Best Long Term Investment Options

Planning for a long term investment? But, how? Most investors look for the ‘best instrument’ to safeguard their hard earned money. But, before you invest, understanding the importance of the right investment is very significant.

So, here is a list of some the best long term investment options with their investment purpose.

Top Long Term Investment Options in India

1. Public Provident Fund or PPF

Public Provident Fund (PPF) is one of the most popular long term investment options in India. Since it's backed by the Government of India, it is a safe investment with an attractive interest rate. Moreover, it offers tax benefits under Section 80C, of income tax 1961, and also the interest income is exempted from tax.

PPF comes with a maturity period of 15 years, however, it can be extended within a year of maturity for five years and more. Annual deposits of minimum INR 500 to maximum INR 1.5 lakh can be invested in PPF account.

Fund Selection Methodology used to find 10 funds

2. Mutual Funds

A mutual fund is one of the best long term investment options in India. A Mutual Fund is a collective pool of money with a common objective for purchasing securities (via the fund). Mutual Funds are regulated by the Securities and Exchange Board of India (SEBI) and are managed by Asset Management Companies (AMC’s). Mutual Funds have gained immense popularity amongst investors over the past few years.

There are various Types of Mutual Funds like Equity Funds, debt funds, Money market funds, Hybrid Fund and gold funds. Each has its own investment objective. However, people who look to balance risk and return, generally prefer to invest in equity and bond Mutual Funds.

The Systematic Investment plan (SIP) is also considered to be one of the best long term investment options to invest in a Mutual Fund. SIPs make an excellent tool for Investing hard earned money, especially for those earning salaries. There are various SIP calculators available in the market that try to help investors make investment plans.

Some of the best mutual funds to invest in India having Assets more than 300 Crore and having best CAGR returns for last 5 years are :

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP World Gold Fund Growth ₹60.3973

↓ -2.23 ₹1,756 32.8 78.1 143 56.3 28.1 167.1 SBI PSU Fund Growth ₹36.7055

↑ 0.18 ₹5,817 7.8 17.7 33.3 34.3 27.5 11.3 ICICI Prudential Infrastructure Fund Growth ₹198.6

↑ 0.98 ₹8,134 0.1 2.5 18.5 25.4 26.5 6.7 Invesco India PSU Equity Fund Growth ₹68.86

↑ 0.52 ₹1,449 3.1 11.2 33.1 32.2 25.9 10.3 SBI Gold Fund Growth ₹43.8818

↓ -0.02 ₹10,775 23.5 50.1 72.6 37.3 24.9 71.5 Axis Gold Fund Growth ₹43.6124

↑ 0.06 ₹2,167 24 50 71.5 36.9 24.9 69.8 ICICI Prudential Regular Gold Savings Fund Growth ₹46.4349

↑ 0.04 ₹4,482 23.6 50.1 72.9 37 24.8 72 Nippon India Gold Savings Fund Growth ₹57.4018

↑ 0.03 ₹5,301 23.4 50.3 72.5 37 24.8 71.2 HDFC Gold Fund Growth ₹44.7704

↓ -0.07 ₹8,501 23.3 49.8 72.2 37 24.7 71.3 Aditya Birla Sun Life Gold Fund Growth ₹43.5454

↓ -0.16 ₹1,266 23.6 50 72.9 37 24.7 72 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 17 Feb 26 Research Highlights & Commentary of 10 Funds showcased

