Best Investment Options with Higher Returns

Many people are inclining towards Investing in high yield instruments. But, amongst so many options, it is often difficult to choose the ideal avenue. To start with, one should always invest based on financial goals, risk appetite, investment tenure, liquidity and taxation. High return investments often come with high risks. These are preferably long-term investments with a long holding period. Thus, one should be familiar with the advantages and disadvantages of such high return investments. This article will guide you through some of the high return investments.

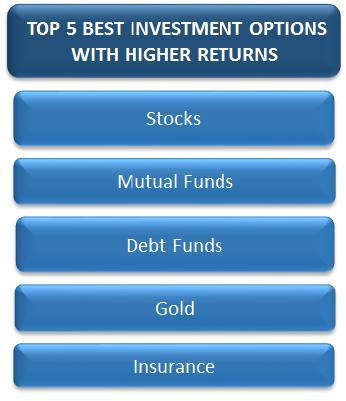

Top 5 Best Investment Options with Higher Returns

1. Stocks

Stocks are preferred for higher returns, but many times, investors don’t pay much attention to the risks as compared to the returns. Investing in the stock market will be is possible only if you know how to start. But without knowledge, you may feel lost. Hence, investors wanting to invest in stocks should assess themselves on the following parameters-

- In-depth knowledge about the markets

- Knowledge on how to assess good stocks from bad ones

- Ability to Monitor, since exiting is also important

- Ready to take high risks

Investors who feel confident about the above can try to invest in stocks.

2. Equity Mutual Funds

For investors looking for high return investments, the Mutual Fund is one of the best investment options in India. As the name signifies, a Mutual Fund is a collective pool of money with a common objective of purchasing securities (via the fund). Mutual Funds are regulated by the SEBI (Securities and Exchange Board of India) and are managed by AMCs (Asset Management Companies).

Investors can choose from a host of option such as Large cap funds, mid & small cap and thematic funds. Large-cap funds carry low risks compared to mid-cap and thematic funds. Since thematic funds give exposure to a specific industry, they carry the highest risks amongst all equity mutual funds.

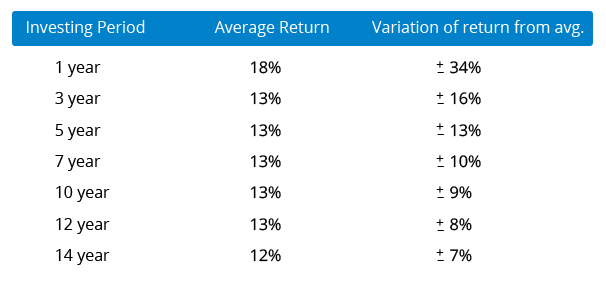

Investors planning to invest in equity mutual funds are advisable to stay for a longer period of time i.e., more than 5- 10 years. Below is an analysis done on the BSE Sensex since 1979 to 2016 showing average returns and the variation from this average in case of different holding periods.

Mode of Investment- The Systematic Investment plan (SIP) is also considered to be one of the best investment options to invest in a Mutual Fund. SIPs make an excellent tool for investing money, especially for those earning salaries. The investment through a SIP is invested in stock markets, thus generates good returns when invested for a long duration.

Other than this, investors can invest in ELSS. Equity Linked Savings Schemes (ELSS) are tax-saving Mutual Funds. By investing in ELSS, one can attain deductions up to INR 1,50,000 from their taxable income as per the Section 80C of income tax Act. These funds have a lock-in period of three years and invest a majority of their portfolio in the stock market.

Investors can invest in these funds via Mutual Fund companies, through distributor services, Brokers (regulated by SEBI), Independent financial advisers (IFAs), or through various online portals. Investors should choose Equity Funds that are doing well in the market. One should know how a fund behaves and performs during market fluctuations.

Talk to our investment specialist

Fund Selection Methodology used to find 5 funds

Best Equity Funds to Invest

Some of the Best equity funds to invest in India are:

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP US Flexible Equity Fund Growth ₹78.5908

↑ 0.00 ₹1,119 3.9 12.9 38.1 23.1 17.2 33.8 DSP Natural Resources and New Energy Fund Growth ₹107.797

↑ 1.36 ₹1,765 12.8 19.1 34 23.6 20.5 17.5 Franklin Asian Equity Fund Growth ₹38.237

↑ 0.75 ₹372 8.5 18.9 34 14.4 3.2 23.7 Franklin Build India Fund Growth ₹143.766

↓ -0.94 ₹3,003 0.8 2.9 17.1 26.2 22.7 3.7 Aditya Birla Sun Life Banking And Financial Services Fund Growth ₹61.22

