Penny Stocks: Investment Strategy or Fad?

Penny Stocks are known to be risky, but low price stocks that lack liquidity and have a very low market capitalisation. But, if chosen correctly, they can give you even make a good investment.

What are Penny Stocks?

As the name suggests, penny stocks trade for a penny, i.e. a very small amount. They are also known as cent stocks. In India these stocks can have market values below INR 10. In western markets, it can trade below $5.

Benefits of Investing in Penny Stocks

Low share prices

The best feature of penny stocks is their low price. You don’t need to invest a lot of money. This becomes beneficial for investors on a budget.

High gains

Penny stocks offer the potential for high gains. The companies that provide them are still in the growth phase. This means that the value of the stocks can rise higher than the high-priced stocks of large and well-established corporations. Also, even if the prices of the stocks increase marginally, the profits would be huge.

For example, if an investor has 10000 shares of INR 5 each, he has a total amount of INR 50,000 invested. Now if the price goes up to INR 8 in a day, the investor profits 3 bucks a share. This values his total investment at INR 80,000( 30,000 more in a single day!).

But, the thing to remember here is that you will most likely lose money rather than gaining because of the volatile nature of these stocks.

Talk to our investment specialist

Risks of Investing in Penny Stocks

High risk

Penny stocks can lose money as quickly as they make it. The low price of the stocks may be an indicator that the company is not doing well, making them highly risky. The returns may be high, but so are the risks. Hence, penny stocks should be considered only by experienced investors who are willing to take huge risks.

Liquidity

Even though penny stocks have a smaller denomination compared to regular stocks, their liquidity remains a concern. Since these stocks carry high risk and have fewer regulations, buyers are sceptical of buying them. This affects the liquidity of the stocks, making them unattractive to investors.

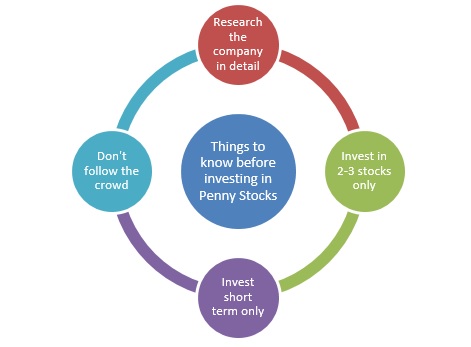

Things to Remember While Selecting Best Penny Stocks

Research about the

Penny stock companies are generally small. They are not quite popular or well known even though they are listed on the stock exchange. Before Investing in these stocks, look into the company and its products and understand what you might be investing in. You don’t want to end up with shares of a company nearing bankruptcy or had weak fundamentals. Look at the fine print before putting up your hard-earned money.

Invest in limited stocks

Though the low price of these stocks may seem like an attractive option, don’t be lured into buying more. Penny stocks have large fluctuations. Investing in only 2-3 stocks is wise because it helps in keeping track of them.

Invest for short term

Investing in penny stocks should be a short-term investment strategy only. These stocks have no predictability. So you can gain money today and lose it the very next day. A wise option is to exit while you gain money, making penny stocks a suitable for short-terms only. However, one should note there is no easy money to be made.

Don't follow the herd

There are always rumours about penny stocks, which usually affect their prices. Traders love to follow the pump and dump strategy here. What happens in this strategy is that rumours are spread about the stocks and traders buy the stocks in bulk to show a high demand. Since there is not a lot of information available to the public about the penny stocks, they look at the rising demand and invest their money. Once the stock has reached a decent value, the traders sell it off. This affects the share price, which then drops drastically and investors lose all their money. The key is to keep a low profile rather than invest hastily.

Investing in cent stocks is more of a fad, rather than just an investment strategy. They should only be considered by highly experienced investors who have a penchant for taking risks, who can monitor the markets and have the ability to take losses. Always remember, penny stocks are more like “high risk” stocks, which may not match the risk profile of most investors, they work on information asymmetry and move in ways most seasoned investors are not able to predict. For retail investors, Mutual Funds are a safer and better option which may not offer superlative returns (though over long periods they do!) but give a steady return over time and are managed by experts.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

thank you so much for providing a knowledge

Best jankari ke liye thanks..