Best SIP Plans for Long Term Investment 2026

The concept of Systematic Investment plan (SIP) has been gaining a lot of popularity amongst Indian investors since last few years. It is an excellent way to create a long-term savings habit. It helps in creating a large corpus for the future Financial goals. In a SIP, a fixed amount is invested monthly in a fund on a specific date by the investor.

Once you begin Investing monthly in a SIP for a longer period of time, your money starts growing every day (being invested in the stock market). Systematic Investment Plan helps you to average your purchase cost and maximise returns. When an investor invests regularly over a period, irrespective of the market conditions, he would get more units when the market is low & less units when the market is high. This averages out the purchase cost of your mutual fund units. Similarly, let’s check some of the most important benefits of a SIP in the long-run.

Talk to our investment specialist

Benefits of Long Term SIP Investment

Some of the important benefits of a SIP are:

Power of Compounding

When you invest over a longer duration, your investment starts compounding. This means that when you earn returns on the returns earned by your investment, your money would start compounding. This helps you to build a large corpus over the long run with regular small investments.

Helps in Achieving Goals

SIP is a smart way to achieve all your long-term financial goals like retirement, marriage, purchase of a house/car, etc. Investors can simply start investing in Mutual Funds as per their financial goals and attain them at certain period of time. If one starts investing at an early age, there is enough time for their SIP to grow. In this way it also becomes easier to fulfil all their goals on time.

Affordable

One of the most attractive parts of a systematic investment plan is its affordability. One can invest an amount as low as INR 500, which enables a route to a large number of Indians to initiate into investments. So, one who can’t make a lump sum payment, can invest via a SIP in Mutual Funds.

Why SIP is Best for Long Term Investment?

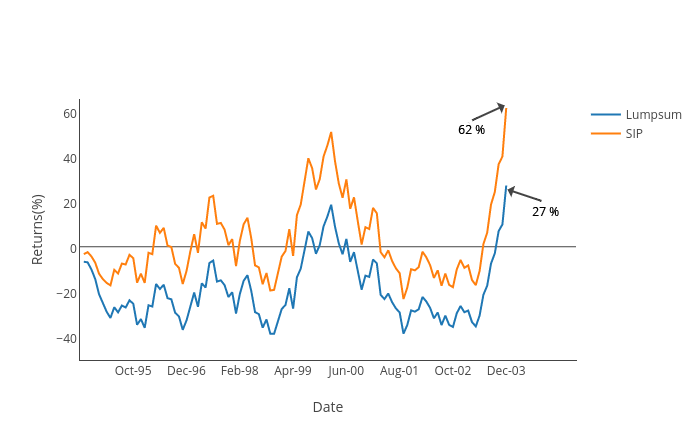

Investors often wonder of how SIPs are more profitable in the long-run than lump sum mode. Well, the historical data says so! Let’s check the data of the worst period of the stock market.

The worst period to start investing was around September 1994 (this was the time when the stock market had peaked). If one looks at the market data, the investor who had invested a lump sum sat on negative returns for 59 months (nearly 5 years!). The investor broke even in about July of 1999. The next year though some returns were generated, these returns were short lived due to the 2000 stock market crash subsequently. After suffering for another 4 years (with negative returns) and the investor finally became positive in October 2003. This was possibly the worst time to have invested a lump sum.

What happened to the SIP investor? The systematic Investment Plan investor was negative for only 19 months and started posting profits, however, these were short-lived. The SIP investors were up again by May 1999 after suffering interim losses. While the journey still continued to be shaky, SIP investors showed profits in the Portfolio much earlier.

So, who made better profits? The maximum loss for the lump sum investor was nearly 40%, whereas for the SIP investor was 23%. The systematic investment plan investor had a faster recovery period as well as a lower loss in the portfolio.

Best Mutual Funds for Long Term SIP Investment

Some of the best mutual funds SIP for a long-term are as follows-

Fund Selection Methodology used to find 5 funds

Best Large Cap Funds for Long Term SIP

Large cap funds are a type of Equity Mutual Funds where the corpus is invested in the stocks of companies with large market capitalization. These companies are mainly large firms with large businesses & big teams. The market capitalization of these companies is INR 1000 Cr & more. Since, the investments are made in big companies, these firms have more possibility of showing year on year steady growth, which in turns also offers stability over a time. These funds are considered to be safe & less volatile to the market fluctuations compared to mid & Small cap funds.

