ರಿಟರ್ನ್ಸ್ ಮೂಲಕ ಅತ್ಯುತ್ತಮ ಸಮತೋಲಿತ ಮ್ಯೂಚುಯಲ್ ಫಂಡ್ಗಳು 2022

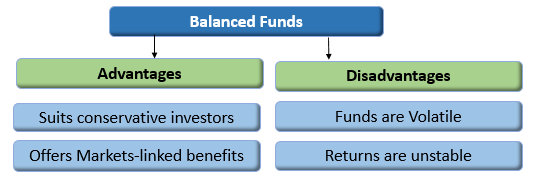

ಅತ್ಯುತ್ತಮ ಸಮತೋಲಿತ ಪ್ರಯೋಜನ ನಿಧಿಗಳು ಇವೆಮ್ಯೂಚುಯಲ್ ಫಂಡ್ಗಳು ಅದು ಅವರ ಆಸ್ತಿಯಲ್ಲಿ 65% ಕ್ಕಿಂತ ಹೆಚ್ಚು ಹೂಡಿಕೆ ಮಾಡುತ್ತದೆಈಕ್ವಿಟಿಗಳು ಮತ್ತು ಸಾಲದ ಉಪಕರಣಗಳಲ್ಲಿನ ಉಳಿದ ಸ್ವತ್ತುಗಳು ಉತ್ತಮ ಒಟ್ಟಾರೆ ಆದಾಯವನ್ನು ನೀಡುತ್ತದೆ. ಸಮತೋಲಿತ ಮ್ಯೂಚುವಲ್ ಫಂಡ್ಗಳು ಹೂಡಿಕೆದಾರರಿಗೆ ಲಾಭದಾಯಕವಾಗಿದ್ದು, ಅವರು ತೆಗೆದುಕೊಳ್ಳಲು ಸಿದ್ಧರಿದ್ದಾರೆಮಾರುಕಟ್ಟೆ ಕೆಲವು ಸ್ಥಿರ ಆದಾಯಗಳನ್ನು ಹುಡುಕುತ್ತಿರುವಾಗ ಅಪಾಯ. ಈಕ್ವಿಟಿಗಳು ಮತ್ತು ಸ್ಟಾಕ್ಗಳಲ್ಲಿ ಹೂಡಿಕೆ ಮಾಡಿದ ಸ್ವತ್ತುಗಳು ಮಾರುಕಟ್ಟೆ-ಸಂಯೋಜಿತ ಆದಾಯವನ್ನು ನೀಡುತ್ತವೆ ಆದರೆ ಸಾಲ ಉಪಕರಣಗಳಲ್ಲಿ ಹೂಡಿಕೆ ಮಾಡಿದ ಸ್ವತ್ತುಗಳು ಸ್ಥಿರ ಆದಾಯವನ್ನು ನೀಡುತ್ತವೆ. ಇಕ್ವಿಟಿ ಮತ್ತು ಸಾಲ ಎರಡರ ಸಂಯೋಜನೆಯಾಗಿರುವುದರಿಂದ ಹೂಡಿಕೆದಾರರು ಬಹಳ ಜಾಗರೂಕರಾಗಿರಬೇಕುಹೂಡಿಕೆ ಈ ನಿಧಿಗಳಲ್ಲಿ. ಹೂಡಿಕೆದಾರರು ಟಾಪ್ ಅನ್ನು ನೋಡಲು ಸಲಹೆ ನೀಡುತ್ತಾರೆಸಮತೋಲಿತ ನಿಧಿ ಬ್ಯಾಲೆನ್ಸ್ಡ್ ಮ್ಯೂಚುವಲ್ ಫಂಡ್ಗಳಲ್ಲಿ ಹೂಡಿಕೆ ಮಾಡುವ ಮೊದಲು. ನಾವು ಟಾಪ್ ಬ್ಯಾಲೆನ್ಸ್ಡ್ ಮ್ಯೂಚುಯಲ್ ಫಂಡ್ಗಳನ್ನು ಕೆಳಗೆ ಪಟ್ಟಿ ಮಾಡಿದ್ದೇವೆ.

Talk to our investment specialist

ರಿಟರ್ನ್ಸ್ ಮೂಲಕ ಟಾಪ್ 10 ಬ್ಯಾಲೆನ್ಸ್ಡ್ ಮ್ಯೂಚುಯಲ್ ಫಂಡ್ಗಳು

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Sundaram Equity Hybrid Fund Growth ₹135.137

↑ 0.78 ₹1,954 0.5 10.5 27.1 16 14.2 SBI Dynamic Asset Allocation Fund Growth ₹15.9463

↑ 0.03 ₹655 3.9 6.2 25.1 6.9 8.3 Axis Triple Advantage Fund Growth ₹45.4255

↑ 0.16 ₹1,875 5.1 13.9 23.3 15.9 11.4 15.3 SBI Multi Asset Allocation Fund Growth ₹66.8116

↑ 0.00 ₹13,033 4.8 13.1 22.9 20 14.8 18.6 Bandhan Hybrid Equity Fund Growth ₹27.134

↑ 0.06 ₹1,576 0.4 5.4 18.7 16.5 13.5 7.7 ICICI Prudential Multi-Asset Fund Growth ₹822.595

↑ 2.89 ₹78,179 2.1 9.3 17.2 19.5 19.8 18.6 Mirae Asset Hybrid Equity Fund Growth ₹33.634

↑ 0.07 ₹9,538 1.1 5.5 16.2 14.7 11.8 9.7 HDFC Multi-Asset Fund Growth ₹76.753

↑ 0.01 ₹5,460 2.3 7.6 16.2 15.4 13 13.2 ICICI Prudential Equity and Debt Fund Growth ₹410.84

