರ ಸಾಂಪ್ರದಾಯಿಕ ಸಾಲ-ಆಧಾರಿತ ಹೂಡಿಕೆಗಳ ಆದಾಯವನ್ನು ಸುಲಭವಾಗಿ ಸೋಲಿಸಬಹುದು. ಆದ್ದರಿಂದ, ELSS ಮ್ಯೂಚುಯಲ್ ಫಂಡ್ಗಳು ಹೂಡಿಕೆದಾರರಿಗೆ ಎರಡೂ ಪ್ರಪಂಚದ ಅತ್ಯುತ್ತಮವಾದ-ಹೆಚ್ಚಿನ ಆದಾಯ ಮತ್ತು ತೆರಿಗೆ ಪ್ರಯೋಜನಗಳನ್ನು ಒದಗಿಸುತ್ತವೆ.

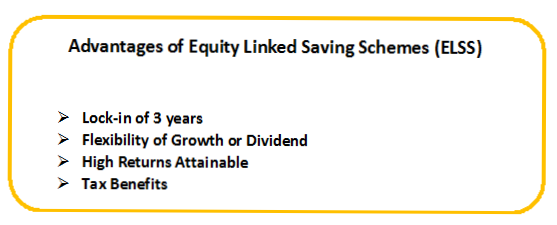

ಕಡಿಮೆ ಲಾಕ್-ಇನ್ ಅವಧಿ

ಸಾಂಪ್ರದಾಯಿಕ ತೆರಿಗೆ ಉಳಿತಾಯ ಹೂಡಿಕೆ ಆಯ್ಕೆಗಳಿಗೆ ಹೋಲಿಸಿದರೆ ELSS ಮ್ಯೂಚುಯಲ್ ಫಂಡ್ಗಳು ಕಡಿಮೆ ಲಾಕ್-ಇನ್ ಅವಧಿಯನ್ನು ಹೊಂದಿವೆ. ELSS ಫಂಡ್ಗಳ ಲಾಕ್-ಇನ್ ಅವಧಿಯು 3 ವರ್ಷಗಳು ಮತ್ತು PPF ನ ಅವಧಿಯು 15 ವರ್ಷಗಳು ಮತ್ತುNPS ತನಕ ಆಗಿದೆನಿವೃತ್ತಿ. ಆದ್ದರಿಂದ, ELSS ನಲ್ಲಿ ಹೂಡಿಕೆ ಮಾಡುವುದರಿಂದ ನಿಮ್ಮ ಹಣವು ದೀರ್ಘಾವಧಿಯವರೆಗೆ ಲಾಕ್ ಆಗುವುದಿಲ್ಲ ಮತ್ತು ಲಾಕ್-ಇನ್ ಮುಗಿದ ನಂತರ ನೀವು ಹೂಡಿಕೆ ಮಾಡುವುದನ್ನು ನಿಲ್ಲಿಸಬಹುದು.

ಹೆಚ್ಚು ಹೊಂದಿಕೊಳ್ಳುವ ಹೂಡಿಕೆ

ELSS ಮ್ಯೂಚುಯಲ್ ಫಂಡ್ಗಳ ನಮ್ಯತೆಯು ಎಲ್ಲಾ ಇತರ ತೆರಿಗೆ ಉಳಿತಾಯ ಹೂಡಿಕೆಗಳಿಗಿಂತ ಹೆಚ್ಚು. ಸಾಂಪ್ರದಾಯಿಕ ಹೂಡಿಕೆಗಳಿಗಿಂತ ಭಿನ್ನವಾಗಿ, ಕೇವಲ ಒಂದು ರೀತಿಯ ಆಯ್ಕೆಯಲ್ಲಿ ಹೂಡಿಕೆ ಮಾಡುವ ಅಗತ್ಯವಿಲ್ಲ. ELSS ನಿಧಿಗಳು ವಿವಿಧ ರೀತಿಯ ಹೂಡಿಕೆಗಳೊಂದಿಗೆ ನಿಮ್ಮ ಪೋರ್ಟ್ಫೋಲಿಯೊವನ್ನು ವೈವಿಧ್ಯಗೊಳಿಸಲು ನಿಮಗೆ ಅನುವು ಮಾಡಿಕೊಡುತ್ತದೆ. ಅಲ್ಲದೆ, ಲಾಕ್-ಇನ್ ಅವಧಿ ಮುಗಿದ ನಂತರವೂ ಹೂಡಿಕೆದಾರರು ಈ ಫಂಡ್ಗಳಲ್ಲಿ ಹೂಡಿಕೆ ಮಾಡಬಹುದು. ಆದ್ದರಿಂದ, ಲಾಕ್-ಇನ್ ಮುಗಿದ ನಂತರ, ನಿಮ್ಮ ಅನುಕೂಲಕ್ಕೆ ಅನುಗುಣವಾಗಿ ಹೂಡಿಕೆಯಲ್ಲಿ ಉಳಿಯಲು ಅಥವಾ ರಿಡೀಮ್ ಮಾಡಲು ನೀವು ಸುಲಭವಾಗಿ ಆಯ್ಕೆ ಮಾಡಬಹುದು.

ತೀರ್ಮಾನ

ಕೊನೆಯಲ್ಲಿ, ELSS ಫಂಡ್ಗಳಲ್ಲಿ ಹೂಡಿಕೆ ಮಾಡುವ ಹೂಡಿಕೆದಾರರಿಗೆ ಇಲ್ಲಿ ಕೆಲವು ಸಲಹೆಗಳಿವೆ.

- ELSS ನಲ್ಲಿ ಹೂಡಿಕೆಯನ್ನು ಮೊದಲೇ ಪ್ರಾರಂಭಿಸಿ

- ನಿಮ್ಮ ಮಿತಿಯಲ್ಲಿ ಹೂಡಿಕೆ ಮಾಡಿ

- ಡಿವಿಡೆಂಡ್ ಮರುಹೂಡಿಕೆಯನ್ನು ಆಯ್ಕೆ ಮಾಡಬೇಡಿ

- ನಿಧಾನವಾಗಿ ಮತ್ತು ಕ್ರಮೇಣವಾಗಿ ಪಡೆದುಕೊಳ್ಳಿ

- ಎ ಮೂಲಕ ಹೂಡಿಕೆ ಮಾಡಿSIP

ಇಲ್ಲಿ ಒದಗಿಸಲಾದ ಮಾಹಿತಿಯು ನಿಖರವಾಗಿದೆ ಎಂದು ಖಚಿತಪಡಿಸಿಕೊಳ್ಳಲು ಎಲ್ಲಾ ಪ್ರಯತ್ನಗಳನ್ನು ಮಾಡಲಾಗಿದೆ. ಆದಾಗ್ಯೂ, ಡೇಟಾದ ನಿಖರತೆಯ ಬಗ್ಗೆ ಯಾವುದೇ ಗ್ಯಾರಂಟಿಗಳನ್ನು ನೀಡಲಾಗುವುದಿಲ್ಲ. ಯಾವುದೇ ಹೂಡಿಕೆ ಮಾಡುವ ಮೊದಲು ದಯವಿಟ್ಟು ಸ್ಕೀಮ್ ಮಾಹಿತಿ ದಾಖಲೆಯೊಂದಿಗೆ ಪರಿಶೀಲಿಸಿ.

Research Highlights for IDBI Equity Advantage Fund