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Nippon India Large Cap Fund Growth ₹89.2487

↓ -0.95 ₹50,107 100 -5.3 -1.8 11.3 17.6 16.4 9.2 ICICI Prudential Bluechip Fund Growth ₹108.85

↓ -1.20 ₹76,646 100 -6.3 -1 10.8 16.7 14.6 11.3 DSP TOP 100 Equity Growth ₹459.769

↓ -5.48 ₹7,163 500 -6.1 -1.2 7 16.3 12.5 8.4 Bandhan Large Cap Fund Growth ₹75.844

↓ -0.85 ₹1,980 100 -5.7 -1 11.8 16.1 12.5 8.2 Invesco India Largecap Fund Growth ₹66.63

↓ -0.88 ₹1,666 100 -7 -3.7 10 15.7 12.9 5.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 6 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Nippon India Large Cap Fund ICICI Prudential Bluechip Fund DSP TOP 100 Equity Bandhan Large Cap Fund Invesco India Largecap Fund Point 1 Upper mid AUM (₹50,107 Cr). Highest AUM (₹76,646 Cr). Lower mid AUM (₹7,163 Cr). Bottom quartile AUM (₹1,980 Cr). Bottom quartile AUM (₹1,666 Cr). Point 2 Established history (18+ yrs). Established history (17+ yrs). Oldest track record among peers (23 yrs). Established history (19+ yrs). Established history (16+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 2★ (bottom quartile). Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 16.42% (top quartile). 5Y return: 14.65% (upper mid). 5Y return: 12.50% (bottom quartile). 5Y return: 12.48% (bottom quartile). 5Y return: 12.93% (lower mid). Point 6 3Y return: 17.62% (top quartile). 3Y return: 16.73% (upper mid). 3Y return: 16.34% (lower mid). 3Y return: 16.14% (bottom quartile). 3Y return: 15.73% (bottom quartile). Point 7 1Y return: 11.30% (upper mid). 1Y return: 10.77% (lower mid). 1Y return: 6.97% (bottom quartile). 1Y return: 11.83% (top quartile). 1Y return: 10.04% (bottom quartile). Point 8 Alpha: 0.30 (lower mid). Alpha: 0.35 (upper mid). Alpha: -1.18 (bottom quartile). Alpha: 0.90 (top quartile). Alpha: -1.06 (bottom quartile). Point 9 Sharpe: 0.30 (upper mid). Sharpe: 0.30 (lower mid). Sharpe: 0.17 (bottom quartile). Sharpe: 0.35 (top quartile). Sharpe: 0.20 (bottom quartile). Point 10 Information ratio: 1.22 (top quartile). Information ratio: 1.01 (upper mid). Information ratio: 0.64 (bottom quartile). Information ratio: 0.69 (bottom quartile). Information ratio: 0.72 (lower mid). Nippon India Large Cap Fund

ICICI Prudential Bluechip Fund

DSP TOP 100 Equity

Bandhan Large Cap Fund

Invesco India Largecap Fund

Best Mid & Small Cap Funds for Long Term SIP

Mid cap and small cap funds are a type of equity mutual fund that invests in emerging companies in India. mid cap funds invest in companies which have a market capitalization of INR 500 to 1000 Cr. And, small caps are typically defined as firms with a market cap of around INR 500 Crore. These firms are called the future leader of the market. If the company does well in the future, these funds have a great potential to deliver good returns in the long-run. But, the risk is higher in mid & small cap funds. So, when an investor is investing in these funds, they should invest for a longer duration.

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Nippon India Small Cap Fund Growth ₹157.625

↓ -0.54 ₹65,812 100 -4.8 -6.1 8.3 19.2 21.6 -4.7 HDFC Mid-Cap Opportunities Fund Growth ₹194.667

↓ -1.64 ₹92,187 300 -4.4 1.4 16.1 24 21.2 6.8 Motilal Oswal Midcap 30 Fund Growth ₹86.5888

↓ -0.77 ₹34,432 500 -15.6 -16.8 -4.2 19.4 20.9 -12.1 Edelweiss Mid Cap Fund Growth ₹100.672

↓ -0.49 ₹13,802 500 -3.2 0.5 17.7 24.7 20.3 3.8 Invesco India Mid Cap Fund Growth ₹172.23

