Which SIP Is Best for 5 Years? Top Mutual Fund SIPs Explained

Choosing the Top SIP for a 5-year investment is one of the most common questions Indian investors ask today — especially for goals like buying a car, planning a wedding, or creating a home down payment.

The short answer is — there is no single best SIP for everyone.

The ideal SIP for 5 years depends on three factors:

- your risk tolerance

- your return expectations

- and the mutual fund category you choose

For a 5-year time horizon, investors should focus on stable equity and hybrid Mutual Funds, rather than high-risk small-cap or thematic funds.

In this guide, we explain -

- which SIP categories work best for 5 years

- top performing mutual fund SIPs based on consistency

- how much return you can realistically expect

- and a step-by-step method to select the right fund for your goal

Best SIP Options for 5-Year Investment (Quick Summary)

| Investor Type | Ideal SIP Category |

|---|---|

| Conservative | Hybrid Fund |

| Moderate | Flexi Cap Funds |

| Moderate–Aggressive | Large & mid cap funds |

| High Risk | Ideally not recommended for 5 years |

- Small-cap and sectoral funds are generally not suitable for a 5-year SIP due to high Volatility.

1. Why SIP Is Ideal for a 5-Year Investment

Most Indian investors today prefer SIP because it solves three major problems:

✔ Prevents timing the market

You invest every month — in highs and lows — automatically averaging your cost.

✔ Helps you beat inflation

- Inflation is now ~5–6%.

- Fixed deposits rarely beat this over 5 years. But mutual funds, especially equity and hybrid categories, have historically delivered 10–13% CAGR.

✔ Builds a disciplined habit

Even a ₹1,000 or ₹2,000 monthly SIP compounds to a meaningful amount in five years.

✔ Flexible + Customisable

You can:

- Pause SIP

- Increase or decrease amount

- Withdraw partially

- Switch funds

- Stop anytime

This flexibility is perfect for medium-term goals.

Talk to our investment specialist

Key SIP Trends Every Investor Should Know

Understanding the SIP environment helps you choose smarter.

Record SIP inflows

According to AMFI, SIP inflows consistently hit all-time highs throughout 2024. This shows -

- Higher investor confidence

- Strong participation from Tier-2 and Tier-3 cities

- More long-term investors staying invested

Rise of Flexi Cap and Large & Mid Cap funds

These categories outperformed small caps in 2024 due to better risk-adjusted returns. This makes them suitable for a 5-year goal.

Market volatility rose in 2024

Events like global rate cuts, elections, and geopolitical uncertainty increased volatility. SIPs benefit from volatility due to rupee-cost averaging.

Younger investors dominate

The average SIP investor age dropped to 28–32 years.

Most popular SIP tenure: 5 years

A 5-year period perfectly balances -

- Growth potential

- Risk moderation

- Goal-based planning

Is 5 Years Enough for Equity SIP?

- Yes, but with the right categories.

- Not all Equity Funds suit a 5-year SIP.

Here’s why:

- Small-cap and sectoral funds can be extremely volatile in short horizons.

- Hybrid and flexi-cap funds reduce downside risk.

- Large caps offer stability when markets are uncertain.

So,

- ✔ Equity is suitable for 5 years if you stick to stable categories

- ✔ Hybrid funds are perfect for conservative investors

How to Choose the Best SIP Plan for a 5-Year Goal

Choosing the right SIP for a 5-year horizon isn’t complicated — but it does need a bit of structure. Here’s a clean, practical way to do it -

Step 1: Understand Your Risk Comfort

Ask yourself one question: How much market ups-and-downs can I genuinely handle?

- If you prefer stability: go with Hybrid Funds or Large-Cap Funds

- If you’re okay with moderate swings: Flexi-Cap Funds are a balanced choice

- If you want higher growth and can stay calm during volatility: choose Large & Mid-Cap Funds

Your risk level automatically decides your category.

Step 2: Evaluate the Fund Properly

Once you know the category, check a few core metrics to ensure you’re not picking a weak fund -

- A fund with at least 5 years of history

- Consistent rolling returns, not just one lucky year

- A low to reasonable expense ratio

- Controlled volatility (standard deviation shouldn’t be too high for the category)

- A fund manager with a solid, steady track record

These checks tell you if the fund is reliable.

Step 3: Skip High-Risk Funds for This Timeframe

For a 5-year goal, it's smarter to avoid categories that swing too wildly -

- Small cap funds

- Sector or thematic funds

- Pure international fund

They’re fantastic for long-term wealth but unpredictable for a 5-year SIP. They are good to plan for something beyond 8 to 10 years.