↑ 1.12 ₹49,641 0.2 5.2 15.6 19.2 19.1 13.3 UTI Multi Asset Fund Growth ₹79.7729

↑ 0.10 ₹6,720 1.5 8.4 15.2 20.4 14.5 11.1 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 31 Dec 21 Research Highlights & Commentary of 10 Funds showcased

Commentary Sundaram Equity Hybrid Fund SBI Dynamic Asset Allocation Fund Axis Triple Advantage Fund SBI Multi Asset Allocation Fund Bandhan Hybrid Equity Fund ICICI Prudential Multi-Asset Fund Mirae Asset Hybrid Equity Fund HDFC Multi-Asset Fund ICICI Prudential Equity and Debt Fund UTI Multi Asset Fund Point 1 Lower mid AUM (₹1,954 Cr). Bottom quartile AUM (₹655 Cr). Bottom quartile AUM (₹1,875 Cr). Upper mid AUM (₹13,033 Cr). Bottom quartile AUM (₹1,576 Cr). Highest AUM (₹78,179 Cr). Upper mid AUM (₹9,538 Cr). Lower mid AUM (₹5,460 Cr). Top quartile AUM (₹49,641 Cr). Upper mid AUM (₹6,720 Cr). Point 2 Established history (25+ yrs). Established history (10+ yrs). Established history (15+ yrs). Established history (20+ yrs). Established history (9+ yrs). Established history (23+ yrs). Established history (10+ yrs). Established history (20+ yrs). Oldest track record among peers (26 yrs). Established history (17+ yrs). Point 3 Rating: 2★ (upper mid). Not Rated. Rating: 2★ (upper mid). Top rated. Not Rated. Rating: 2★ (lower mid). Not Rated. Rating: 3★ (upper mid). Rating: 4★ (top quartile). Rating: 1★ (lower mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderate. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderate. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 14.20% (upper mid). 5Y return: 8.31% (bottom quartile). 5Y return: 11.44% (bottom quartile). 5Y return: 14.80% (upper mid). 5Y return: 13.48% (lower mid). 5Y return: 19.83% (top quartile). 5Y return: 11.82% (bottom quartile). 5Y return: 13.01% (lower mid). 5Y return: 19.15% (top quartile). 5Y return: 14.52% (upper mid). Point 6 3Y return: 16.03% (lower mid). 3Y return: 6.92% (bottom quartile). 3Y return: 15.90% (lower mid). 3Y return: 20.00% (top quartile). 3Y return: 16.46% (upper mid). 3Y return: 19.53% (upper mid). 3Y return: 14.66% (bottom quartile). 3Y return: 15.40% (bottom quartile). 3Y return: 19.23% (upper mid). 3Y return: 20.41% (top quartile). Point 7 1Y return: 27.10% (top quartile). 1Y return: 25.12% (top quartile). 1Y return: 23.33% (upper mid). 1Y return: 22.91% (upper mid). 1Y return: 18.67% (upper mid). 1Y return: 17.25% (lower mid). 1Y return: 16.22% (lower mid). 1Y return: 16.18% (bottom quartile). 1Y return: 15.59% (bottom quartile). 1Y return: 15.24% (bottom quartile). Point 8 1M return: 1.80% (top quartile). 1M return: 1.04% (lower mid). 1M return: 1.19% (upper mid). 1M return: 0.84% (bottom quartile). 1M return: 1.33% (upper mid). 1M return: 0.60% (bottom quartile). 1M return: 1.10% (upper mid). 1M return: 1.38% (top quartile). 1M return: 0.89% (lower mid). 1M return: 0.28% (bottom quartile). Point 9 Alpha: 5.81 (top quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: -1.32 (bottom quartile). Alpha: 0.00 (lower mid). Alpha: 0.66 (upper mid). Alpha: 0.00 (bottom quartile). Alpha: 4.49 (top quartile). Alpha: 0.00 (bottom quartile). Point 10 Sharpe: 2.64 (top quartile). Sharpe: 2.59 (top quartile). Sharpe: 1.01 (lower mid). Sharpe: 1.60 (upper mid). Sharpe: 0.17 (bottom quartile). Sharpe: 1.86 (upper mid). Sharpe: 0.36 (bottom quartile). Sharpe: 1.10 (upper mid). Sharpe: 0.83 (lower mid). Sharpe: 0.55 (bottom quartile). Sundaram Equity Hybrid Fund

SBI Dynamic Asset Allocation Fund

Axis Triple Advantage Fund

SBI Multi Asset Allocation Fund

Bandhan Hybrid Equity Fund

ICICI Prudential Multi-Asset Fund

Mirae Asset Hybrid Equity Fund

HDFC Multi-Asset Fund

ICICI Prudential Equity and Debt Fund

UTI Multi Asset Fund

ಟಾಪ್ 10 ಬ್ಯಾಲೆನ್ಸ್ಡ್ ಅಡ್ವಾಂಟೇಜ್ ಮ್ಯೂಚುಯಲ್ ಫಂಡ್ಗಳು

(Erstwhile Sundaram Balanced Fund) The scheme seeks to generate capital appreciation and current income through a judicious mix of investments in equities and fixed income securities. Below is the key information for Sundaram Equity Hybrid Fund Returns up to 1 year are on The objective of the fund will be to provide investors with an opportunity to invest in a portfolio of a mix of equity and equity related securities and fixed income instruments. The allocation between fixed income and equity instruments will be managed dynamically so as to provide investors with long term capital appreciation However, there can be no assurance that the investment objective of the Scheme will be achieved. Research Highlights for SBI Dynamic Asset Allocation Fund Below is the key information for SBI Dynamic Asset Allocation Fund Returns up to 1 year are on To generate long term capital appreciation by investing in a diversified portfolio of equity and equity related instruments, fixed income instruments & gold exchange traded funds. Research Highlights for Axis Triple Advantage Fund Below is the key information for Axis Triple Advantage Fund Returns up to 1 year are on (Erstwhile SBI Magnum Monthly Income Plan Floater) To provide regular income, liquidity and attractive returns to investors in addition

