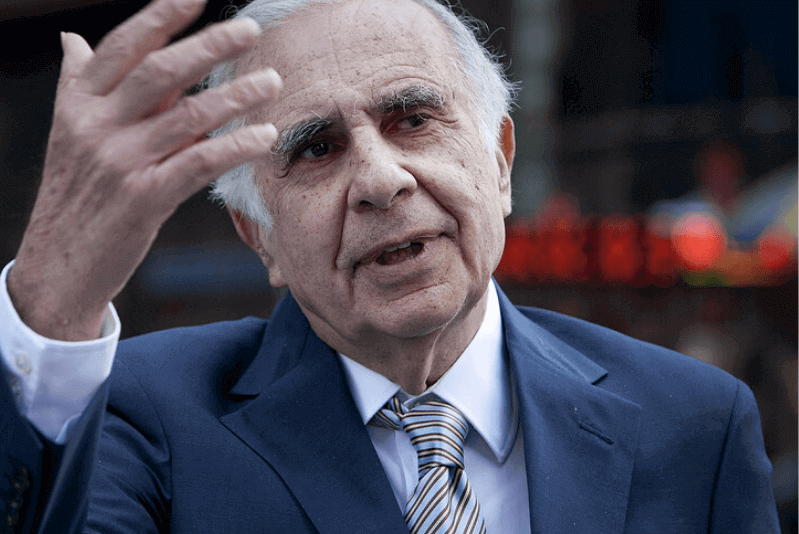

Best Investing Strategies from Legendary Businessman Carl Icahn

Carl Celian Icahn is an American businessman and the founder of Icahn Enterprises, New York City. It is a diversified conglomerate holding company which was previously known as American Real Estate Partners. Mr Icahn is also the chairman of Federal-Mogul that manufactures and supplies powertrain components and vehicle safety products.

Carl Icahn is one of the most successful figures of Wall Street. He is popularly known as ‘corporate raider’. In February 2017, his net worth is estimated at $16.6 billion and he was also known as the 5th wealthiest hedge manager. In January 2017, U.S. President Donald Trump appointed him as one of his advisers. However, he discontinued due to certain issues.

In 2018, he was listed as number 31 on the 400 Wealthiest Americans list by Forbes. In 2019, Mr Icahn was listed as number 11 on the Forbes List of Highest-Earning hedge fund Managers. In the same year, Forbes also ranked Carl Icahn as number 61 on their Billionaires list.

Details about Carl Icahn

| Details | Description |

|---|---|

| Name | Carl Celian Icahn |

| Birthdate | February 16, 1936 |

| Age | 84 |

| Birthplace | New York City, New York, U.S. |

| Alma Mater | Princeton University, New York University |

| Occupation | Businessman |

| Net worth | US $14.7 Billion (February 2020) |

In 1968, Carl Icahn established his renowned brokerage firm Icahn Enterprises. In 1980, Mr Icahn was involved in corporate raiding and he rationalised the same by saying that it profited the ordinary stockholders. He merged raiding with green mailing where he threatened companies like Marshall Field and Phillips Petroleum. These companies repurchased their shares at a premium rate to remove the threat. In 1985, Mr Icahn purchased the Transworld Airline (TWA) as a profit of $469 million.

In the 1990’s he had his control on various companies like Nabisco, Texaco, Blockbuster, USX, Marvel Comics, Revlon, Fairmont Hotels, Time Warner, Herbalife, Netflix, and Motorola.

Talk to our investment specialist

1. Value Investing

Carl Icahn always addressed his stocks as a share he owns in a company. He did not merely look at it as just an investment. One of the things he says is that if you want to be successful in Investing, understand the businesses whose stock you want to buy.

He encourages to research the businesses you want to buy stocks from and then proceeds for investment. Alongside, treat your investment as your share in the business.

2. Be an Active Trader

Carl Icahn has always been an active trader. He frequently is involved in trade and eventually takes control of the company. He then proceeds to make a transformation and changes the leadership style of the company to make beneficial changes.

Once he has established those changes, he waits for the profits to take root and then the stock price rises. When he is convinced that the price has reached a good level, he sells the stake and makes a profit.

One of the examples that suit this is, in 2012, Mr Icahn bought Netflix shares. He then made a statement that Netflix was a good investment and can be of strategic value to big companies if acquired. This positive statement from him drove Netflix share prices. Mr Icahn then sold his stake in 2015 and made a whopping $1.6 billion profit.

3. Act

Carl Icahn says acting impulsively and not acting at all are two cardinal sins. He encourages to remain patient, but also suggests to be highly aggressive when it comes to performance. Sitting idly will not allow an investor to exploit a great opportunity. However, one should not also act impulsively because the situation feels like it.

4. Don’t Fall for Popular Stocks

One of the things Carl Icahn believes and advices is - in the world of investing, don’t fall for the popular trend. He points out, if you go along with the popular trend, you may end up with huge losses. He warns against group thinking.

He always buys shares in companies that aren’t popular. He rightly says that you should be greedy when everyone else is afraid, and be afraid when everyone else is greedy. This can bring in a profit for you if you are able to make the right calls.

He points out that stocks and investments are not perfect and sometimes they are priced lower than their actual value. He says that the trick to becoming successful is to invest in undervalued assets.

5. Be a Long-term Investor

Carl Icahn believes in being a long-term investor. While being an active trader, he makes sure to have long-term investments too. In fact, he says that you can be an active trader and long-term investor at the same time. He definitely has some short-term trading down his Portfolio, but that was solely for the purpose of profit.

Investing for a long-term is wise and even profitable. The investor will get the value of the investment with a bonus if kept for long.

Conclusion

Carl Icahn is one of the most coveted businessmen of today. His smart investing techniques have swept across the globe. He never shy’s away from investing in anything when it comes to profit-making with efficiency. His thinking has landed various companies in positions of power and profit. If there is one thing you can learn from Mr Icahn, it is that never fall for the trend. Always keep your eyes open and never act impulsively. Invest for long-term and help your wealth grow with active trading.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.