Balanced Investment Strategy

Defining Balanced Investment Strategy

A balanced investment strategy is a method of merging investments in a Portfolio that has an objective to balance return and risk.

Generally, balanced portfolios get divided equally between Bonds and stocks.

Explaining Balanced Investment Strategy

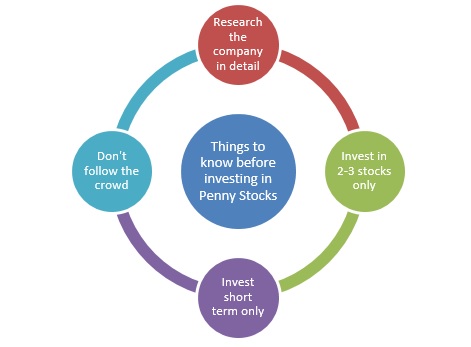

There are, indeed, several methods to put a portfolio together, based on the risk tolerance and preference of the investor. On one end, you can keep an eye on strategies that aim at current income and capital preservation.

Generally, these are safe; however, they yield lower investments. Moreover, they are adequate for investors who are concerned with preserving the capital that they have and not much with their growing capital.

And, on the other hand, you can have strategies that work with the aim of growth. These are aggressive and comprise higher weighting stocks. Although they provide lesser security, they concentrate more on high yielding returns.

Such strategies are appropriate for young investors who have high-risk tolerance and are comfortable with short-term Volatility to get better, long-term returns. Furthermore, investors who belong to both camps can choose a balanced investment strategy. This brings them a mixture of elements from both aggressive and conservative approaches.

In the past, investors needed to assemble portfolios manually by buying every individual investment. Or else, they had to depend upon investment advisors or financial institutions for better choices. However, today, online platforms have streamlined the workflow that allows investors to invest money in selected strategies organized on the basis of risk tolerance.

Balanced Investment Portfolio Example

Let’s take a balanced investment strategy example here. Suppose a boy is in his mid-20s and just graduated. He is new to the investment world but wants to invest Rs. 10,000. The boy is ready to wait for a favourable time before withdrawing the capital in a jiffy.

Talk to our investment specialist

Objectively, considering that the boy is still young and doesn’t have financial requirements at the time, he can adopt a risky investment strategy with long-term growth potential. However, since he doesn’t want to take much risk, he decides to go with a conservative approach.

Keeping this in mind, the boy chooses a balanced investment strategy with a 50-50 split between equity and fixed-income securities. While the fixed-income securities have high-quality government bonds with high-rated corporate bonds. And, the equities would have reputable stocks for dividend payments and consistent earnings.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.