to mitigating the impact of interest rate risk through an actively managed

portfolio of floating rate and fixed rate debt instruments, equity, money market

instruments and derivatives. Research Highlights for SBI Multi Asset Allocation Fund Below is the key information for SBI Multi Asset Allocation Fund Returns up to 1 year are on (Erstwhile IDFC Balanced Fund) The Fund seeks to generate long term capital appreciation along with current income by investing in a mix of equity and equity related securities, debt securities and money market instruments. There is no assurance or guarantee that the objectives of the scheme will be realised. Research Highlights for Bandhan Hybrid Equity Fund Below is the key information for Bandhan Hybrid Equity Fund Returns up to 1 year are on (Erstwhile ICICI Prudential Dynamic Plan) To generate capital appreciation by actively investing in equity and equity related securities. For defensive considerations, the Scheme may invest in debt, money market instruments and derivatives. The investment manager will have the discretion to take aggressive asset calls i.e. by staying 100% invested in equity market/equity related instruments at a given point of time and 0% at another, in which case, the fund may be invested in debt related instruments at its discretion. The AMC may choose to churn the portfolio of the Scheme in order to achieve the investment objective. The Scheme is suitable for investors seeking high returns and for those who are willing to take commensurate risks. Research Highlights for ICICI Prudential Multi-Asset Fund Below is the key information for ICICI Prudential Multi-Asset Fund Returns up to 1 year are on (Erstwhile Mirae Asset Prudence Fund) The investment objective of the Scheme is to generate capital appreciation along with current income from a combined portfolio of predominantly investing in equity & equity related instruments and balance in debt and money market instruments.

The Scheme does not guarantee or assure any returns. Research Highlights for Mirae Asset Hybrid Equity Fund Below is the key information for Mirae Asset Hybrid Equity Fund Returns up to 1 year are on (Erstwhile HDFC Multiple Yield Fund - Plan 2005) To generate positive returns over medium time frame

with low risk of capital loss over medium time frame.

However, there can be no assurance that the

investment objective of the Scheme will be achieved Research Highlights for HDFC Multi-Asset Fund Below is the key information for HDFC Multi-Asset Fund Returns up to 1 year are on (Erstwhile ICICI Prudential Balanced Fund) To generate long term capital appreciation and current income from a portfolio

that is invested in equity and equity related securities as well as in fixed income

securities. Research Highlights for ICICI Prudential Equity and Debt Fund Below is the key information for ICICI Prudential Equity and Debt Fund Returns up to 1 year are on (Erstwhile UTI Wealth Builder Fund) The objective of the Scheme is to achieve long term capital appreciation by investing predominantly in a diversified portfolio of equity and equity related instruments along with investments in Gold ETFs and Debt and Money Market Instruments. However, there can be no assurance that the investment objective of the Scheme will be achieved. Research Highlights for UTI Multi Asset Fund Below is the key information for UTI Multi Asset Fund Returns up to 1 year are on 1. Sundaram Equity Hybrid Fund

Sundaram Equity Hybrid Fund

Growth Launch Date 23 Jun 00 NAV (31 Dec 21) ₹135.137 ↑ 0.78 (0.58 %) Net Assets (Cr) ₹1,954 on 30 Nov 21 Category Hybrid - Hybrid Equity AMC Sundaram Asset Management Company Ltd Rating ☆☆ Risk Moderately High Expense Ratio 2.18 Sharpe Ratio 2.64 Information Ratio -0.12 Alpha Ratio 5.81 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 Returns for Sundaram Equity Hybrid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 1.8% 3 Month 0.5% 6 Month 10.5% 1 Year 27.1% 3 Year 16% 5 Year 14.2% 10 Year 15 Year Since launch 12.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for Sundaram Equity Hybrid Fund

Name Since Tenure Data below for Sundaram Equity Hybrid Fund as on 30 Nov 21

Asset Allocation

Asset Class Value Equity Sector Allocation

Sector Value Debt Sector Allocation

Sector Value Credit Quality

Rating Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 2. SBI Dynamic Asset Allocation Fund

SBI Dynamic Asset Allocation Fund

Growth Launch Date 26 Mar 15 NAV (02 Jul 21) ₹15.9463 ↑ 0.03 (0.18 %) Net Assets (Cr) ₹655 on 31 May 21 Category Hybrid - Dynamic Allocation AMC SBI Funds Management Private Limited Rating Risk Moderately High Expense Ratio 2.07 Sharpe Ratio 2.59 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 Returns for SBI Dynamic Asset Allocation Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 1% 3 Month 3.9% 6 Month 6.2% 1 Year 25.1% 3 Year 6.9% 5 Year 8.3% 10 Year 15 Year Since launch 7.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for SBI Dynamic Asset Allocation Fund

Name Since Tenure Data below for SBI Dynamic Asset Allocation Fund as on 31 May 21

Asset Allocation

Asset Class Value Equity Sector Allocation

Sector Value Debt Sector Allocation

Sector Value Credit Quality

Rating Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 3. Axis Triple Advantage Fund

