How to Use STP (Systematic Transfer Plan) Like a Pro!

You’ve heard of SIPs. You’ve probably used them. But there’s another underrated tool in the mutual fund world — STP (Systematic Transfer Plan). STPs can be a game-changer for investors who want to shift funds from debt to equity (or vice versa) strategically, reduce Market timing risk, or manage lump sum investments more efficiently. Let’s understand how STPs work, who should use them, and how to make the most of this powerful but underused strategy.

🔄 What is a Systematic Transfer Plan (STP)?

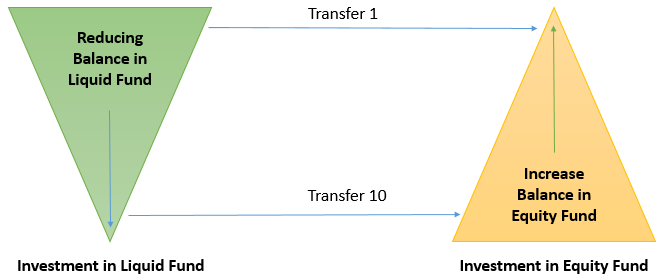

STP is a feature offered by Mutual Funds that allows you to transfer a fixed amount from one scheme to another at regular intervals (usually from a Debt fund to an Equity Fund).

Key idea: Instead of Investing a lump sum in equity at once, you invest it first in a liquid or ultra-short-term debt fund and then systematically transfer it to an equity mutual fund.

This smoothens entry into volatile markets and avoids bad timing.

How Does STP Work?

- Invest a lump sum in a source fund (typically debt/Liquid Fund)

- Choose a target fund (usually equity or Hybrid Fund)

- Set frequency (weekly/monthly) and transfer amount

- The money moves automatically at set intervals

When Should You Use an STP?

- ✅ Lump Sum Investment: Got a bonus or large corpus? Park it in a liquid fund and gradually move to equity using STP.

- ✅ Market Volatility: STPs reduce the risk of investing everything at market highs.

- ✅ Goal-Based Planning: For short-to-medium term goals, you can move from equity to debt before your goal date to protect Capital.

- ✅ Asset Allocation Maintenance: Helps rebalance your Portfolio smoothly over time.

Talk to our investment specialist

Types of STPs

| Type | Description |

|---|---|

| Fixed STP | Fixed amount is transferred periodically |

| Capital Appreciation STP | Only gains are transferred to target fund |

| Flexi STP | Amount depends on market valuation or NAV gap |

STP vs SIP vs SWP

| Feature | STP | SIP | SWP |

|---|---|---|---|

| Purpose | Transfer between funds | Invest fresh money | Withdraw from fund |

| Direction | Within AMC, debt to equity | From Bank to fund | Fund to bank |

| Ideal For | Managing lump sum risk | Regular investing | retirement Income |

STP Strategy Example: Bonus Investment

- You receive ₹5 lakh bonus

- Instead of lump sum equity, invest in Liquid Fund A

- Set up a 6-month STP to Equity Fund B (₹83,000/month)

- This spreads market entry and gives debt return on idle capital

Important Things to Remember

- STP works only within the same AMC

- Some AMCs have a minimum STP amount or restrictions

- Check for exit load or Capital Gains in source fund before starting

- Returns from debt fund may be taxable

- STP from equity to debt is less common but used near goal timelines

Pro Tips to Use STP Effectively

- Use liquid or ultra-short duration fund as source

- Choose a 6–12 month horizon for smoother transitions

- Combine with goal-based strategy: equity to debt before goal date

- Review performance mid-way and adjust transfer frequency if needed

Final Thoughts

STPs offer the perfect middle ground between SIPs and Lump sum investing. They're especially useful when you have a large sum and don’t want to commit all of it to equities in one go. If used wisely, Systematic Transfer Plans can help you lower risk, improve long-term returns, and build a more stable investing journey.

Start with a goal, pick your funds carefully, and let STPs do the heavy lifting.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.