Step 4: Review Once a Year — Not Every Month

A simple yearly check is enough. Look at -

- How the entire category is doing (not just your fund)

- Major changes in the Portfolio

- Any shifts in the Risk-o-Meter

If everything looks stable, continue the SIP. If the category itself is struggling for long, consider switching.

Expected SIP Returns for 5-Year Investment

Based on long-term historical data:

| Fund Category | Expected CAGR |

|---|---|

| Hybrid Funds | 8% – 10% |

| Large cap funds | 10% – 11% |

| Flexi Cap Funds | 11% – 13% |

| Large & Mid Cap | 12% – 14% |

These are indicative returns, not guaranteed. Actual returns depend on market cycles and discipline.

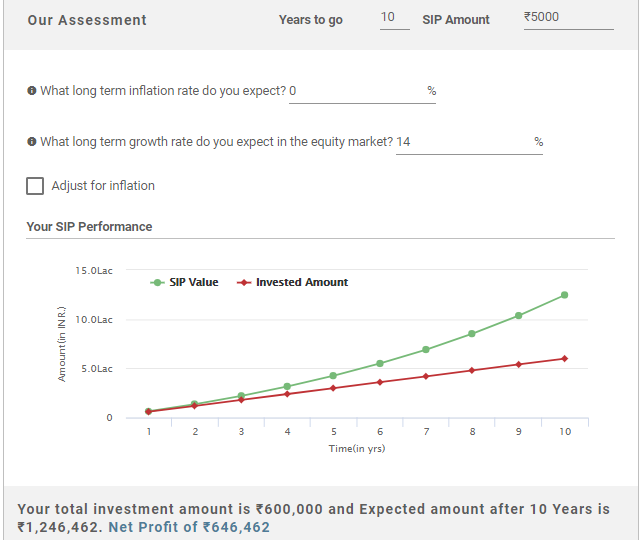

How Much Can SIP Grow in 5 Years?

| Monthly SIP | Approx Value (12% CAGR) |

|---|---|

| ₹3,000 | ₹2.45 lakh |

| ₹5,000 | ₹4.10 lakh |

| ₹10,000 | ₹8.20 lakh |

| ₹20,000 | ₹16.40 lakh |

The above figures are indicative and based on assumed returns.

Your actual SIP returns will depend on:

- monthly SIP investment amount

- investment duration

- expected rate of return

To calculate your personalised SIP returns:

➡️ Use Fincash sip calculator to estimate your 5-year investment value. 🔗 Calculate SIP Returns Instantly

Fund Selection Methodology used to find 10 funds

Best SIP Plans for 5 Year Investment in FY 26 - 27

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP World Gold Fund Growth ₹62.7255

↓ -1.20 ₹1,756 500 36 84.7 155.1 55.6 28.2 167.1 SBI Gold Fund Growth ₹44.489

↓ -0.87 ₹10,775 500 19.9 51.6 75.6 37.2 24.9 71.5 Aditya Birla Sun Life Gold Fund Growth ₹44.2787

↓ -0.70 ₹1,266 100 19.8 51.6 75.4 37.2 24.4 72 HDFC Gold Fund Growth ₹45.3859

↓ -0.87 ₹8,501 300 19.8 51.3 74.8 37 24.6 71.3 ICICI Prudential Regular Gold Savings Fund Growth ₹47.0218

↓ -0.97 ₹4,482 100 19.7 51.3 75.1 37 24.7 72 Nippon India Gold Savings Fund Growth ₹58.0764

↓ -1.11 ₹5,301 100 19.5 51.2 74.8 36.8 24.6 71.2 IDBI Gold Fund Growth ₹39.3486

↓ -0.90 ₹623 500 19.3 50.6 73.1 36.7 24.8 79 Kotak Gold Fund Growth ₹58.3993

↓ -1.04 ₹5,213 1,000 19.7 51.3 74.9 36.7 24.4 70.4 Axis Gold Fund Growth ₹44.0864

↓ -0.97 ₹2,167 1,000 19 51 73.8 36.6 24.7 69.8 SBI PSU Fund Growth ₹35.8635

↓ -0.43 ₹5,817 500 5.9 14.5 28.8 33.7 28.5 11.3 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 12 Feb 26 Research Highlights & Commentary of 10 Funds showcased