Axis Triple Advantage Fund

Growth Launch Date 23 Aug 10 NAV (16 Feb 26) ₹45.4255 ↑ 0.16 (0.35 %) Net Assets (Cr) ₹1,875 on 31 Dec 25 Category Hybrid - Multi Asset AMC Axis Asset Management Company Limited Rating ☆☆ Risk Moderately High Expense Ratio 2.1 Sharpe Ratio 1.01 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹12,316 31 Jan 23 ₹11,603 31 Jan 24 ₹13,362 31 Jan 25 ₹15,261 31 Jan 26 ₹18,429 Returns for Axis Triple Advantage Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 1.2% 3 Month 5.1% 6 Month 13.9% 1 Year 23.3% 3 Year 15.9% 5 Year 11.4% 10 Year 15 Year Since launch 10.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 15.3% 2023 15.4% 2022 12.9% 2021 -5.8% 2020 22.8% 2019 18% 2018 15.3% 2017 1.9% 2016 15.9% 2015 7.1% Fund Manager information for Axis Triple Advantage Fund

Name Since Tenure Devang Shah 5 Apr 24 1.82 Yr. Aditya Pagaria 1 Jun 24 1.67 Yr. Ashish Naik 22 Jun 16 9.62 Yr. Hardik Shah 5 Apr 24 1.82 Yr. Pratik Tibrewal 1 Feb 25 1 Yr. Krishnaa N 16 Dec 24 1.13 Yr. Data below for Axis Triple Advantage Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 9.13% Equity 64.69% Debt 9.38% Other 16.79% Equity Sector Allocation

Sector Value Financial Services 23.2% Consumer Cyclical 8.51% Technology 6.26% Health Care 6.22% Basic Materials 6.15% Industrials 5.66% Consumer Defensive 4.56% Energy 3.3% Communication Services 2.46% Real Estate 0.94% Utility 0.07% Debt Sector Allocation

Sector Value Cash Equivalent 9.74% Corporate 6.29% Government 2.48% Credit Quality

Rating Value A 10.39% AA 38.79% AAA 50.82% Top Securities Holdings / Portfolio

Name Holding Value Quantity Axis Gold ETF

- | -13% ₹264 Cr 20,259,852

↓ -3,988,399 HDFC Bank Ltd (Financial Services)

Equity, Since 30 Sep 10 | HDFCBANK7% ₹141 Cr 1,518,753

↑ 509,735 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Nov 18 | ICICIBANK5% ₹103 Cr 756,550

↑ 55,032 Axis Silver ETF

- | -4% ₹87 Cr 2,917,000

↓ -333,000 State Bank of India (Financial Services)

Equity, Since 30 Nov 22 | SBIN4% ₹77 Cr 716,029

↑ 86,532 Reliance Industries Ltd (Energy)

Equity, Since 30 Apr 19 | RELIANCE3% ₹64 Cr 455,456

↑ 328,114 Future on BANK Index

- | -3% -₹55 Cr 584,650

↑ 182,050 Infosys Ltd (Technology)

Equity, Since 31 May 18 | INFY2% ₹45 Cr 276,762 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Oct 24 | KOTAKBANK2% ₹42 Cr 1,023,663

↑ 281,083 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Jan 24 | BHARTIARTL2% ₹40 Cr 202,647 4. SBI Multi Asset Allocation Fund

SBI Multi Asset Allocation Fund

Growth Launch Date 21 Dec 05 NAV (17 Feb 26) ₹66.8116 ↑ 0.00 (0.00 %) Net Assets (Cr) ₹13,033 on 31 Dec 25 Category Hybrid - Multi Asset AMC SBI Funds Management Private Limited Rating ☆☆☆☆ Risk Moderate Expense Ratio 1.46 Sharpe Ratio 1.6 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹11,431 31 Jan 23 ₹11,977 31 Jan 24 ₹15,246 31 Jan 25 ₹16,963 31 Jan 26 ₹20,613 Returns for SBI Multi Asset Allocation Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 0.8% 3 Month 4.8% 6 Month 13.1% 1 Year 22.9% 3 Year 20% 5 Year 14.8% 10 Year 15 Year Since launch 9.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 18.6% 2023 12.8% 2022 24.4% 2021 6% 2020 13% 2019 14.2% 2018 10.6% 2017 0.4% 2016 10.9% 2015 8.7% Fund Manager information for SBI Multi Asset Allocation Fund

Name Since Tenure Dinesh Balachandran 31 Oct 21 4.26 Yr. Mansi Sajeja 1 Dec 23 2.17 Yr. Vandna Soni 1 Jan 24 2.09 Yr. Data below for SBI Multi Asset Allocation Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 14.55% Equity 46.65% Debt 29.4% Other 9.4% Equity Sector Allocation

Sector Value Financial Services 12.84% Real Estate 5.6% Basic Materials 5.35% Consumer Cyclical 4.86% Energy 4.05% Technology 3.18% Consumer Defensive 2.54% Utility 2.11% Industrials 1.84% Communication Services 1.75% Health Care 1.67% Debt Sector Allocation

Sector Value Corporate 25.73% Cash Equivalent 13.22% Government 5.01% Credit Quality

Rating Value A 2.03% AA 55.85% AAA 42.12% Top Securities Holdings / Portfolio

Name Holding Value Quantity SBI Silver ETF

- | -6% ₹920 Cr 32,296,178

↓ -8,000,000 Brookfield India Real Estate Trust (Real Estate)

-, Since 30 Apr 25 | BIRET4% ₹535 Cr 15,164,234 SBI Gold ETF

- | -3% ₹508 Cr 37,241,000 Adani Power Limited

Debentures | -2% ₹299 Cr 30,000

↑ 30,000 Punjab National Bank (Financial Services)

Equity, Since 31 Oct 24 | PNB2% ₹263 Cr 21,000,000 Jtpm Metal TRaders Limited

Debentures | -2% ₹258 Cr 25,000 HDFC Bank Ltd (Financial Services)

Equity, Since 30 Nov 22 | HDFCBANK2% ₹247 Cr 2,662,000 Union Bank of India

Domestic Bonds | -2% ₹244 Cr 5,000

↑ 5,000 GAIL (India) Ltd (Utilities)

