All About Swachh Bharat Cess (SBC)

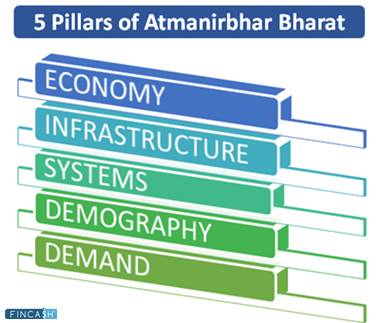

On the first year as a Prime Minister, Narendra Modi vowed for a Swachh Bharat Abhiyaan. The mission aims to clean up the street, roads and infrastructure of cities towns, urban and rural areas in India.

Cleanliness is connected to the tourism and global interests of the country. Prime Minister has directly linked the Clean India movement with the economic health of the country. The movement can contribute to GDP growth, which will provide a source of employment and reduce health costs, thereby connecting to economic activity.

What is Swachh Bharat Cess?

After releasing the Swachh Bharat Campaign, the Government of India introduced an additional cess known as ‘Swachh Bharat Cess’, which came into effect from 15 November 2015.

SBC would be levied on the same taxable value as service tax. As of now, the current service tax rate including the Swachh Bharat Cess stands at 0.5% and 14.50% on all taxable services, which will fund Swachh Bharat Abhiyaan.

The SBC is collected as per provision of Chapter VI (Section 119) of the Finance Act, 2015.

Aspects of Swachh Bharat Cess

1. Services

The Swachh Bharat Cess is applicable on services such as AC hotels, road, rail services, insurance premiums, lottery services, and so on.

2. Utilization

The amount collected from the tax is pooled into the Consolidated Fund of India (Main Bank account of the Government) for the efficacious utilization for promoting Swachh Bharat Abhiyaan.

3. Invoice

The charge of the SBC is included separately in the invoice. This cess is paid under a different Accounting code and accounted separately.

Talk to our investment specialist

4. Tax Rate

The Swachh Bharat Cess is not calculated on the service tax per service, but on the taxable value of a service. It is applied at 0.05% on the value of service tax which is taxable.

5. Reverse Charge

The Finance Act 1994 of Section 119 (5) (Chapter V) will apply on the Swachh Bharat Cess as the reverse charge. Rule no. 7 in the taxation shows the point of taxation is when a service provider receives the due amount.

6. Cenvat Credit

The Swachh Bharat Cess is included in the Cenvat Credit Chain. In simple words, SBC cannot be paid by using any other taxes.

7. Calculation

This cess is based on the value as per Service Tax, Rules 2006 (Determination of Value). It is compared to service related to food at a restaurant, air-conditioning amenities. The current charges are 0.5% of the 40% of the total amount.

8. Refund

Special Economic Zone (SEZ) units enable the refund of the Swachh Bharat Cess paid on particular service.

9. Taxation Scenario

There are no changes in SBC of the invoice is raised before 15 November 2015.

The Swachh Bharat Cess will be liable on services provided before or after 15 November 2015 (invoice or payments which are issued and received before or after the given date)

Swachh Bharat Cess Applicability Dates and Tax Rates

Swachh Bharat Cess doesn’t applicable on every service, you can find below the applicability, dates and tax rates:

- Swachh Bharat is only applied on taxable services

- It is applicable with effect from 15-11-2015

- SBC is applicable to the value of the service taxes at around 14.5% from 15-11-2015

- It is not applicable to non-taxable services incorporating the exempted services

- Swachh Bharat Cess invoice disclosure and the payment has to be segregated.

Swachh Bharat Cess Collection

According to the RTI application filed by The Wire, the amount of Rs. 2,100 crore was collected under the Swachh Bharat Cess even after the abolishment. In response to the RTI application, the finance ministry has disclosed that the cess was collected after Swachh Bharat abolished was Rs. 2,0367 crore.

As per RTI, Rs. 20,632 crore was collected in SBC between 2015-2018. From 2015 to 2019 the whole collection of each year is mentioned below:

| Financial Year | Swachh Bharat Cess Amount Collected |

|---|---|

| 2015-2016 | Rs.3901.83 Cr |

| 2016-2017 | Rs.12306.76 Cr |

| 2017-2018 | Rs. 4242.07 Cr |

| 2018-2019 | Rs.149.40 Cr |

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.