Investing 101: How Today’s Youth Can Start Building Wealth Early

Investing is not just for the wealthy or the experienced; it's a powerful tool that can help young people secure their financial future.

Whether you're saving for a house, a dream holiday, or retirement, the earlier you start, the better. Let's dive into the basics of investing and how you can begin building wealth today.

Why Start Investing Early?

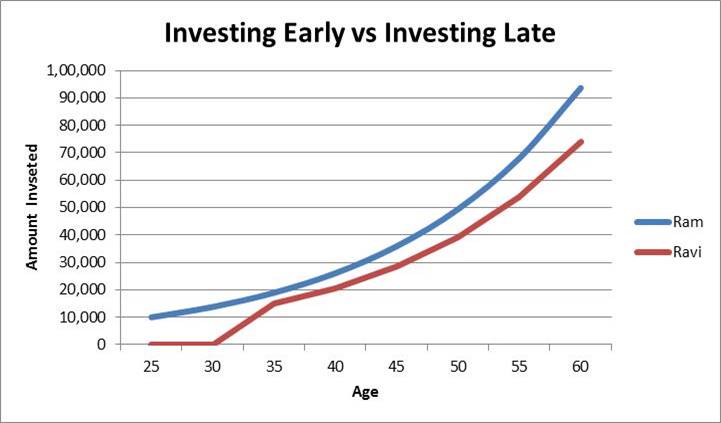

Time is your greatest ally when it comes to investing. The sooner you start, the more time your money has to grow through the power of compound interest. Compound interest means earning interest on your initial investment and the interest it accumulates over time. Even small amounts can grow significantly if invested wisely over a long period.

For example, if you start investing ₹5,000 a month at age 20 with an Average Annual Return of 12% (which is a reasonable expectation from Equity Mutual Funds in India), you could have over ₹2.5 crore by the time you’re 60. Starting at 30 would still leave you with a considerable amount, but it would be significantly less—around ₹1 crore. The difference is the Power of Compounding over an extra decade.

Getting Started: The Basics of Mutual Funds

Mutual Funds

What are they? A mutual fund pools money from many investors to buy a diversified Portfolio of stocks, Bonds, or other securities.

Why invest in them? Mutual Funds offer a way to invest in a variety of assets, which can help spread out risk. They are managed by professionals, so you don’t need to pick individual stocks yourself. SIPs (Systematic Investment Plans) in mutual funds are particularly popular in India for their disciplined approach to investing.

Talk to our investment specialist

Understanding Risk and Diversification

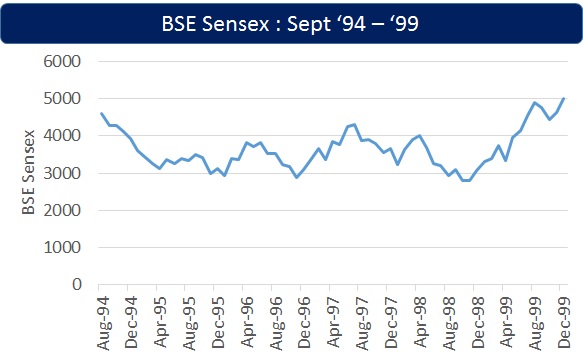

Investing always involves some level of risk. Stocks can go up, but they can also go down. That’s why it’s essential to diversify your investments—meaning, don’t put all your money into one stock or one type of asset. Diversification reduces risk by spreading your investments across different assets, such as stocks, bonds, and Real Estate. If one investment underperforms, others might do well, balancing out your portfolio.

The Power of Compound Interest

Compound interest is the key to building wealth over time. It allows your investments to grow exponentially, as you earn interest on both your original investment and the interest it has already earned.

Here’s a simple example: If you invest ₹10,000 at an annual interest rate of 10%, after one year, you’ll have ₹11,000. In the second year, you’ll earn 10% on ₹11,000, and so on. Over time, this compounding effect can turn a small investment into a significant sum.