Equity, Since 31 Mar 21 | GAIL2% ₹240 Cr 14,350,297 Reliance Industries Ltd (Energy)

Equity, Since 15 Sep 24 | RELIANCE2% ₹240 Cr 1,720,000 5. Bandhan Hybrid Equity Fund

Bandhan Hybrid Equity Fund

Growth Launch Date 30 Dec 16 NAV (17 Feb 26) ₹27.134 ↑ 0.06 (0.21 %) Net Assets (Cr) ₹1,576 on 31 Dec 25 Category Hybrid - Hybrid Equity AMC IDFC Asset Management Company Limited Rating Risk Moderately High Expense Ratio 2.35 Sharpe Ratio 0.17 Information Ratio 0.62 Alpha Ratio -1.32 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹12,888 31 Jan 23 ₹12,821 31 Jan 24 ₹15,921 31 Jan 25 ₹17,745 31 Jan 26 ₹19,939 Returns for Bandhan Hybrid Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 1.3% 3 Month 0.4% 6 Month 5.4% 1 Year 18.7% 3 Year 16.5% 5 Year 13.5% 10 Year 15 Year Since launch 11.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.7% 2023 21% 2022 20.4% 2021 -1.1% 2020 30.8% 2019 13.9% 2018 4.7% 2017 -3.8% 2016 16.2% 2015 Fund Manager information for Bandhan Hybrid Equity Fund

Name Since Tenure Harshal Joshi 28 Jul 21 4.52 Yr. Brijesh Shah 10 Jun 24 1.64 Yr. Prateek Poddar 7 Jun 24 1.65 Yr. Ritika Behera 7 Oct 23 2.32 Yr. Gaurav Satra 7 Jun 24 1.65 Yr. Data below for Bandhan Hybrid Equity Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 4.99% Equity 77.63% Debt 17.38% Equity Sector Allocation

Sector Value Financial Services 22.64% Consumer Cyclical 11.99% Technology 8% Health Care 6.39% Industrials 6.05% Basic Materials 5.97% Consumer Defensive 4.92% Energy 3.96% Utility 3.5% Communication Services 3.01% Real Estate 1.17% Debt Sector Allocation

Sector Value Corporate 9.43% Government 7.95% Cash Equivalent 4.99% Credit Quality

Rating Value AA 4.37% AAA 95.63% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 30 Jun 24 | HDFCBANK6% ₹92 Cr 992,042

↓ -2,027 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Jul 24 | ICICIBANK5% ₹78 Cr 574,500

↑ 109,372 Reliance Industries Ltd (Energy)

Equity, Since 30 Apr 20 | RELIANCE4% ₹62 Cr 440,969

↓ -47,022 Tata Capital Limited

Debentures | -3% ₹50 Cr 5,000,000 7.30% Gs 2053

Sovereign Bonds | -3% ₹50 Cr 5,000,000 LIC Housing Finance Ltd

Debentures | -3% ₹45 Cr 4,500,000

↑ 4,500,000 State Bank of India (Financial Services)

Equity, Since 28 Feb 21 | SBIN3% ₹45 Cr 416,237

↑ 15,707 Infosys Ltd (Technology)

Equity, Since 31 Jan 17 | INFY3% ₹44 Cr 266,662

↑ 15,696 Axis Bank Ltd (Financial Services)

Equity, Since 31 Jan 17 | AXISBANK3% ₹43 Cr 316,843

↓ -34,434 NTPC Ltd (Utilities)

Equity, Since 28 Feb 23 | NTPC2% ₹39 Cr 1,090,788

↑ 39,365 6. ICICI Prudential Multi-Asset Fund

ICICI Prudential Multi-Asset Fund

Growth Launch Date 31 Oct 02 NAV (16 Feb 26) ₹822.595 ↑ 2.89 (0.35 %) Net Assets (Cr) ₹78,179 on 31 Dec 25 Category Hybrid - Multi Asset AMC ICICI Prudential Asset Management Company Limited Rating ☆☆ Risk Moderately High Expense Ratio 1.47 Sharpe Ratio 1.86 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹14,181 31 Jan 23 ₹15,831 31 Jan 24 ₹20,109 31 Jan 25 ₹23,330 31 Jan 26 ₹27,072 Returns for ICICI Prudential Multi-Asset Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 0.6% 3 Month 2.1% 6 Month 9.3% 1 Year 17.2% 3 Year 19.5% 5 Year 19.8% 10 Year 15 Year Since launch 20.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 18.6% 2023 16.1% 2022 24.1% 2021 16.8% 2020 34.7% 2019 9.9% 2018 7.7% 2017 -2.2% 2016 28.2% 2015 12.5% Fund Manager information for ICICI Prudential Multi-Asset Fund

Name Since Tenure Sankaran Naren 1 Feb 12 14.01 Yr. Manish Banthia 22 Jan 24 2.03 Yr. Ihab Dalwai 3 Jun 17 8.67 Yr. Akhil Kakkar 22 Jan 24 2.03 Yr. Sri Sharma 30 Apr 21 4.76 Yr. Gaurav Chikane 2 Aug 21 4.5 Yr. Sharmila D'Silva 31 Jul 22 3.51 Yr. Masoomi Jhurmarvala 4 Nov 24 1.24 Yr. Data below for ICICI Prudential Multi-Asset Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 17.14% Equity 64.5% Debt 8.61% Other 9.75% Equity Sector Allocation

Sector Value Financial Services 21.64% Consumer Cyclical 11.89% Consumer Defensive 6.97% Industrials 6.24% Technology 5.51% Basic Materials 5.43% Energy 4.1% Health Care 3.53% Utility 2.33% Communication Services 1.97% Real Estate 1.93% Debt Sector Allocation

