EBITDA-to-Interest Coverage Ratio

What is EBITDA-to-Interest Coverage Ratio?

EBITDA-to-Interest Coverage Ratio is an important financial ratio that is utilized by economists for analyzing the overall financial stability of an organization. It is achieved by examining whether or not the company is profitable enough for paying off the respective interest expenses with the help of pre-tax income of the firm.

Particularly, the given ratio is helpful in observing what portion of EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) can be utilized for the given purpose.

The EBITDA-to-Interest Coverage Ratio also goes by the name as EBITDA Coverage. The major point of difference between the interest coverage ratio and EBITDA Coverage ratio is that the former is known to make use of EBIT (Earnings Before Income & Taxes) instead of using the highly encompassing EBITDA.

Calculating EBITDA-to-Interest Coverage Ratio

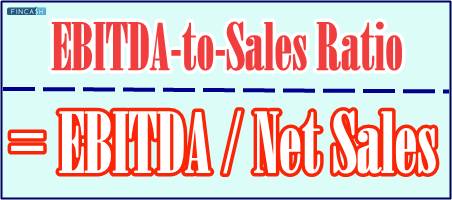

EBITDA-to-Interest Coverage Ratio Formula = (EBITDA) / (Total Payment of Interest)

Talk to our investment specialist

Understanding of EBITDA-to-Interest Coverage Ratio

The given financial ratio was initially utilized by bankers in the leveraged buyout context. The given set of bankers were known to make use of the same as a first screen for determining whether or not a newly restructured company be capable of servicing the obligations related to short-term debt. A ratio that turns out greater than 1 in value is known to indicate that the company tends to have enough interest coverage for paying off the respective interest expenses.

While the given ratio turns out to be a seamless mechanism for analyzing whether or not a particular company can cover the expenses related to interest. The applications of the given ratio also tend to be limited by its relevance with respect to EBITDA to serve as the proxy for multiple financial figures.

EBITDA-to-Interest Coverage Ratio Example

For instance, let us assume that a particular company has the given EBITDA-to-Interest Coverage Ratio valuing at 1.25. This might not necessarily imply that it would be capable of covering the respective interest payments. This is because the company might be required to spend a significant portion of the respective profits on the replacement of old equipment.

As EBITDA is not known to account for expenses related to depreciation, the ratio value of 1.25 might not serve to be a definitive indicator of the company’s financial durability.

Benefits of Using EBITDA-to-Interest Coverage Ratio

The given ratio is known to play a vital role when it comes to measuring the overall financial stability and durability of the company. Some of the essential benefits of this parameter are:

- Offering a trustable overview of the overall growth of the business along with its effectiveness in terms of the operating model

- Showing the actual value of the cash flow of the company that is generated with the help of active operations

- Comparing the financial efficiency of the firm with respect to the relevant competitors

- Indicating the overall appeal of the company for leveraged buyouts

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You Might Also Like