Commentary DSP World Gold Fund SBI Gold Fund Aditya Birla Sun Life Gold Fund HDFC Gold Fund ICICI Prudential Regular Gold Savings Fund Nippon India Gold Savings Fund IDBI Gold Fund Kotak Gold Fund Axis Gold Fund SBI PSU Fund Point 1 Bottom quartile AUM (₹1,756 Cr). Highest AUM (₹10,775 Cr). Bottom quartile AUM (₹1,266 Cr). Top quartile AUM (₹8,501 Cr). Lower mid AUM (₹4,482 Cr). Upper mid AUM (₹5,301 Cr). Bottom quartile AUM (₹623 Cr). Upper mid AUM (₹5,213 Cr). Lower mid AUM (₹2,167 Cr). Upper mid AUM (₹5,817 Cr). Point 2 Oldest track record among peers (18 yrs). Established history (14+ yrs). Established history (13+ yrs). Established history (14+ yrs). Established history (14+ yrs). Established history (14+ yrs). Established history (13+ yrs). Established history (14+ yrs). Established history (14+ yrs). Established history (15+ yrs). Point 3 Top rated. Rating: 2★ (upper mid). Rating: 3★ (top quartile). Rating: 1★ (lower mid). Rating: 1★ (lower mid). Rating: 2★ (upper mid). Not Rated. Rating: 1★ (bottom quartile). Rating: 1★ (bottom quartile). Rating: 2★ (upper mid). Point 4 Risk profile: High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: High. Point 5 5Y return: 28.22% (top quartile). 5Y return: 24.87% (upper mid). 5Y return: 24.45% (bottom quartile). 5Y return: 24.60% (lower mid). 5Y return: 24.71% (upper mid). 5Y return: 24.60% (bottom quartile). 5Y return: 24.78% (upper mid). 5Y return: 24.39% (bottom quartile). 5Y return: 24.66% (lower mid). 5Y return: 28.49% (top quartile). Point 6 3Y return: 55.56% (top quartile). 3Y return: 37.21% (top quartile). 3Y return: 37.16% (upper mid). 3Y return: 37.01% (upper mid). 3Y return: 36.95% (upper mid). 3Y return: 36.85% (lower mid). 3Y return: 36.72% (lower mid). 3Y return: 36.68% (bottom quartile). 3Y return: 36.65% (bottom quartile). 3Y return: 33.68% (bottom quartile). Point 7 1Y return: 155.09% (top quartile). 1Y return: 75.59% (top quartile). 1Y return: 75.37% (upper mid). 1Y return: 74.77% (lower mid). 1Y return: 75.08% (upper mid). 1Y return: 74.76% (lower mid). 1Y return: 73.12% (bottom quartile). 1Y return: 74.87% (upper mid). 1Y return: 73.75% (bottom quartile). 1Y return: 28.78% (bottom quartile). Point 8 Alpha: 1.32 (top quartile). 1M return: 8.39% (upper mid). 1M return: 8.61% (top quartile). 1M return: 8.17% (lower mid). 1M return: 8.18% (upper mid). 1M return: 8.30% (upper mid). 1M return: 7.74% (bottom quartile). 1M return: 8.52% (top quartile). 1M return: 7.96% (lower mid). Alpha: -0.22 (bottom quartile). Point 9 Sharpe: 3.42 (bottom quartile). Alpha: 0.00 (top quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (upper mid). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Alpha: 0.00 (bottom quartile). Sharpe: 0.33 (bottom quartile). Point 10 Information ratio: -0.67 (bottom quartile). Sharpe: 4.38 (upper mid). Sharpe: 4.49 (top quartile). Sharpe: 4.39 (upper mid). Sharpe: 4.33 (lower mid). Sharpe: 4.46 (upper mid). Sharpe: 4.30 (bottom quartile). Sharpe: 4.63 (top quartile). Sharpe: 4.36 (lower mid). Information ratio: -0.47 (bottom quartile). DSP World Gold Fund