↓ -1.16 ₹3,641 -5 3.7 17 15.5 12.1 17.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 5 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP US Flexible Equity Fund DSP Natural Resources and New Energy Fund Franklin Asian Equity Fund Franklin Build India Fund Aditya Birla Sun Life Banking And Financial Services Fund Point 1 Bottom quartile AUM (₹1,119 Cr). Lower mid AUM (₹1,765 Cr). Bottom quartile AUM (₹372 Cr). Upper mid AUM (₹3,003 Cr). Highest AUM (₹3,641 Cr). Point 2 Established history (13+ yrs). Established history (17+ yrs). Oldest track record among peers (18 yrs). Established history (16+ yrs). Established history (12+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 5★ (bottom quartile). Rating: 5★ (bottom quartile). Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 17.22% (lower mid). 5Y return: 20.54% (upper mid). 5Y return: 3.16% (bottom quartile). 5Y return: 22.67% (top quartile). 5Y return: 12.07% (bottom quartile). Point 6 3Y return: 23.08% (lower mid). 3Y return: 23.59% (upper mid). 3Y return: 14.40% (bottom quartile). 3Y return: 26.21% (top quartile). 3Y return: 15.53% (bottom quartile). Point 7 1Y return: 38.06% (top quartile). 1Y return: 34.03% (upper mid). 1Y return: 33.97% (lower mid). 1Y return: 17.13% (bottom quartile). 1Y return: 17.03% (bottom quartile). Point 8 Alpha: 2.18 (top quartile). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Alpha: 0.00 (bottom quartile). Alpha: 0.61 (upper mid). Point 9 Sharpe: 1.15 (lower mid). Sharpe: 1.32 (upper mid). Sharpe: 2.24 (top quartile). Sharpe: 0.21 (bottom quartile). Sharpe: 1.03 (bottom quartile). Point 10 Information ratio: -0.16 (bottom quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.25 (top quartile). DSP US Flexible Equity Fund

DSP Natural Resources and New Energy Fund

Franklin Asian Equity Fund

Franklin Build India Fund

Aditya Birla Sun Life Banking And Financial Services Fund

3. Debt Funds

Debt funds are preferred by investors looking for a steady income with relatively lower risks, as they are comparatively less volatile than equity funds. A debt fund invests in fixed income instruments. As these funds invest most of the money in debt instruments such as government securities, corporate Bonds, money market instruments etc., they are considered to be a relatively safer investment than equity. However, there are risks to investing in debt funds too.

There are different types of debt funds such as Gilt Funds, Liquid Funds, ultra-short term funds, short-term funds, dynamic bonds and long-term income funds. Since debt mutual funds largely invest in government securities, corporate debt, etc., they are not affected by equity market volatility. However, long-term funds do carry moderate to high risk and any adverse interest rate movement can give negative returns. But at the same time, if chosen wisely, debt funds can give medium to high returns.Thus, investors can consider debt funds as one of the best investment options in India.

Best Debt Funds to Invest

Some of the best debt mutual funds to invest in India are:

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Axis Credit Risk Fund Growth ₹22.5071

↓ -0.01 ₹363 1.3 3.7 8.7 8 6.8 8.7 PGIM India Credit Risk Fund Growth ₹15.5876

↑ 0.00 ₹39 0.6 4.4 8.4 3 4.2 UTI Banking & PSU Debt Fund Growth ₹22.7962

↑ 0.01 ₹1,078 1 2.7 7.4 7.4 7.3 7.8 Aditya Birla Sun Life Savings Fund Growth ₹571.703

↑ 0.19 ₹22,857 1.3 3 7.2 7.4 6.3 7.4 HDFC Banking and PSU Debt Fund Growth ₹23.8083

↑ 0.00 ₹5,620 0.6 2.6 7 7.3 6.1 7.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 6 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Axis Credit Risk Fund PGIM India Credit Risk Fund UTI Banking & PSU Debt Fund Aditya Birla Sun Life Savings Fund HDFC Banking and PSU Debt Fund Point 1 Bottom quartile AUM (₹363 Cr). Bottom quartile AUM (₹39 Cr). Lower mid AUM (₹1,078 Cr). Highest AUM (₹22,857 Cr). Upper mid AUM (₹5,620 Cr). Point 2 Established history (11+ yrs). Established history (11+ yrs). Established history (12+ yrs). Oldest track record among peers (22 yrs). Established history (11+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 5★ (bottom quartile). Rating: 5★ (bottom quartile). Point 4 Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderately Low. Risk profile: Moderately Low. Point 5 1Y return: 8.69% (top quartile). 1Y return: 8.43% (upper mid). 1Y return: 7.44% (lower mid). 1Y return: 7.16% (bottom quartile). 1Y return: 7.05% (bottom quartile). Point 6 1M return: 0.70% (top quartile). 1M return: 0.27% (bottom quartile). 1M return: 0.51% (bottom quartile). 1M return: 0.52% (lower mid). 1M return: 0.55% (upper mid). Point 7 Sharpe: 2.08 (upper mid). Sharpe: 1.73 (lower mid). Sharpe: 1.05 (bottom quartile). Sharpe: 2.17 (top quartile). Sharpe: 0.36 (bottom quartile). Point 8 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 8.64% (top quartile). Yield to maturity (debt): 5.01% (bottom quartile). Yield to maturity (debt): 7.04% (lower mid). Yield to maturity (debt): 6.81% (bottom quartile). Yield to maturity (debt): 7.26% (upper mid). Point 10 Modified duration: 2.29 yrs (bottom quartile). Modified duration: 0.54 yrs (upper mid). Modified duration: 1.11 yrs (lower mid). Modified duration: 0.47 yrs (top quartile). Modified duration: 3.13 yrs (bottom quartile). Axis Credit Risk Fund