Commentary DSP World Gold Fund SBI PSU Fund ICICI Prudential Infrastructure Fund Invesco India PSU Equity Fund SBI Gold Fund Axis Gold Fund ICICI Prudential Regular Gold Savings Fund Nippon India Gold Savings Fund HDFC Gold Fund Aditya Birla Sun Life Gold Fund Point 1 Bottom quartile AUM (₹1,756 Cr). Upper mid AUM (₹5,817 Cr). Upper mid AUM (₹8,134 Cr). Bottom quartile AUM (₹1,449 Cr). Highest AUM (₹10,775 Cr). Lower mid AUM (₹2,167 Cr). Lower mid AUM (₹4,482 Cr). Upper mid AUM (₹5,301 Cr). Top quartile AUM (₹8,501 Cr). Bottom quartile AUM (₹1,266 Cr). Point 2 Established history (18+ yrs). Established history (15+ yrs). Oldest track record among peers (20 yrs). Established history (16+ yrs). Established history (14+ yrs). Established history (14+ yrs). Established history (14+ yrs). Established history (14+ yrs). Established history (14+ yrs). Established history (13+ yrs). Point 3 Top rated. Rating: 2★ (upper mid). Rating: 3★ (top quartile). Rating: 3★ (upper mid). Rating: 2★ (lower mid). Rating: 1★ (bottom quartile). Rating: 1★ (bottom quartile). Rating: 2★ (lower mid). Rating: 1★ (bottom quartile). Rating: 3★ (upper mid). Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 28.10% (top quartile). 5Y return: 27.55% (top quartile). 5Y return: 26.52% (upper mid). 5Y return: 25.92% (upper mid). 5Y return: 24.92% (upper mid). 5Y return: 24.86% (lower mid). 5Y return: 24.83% (lower mid). 5Y return: 24.75% (bottom quartile). 5Y return: 24.70% (bottom quartile). 5Y return: 24.70% (bottom quartile). Point 6 3Y return: 56.28% (top quartile). 3Y return: 34.34% (bottom quartile). 3Y return: 25.38% (bottom quartile). 3Y return: 32.18% (bottom quartile). 3Y return: 37.31% (top quartile). 3Y return: 36.93% (lower mid). 3Y return: 37.03% (upper mid). 3Y return: 37.00% (upper mid). 3Y return: 36.99% (lower mid). 3Y return: 37.01% (upper mid). Point 7 1Y return: 143.03% (top quartile). 1Y return: 33.34% (bottom quartile). 1Y return: 18.45% (bottom quartile). 1Y return: 33.14% (bottom quartile). 1Y return: 72.57% (upper mid). 1Y return: 71.46% (lower mid). 1Y return: 72.86% (upper mid). 1Y return: 72.47% (upper mid). 1Y return: 72.18% (lower mid). 1Y return: 72.94% (top quartile). Point 8 Alpha: 1.32 (top quartile). Alpha: -0.22 (bottom quartile). Alpha: 0.00 (top quartile). Alpha: -1.90 (bottom quartile). 1M return: 5.66% (upper mid). 1M return: 5.72% (upper mid). 1M return: 5.74% (upper mid). 1M return: 5.76% (top quartile). 1M return: 5.56% (lower mid). 1M return: 5.58% (lower mid). Point 9 Sharpe: 3.42 (lower mid). Sharpe: 0.33 (bottom quartile). Sharpe: 0.12 (bottom quartile). Sharpe: 0.27 (bottom quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (upper mid). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Point 10 Information ratio: -0.67 (bottom quartile). Information ratio: -0.47 (bottom quartile). Information ratio: 0.00 (top quartile). Information ratio: -0.37 (bottom quartile). Sharpe: 4.38 (upper mid). Sharpe: 4.36 (upper mid). Sharpe: 4.33 (lower mid). Sharpe: 4.46 (top quartile). Sharpe: 4.39 (upper mid). Sharpe: 4.49 (top quartile). DSP World Gold Fund

SBI PSU Fund

ICICI Prudential Infrastructure Fund

Invesco India PSU Equity Fund

SBI Gold Fund

Axis Gold Fund

ICICI Prudential Regular Gold Savings Fund

Nippon India Gold Savings Fund

HDFC Gold Fund

Aditya Birla Sun Life Gold Fund

3. Post Office Savings Schemes

Post Office Saving Schemes are considered to be one of the best long term investment options for government employees, salaried class and businessmen. They offer a moderate rate of interest and tax benefits under section 80C of Income Tax Act as well.

Some of the most popular Post Office Saving Schemes are as follows-

- Senior Citizen Savings Scheme

- Monthly Income Scheme Account

- Recurring deposit Accounts

- National Savings Certificates (NSC)

- Sukanya Samridhi Yojana (SSY)

4. Bonds

Bonds are a part of long term investment options. A bond is an investing instrument used to borrow money. It’s a long-term debt instrument, used by the companies to raise capital from the public. In return, bonds offer a fixed interest rate on investment. The principle amount is paid back to the investor at the maturity period.

So, investing in long-term bonds is considered as a good alternative for earning decent returns on your investment.

Talk to our investment specialist

5. Fixed Deposit (FD)

Fixed deposit is a good to go as one of the best long term investment options as it is considered to be the easiest and common instrument. It is yet another option for risk-free investment. Investors can invest any amount in an FD for a maximum period of 10 years. But, the interest varies depending on the amount of investment and also the tenure.