SBI Gold Fund

Aditya Birla Sun Life Gold Fund

HDFC Gold Fund

ICICI Prudential Regular Gold Savings Fund

Nippon India Gold Savings Fund

IDBI Gold Fund

Kotak Gold Fund

Axis Gold Fund

SBI PSU Fund

*Funds mentioned are considering best "The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in units of MLIIF - WGF. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or units of money market/liquid schemes of DSP Merrill Lynch Mutual Fund, in order to meet liquidity requirements from time to time. However, there is no assurance that the investment objective of the Scheme will be realized." Below is the key information for DSP World Gold Fund Returns up to 1 year are on The scheme seeks to provide returns that closely correspond to returns provided by SBI - ETF Gold (Previously known as SBI GETS). Research Highlights for SBI Gold Fund Below is the key information for SBI Gold Fund Returns up to 1 year are on An Open ended Fund of Funds Scheme with the investment objective to provide returns that tracks returns provided by Birla Sun Life Gold ETF (BSL Gold ETF). Research Highlights for Aditya Birla Sun Life Gold Fund Below is the key information for Aditya Birla Sun Life Gold Fund Returns up to 1 year are on To seek capital appreciation by investing in units of HDFC Gold Exchange Traded Fund (HGETF). Research Highlights for HDFC Gold Fund Below is the key information for HDFC Gold Fund Returns up to 1 year are on ICICI Prudential Regular Gold Savings Fund (the Scheme) is a fund of funds scheme with the primary objective to generate returns by investing in units of ICICI Prudential Gold Exchange Traded Fund (IPru Gold ETF).

However, there can be no assurance that the investment objectives of the Scheme will be realized. Research Highlights for ICICI Prudential Regular Gold Savings Fund Below is the key information for ICICI Prudential Regular Gold Savings Fund Returns up to 1 year are on The investment objective of the Scheme is to seek to provide returns that closely correspond to returns provided by Reliance ETF Gold BeES. Research Highlights for Nippon India Gold Savings Fund Below is the key information for Nippon India Gold Savings Fund Returns up to 1 year are on The investment objective of the Scheme will be to generate returns that correspond closely to the returns generated by IDBI Gold Exchange Traded Fund (IDBI GOLD ETF). Research Highlights for IDBI Gold Fund Below is the key information for IDBI Gold Fund Returns up to 1 year are on The investment objective of the scheme is to generate returns by investing in units of Kotak Gold Exchange Traded Fund. Research Highlights for Kotak Gold Fund Below is the key information for Kotak Gold Fund Returns up to 1 year are on To generate returns that closely correspond to returns generated by Axis Gold ETF. Research Highlights for Axis Gold Fund Below is the key information for Axis Gold Fund Returns up to 1 year are on The objective of the scheme would be to provide investors with opportunities for long-term growth in capital along with the liquidity of an open-ended scheme through an active management of investments in a diversified basket of equity stocks of domestic Public Sector Undertakings and in debt and money market instruments issued by PSUs AND others. Research Highlights for SBI PSU Fund Below is the key information for SBI PSU Fund Returns up to 1 year are on CAGR returns for over 3 years and fund having atleast have market history (Fund age) of 3 year and have minimum 500 Crore of asset under management.

1. DSP World Gold Fund

DSP World Gold Fund

Growth Launch Date 14 Sep 07 NAV (12 Feb 26) ₹62.7255 ↓ -1.20 (-1.88 %) Net Assets (Cr) ₹1,756 on 31 Dec 25 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.41 Sharpe Ratio 3.42 Information Ratio -0.67 Alpha Ratio 1.32 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹8,807 31 Jan 23 ₹9,422 31 Jan 24 ₹8,517 31 Jan 25 ₹12,548 31 Jan 26 ₹33,170 Returns for DSP World Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 12 Feb 26 Duration Returns 1 Month 7.6% 3 Month 36% 6 Month 84.7% 1 Year 155.1% 3 Year 55.6% 5 Year 28.2% 10 Year 15 Year Since launch 10.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 167.1% 2023 15.9% 2022 7% 2021 -7.7% 2020 -9% 2019 31.4% 2018 35.1% 2017 -10.7% 2016 -4% 2015 52.7% Fund Manager information for DSP World Gold Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.85 Yr. Data below for DSP World Gold Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Basic Materials 94.95% Asset Allocation

Asset Class Value Cash 2.43% Equity 94.95% Debt 0.01% Other 2.6% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Gold I2

Investment Fund | -74% ₹1,294 Cr 1,219,254

↓ -59,731 VanEck Gold Miners ETF

- | GDX25% ₹442 Cr 573,719 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -2% ₹28 Cr Net Receivables/Payables

Net Current Assets | -0% -₹8 Cr 2. SBI Gold Fund

SBI Gold Fund

Growth Launch Date 12 Sep 11 NAV (13 Feb 26) ₹44.489 ↓ -0.87 (-1.91 %) Net Assets (Cr) ₹10,775 on 31 Dec 25 Category Gold - Gold AMC SBI Funds Management Private Limited Rating ☆☆ Risk Moderately High Expense Ratio 0.3 Sharpe Ratio 4.38 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹9,629 31 Jan 23 ₹11,359 31 Jan 24 ₹12,462 31 Jan 25 ₹16,115 31 Jan 26 ₹30,818 Returns for SBI Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 12 Feb 26 Duration Returns 1 Month 8.4% 3 Month 19.9% 6 Month 51.6% 1 Year 75.6% 3 Year 37.2% 5 Year 24.9% 10 Year 15 Year Since launch 10.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 71.5% 2023 19.6% 2022 14.1% 2021 12.6% 2020 -5.7% 2019 27.4% 2018 22.8% 2017 6.4% 2016 3.5% 2015 10% Fund Manager information for SBI Gold Fund