↓ -1.82 ₹10,058 500 -6.9 -4.5 18 25.3 19.8 6.3 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 6 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Nippon India Small Cap Fund HDFC Mid-Cap Opportunities Fund Motilal Oswal Midcap 30 Fund Edelweiss Mid Cap Fund Invesco India Mid Cap Fund Point 1 Upper mid AUM (₹65,812 Cr). Highest AUM (₹92,187 Cr). Lower mid AUM (₹34,432 Cr). Bottom quartile AUM (₹13,802 Cr). Bottom quartile AUM (₹10,058 Cr). Point 2 Established history (15+ yrs). Oldest track record among peers (18 yrs). Established history (12+ yrs). Established history (18+ yrs). Established history (18+ yrs). Point 3 Top rated. Rating: 3★ (upper mid). Rating: 3★ (lower mid). Rating: 3★ (bottom quartile). Rating: 2★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: High. Risk profile: Moderately High. Point 5 5Y return: 21.58% (top quartile). 5Y return: 21.19% (upper mid). 5Y return: 20.93% (lower mid). 5Y return: 20.34% (bottom quartile). 5Y return: 19.76% (bottom quartile). Point 6 3Y return: 19.22% (bottom quartile). 3Y return: 24.00% (lower mid). 3Y return: 19.40% (bottom quartile). 3Y return: 24.70% (upper mid). 3Y return: 25.30% (top quartile). Point 7 1Y return: 8.31% (bottom quartile). 1Y return: 16.14% (lower mid). 1Y return: -4.21% (bottom quartile). 1Y return: 17.71% (upper mid). 1Y return: 18.00% (top quartile). Point 8 Alpha: -0.64 (bottom quartile). Alpha: 3.73 (top quartile). Alpha: -12.33 (bottom quartile). Alpha: 1.70 (upper mid). Alpha: 0.00 (lower mid). Point 9 Sharpe: -0.19 (bottom quartile). Sharpe: 0.49 (top quartile). Sharpe: -0.54 (bottom quartile). Sharpe: 0.33 (lower mid). Sharpe: 0.35 (upper mid). Point 10 Information ratio: 0.02 (lower mid). Information ratio: 0.47 (upper mid). Information ratio: -0.10 (bottom quartile). Information ratio: 0.49 (top quartile). Information ratio: 0.00 (bottom quartile). Nippon India Small Cap Fund

HDFC Mid-Cap Opportunities Fund

Motilal Oswal Midcap 30 Fund

Edelweiss Mid Cap Fund

Invesco India Mid Cap Fund

Best Diversified Funds for Long Term SIP

Diversified Funds are a class of equity mutual funds. These are the funds that invest across market capitalization, i.e., in large, mid & small cap funds. As, diversified funds invest across market caps, they master in balancing the portfolio. Investors can create a good balance in their portfolio by investing in diversified funds. However, they would still be affected by the Volatility of equities during an unstable market condition.

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) IDBI Diversified Equity Fund Growth ₹37.99

↑ 0.14 ₹382 500 10.2 13.2 13.5 22.7 12 Aditya Birla Sun Life Manufacturing Equity Fund Growth ₹33.31

↑ 0.06 ₹1,051 1,000 0.7 3.2 17.9 20.8 14.5 3.5 Nippon India Multi Cap Fund Growth ₹288.449

↓ -2.03 ₹48,809 100 -4.3 -3.8 11.5 20.4 19.7 4.1 HDFC Equity Fund Growth ₹1,987.19

↓ -26.14 ₹97,452 300 -4.6 -0.4 12.5 20.3 19.3 11.4 Mahindra Badhat Yojana Growth ₹34.8417

↓ -0.29 ₹6,046 500 -3.1 0.3 14.8 19.6 17.5 3.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 28 Jul 23 Research Highlights & Commentary of 5 Funds showcased

Commentary IDBI Diversified Equity Fund Aditya Birla Sun Life Manufacturing Equity Fund Nippon India Multi Cap Fund HDFC Equity Fund Mahindra Badhat Yojana Point 1 Bottom quartile AUM (₹382 Cr). Bottom quartile AUM (₹1,051 Cr). Upper mid AUM (₹48,809 Cr). Highest AUM (₹97,452 Cr). Lower mid AUM (₹6,046 Cr). Point 2 Established history (11+ yrs). Established history (11+ yrs). Established history (20+ yrs). Oldest track record among peers (31 yrs). Established history (8+ yrs). Point 3 Rating: 2★ (upper mid). Not Rated. Rating: 2★ (lower mid). Top rated. Not Rated. Point 4 Risk profile: Moderately High. Risk profile: High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 12.03% (bottom quartile). 5Y return: 14.48% (bottom quartile). 5Y return: 19.71% (top quartile). 5Y return: 19.27% (upper mid). 5Y return: 17.51% (lower mid). Point 6 3Y return: 22.73% (top quartile). 3Y return: 20.81% (upper mid). 3Y return: 20.36% (lower mid). 3Y return: 20.35% (bottom quartile). 3Y return: 19.57% (bottom quartile). Point 7 1Y return: 13.54% (lower mid). 1Y return: 17.91% (top quartile). 1Y return: 11.48% (bottom quartile). 1Y return: 12.47% (bottom quartile). 1Y return: 14.82% (upper mid). Point 8 Alpha: -1.07 (bottom quartile). Alpha: 0.00 (lower mid). Alpha: -0.46 (bottom quartile). Alpha: 4.79 (top quartile). Alpha: 2.62 (upper mid). Point 9 Sharpe: 1.01 (top quartile). Sharpe: 0.12 (bottom quartile). Sharpe: 0.09 (bottom quartile). Sharpe: 0.67 (upper mid). Sharpe: 0.29 (lower mid). Point 10 Information ratio: -0.53 (bottom quartile). Information ratio: 0.00 (bottom quartile). Information ratio: 0.49 (upper mid). Information ratio: 1.25 (top quartile). Information ratio: 0.45 (lower mid). IDBI Diversified Equity Fund

