Section 80EEA

First-time house buyers have a great advantage when it comes to home loans. The government of India has made additional provisions to help house buyers under the ‘Housing for All’ scheme. The income tax Act, 1961, has provision to help first-time homebuyers purchase an affordable home with extra benefits. The benefits and deduction on Home Loan interest rate is mentioned under Section 80EE and Section 80EEA.

Let’s take a look at the various aspects of Section 80EEA.

Sec 80EEA 2021 Budget Update

Tax holiday for affordable housing projects has been extended until 31 March 2022.

No ITR filing required for Senior Citizens (aged 75 years and more) having only pension and interest income.

No change in Surcharge and HEC rates and standard deduction

Date of sanction of home loan u/s 80EEA is extended. It is proposed to increase the date of loan sanction from 31st March, 2021 to 31st March, 2022.

What is Section 80EEA?

Section 80EEA was introduced in the 2019 Union budget under the housing for all by 2022 programme by the government. Under the scheme, you could a forward additional tax benefit on the purchase of affordable homes.

As per Section 80EEA - "In computing the total income of an assessee, being an individual not eligible to claim deduction under Section 80E, there shall be deducted in accordance with and subject to the provisions of this section, interest payable on loan taken by him from any financial institution for the purpose of acquisition of a residential housing property."

Amount Deductible Under Section 80EEA

Under this section, you can save an additional Rs. 1.50 lakh or the interest paid on home loans. This is above the lakhs that you may have already saved under Section 24(b).

Finance minister Nirmala Sitharaman in the Union Budget of 2019 said the interest paid on housing loan is allowed as a deduction to the extent of Rs. 2 lakh when it comes to self-occupied property. To provide for the benefit and additional deduction of Rs. 1.5 lakh for interest paid on loans taken up to March 31, 2020 will be available for purchasing affordable houses up to Rs. 45 lakhs.

This means that, if you are planning to buy an affordable house will get an enhanced interest deduction up to Rs. 3.5 lakhs.

Note that all types of buyers can claim deduction on home loan interest payment under section 24(b). The Rs. 1.50 lakh rebate against interest payment under Section 80EEA is this limit.

Deduction for Interest paid on Home loans U/S 24(b) Section 80EE & Section 80EEA

The deduction under Section 80EEA cannot be claimed with Section 80E.

The deduction under all three sections are mentioned below-

| Section 24(b) | Section 80EE | Section 80EEA |

|---|---|---|

| Under section 24(b) there is a deduction of Rs. 2 lakhs for self-occupied property and entire interest for let out property | Under section 80E deduction of Rs. 50,000 after making use of the deduction already available under 24(b) is available for first time home buyers. | Under section 80EEA additional deduction of Rs 1.5 Lakhs after receiving the limit as mentioned under section 24(b) for the first time home buyers. |

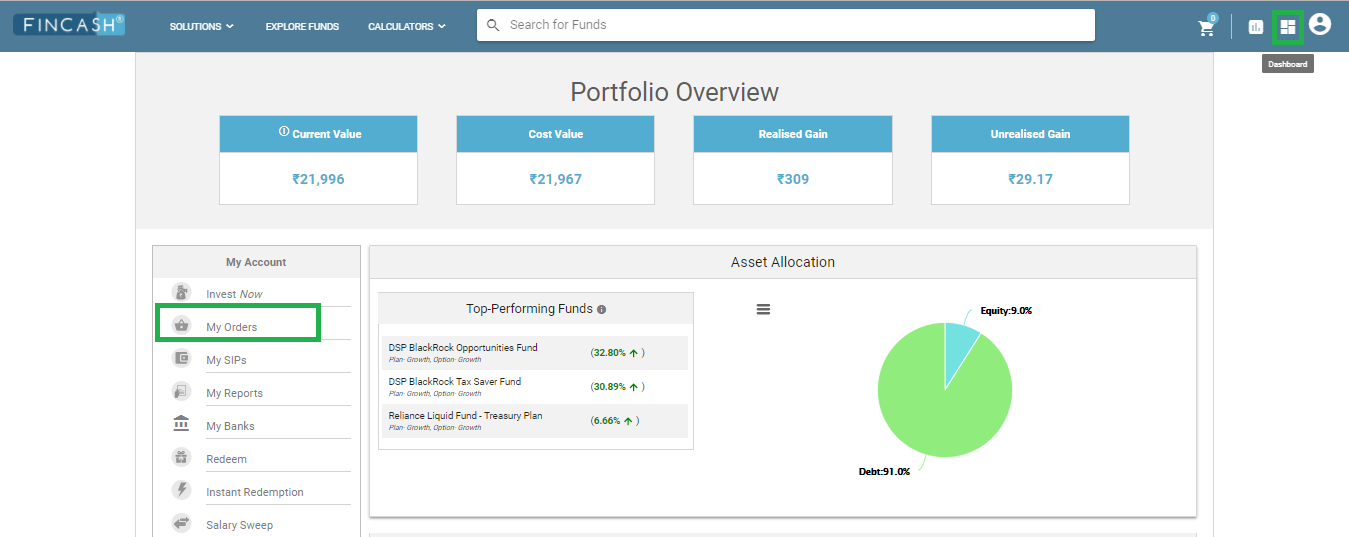

Talk to our investment specialist

Eligibility Criteria Under Section 80EEA

1. First time home buyers

The benefit under Section III can be availed only by the first time home buyers. This is because the section is a condition that the borrower of such a loan should not be owning any residential property.

2. Home loan interest

Deduction under this section can be claimed against home loan interest payment only.

3. Period

If your home loan sanction between April 1, 2019, and March 31, 2020, you are allowed to claim the benefits.

4. Buyer category

Only individuals can claim deductions under the section. hindu undivided family, etc cannot clean the benefits.

5. Home loan source

If you wish to avail the benefits under the section you have to borrow this home loan from a financial institution like a Bank and not from friends or family.

6. Property type

Deduction under the section is available for residential house properties. The deduction is available for the purchase of a residential property and not for repair maintenance or reconstruction.

7. Limitation

You cannot claim deduction under section 80EEA, if you are already claiming deduction under Section 80EE.

8. Non-residential Individuals

This section does not specify whether first time home buyer has to be e a resident Indian it can be understood that non-resident individuals can also give deduction under Sec 80EEA..

Conditions to Claim Deduction under Section 80EEA

1. Area limit

The finance bill has specified that the area of a residential property you wish to claim deduction on in a metropolitan city should not exceed 645 sq ft of 60 sq metres. Cities are the metropolitan cities the area limit has been limited to 968 sq ft for 90 sq metres.

2. Metropolitan cities

Cities are considered as metropolitan under the section are Chennai, Delhi, Mumbai, Bengaluru, Ghaziabad, Faridabad, Hyderabad, Gurugram, Kolkata, Noida and Greater Noida.

3. Borrowers

As you know you can claim Rs. 1.50 lakh deduction under this section. In the case of joint borrowers or co-borrowers, both can claim a reduction of Rs. 1.50 lakhs if all conditions are met.

Difference between Section 80EEA & Section 24(b)

You can claim deduction under both the section and enhance your total non-taxable income.

There are certain points of differences are mentioned below:

| Section 24(b) | Section 80EEA |

|---|---|

| Under section 24(b) you must have possession of the house | Under section 80EEA is not required |

| Loan sources can be personal sources | losses can only be banks |

| The deduction limit is Rs. 2 lakhs or entire interest | Deduction is limited to Rs. 1.50 lakh |

Conclusion

Section 80EEA the great option for all first time home buyers. A complete benefits by following all the conditions today.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.