Name Since Tenure Raviprakash Sharma 12 Sep 11 14.31 Yr. Data below for SBI Gold Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 1.25% Other 98.75% Top Securities Holdings / Portfolio

Name Holding Value Quantity SBI Gold ETF

- | -100% ₹10,805 Cr 951,342,785

↑ 86,762,195 Net Receivable / Payable

CBLO | -1% -₹125 Cr Treps

CBLO/Reverse Repo | -1% ₹94 Cr 3. Aditya Birla Sun Life Gold Fund

Aditya Birla Sun Life Gold Fund

Growth Launch Date 20 Mar 12 NAV (13 Feb 26) ₹44.2787 ↓ -0.70 (-1.56 %) Net Assets (Cr) ₹1,266 on 31 Dec 25 Category Gold - Gold AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 0.51 Sharpe Ratio 4.49 Information Ratio 0 Alpha Ratio 0 Min Investment 100 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹9,602 31 Jan 23 ₹11,314 31 Jan 24 ₹12,322 31 Jan 25 ₹15,883 31 Jan 26 ₹31,280 Returns for Aditya Birla Sun Life Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 12 Feb 26 Duration Returns 1 Month 8.6% 3 Month 19.8% 6 Month 51.6% 1 Year 75.4% 3 Year 37.2% 5 Year 24.4% 10 Year 15 Year Since launch 11.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 72% 2023 18.7% 2022 14.5% 2021 12.3% 2020 -5% 2019 26% 2018 21.3% 2017 6.8% 2016 1.6% 2015 11.5% Fund Manager information for Aditya Birla Sun Life Gold Fund

Name Since Tenure Priya Sridhar 31 Dec 24 1 Yr. Data below for Aditya Birla Sun Life Gold Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 1.33% Other 98.67% Top Securities Holdings / Portfolio

Name Holding Value Quantity Aditya BSL Gold ETF

- | -100% ₹1,268 Cr 107,894,183

↑ 5,418,626 Net Receivables / (Payables)

Net Current Assets | -1% -₹10 Cr Clearing Corporation Of India Limited

CBLO/Reverse Repo | -1% ₹8 Cr 4. HDFC Gold Fund

HDFC Gold Fund

Growth Launch Date 24 Oct 11 NAV (13 Feb 26) ₹45.3859 ↓ -0.87 (-1.89 %) Net Assets (Cr) ₹8,501 on 31 Dec 25 Category Gold - Gold AMC HDFC Asset Management Company Limited Rating ☆ Risk Moderately High Expense Ratio 0.49 Sharpe Ratio 4.39 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 300 Exit Load 0-6 Months (2%),6-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹9,641 31 Jan 23 ₹11,342 31 Jan 24 ₹12,349 31 Jan 25 ₹15,958 31 Jan 26 ₹30,476 Returns for HDFC Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 12 Feb 26 Duration Returns 1 Month 8.2% 3 Month 19.8% 6 Month 51.3% 1 Year 74.8% 3 Year 37% 5 Year 24.6% 10 Year 15 Year Since launch 11.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 71.3% 2023 18.9% 2022 14.1% 2021 12.7% 2020 -5.5% 2019 27.5% 2018 21.7% 2017 6.6% 2016 2.8% 2015 10.1% Fund Manager information for HDFC Gold Fund

Name Since Tenure Arun Agarwal 15 Feb 23 2.88 Yr. Nandita Menezes 29 Mar 25 0.76 Yr. Data below for HDFC Gold Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 1.32% Other 98.68% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Gold ETF