Aditya Birla Sun Life Manufacturing Equity Fund

Nippon India Multi Cap Fund

HDFC Equity Fund

Mahindra Badhat Yojana

Best Sector Funds for SIP Long Term

sector funds invests in securities of specific sectors of the economy, such as telecom, banking, FMCG, Information Technology (IT), pharmaceutical, and infrastructure, etc. For instance, a pharma fund can invest only in stocks of pharma companies and a banking sector fund can invest in banks. Being a sector-specific fund, the risk in such funds is higher. Thus, an investor should have an in-depth knowledge about the specific sector before investing in the fund.

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP Natural Resources and New Energy Fund Growth ₹107.797

↑ 1.36 ₹1,765 500 12.8 19.1 34 23.6 20.5 17.5 Franklin Build India Fund Growth ₹143.766

↓ -0.94 ₹3,003 500 0.8 2.9 17.1 26.2 22.7 3.7 Aditya Birla Sun Life Banking And Financial Services Fund Growth ₹61.22

↓ -1.16 ₹3,641 1,000 -5 3.7 17 15.5 12.1 17.5 ICICI Prudential Banking and Financial Services Fund Growth ₹130.72

↓ -2.37 ₹10,951 100 -6.4 -0.2 12.3 14.2 11.5 15.9 Bandhan Infrastructure Fund Growth ₹45.942

↓ -0.03 ₹1,428 100 -4.1 -6.7 6.3 22.5 19.7 -6.9 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 5 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP Natural Resources and New Energy Fund Franklin Build India Fund Aditya Birla Sun Life Banking And Financial Services Fund ICICI Prudential Banking and Financial Services Fund Bandhan Infrastructure Fund Point 1 Bottom quartile AUM (₹1,765 Cr). Lower mid AUM (₹3,003 Cr). Upper mid AUM (₹3,641 Cr). Highest AUM (₹10,951 Cr). Bottom quartile AUM (₹1,428 Cr). Point 2 Oldest track record among peers (17 yrs). Established history (16+ yrs). Established history (12+ yrs). Established history (17+ yrs). Established history (15+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 5★ (bottom quartile). Rating: 5★ (bottom quartile). Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 20.54% (upper mid). 5Y return: 22.67% (top quartile). 5Y return: 12.07% (bottom quartile). 5Y return: 11.53% (bottom quartile). 5Y return: 19.68% (lower mid). Point 6 3Y return: 23.59% (upper mid). 3Y return: 26.21% (top quartile). 3Y return: 15.53% (bottom quartile). 3Y return: 14.20% (bottom quartile). 3Y return: 22.50% (lower mid). Point 7 1Y return: 34.03% (top quartile). 1Y return: 17.13% (upper mid). 1Y return: 17.03% (lower mid). 1Y return: 12.26% (bottom quartile). 1Y return: 6.29% (bottom quartile). Point 8 Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.61 (top quartile). Alpha: -2.00 (bottom quartile). Alpha: 0.00 (bottom quartile). Point 9 Sharpe: 1.32 (top quartile). Sharpe: 0.21 (bottom quartile). Sharpe: 1.03 (upper mid). Sharpe: 0.78 (lower mid). Sharpe: -0.27 (bottom quartile). Point 10 Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.25 (top quartile). Information ratio: -0.01 (bottom quartile). Information ratio: 0.00 (bottom quartile). DSP Natural Resources and New Energy Fund

Franklin Build India Fund

Aditya Birla Sun Life Banking And Financial Services Fund

ICICI Prudential Banking and Financial Services Fund

Bandhan Infrastructure Fund

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Very good for young generation.