GSTR-11: Return for Unique Identity Number (UIN) Holders

GSTR-11 is a special return under the GST regime. It is to be filed by those who have been issued with a Unique Identity Number (UIN).

What is GSTR-11?

GSTR-11 is a document that is to be filed by registered organisations or persons who have been issued the UIN during the months of their purchase for consumption in India. They can get a tax credit/refund on their purchases.

Who Are Unique Identity Number Holders?

Unique Identity Number Holders are foreign diplomatic missions and embassies. They are not liable to pay taxes in India.

UIN is issued to these persons so that any amount of tax they’ve paid for anything purchased in the country can be refunded back to them. However, to get the refund they have to file GSTR-11.

Here’s a list of those who can apply for UIN:

- United Nation Organisation’s specialised agency.

- Consulate or Embassy of foreign countries

- Multilateral Financial Institution and Organisation and UN Act 1947

- Person or class of persons notified by Commissioner

Talk to our investment specialist

Due Dates for Filing GSTR-11

GSTR-11 is to be filed by the 28th of the following month from the month of purchase and availing of services. For instance, a diplomat of the embassy has paid tax while purchasing food or staying in the country in January. He/she is required to file GSTR-11 by 28th February.

Following are the due dates for 2020:

| Period | Due Dates |

|---|---|

| February Return | March 28th 2020 |

| March Return | April 28th 2020 |

| April Return | May 28th 2020 |

| May Return | June 28th 2020 |

| June Return | July 28th 2020 |

| July Return | August 28th 2020 |

| August Return | September 28th 2020 |

| September Return | October 28th 2020 |

| October Return | November 28th 2020 |

| November Return | December 28th 2020 |

| December Return | January 28th 2021 |

Difference Between GSTR-1 and GSTR-11

GSTR-1 and GSTR-11 are two completely different returns. Those who file GSTR-1 don’t need to file GSTR-11 and vice versa.

Following are the differences:

| GSTR-1 | GSTR-11 |

|---|---|

| It is filed by a registered taxable person under the GST regime in India. | It is filed by Unique identification number (UIN) Holder. |

| It is a monthly statement of outward supplies. | It is an inward supplies statement for UIN holder. |

| It has to be filed on the 10th of every month. | It has to be filed after the completion of one month of inward supplies i.e. 28th of the following month. |

| It has to be filed by everyone except composition scheme taxable persons, Non-resident foreign taxpayers, TDS deductors, E-commerce operators and Input Service Distributors. | It has to be filed by UIN holders only. No one else under the GST regime of India is required to file this return. |

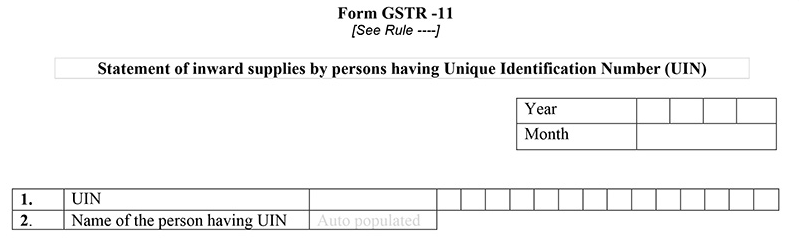

Details in GSTR 11 Form

The government has prescribed 4 headings in GSTR-11 Form. They are as follows:

1. Unique Identity Number (UIN)

This is a special number allotted to the person. It has to be entered here.

2. Name of the person having UIN

This is auto-populated

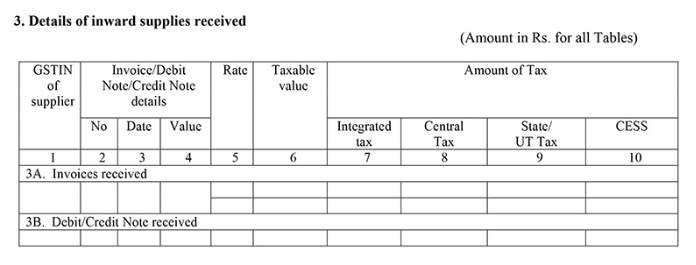

3. Details of Inward Supplies received

UIN holder is required to provide the GSTIN of the suppliers they have purchased goods from. On filing the GSTIN, details will be auto-populated from the supplier’s GSTR-1 form. UIN holder can’t make changes to this.

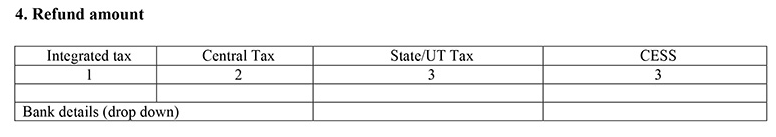

4. Refund amount

The refund amount will be auto-calculated in this section. UIN holder will need to file details like a Bank account number for the transfer of the refund amount.

Verification: It is important to file the return with verified details. UIN holder has to authenticate the details entered in the form by using the digital signature certificate (DSC) or Aadhar based signature verification system.

Conclusion

GSTR-11 is the most important return for UIN holders if they wish to claim back the tax they have paid for inward supplies in India. There’s no penalty for late filing since it’s a return for a refund.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.