- | -100% ₹8,513 Cr 748,659,417

↑ 41,324,000 Net Current Assets

Net Current Assets | -1% -₹43 Cr Treps - Tri-Party Repo

CBLO/Reverse Repo | -0% ₹31 Cr 5. ICICI Prudential Regular Gold Savings Fund

ICICI Prudential Regular Gold Savings Fund

Growth Launch Date 11 Oct 11 NAV (13 Feb 26) ₹47.0218 ↓ -0.97 (-2.01 %) Net Assets (Cr) ₹4,482 on 31 Dec 25 Category Gold - Gold AMC ICICI Prudential Asset Management Company Limited Rating ☆ Risk Moderately High Expense Ratio 0.38 Sharpe Ratio 4.33 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-15 Months (2%),15 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹9,678 31 Jan 23 ₹11,361 31 Jan 24 ₹12,399 31 Jan 25 ₹16,060 31 Jan 26 ₹31,216 Returns for ICICI Prudential Regular Gold Savings Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 12 Feb 26 Duration Returns 1 Month 8.2% 3 Month 19.7% 6 Month 51.3% 1 Year 75.1% 3 Year 37% 5 Year 24.7% 10 Year 15 Year Since launch 11.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 72% 2023 19.5% 2022 13.5% 2021 12.7% 2020 -5.4% 2019 26.6% 2018 22.7% 2017 7.4% 2016 0.8% 2015 8.9% Fund Manager information for ICICI Prudential Regular Gold Savings Fund

Name Since Tenure Manish Banthia 27 Sep 12 13.27 Yr. Nishit Patel 29 Dec 20 5.01 Yr. Ashwini Bharucha 1 Nov 25 0.17 Yr. Venus Ahuja 1 Nov 25 0.17 Yr. Data below for ICICI Prudential Regular Gold Savings Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 1.46% Other 98.54% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Pru Gold ETF

- | -100% ₹4,479 Cr 391,858,244

↑ 23,365,770 Treps

CBLO/Reverse Repo | -2% ₹73 Cr Net Current Assets

Net Current Assets | -2% -₹70 Cr 6. Nippon India Gold Savings Fund

Nippon India Gold Savings Fund

Growth Launch Date 7 Mar 11 NAV (13 Feb 26) ₹58.0764 ↓ -1.11 (-1.88 %) Net Assets (Cr) ₹5,301 on 31 Dec 25 Category Gold - Gold AMC Nippon Life Asset Management Ltd. Rating ☆☆ Risk Moderately High Expense Ratio 0.35 Sharpe Ratio 4.46 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (2%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹9,635 31 Jan 23 ₹11,321 31 Jan 24 ₹12,369 31 Jan 25 ₹15,957 31 Jan 26 ₹31,222 Returns for Nippon India Gold Savings Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 12 Feb 26 Duration Returns 1 Month 8.3% 3 Month 19.5% 6 Month 51.2% 1 Year 74.8% 3 Year 36.8% 5 Year 24.6% 10 Year 15 Year Since launch 12.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 71.2% 2023 19% 2022 14.3% 2021 12.3% 2020 -5.5% 2019 26.6% 2018 22.5% 2017 6% 2016 1.7% 2015 11.6% Fund Manager information for Nippon India Gold Savings Fund

Name Since Tenure Himanshu Mange 23 Dec 23 2.03 Yr. Data below for Nippon India Gold Savings Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 1.16% Other 98.84% Top Securities Holdings / Portfolio

Name Holding Value Quantity Nippon India ETF Gold BeES

- | -100% ₹5,311 Cr 482,305,733

↑ 18,874,222 Net Current Assets

Net Current Assets | -0% -₹24 Cr Triparty Repo

CBLO/Reverse Repo | -0% ₹14 Cr Cash Margin - Ccil

CBLO/Reverse Repo | -0% ₹0 Cr 7. IDBI Gold Fund

IDBI Gold Fund

Growth Launch Date 14 Aug 12 NAV (13 Feb 26) ₹39.3486 ↓ -0.90 (-2.24 %) Net Assets (Cr) ₹623 on 31 Dec 25 Category Gold - Gold AMC IDBI Asset Management Limited Rating Risk Moderately High Expense Ratio 0.64 Sharpe Ratio 4.3 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹9,678 31 Jan 23 ₹11,393 31 Jan 24 ₹12,454 31 Jan 25 ₹16,090 31 Jan 26 ₹31,809 Returns for IDBI Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 12 Feb 26 Duration Returns 1 Month 7.7% 3 Month 19.3% 6 Month 50.6% 1 Year 73.1% 3 Year 36.7% 5 Year 24.8% 10 Year 15 Year Since launch 10.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 79% 2023 18.7% 2022 14.8% 2021 12% 2020 -4% 2019 24.2% 2018 21.6% 2017 5.8% 2016 1.4% 2015 8.3% Fund Manager information for IDBI Gold Fund

