EBITDA-to-Sales Ratio

What is EBITDA-to-Sales Ratio?

EBITDA-to-Sales Ratio is an important financial metric that is utilized for analyzing the overall profitability of the company by comparing the revenue of the business with its respective earnings. To be more precise, as EBITDA gets derived from the respective revenue, the given metric is helpful in indicating the overall percentage of the earnings of the company remaining after the respective operating expenses.

Operating expenses are known to include COGS (Cost of Goods Sold) and expenses related to SG&A (Selling, General, & Administrative).

The ratio is known to focus on the concept of direct operating costs while eliminating the overall effects of the capital structure of the company by getting rid of interest, income taxes, and amortization & depreciation expenses.

EBITDA-to-Sales Ratio also goes by the name as EBITDA Margin. A higher value of appreciation is contributed to the ratio. This is because the same is known to indicate that the firm is capable of keeping the respective earnings at a moderate level with the help of efficient processes that are responsible for keeping the overall expenses low.

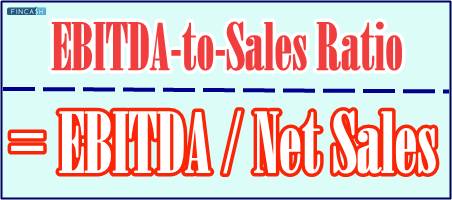

Calculating EBITDA-to-Sales Ratio

EBITDA-to-Sales Ratio Formula = (EBITDA) / (Net Sales)

EBITDA is known to stand for Earnings Before Interest, Taxes, Depreciation, and Amortization. Here, the value is calculated through the deduction of all possible expenses from the respective earnings. It is also called as net revenues, but it excludes factors like amortization, depreciation, interest, and taxes.

The value for EBITDA-to-Sales Ratio can be regarded as equal to that of EBITDA-to-Sales. A calculation result which equals to 1 helps in indicating that the company has no depreciation, amortization, interest, or taxes. Therefore, it is virtually guaranteed that the overall calculation of the EBITDA-to-Sales Ratio of a company is going to be less than 1. This is because of the extra deduction of the overall expenses.

As there is the impossibility of some negative amount for the given expenses, the EBITDA-to-Sales Ratio is not expected to return the value that turns out greater than 1. A value that comes to be greater than 1 serves to be a sign of miscalculation.

In specific instances, EBITDA can be perceived as a measure of liquidity. The overall comparison is being made between the values of residual net income and total revenue earned before specific expenses. Therefore, the value for EBITDA-to-Sales Ratio is known to reveal the total amount a particular business can expect to receive after the operating costs are paid. In its true sense, it might not be a concept of liquidity. However, the given calculation is still known to reveal how seamless it is for a business organization to cover and pay for specific costs.

Talk to our investment specialist

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.