What is High-Low Index?

A high-low index records stocks in an overall index's new 52-week highs and lows. It is regarded as an indicator in Technical Analysis, chart analysis, and historical stock data. The High-low index is used to identify the Market or index's direction — whether it will rise or fall. The high-low index is sometimes referred to as a breadth indicator since it measures the strength and weakness of an index.

How is the High-Low Index Calculated?

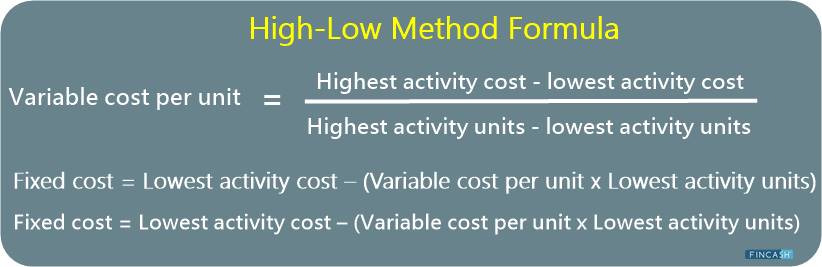

Using the Record High Percent technique, the high-low index is calculated. It is done by taking the simple Moving Average of new 52-week highs and new 52-week lows of an Underlying index over a defined period of time. Here is the Record High Percentage formula:

Record High Percent = New Highs/ New Highs + New Lows * 100

Once a record high percent is calculated, the high-low index must be evaluated using a simple moving average of the previous ten days (or another time period). Using the simple moving average, you can get a more apparent and understood trend of the underlying index.

Interpretation of High-Low Index

The high-low index is used to determine whether the underlying index is bullish or bearish. You must look at the high-low index level to establish the appropriate circumstance. If the high-low index is greater than 50, it means there are more 52-week record highs than record lows.

The opposite is true if the index is below 50. The high-low index must also be persistently around 70 for the underlying index to be considered bullish. To be considered bearish, the index must be persistently below 30.

Talk to our investment specialist

Trading with High-Low Index

A 20-day moving average is sometimes added to the high-low index and used as a signal line to begin a trade by many traders. Take a look at how it's done:

- A buy signal is generated the moment an index goes beyond its moving average

- When it crosses below its moving average, a sell signal is generated

Traders should use additional technical indicators to filter the signals given by the high-low index. This index can also be used to determine if a market is bullish or bearish. If the indicator is over 50, for example, a trader can elect to trade the long side of the market solely.

Relationship Between High-Low Index and Market Efficiency

The high-low index is a trading indicator that leverages the Record High Percent to reflect historical data by using a simple moving average of new highs and new lows. However, in finance and the Capital markets, one of the oldest maxims is that previous performance does not predict future performance.

A high-low index can be helpful in determining the relative strength of an underlying index. However, using it as a trading indicator to produce buy or sell signals requires that the market is neither weak nor efficient, which can lead to adverse outcomes.

Simple market Efficiency theory posits three degrees of market efficiency:

- Strong form efficiency

- Semi-strong form efficiency

- Weak form efficiency

These are ranked from most to least efficient. Acting solely on high-low index buy or sell signals would suggest that an investor believes an indicator or marketplace is not weak or inefficient, which is very unlikely.

Takeaway

The High-Low Index can be considered as a market breadth indicator that evaluates the strength and weakness of a certain index. When used along with other methods of analysis, the indicator performs best. It's a very simple calculation that aims to serve as a momentum indicator for detecting overbought market circumstances. It determines the difference between the current high and the prior low for a given time period. This provides a Range of indicators for the market that you can use while Investing.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.