PGIM India Credit Risk Fund

UTI Banking & PSU Debt Fund

Aditya Birla Sun Life Savings Fund

HDFC Banking and PSU Debt Fund

4. Gold

Investing in Gold as it’s not only considered to be one of the best investment options, but also to be one of the best hedges for inflation. Today, there are many options to invest in gold. Investors can buy physical gold through gold coins or bars; they can buy products backed by physical gold (e.g. Gold Exchange Traded Fund), which offer direct exposure to the gold price. They can also buy other gold-related products, which may not include ownership of gold, but are directly related to the gold price. Gold, at times of a crisis, negative sentiments and in downturns of the markets is an asset class of choice. It is in these periods that gold yields very good returns. Over a long period of time, gold is a very good hedge against inflation and keeps the value of your capital intact.

Apart from this, there are three new Gold Schemes launched by the Government of India, which is currently blooming in the Indian gold market. They are viz, the Sovereign Gold Bond Scheme, Gold Monetisation Scheme and the Indian Gold Bond Scheme. Investors can invest in these schemes and plan their gold investments accordingly.

Best Gold Funds to Invest

Some of the best underlying gold ETFs to invest in India are:

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP World Gold Fund Growth ₹63.9103

↓ -2.35 ₹1,975 28.7 64.3 164.1 58.8 31 167.1 Aditya Birla Sun Life Gold Fund Growth ₹45.7966

↓ -0.53 ₹1,781 22.6 47.3 81.3 39.3 27 72 Invesco India Gold Fund Growth ₹43.8958

↓ -0.52 ₹476 21.5 45.8 78.3 38.5 26.6 69.6 SBI Gold Fund Growth ₹46.1239

↓ -0.55 ₹15,024 22.4 47.5 81.5 39.7 27.3 71.5 Nippon India Gold Savings Fund Growth ₹60.2398

↓ -0.65 ₹7,160 22.2 47.2 81.2 39.3 27.1 71.2 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 5 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP World Gold Fund Aditya Birla Sun Life Gold Fund Invesco India Gold Fund SBI Gold Fund Nippon India Gold Savings Fund Point 1 Lower mid AUM (₹1,975 Cr). Bottom quartile AUM (₹1,781 Cr). Bottom quartile AUM (₹476 Cr). Highest AUM (₹15,024 Cr). Upper mid AUM (₹7,160 Cr). Point 2 Oldest track record among peers (18 yrs). Established history (13+ yrs). Established history (14+ yrs). Established history (14+ yrs). Established history (15+ yrs). Point 3 Top rated. Rating: 3★ (upper mid). Rating: 3★ (lower mid). Rating: 2★ (bottom quartile). Rating: 2★ (bottom quartile). Point 4 Risk profile: High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 30.96% (top quartile). 5Y return: 26.98% (bottom quartile). 5Y return: 26.58% (bottom quartile). 5Y return: 27.34% (upper mid). 5Y return: 27.12% (lower mid). Point 6 3Y return: 58.76% (top quartile). 3Y return: 39.27% (bottom quartile). 3Y return: 38.53% (bottom quartile). 3Y return: 39.67% (upper mid). 3Y return: 39.34% (lower mid). Point 7 1Y return: 164.13% (top quartile). 1Y return: 81.30% (lower mid). 1Y return: 78.28% (bottom quartile). 1Y return: 81.52% (upper mid). 1Y return: 81.25% (bottom quartile). Point 8 Alpha: 2.12 (top quartile). 1M return: 4.23% (bottom quartile). 1M return: 4.57% (lower mid). 1M return: 4.44% (bottom quartile). 1M return: 4.60% (upper mid). Point 9 Sharpe: 3.41 (top quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Alpha: 0.00 (bottom quartile). Point 10 Information ratio: -0.47 (bottom quartile). Sharpe: 3.08 (bottom quartile). Sharpe: 3.23 (lower mid). Sharpe: 3.25 (upper mid). Sharpe: 3.01 (bottom quartile). DSP World Gold Fund

Aditya Birla Sun Life Gold Fund

Invesco India Gold Fund

SBI Gold Fund

Nippon India Gold Savings Fund

5. Insurance- Endowment Plan

An Endowment Plan gives life cover and also helps the policyholder to save regularly over a specified period of time. Upon maturity, the insured receives a lump sum amount. There a few types of policies in this plan, such as; Endowment insurance with Profit, Endowment Insurance without profit, Unit Linked Endowment Plan and Full Endowment Plan. Additionally, there are bonuses offered by the Insurance companies in India on these policies time to time. A bonus is an extra amount which adds to the promised amount. The insured must have an endowment policy with profit to avail these profits offered by the insurance company.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.