Sector Value Cash Equivalent 15.9% Corporate 5.03% Government 4.81% Credit Quality

Rating Value A 1.28% AA 17.26% AAA 81.46% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Pru Gold ETF

- | -9% ₹7,375 Cr 528,202,636

↑ 38,731,754 ICICI Bank Ltd (Financial Services)

Equity, Since 31 May 06 | ICICIBANK4% ₹3,153 Cr 23,271,875 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jan 22 | HDFCBANK4% ₹2,932 Cr 31,556,280

↑ 8,362,197 Axis Bank Ltd (Financial Services)

Equity, Since 31 Dec 20 | AXISBANK3% ₹2,292 Cr 16,726,017

↓ -950,000 ITC Ltd (Consumer Defensive)

Equity, Since 31 Mar 24 | ITC3% ₹2,208 Cr 68,525,718

↑ 19,307,692 Reliance Industries Ltd (Energy)

Equity, Since 31 Dec 20 | RELIANCE3% ₹2,142 Cr 15,349,805 Infosys Ltd (Technology)

Equity, Since 31 Oct 19 | INFY2% ₹1,842 Cr 11,225,639

↓ -188,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 28 Feb 23 | INDIGO2% ₹1,705 Cr 3,709,974

↑ 1,141,295 Bajaj Finserv Ltd (Financial Services)

Equity, Since 31 Jan 24 | BAJAJFINSV2% ₹1,580 Cr 8,094,127

↑ 2,792,657 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 31 Aug 21 | MARUTI2% ₹1,487 Cr 1,018,654

↑ 100,000 7. Mirae Asset Hybrid Equity Fund

Mirae Asset Hybrid Equity Fund

Growth Launch Date 29 Jul 15 NAV (17 Feb 26) ₹33.634 ↑ 0.07 (0.20 %) Net Assets (Cr) ₹9,538 on 31 Dec 25 Category Hybrid - Hybrid Equity AMC Mirae Asset Global Inv (India) Pvt. Ltd Rating Risk Moderately High Expense Ratio 1.16 Sharpe Ratio 0.36 Information Ratio 0.42 Alpha Ratio 0.66 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹12,447 31 Jan 23 ₹12,538 31 Jan 24 ₹15,364 31 Jan 25 ₹16,890 31 Jan 26 ₹18,651 Returns for Mirae Asset Hybrid Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 1.1% 3 Month 1.1% 6 Month 5.5% 1 Year 16.2% 3 Year 14.7% 5 Year 11.8% 10 Year 15 Year Since launch 12.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 9.7% 2023 13.6% 2022 19% 2021 2.4% 2020 23.8% 2019 13.7% 2018 11.9% 2017 1.3% 2016 27.8% 2015 8.5% Fund Manager information for Mirae Asset Hybrid Equity Fund

Name Since Tenure Vrijesh Kasera 1 Apr 20 5.84 Yr. Harshad Borawake 1 Apr 20 5.84 Yr. Basant Bafna 27 Dec 25 0.1 Yr. Data below for Mirae Asset Hybrid Equity Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 3.95% Equity 76.57% Debt 19.47% Equity Sector Allocation

Sector Value Financial Services 26.38% Consumer Cyclical 8.55% Industrials 7.53% Health Care 6.31% Basic Materials 6.14% Technology 5.92% Energy 4.2% Consumer Defensive 3.91% Utility 3.89% Communication Services 3.22% Real Estate 0.52% Debt Sector Allocation

Sector Value Corporate 10.85% Government 8.88% Cash Equivalent 3.69% Credit Quality

Rating Value AA 9.72% AAA 90.28% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jul 15 | HDFCBANK7% ₹663 Cr 7,130,361

↑ 500,000 State Bank of India (Financial Services)

Equity, Since 31 Jul 15 | SBIN4% ₹418 Cr 3,879,966 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Jul 15 | ICICIBANK4% ₹399 Cr 2,945,542

↑ 60,000 Axis Bank Ltd (Financial Services)

Equity, Since 31 Jul 15 | AXISBANK3% ₹287 Cr 2,097,277 Reliance Industries Ltd (Energy)

Equity, Since 31 Jul 15 | RELIANCE3% ₹283 Cr 2,026,068

↑ 70,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Jul 15 | LT3% ₹238 Cr 604,332 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Jul 15 | BHARTIARTL2% ₹223 Cr 1,130,968

↑ 25,000 Infosys Ltd (Technology)

Equity, Since 31 Jul 15 | INFY2% ₹216 Cr 1,314,141 NTPC Ltd (Utilities)

Equity, Since 30 Apr 22 | NTPC2% ₹206 Cr 5,783,328

↓ -1,350,000 Torrent Pharmaceuticals Limited

Debentures | -2% ₹165 Cr 16,500,000

↑ 16,500,000 8. HDFC Multi-Asset Fund

HDFC Multi-Asset Fund

Growth Launch Date 17 Aug 05 NAV (17 Feb 26) ₹76.753 ↑ 0.01 (0.01 %) Net Assets (Cr) ₹5,460 on 31 Dec 25 Category Hybrid - Multi Asset AMC HDFC Asset Management Company Limited Rating ☆☆☆ Risk Moderate Expense Ratio 1.85 Sharpe Ratio 1.1 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 300 Exit Load 0-15 Months (1%),15 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹11,956 31 Jan 23 ₹12,562 31 Jan 24 ₹15,094 31 Jan 25 ₹16,850 31 Jan 26 ₹19,343 Returns for HDFC Multi-Asset Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 1.4% 3 Month 2.3% 6 Month 7.6% 1 Year 16.2% 3 Year 15.4% 5 Year 13% 10 Year 15 Year Since launch 10.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 13.2% 2023 13.5% 2022 18% 2021 4.3% 2020 17.9% 2019 20.9% 2018 9.3% 2017 -1.9% 2016 11.8% 2015 8.9% Fund Manager information for HDFC Multi-Asset Fund