Name Since Tenure Sumit Bhatnagar 1 Jun 24 1.59 Yr. Data below for IDBI Gold Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 2.77% Other 97.23% Top Securities Holdings / Portfolio

Name Holding Value Quantity LIC MF Gold ETF

- | -99% ₹617 Cr 493,852

↑ 35,100 Treps

CBLO/Reverse Repo | -2% ₹13 Cr Net Receivables / (Payables)

Net Current Assets | -1% -₹7 Cr 8. Kotak Gold Fund

Kotak Gold Fund

Growth Launch Date 25 Mar 11 NAV (13 Feb 26) ₹58.3993 ↓ -1.04 (-1.75 %) Net Assets (Cr) ₹5,213 on 31 Dec 25 Category Gold - Gold AMC Kotak Mahindra Asset Management Co Ltd Rating ☆ Risk Moderately High Expense Ratio 0.5 Sharpe Ratio 4.63 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-6 Months (2%),6-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹9,630 31 Jan 23 ₹11,266 31 Jan 24 ₹12,247 31 Jan 25 ₹15,860 31 Jan 26 ₹29,505 Returns for Kotak Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 12 Feb 26 Duration Returns 1 Month 8.5% 3 Month 19.7% 6 Month 51.3% 1 Year 74.9% 3 Year 36.7% 5 Year 24.4% 10 Year 15 Year Since launch 12.6% Historical performance (Yearly) on absolute basis

Year Returns 2024 70.4% 2023 18.9% 2022 13.9% 2021 11.7% 2020 -4.7% 2019 26.6% 2018 24.1% 2017 7.3% 2016 2.5% 2015 10.2% Fund Manager information for Kotak Gold Fund

Name Since Tenure Abhishek Bisen 25 Mar 11 14.78 Yr. Jeetu Sonar 1 Oct 22 3.25 Yr. Data below for Kotak Gold Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 1.32% Other 98.68% Top Securities Holdings / Portfolio

Name Holding Value Quantity Kotak Gold ETF

- | -100% ₹5,221 Cr 471,742,933

↑ 14,812,922 Net Current Assets/(Liabilities)

Net Current Assets | -1% -₹29 Cr Triparty Repo

CBLO/Reverse Repo | -0% ₹21 Cr 9. Axis Gold Fund

Axis Gold Fund

Growth Launch Date 20 Oct 11 NAV (13 Feb 26) ₹44.0864 ↓ -0.97 (-2.16 %) Net Assets (Cr) ₹2,167 on 31 Dec 25 Category Gold - Gold AMC Axis Asset Management Company Limited Rating ☆ Risk Moderately High Expense Ratio 0.5 Sharpe Ratio 4.36 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹9,659 31 Jan 23 ₹11,397 31 Jan 24 ₹12,487 31 Jan 25 ₹16,126 31 Jan 26 ₹29,924 Returns for Axis Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 12 Feb 26 Duration Returns 1 Month 8% 3 Month 19% 6 Month 51% 1 Year 73.8% 3 Year 36.6% 5 Year 24.7% 10 Year 15 Year Since launch 10.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 69.8% 2023 19.2% 2022 14.7% 2021 12.5% 2020 -4.7% 2019 26.9% 2018 23.1% 2017 8.3% 2016 0.7% 2015 10.7% Fund Manager information for Axis Gold Fund

Name Since Tenure Aditya Pagaria 9 Nov 21 4.15 Yr. Pratik Tibrewal 1 Feb 25 0.91 Yr. Data below for Axis Gold Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 1.48% Other 98.52% Top Securities Holdings / Portfolio

Name Holding Value Quantity Axis Gold ETF

- | -100% ₹2,168 Cr 195,829,138

↑ 10,476,454 Net Receivables / (Payables)

CBLO | -1% -₹13 Cr Clearing Corporation Of India Ltd

CBLO/Reverse Repo | -1% ₹12 Cr 10. SBI PSU Fund

SBI PSU Fund

Growth Launch Date 7 Jul 10 NAV (13 Feb 26) ₹35.8635 ↓ -0.43 (-1.19 %) Net Assets (Cr) ₹5,817 on 31 Dec 25 Category Equity - Sectoral AMC SBI Funds Management Private Limited Rating ☆☆ Risk High Expense Ratio 1.89 Sharpe Ratio 0.33 Information Ratio -0.47 Alpha Ratio -0.22 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹14,656 31 Jan 23 ₹17,067 31 Jan 24 ₹30,032 31 Jan 25 ₹32,242 31 Jan 26 ₹38,028 Returns for SBI PSU Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 12 Feb 26 Duration Returns 1 Month 5.7% 3 Month 5.9% 6 Month 14.5% 1 Year 28.8% 3 Year 33.7% 5 Year 28.5% 10 Year 15 Year Since launch 8.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 11.3% 2023 23.5% 2022 54% 2021 29% 2020 32.4% 2019 -10% 2018 6% 2017 -23.8% 2016 21.9% 2015 16.2% Fund Manager information for SBI PSU Fund