How to Start Investing

Set Your Goals: Determine why you’re investing. Is it for a specific goal, like buying a house, or for general wealth building?

Choose Your Investment Platform: There are many online platforms in India, like Fincash.com, where you can start investing with just a small amount of money, the best part is it is a user-friendly interface.

Start Small: If you’re new to investing, start with a small amount that you’re comfortable with. You can increase your investments as you become more confident.

Stay Consistent: Investing regularly, even with small amounts, can build significant wealth over time. Setting up an SIP (Systematic Investment plan) in a mutual fund is an excellent way to stay consistent.

Educate Yourself: Continue learning about investing. The more you know, the better decisions you’ll make.

5 Reasons Why Every Young Adult Should Start Investing Today

Power of Compounding: Starting early allows your money to grow exponentially through compound interest, turning small investments into substantial amounts and providing future financial security.

Financial Independence: Investing builds wealth over time, giving you control over your financial future and the freedom to make life choices without relying on others.

Beating Inflation: Investments, especially in equities, offer returns that outpace Inflation, preserving and enhancing your purchasing power compared to traditional savings accounts.

Building Wealth for Life Goals: early investing helps you accumulate funds for significant life goals, making it easier to achieve milestones like buying a home or retiring early without Financial Stress.

Learning Financial Discipline: Regular investing cultivates the habit of saving and financial discipline, essential for wealth creation and effective financial management throughout life.

Top 11 SIP Mutual Funds in India FY 25 - 26

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) SBI PSU Fund Growth ₹36.5276

↑ 0.18 ₹5,817 500 6.8 17.1 33.3 34.1 28.3 11.3 DSP World Gold Fund Growth ₹62.625

↓ -0.10 ₹1,756 500 34.3 83.1 153 55.4 28.2 167.1 ICICI Prudential Infrastructure Fund Growth ₹197.62

↑ 1.04 ₹8,134 100 -1.3 2.8 17.4 25.2 26.8 6.7 Invesco India PSU Equity Fund Growth ₹68.34

↑ 0.60 ₹1,449 500 1.9 10.3 31.4 31.8 26.5 10.3 DSP India T.I.G.E.R Fund Growth ₹324.783

↑ 1.00 ₹5,323 500 1.1 5.2 21.7 25.7 24.4 -2.5 Nippon India Power and Infra Fund Growth ₹352.934

↑ 1.19 ₹7,117 100 -0.9 4.4 19.8 26.4 23.8 -0.5 HDFC Infrastructure Fund Growth ₹47.818

↑ 0.18 ₹2,452 300 -1.9 1.4 17.3 27.3 23.8 2.2 Franklin Build India Fund Growth ₹148.907

↑ 0.61 ₹3,036 500 1.7 6.5 23 27.8 23.7 3.7 LIC MF Infrastructure Fund Growth ₹50.3658

↑ 0.41 ₹1,003 1,000 -0.3 4.6 24.3 28.7 23.3 -3.7 ICICI Prudential Dividend Yield Equity Fund Growth ₹55.05

↑ 0.21 ₹6,400 100 -0.1 5.9 16.1 23 23.1 11.8 Canara Robeco Infrastructure Growth ₹164.4

↑ 0.93 ₹894 1,000 0 3.4 23.3 25.9 23 0.1 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 17 Feb 26 Research Highlights & Commentary of 11 Funds showcased

