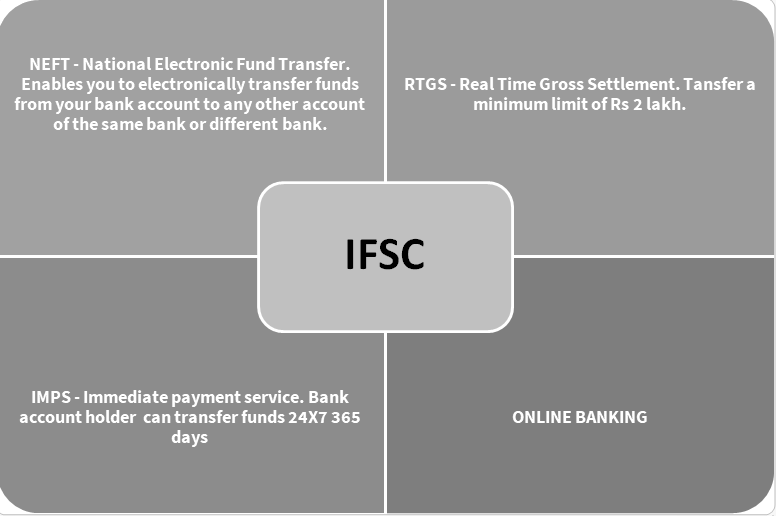

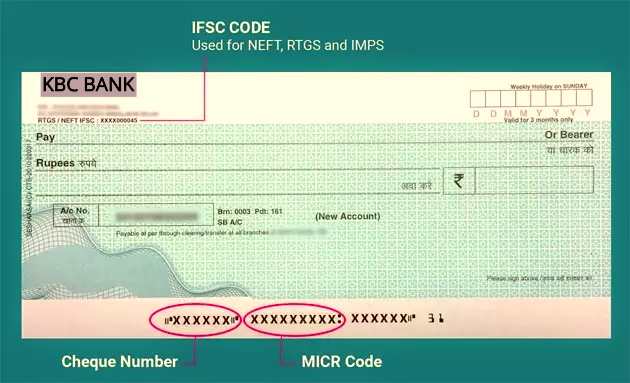

IFSC is used for RTGS/NEFT/UPI/Mutual Fund transactions Below is the details of IFSC code BKID0008951 NEFT - National Electronic Funds Transfer is a nation-wide payment system. Under this Scheme, individuals can electronically transfer funds from HESARAGHATTA, Bank Of India to any individual having an account with any other bank branch in the country participating in the Scheme. NEFT transactions are settled in batches. The acronym 'RTGS' stands for Real Time Gross Settlement, which can be defined as the continuous (real-time) settlement of funds individually on an order by order basis (without netting). 'Real Time' means the processing of instructions at the time they are received rather than at some later time.'Gross Settlement' means the settlement of funds transfer instructions occurs individually (on an instruction by instruction basis). Considering that the funds settlement takes place in the books of the Reserve Bank of India, the payments are final and irrevocable. Immediate Payment Service (IMPS) is an instant payment inter-bank electronic funds transfer system in India. IMPS offers an inter-bank electronic fund transfer service through mobile phones. Unlike NEFT and RTGS, the service is available 24/7 throughout the year including bank holidays. Unified Payments Interface (UPI) is a system that powers multiple bank accounts into a single mobile application (of any participating bank), merging several banking features, seamless fund routing & merchant payments into one hood. It also caters to the “Peer to Peer” collect request which can be scheduled and paid as per requirement and convenience. Each Bank provides its own UPI App for Android, Windows and iOS mobile platform(s). IFSC codes are generally being used in Online Internet Banking transaction to pay for Best Mutual Funds, Telephone Bills, credit card and various other billers. The 11 alphanumeric code of IFSC is structured in a pattern where the first four characters representing the name of the bank, while the last six characters represent the branch of the bank. The fifth character is generally 0 (zero) reserved for future utilisation. The format of IFSC is as below. Hesaraghatta, Bank Of India - IFSC Code

IFSC Code - BKID0008951

IFSC Code BKID0008951 MICR Code NA Bank Bank Of India Branch HESARAGHATTA Branch Code 008951 District Bangalore Urban State Karnataka Address NO 23 V G COMPLEX WARD NO 14 BAGALAGUNTE HESARAGHATTA ROAD BENGALURU 560073 Services Savings/Current Accounts, Loans, Mutual Funds, FOREX, Lockers and Fixed Deposits Bank Of India Hesaraghatta Location Map

Nearby Bank Of India branches

Talk to our investment specialistUses of IFSC Code

NEFT - National Electronic Funds Transfer

RTGS - Real Time Gross Settlement

IMPS - Immediate Payment Service

UPI - Unified Payment Interface

Online Banking

How to find IFSC Code?

Format of IFSC Code

1 2 3 4 5 6 7 8 9 10 11 Bank Code 0 Branch Code How to find MICR Code

How to Invest in Mutual Funds SIP Online?

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data.