6 Best Investment Options for a Salaried Person

To build a strong financial backbone, one should invest the money in the right financial instrument. Though, not every investment guarantees substantial returns, but, if you invest wisely and for a good amount of time, the potential to gain healthy returns is higher. Especially, a salaried person who has to manage investments and expenses within a stipulated income. Hence, a salaried individual need to consider amount, risk, risk, and return while determining the best investment option for them.

So, if you are someone looking out for a safe investment option, here are some of the best investment options in 2026.

1. Invest in Fixed Deposits

Most people consider the Fixed Deposit investment as a part of their Retirement investment options because it enables money to be deposited with banks for a fixed maturity period, ranging from 15 days to five years (& above) and it allows to earn a higher rate of interest than other conventional Savings Account. During the time of maturity, the investor receives a return which is equal to the principal and also the interest earned over the duration of the fixed deposit

Bank fixed deposits can be one of the Best Short Term Investment Options, as these are secure investments. Also, many banks provide better interest rates on FDs, which typically range from 3 percent to 7 percent, per annum. Investors can park their money for a minimum period of seven days to a maximum of 10 years.

2. Invest in Recurring Deposits

A Recurring deposit is an investment cum savings option for those who want to save regularly over a certain period of time and earn a higher interest rate. Every month, a fixed amount of money is deducted either from a Savings Account or a current account. At the end of the maturity period, investors are paid back their invested funds with accrued interest.

3. Invest in Systematic Investment Plan (SIP)

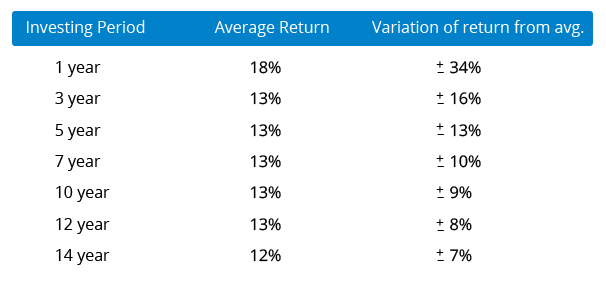

Salaried people can consider Investing in an equity-oriented product. While investing in Equity Funds, one should consider taking a systematic way, i.e. one should put a fixed amount of money every month instead of putting the money all at once. Also, within equity funds, one should diversify investment as per risk and return expectation. Ideally, a salaried person should stay invested for a long duration to earn good returns.

Since equity funds have various categories, investors with a moderate risk appetite can go for large-cap or multi-cap equity funds and investors with a high-risk appetite can invest in a mid-cap and small cap fund. Equity investment through SIP mode reduces the risk in the long term.

Fund Selection Methodology used to find 5 funds

Best Equity SIP Mutual Funds 2026

Some of the best mutual funds to invest in India having Assets more than 300 Crore and having best CAGR returns for last 5 years are :

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP World Gold Fund Growth ₹63.9103

↓ -2.35 ₹1,975 28.7 64.3 164.1 58.8 31 167.1 IDBI Gold Fund Growth ₹41.0563

↓ -0.23 ₹809 22.5 47 81 39.4 27.4 79 SBI Gold Fund Growth ₹46.1239

↓ -0.55 ₹15,024 22.4 47.5 81.5 39.7 27.3 71.5 ICICI Prudential Regular Gold Savings Fund Growth ₹48.6828

↓ -0.60 ₹6,338 22.1 47 81.2 39.5 27.1 72 HDFC Gold Fund Growth ₹47.0527

↓ -0.50 ₹11,458 22.3 47.3 81.1 39.2 27.1 71.3 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 5 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP World Gold Fund IDBI Gold Fund SBI Gold Fund ICICI Prudential Regular Gold Savings Fund HDFC Gold Fund Point 1 Bottom quartile AUM (₹1,975 Cr). Bottom quartile AUM (₹809 Cr). Highest AUM (₹15,024 Cr). Lower mid AUM (₹6,338 Cr). Upper mid AUM (₹11,458 Cr). Point 2 Oldest track record among peers (18 yrs). Established history (13+ yrs). Established history (14+ yrs). Established history (14+ yrs). Established history (14+ yrs). Point 3 Top rated. Not Rated. Rating: 2★ (upper mid). Rating: 1★ (lower mid). Rating: 1★ (bottom quartile). Point 4 Risk profile: High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 30.96% (top quartile). 5Y return: 27.42% (upper mid). 5Y return: 27.34% (lower mid). 5Y return: 27.14% (bottom quartile). 5Y return: 27.13% (bottom quartile). Point 6 3Y return: 58.76% (top quartile). 3Y return: 39.36% (bottom quartile). 3Y return: 39.67% (upper mid). 3Y return: 39.53% (lower mid). 3Y return: 39.20% (bottom quartile). Point 7 1Y return: 164.13% (top quartile). 1Y return: 80.98% (bottom quartile). 1Y return: 81.52% (upper mid). 1Y return: 81.17% (lower mid). 1Y return: 81.11% (bottom quartile). Point 8 Alpha: 2.12 (top quartile). 1M return: 5.04% (upper mid). 1M return: 4.44% (lower mid). 1M return: 4.02% (bottom quartile). 1M return: 4.39% (bottom quartile). Point 9 Sharpe: 3.41 (upper mid). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Alpha: 0.00 (bottom quartile). Point 10 Information ratio: -0.47 (bottom quartile). Sharpe: 3.48 (top quartile). Sharpe: 3.25 (bottom quartile). Sharpe: 3.10 (bottom quartile). Sharpe: 3.29 (lower mid). DSP World Gold Fund