Name Since Tenure Anil Bamboli 17 Aug 05 20.47 Yr. Arun Agarwal 24 Aug 20 5.44 Yr. Srinivasan Ramamurthy 13 Jan 22 4.05 Yr. Bhagyesh Kagalkar 2 Feb 22 4 Yr. Dhruv Muchhal 22 Jun 23 2.61 Yr. Nandita Menezes 29 Mar 25 0.84 Yr. Data below for HDFC Multi-Asset Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 29.12% Equity 49.69% Debt 9.63% Other 11.56% Equity Sector Allocation

Sector Value Financial Services 21.22% Technology 7.92% Consumer Cyclical 7.89% Energy 6.84% Health Care 5.43% Industrials 4.08% Consumer Defensive 3.15% Basic Materials 3.04% Utility 3.04% Communication Services 2.91% Real Estate 1.87% Debt Sector Allocation

Sector Value Cash Equivalent 28.54% Corporate 5.78% Government 4.43% Credit Quality

Rating Value AA 14.51% AAA 85.49% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Gold ETF

- | -12% ₹670 Cr 49,159,819

↓ -8,786,928 Reliance Industries Ltd (Energy)

Equity, Since 30 Jun 18 | RELIANCE5% ₹288 Cr 2,066,500

↑ 50,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 May 18 | HDFCBANK4% ₹255 Cr 2,741,200

↑ 100,000 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Jun 18 | ICICIBANK4% ₹243 Cr 1,796,600

↓ -429,100 Infosys Ltd (Technology)

Equity, Since 31 Jan 16 | INFY4% ₹234 Cr 1,423,600

↑ 823,600 Future on Reliance Industries Ltd

Derivatives | -3% -₹177 Cr 1,266,500

↑ 1,266,500 State Bank of India (Financial Services)

Equity, Since 31 Aug 21 | SBIN3% ₹170 Cr 1,575,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Jun 18 | BHARTIARTL3% ₹144 Cr 731,925 Future on Infosys Ltd

Derivatives | -2% -₹135 Cr 823,600

↑ 823,600 Axis Bank Ltd (Financial Services)

Equity, Since 31 Jan 21 | AXISBANK2% ₹110 Cr 800,000 9. ICICI Prudential Equity and Debt Fund

ICICI Prudential Equity and Debt Fund

Growth Launch Date 3 Nov 99 NAV (17 Feb 26) ₹410.84 ↑ 1.12 (0.27 %) Net Assets (Cr) ₹49,641 on 31 Dec 25 Category Hybrid - Hybrid Equity AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.6 Sharpe Ratio 0.83 Information Ratio 1.94 Alpha Ratio 4.49 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹14,720 31 Jan 23 ₹15,731 31 Jan 24 ₹20,942 31 Jan 25 ₹23,632 31 Jan 26 ₹26,355 Returns for ICICI Prudential Equity and Debt Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 0.9% 3 Month 0.2% 6 Month 5.2% 1 Year 15.6% 3 Year 19.2% 5 Year 19.1% 10 Year 15 Year Since launch 15.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 13.3% 2023 17.2% 2022 28.2% 2021 11.7% 2020 41.7% 2019 9% 2018 9.3% 2017 -1.9% 2016 24.8% 2015 13.7% Fund Manager information for ICICI Prudential Equity and Debt Fund

Name Since Tenure Sankaran Naren 7 Dec 15 10.16 Yr. Manish Banthia 19 Sep 13 12.38 Yr. Mittul Kalawadia 29 Dec 20 5.1 Yr. Akhil Kakkar 22 Jan 24 2.03 Yr. Sri Sharma 30 Apr 21 4.76 Yr. Sharmila D'Silva 31 Jul 22 3.51 Yr. Nitya Mishra 4 Nov 24 1.24 Yr. Data below for ICICI Prudential Equity and Debt Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 6.36% Equity 76.7% Debt 16.9% Other 0% Equity Sector Allocation

Sector Value Financial Services 19.7% Consumer Cyclical 11.2% Energy 7.7% Industrials 7.23% Consumer Defensive 6.67% Health Care 6.43% Utility 5.97% Technology 3.91% Real Estate 3.01% Basic Materials 2.64% Communication Services 2.28% Debt Sector Allocation

Sector Value Government 10.1% Corporate 8.8% Cash Equivalent 4.4% Credit Quality

Rating Value A 1.7% AA 19.74% AAA 78.57% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 31 Jul 12 | ICICIBANK6% ₹3,075 Cr 22,692,140

↓ -270,713 NTPC Ltd (Utilities)

Equity, Since 28 Feb 17 | NTPC5% ₹2,663 Cr 74,795,559

↓ -1,565,210 Reliance Industries Ltd (Energy)

Equity, Since 30 Jun 22 | RELIANCE5% ₹2,643 Cr 18,943,909

↑ 400,000 HDFC Bank Ltd (Financial Services)

Equity, Since 30 Apr 21 | HDFCBANK5% ₹2,382 Cr 25,630,965

↑ 3,908,272 Sun Pharmaceuticals Industries Ltd (Healthcare)

Equity, Since 31 May 16 | SUNPHARMA5% ₹2,262 Cr 14,178,073

↑ 616,988 Axis Bank Ltd (Financial Services)

Equity, Since 31 Mar 21 | AXISBANK3% ₹1,570 Cr 11,459,322 TVS Motor Co Ltd (Consumer Cyclical)

Equity, Since 28 Feb 18 | TVSMOTOR3% ₹1,464 Cr 3,981,427

↓ -30,966 Avenue Supermarts Ltd (Consumer Defensive)