6. Gold

Indian investors often look for Investing in Gold and it's also one of the good long term investment options. Gold is used as an inflation hedge. Investing in gold can be done via buying physical gold, gold deposit scheme, gold ETF, Gold Bar or gold Mutual Fund. Some of the best underlying Gold ETFs in India are as follows:

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) SBI Gold Fund Growth ₹43.8818

↓ -0.02 ₹10,775 23.5 50.1 72.6 37.3 24.9 71.5 IDBI Gold Fund Growth ₹38.9617

↑ 0.15 ₹623 23.5 49.3 71.5 37.1 24.6 79 ICICI Prudential Regular Gold Savings Fund Growth ₹46.4349

↑ 0.04 ₹4,482 23.6 50.1 72.9 37 24.8 72 Aditya Birla Sun Life Gold Fund Growth ₹43.5454

↓ -0.16 ₹1,266 23.6 50 72.9 37 24.7 72 Nippon India Gold Savings Fund Growth ₹57.4018

↑ 0.03 ₹5,301 23.4 50.3 72.5 37 24.8 71.2 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary SBI Gold Fund IDBI Gold Fund ICICI Prudential Regular Gold Savings Fund Aditya Birla Sun Life Gold Fund Nippon India Gold Savings Fund Point 1 Highest AUM (₹10,775 Cr). Bottom quartile AUM (₹623 Cr). Lower mid AUM (₹4,482 Cr). Bottom quartile AUM (₹1,266 Cr). Upper mid AUM (₹5,301 Cr). Point 2 Oldest track record among peers (14 yrs). Established history (13+ yrs). Established history (14+ yrs). Established history (13+ yrs). Established history (14+ yrs). Point 3 Rating: 2★ (upper mid). Not Rated. Rating: 1★ (bottom quartile). Top rated. Rating: 2★ (lower mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 24.92% (top quartile). 5Y return: 24.59% (bottom quartile). 5Y return: 24.83% (upper mid). 5Y return: 24.70% (bottom quartile). 5Y return: 24.75% (lower mid). Point 6 3Y return: 37.31% (top quartile). 3Y return: 37.07% (upper mid). 3Y return: 37.03% (lower mid). 3Y return: 37.01% (bottom quartile). 3Y return: 37.00% (bottom quartile). Point 7 1Y return: 72.57% (lower mid). 1Y return: 71.46% (bottom quartile). 1Y return: 72.86% (upper mid). 1Y return: 72.94% (top quartile). 1Y return: 72.47% (bottom quartile). Point 8 1M return: 5.66% (lower mid). 1M return: 5.47% (bottom quartile). 1M return: 5.74% (upper mid). 1M return: 5.58% (bottom quartile). 1M return: 5.76% (top quartile). Point 9 Alpha: 0.00 (top quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Alpha: 0.00 (bottom quartile). Point 10 Sharpe: 4.38 (lower mid). Sharpe: 4.30 (bottom quartile). Sharpe: 4.33 (bottom quartile). Sharpe: 4.49 (top quartile). Sharpe: 4.46 (upper mid). SBI Gold Fund

IDBI Gold Fund

ICICI Prudential Regular Gold Savings Fund

Aditya Birla Sun Life Gold Fund

Nippon India Gold Savings Fund

Whether it's buying a house, gold, car or any asset, investing is an important decision of life and also a necessity. While, each long term investment option has its own benefits and risks, plan and explore the best investment options as mentioned above and enhance your financial security.

Conclusion

Keep focused Financial goals and also remember while choosing best long term investment options you have to plan for a diversified investment strategy. This will minimise your risks. So, start investing a good part of your earnings in long term investment plans!

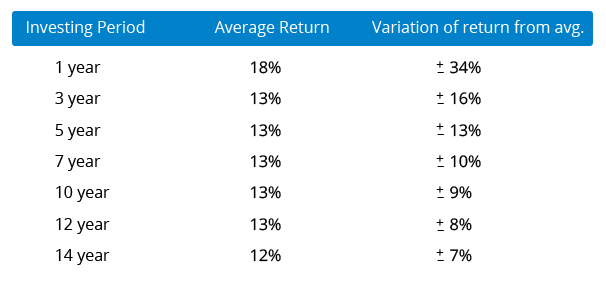

One looking for Long Term investments in various asset classes as described above. Illustration with timeframe:

| Horizon | Asset Class | Risk |

|---|---|---|

| > 10 Years | Equity Mutual Funds | High |

| > 5 Years | Equity Mutual Funds | High |

| 3 - 5 Years | Bonds/Gold/FD/Debt Mutual Funds | Low |

| 2 -3 Years | Bonds/Gold/Debt Mutual Funds | Low |

| 1 - 2 Year | Ultra Short Debt Mutual Funds/ FD | Low |

| < 1 Year | Ultra Short/Liquid Debt Mutual Funds / FD | Low |

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Best information, Thanks