IDBI Gold Fund

SBI Gold Fund

ICICI Prudential Regular Gold Savings Fund

HDFC Gold Fund

4. Invest in Public Provident Fund (PPF)

Public Provident Fund (PPF) is one of the most popular long term investment options in India. Since it's backed by the Government of India, it is a safe investment with an attractive interest rate. Moreover, it offers tax benefits under Section 80C, of income tax 1961, and also the interest income is exempted from tax. PPF comes with a maturity period of 15 years, however, it can be extended within a year of maturity for five years and more. Annual deposits of minimum INR 500 to maximum INR 1.5 lakh can be invested in PPF account.

Talk to our investment specialist

5. Invest in National Pension Scheme (NPS)

New Pension Scheme is gaining popularity in India as one of the best retirement investment options. NPS is open to all but, is mandatory for all government employees. An investor can deposit a minimum of INR 500 per month or INR 6000 yearly, making it as the most convenient for Indian citizens. Investors can consider NPS as a good idea for their Retirement planning because there is no direct tax exemption during the time of withdrawal as the amount is tax-free as per Tax Act, 1961. This scheme is a risk-free investment as it's backed by the Government of India.

6. Invest in Gold

Indian investors often look for Investing in Gold and it's also one of the good long term investment options. Gold is used as an inflation hedge. Investing in gold can be done via buying physical gold, gold deposit scheme, gold ETF, Gold Bar or gold Mutual Fund. Some of the best underlying Gold ETFs in India are as follows:

Best Gold Mutual Funds 2026

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Aditya Birla Sun Life Gold Fund Growth ₹45.7966

↓ -0.53 ₹1,781 22.6 47.3 81.3 39.3 27 72 Invesco India Gold Fund Growth ₹43.8958

↓ -0.52 ₹476 21.5 45.8 78.3 38.5 26.6 69.6 SBI Gold Fund Growth ₹46.1239

↓ -0.55 ₹15,024 22.4 47.5 81.5 39.7 27.3 71.5 Nippon India Gold Savings Fund Growth ₹60.2398

↓ -0.65 ₹7,160 22.2 47.2 81.2 39.3 27.1 71.2 ICICI Prudential Regular Gold Savings Fund Growth ₹48.6828

↓ -0.60 ₹6,338 22.1 47 81.2 39.5 27.1 72 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 6 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Aditya Birla Sun Life Gold Fund Invesco India Gold Fund SBI Gold Fund Nippon India Gold Savings Fund ICICI Prudential Regular Gold Savings Fund Point 1 Bottom quartile AUM (₹1,781 Cr). Bottom quartile AUM (₹476 Cr). Highest AUM (₹15,024 Cr). Upper mid AUM (₹7,160 Cr). Lower mid AUM (₹6,338 Cr). Point 2 Established history (13+ yrs). Established history (14+ yrs). Established history (14+ yrs). Oldest track record among peers (15 yrs). Established history (14+ yrs). Point 3 Top rated. Rating: 3★ (upper mid). Rating: 2★ (lower mid). Rating: 2★ (bottom quartile). Rating: 1★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 26.98% (bottom quartile). 5Y return: 26.58% (bottom quartile). 5Y return: 27.34% (top quartile). 5Y return: 27.12% (lower mid). 5Y return: 27.14% (upper mid). Point 6 3Y return: 39.27% (bottom quartile). 3Y return: 38.53% (bottom quartile). 3Y return: 39.67% (top quartile). 3Y return: 39.34% (lower mid). 3Y return: 39.53% (upper mid). Point 7 1Y return: 81.30% (upper mid). 1Y return: 78.28% (bottom quartile). 1Y return: 81.52% (top quartile). 1Y return: 81.25% (lower mid). 1Y return: 81.17% (bottom quartile). Point 8 1M return: 4.23% (bottom quartile). 1M return: 4.57% (upper mid). 1M return: 4.44% (lower mid). 1M return: 4.60% (top quartile). 1M return: 4.02% (bottom quartile). Point 9 Alpha: 0.00 (top quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Alpha: 0.00 (bottom quartile). Point 10 Sharpe: 3.08 (bottom quartile). Sharpe: 3.23 (upper mid). Sharpe: 3.25 (top quartile). Sharpe: 3.01 (bottom quartile). Sharpe: 3.10 (lower mid). Aditya Birla Sun Life Gold Fund

Invesco India Gold Fund

SBI Gold Fund

Nippon India Gold Savings Fund

ICICI Prudential Regular Gold Savings Fund

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

This is a very nice article of money saving websites. There is another one which I like very much saveji.com, where you can find fresh coupons, hot deals, vouchers and best cashbacks of all the top brands across all countries.