Name Since Tenure Rohit Shimpi 1 Jun 24 1.59 Yr. Data below for SBI PSU Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Financial Services 35.24% Utility 29.32% Energy 13.87% Industrials 12% Basic Materials 6.69% Asset Allocation

Asset Class Value Cash 2.8% Equity 97.11% Debt 0.08% Top Securities Holdings / Portfolio

Name Holding Value Quantity State Bank of India (Financial Services)

Equity, Since 31 Jul 10 | SBIN17% ₹975 Cr 9,927,500 Bharat Electronics Ltd (Industrials)

Equity, Since 30 Jun 24 | BEL9% ₹518 Cr 12,975,000 NTPC Ltd (Utilities)

Equity, Since 31 Jul 10 | 5325559% ₹509 Cr 15,443,244

↑ 900,000 GAIL (India) Ltd (Utilities)

Equity, Since 31 May 24 | 5321559% ₹502 Cr 29,150,000

↑ 3,400,000 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 31 Jul 10 | 5328988% ₹467 Cr 17,635,554

↑ 1,100,000 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 31 Aug 24 | 5005476% ₹372 Cr 9,700,000 Bank of Baroda (Financial Services)

Equity, Since 31 Aug 24 | 5321346% ₹325 Cr 11,000,000 NMDC Ltd (Basic Materials)

Equity, Since 31 Oct 23 | 5263714% ₹232 Cr 27,900,000 Indian Bank (Financial Services)

Equity, Since 30 Jun 21 | 5328143% ₹203 Cr 2,427,235 Oil India Ltd (Energy)

Equity, Since 31 Mar 24 | OIL3% ₹163 Cr 3,850,000

Common SIP Mistakes You Should Absolutely Avoid

Even smart investors slip up with SIPs — not because they lack discipline, but because some habits feel “right” even when they aren’t. Here are the most common traps to stay away from -

1. Chasing Last Year’s Top Performer

Many investors simply pick a fund that delivered the highest returns last year. But market cycles change quickly, and last year’s chart-topper can easily cool off. Choose consistency—not temporary fame.

2. Starting a SIP Without a Clear Goal

A SIP works best when you know why you’re Investing. When there’s no clear goal, you lose track of how much you should invest or how long you need to stay invested. A defined purpose keeps you disciplined.

3. Pausing SIPs When Markets Fall

This is one of the biggest mistakes. Market dips are actually the best time to accumulate more units at cheaper prices. Stopping your SIP during a fall is like stopping your workout right before you get fit.

4. Using Small-Cap or Mid-Cap Funds for a 5-Year Goal

These categories are fantastic for long-term wealth, but they can swing wildly in the short run. For a 5-year horizon, the volatility can become a roadblock. Safer, steadier categories are better suited for such timelines.

5. Overlooking the Expense Ratio

Most investors skip this tiny detail. But even a small difference in expense ratio can change your long-term returns. Think of it as a silent cost—one that you must keep an eye on.

6. Never Reviewing or Rebalancing Your SIPs

SIPs are not “set and forget.” Your goals or risk appetite may change, and so might the fund’s strategy or performance. A quick annual review keeps your investments aligned and healthy.

Talk to our investment specialist

How to Invest in Mutual Fund SIP Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

Frequently Asked Questions (FAQs)

1. Which SIP is best for 5 years with low risk?

A: Hybrid funds and large-cap funds are suitable, but there is still there could be some risk attached.

2. Can SIP give guaranteed returns?

A: No. Mutual funds are market-linked.

3. Should I stop SIP if market falls?

A: No. Market corrections benefit SIP investors.

4. Is lump sum better than SIP for 5 years?

A: For most investors, SIP is safer due to volatility control.

Conclusion

A 5-year SIP is one of the smartest ways to build medium-term wealth. The key is choosing the right fund category, avoiding unnecessary risk, and staying disciplined.

SIPs turn -

- Small monthly amounts

- Into meaningful wealth

- Through rupee-cost averaging + compounding

In the current market environment, systematic investing through SIPs remains one of the most effective ways to build medium-term wealth.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Research Highlights for DSP World Gold Fund