Equity, Since 31 Jan 23 | DMART2% ₹1,187 Cr 3,218,463 InterGlobe Aviation Ltd (Industrials)

Equity, Since 28 Feb 23 | INDIGO2% ₹1,166 Cr 2,535,996

↑ 76,418 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 31 Jul 21 | MARUTI2% ₹1,132 Cr 775,315

↓ -14,852 10. UTI Multi Asset Fund

UTI Multi Asset Fund

Growth Launch Date 21 Oct 08 NAV (17 Feb 26) ₹79.7729 ↑ 0.10 (0.12 %) Net Assets (Cr) ₹6,720 on 31 Dec 25 Category Hybrid - Multi Asset AMC UTI Asset Management Company Ltd Rating ☆ Risk Moderately High Expense Ratio 1.79 Sharpe Ratio 0.55 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹11,256 31 Jan 23 ₹11,655 31 Jan 24 ₹15,639 31 Jan 25 ₹18,105 31 Jan 26 ₹20,438 Returns for UTI Multi Asset Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 0.3% 3 Month 1.5% 6 Month 8.4% 1 Year 15.2% 3 Year 20.4% 5 Year 14.5% 10 Year 15 Year Since launch 12.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 11.1% 2023 20.7% 2022 29.1% 2021 4.4% 2020 11.8% 2019 13.1% 2018 3.9% 2017 -0.5% 2016 17.1% 2015 7.3% Fund Manager information for UTI Multi Asset Fund

Name Since Tenure Sharwan Kumar Goyal 12 Nov 21 4.22 Yr. Jaydeep Bhowal 1 Oct 24 1.34 Yr. Data below for UTI Multi Asset Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 7.68% Equity 68.24% Debt 9.48% Other 14.6% Equity Sector Allocation

Sector Value Financial Services 15.97% Technology 11.06% Consumer Defensive 8.74% Consumer Cyclical 8.66% Industrials 5.58% Basic Materials 4.97% Health Care 4.22% Real Estate 3.79% Energy 3.27% Communication Services 2.96% Debt Sector Allocation

Sector Value Government 6.42% Cash Equivalent 6.3% Corporate 4.44% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity UTI Gold ETF

- | -15% ₹1,009 Cr 75,949,369

↓ -69,567 State Bank of India (Financial Services)

Equity, Since 31 Oct 25 | SBIN3% ₹185 Cr 1,716,730 Infosys Ltd (Technology)

Equity, Since 31 Mar 24 | INFY3% ₹178 Cr 1,086,475

↑ 30,677 Asian Paints Ltd (Basic Materials)

Equity, Since 31 Oct 24 | ASIANPAINT2% ₹158 Cr 650,377 Nestle India Ltd (Consumer Defensive)

Equity, Since 29 Feb 24 | NESTLEIND2% ₹152 Cr 1,142,201

↑ 22,681 ITC Ltd (Consumer Defensive)

Equity, Since 31 Oct 22 | ITC2% ₹149 Cr 4,622,966

↑ 369,276 Coal India Ltd (Energy)

Equity, Since 31 Oct 22 | COALINDIA2% ₹147 Cr 3,341,545 Tata Consultancy Services Ltd (Technology)

Equity, Since 29 Feb 24 | TCS2% ₹139 Cr 444,634

↑ 12,793 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 24 | BHARTIARTL2% ₹137 Cr 697,974

↑ 20,408 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 31 Oct 23 | MARUTI2% ₹130 Cr 89,156

↑ 2,752

ಆನ್ಲೈನ್ನಲ್ಲಿ ಬ್ಯಾಲೆನ್ಸ್ಡ್ ಅಡ್ವಾಂಟೇಜ್ ಫಂಡ್ಗಳಲ್ಲಿ ಹೂಡಿಕೆ ಮಾಡುವುದು ಹೇಗೆ?

Fincash.com ನಲ್ಲಿ ಜೀವಮಾನಕ್ಕಾಗಿ ಉಚಿತ ಹೂಡಿಕೆ ಖಾತೆಯನ್ನು ತೆರೆಯಿರಿ.

ನಿಮ್ಮ ನೋಂದಣಿ ಮತ್ತು KYC ಪ್ರಕ್ರಿಯೆಯನ್ನು ಪೂರ್ಣಗೊಳಿಸಿ

ದಾಖಲೆಗಳನ್ನು ಅಪ್ಲೋಡ್ ಮಾಡಿ (PAN, ಆಧಾರ್, ಇತ್ಯಾದಿ).ಮತ್ತು, ನೀವು ಹೂಡಿಕೆ ಮಾಡಲು ಸಿದ್ಧರಿದ್ದೀರಿ!

ಇಲ್ಲಿ ಒದಗಿಸಲಾದ ಮಾಹಿತಿಯು ನಿಖರವಾಗಿದೆ ಎಂದು ಖಚಿತಪಡಿಸಿಕೊಳ್ಳಲು ಎಲ್ಲಾ ಪ್ರಯತ್ನಗಳನ್ನು ಮಾಡಲಾಗಿದೆ. ಆದಾಗ್ಯೂ, ಡೇಟಾದ ನಿಖರತೆಯ ಬಗ್ಗೆ ಯಾವುದೇ ಖಾತರಿಗಳನ್ನು ನೀಡಲಾಗುವುದಿಲ್ಲ. ಯಾವುದೇ ಹೂಡಿಕೆ ಮಾಡುವ ಮೊದಲು ದಯವಿಟ್ಟು ಸ್ಕೀಮ್ ಮಾಹಿತಿ ದಾಖಲೆಯೊಂದಿಗೆ ಪರಿಶೀಲಿಸಿ.

Research Highlights for Sundaram Equity Hybrid Fund