Commentary SBI PSU Fund DSP World Gold Fund ICICI Prudential Infrastructure Fund Invesco India PSU Equity Fund DSP India T.I.G.E.R Fund Nippon India Power and Infra Fund HDFC Infrastructure Fund Franklin Build India Fund LIC MF Infrastructure Fund ICICI Prudential Dividend Yield Equity Fund Canara Robeco Infrastructure Point 1 Upper mid AUM (₹5,817 Cr). Lower mid AUM (₹1,756 Cr). Highest AUM (₹8,134 Cr). Bottom quartile AUM (₹1,449 Cr). Upper mid AUM (₹5,323 Cr). Top quartile AUM (₹7,117 Cr). Lower mid AUM (₹2,452 Cr). Lower mid AUM (₹3,036 Cr). Bottom quartile AUM (₹1,003 Cr). Upper mid AUM (₹6,400 Cr). Bottom quartile AUM (₹894 Cr). Point 2 Established history (15+ yrs). Established history (18+ yrs). Established history (20+ yrs). Established history (16+ yrs). Established history (21+ yrs). Oldest track record among peers (21 yrs). Established history (17+ yrs). Established history (16+ yrs). Established history (17+ yrs). Established history (11+ yrs). Established history (20+ yrs). Point 3 Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Rating: 3★ (upper mid). Rating: 3★ (upper mid). Rating: 4★ (upper mid). Rating: 4★ (top quartile). Rating: 3★ (lower mid). Top rated. Not Rated. Rating: 3★ (lower mid). Not Rated. Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: Moderately High. Risk profile: High. Point 5 5Y return: 28.26% (top quartile). 5Y return: 28.18% (top quartile). 5Y return: 26.82% (upper mid). 5Y return: 26.47% (upper mid). 5Y return: 24.39% (upper mid). 5Y return: 23.80% (lower mid). 5Y return: 23.79% (lower mid). 5Y return: 23.70% (lower mid). 5Y return: 23.32% (bottom quartile). 5Y return: 23.13% (bottom quartile). 5Y return: 23.04% (bottom quartile). Point 6 3Y return: 34.12% (top quartile). 3Y return: 55.43% (top quartile). 3Y return: 25.17% (bottom quartile). 3Y return: 31.84% (upper mid). 3Y return: 25.71% (bottom quartile). 3Y return: 26.37% (lower mid). 3Y return: 27.31% (lower mid). 3Y return: 27.85% (upper mid). 3Y return: 28.66% (upper mid). 3Y return: 22.99% (bottom quartile). 3Y return: 25.89% (lower mid). Point 7 1Y return: 33.26% (top quartile). 1Y return: 153.01% (top quartile). 1Y return: 17.42% (bottom quartile). 1Y return: 31.42% (upper mid). 1Y return: 21.75% (lower mid). 1Y return: 19.84% (lower mid). 1Y return: 17.31% (bottom quartile). 1Y return: 22.96% (lower mid). 1Y return: 24.31% (upper mid). 1Y return: 16.07% (bottom quartile). 1Y return: 23.32% (upper mid). Point 8 Alpha: -0.22 (lower mid). Alpha: 1.32 (top quartile). Alpha: 0.00 (upper mid). Alpha: -1.90 (bottom quartile). Alpha: 0.00 (upper mid). Alpha: -15.06 (bottom quartile). Alpha: 0.00 (lower mid). Alpha: 0.00 (lower mid). Alpha: -18.43 (bottom quartile). Alpha: 4.00 (top quartile). Alpha: 0.00 (upper mid). Point 9 Sharpe: 0.33 (upper mid). Sharpe: 3.42 (top quartile). Sharpe: 0.12 (upper mid). Sharpe: 0.27 (upper mid). Sharpe: -0.31 (bottom quartile). Sharpe: -0.20 (bottom quartile). Sharpe: -0.12 (lower mid). Sharpe: -0.05 (lower mid). Sharpe: -0.21 (bottom quartile). Sharpe: 0.52 (top quartile). Sharpe: -0.18 (lower mid). Point 10 Information ratio: -0.47 (bottom quartile). Information ratio: -0.67 (bottom quartile). Information ratio: 0.00 (lower mid). Information ratio: -0.37 (bottom quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.34 (top quartile). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (lower mid). Information ratio: 0.28 (upper mid). Information ratio: 1.38 (top quartile). Information ratio: 0.00 (upper mid). SBI PSU Fund

DSP World Gold Fund

ICICI Prudential Infrastructure Fund

Invesco India PSU Equity Fund

DSP India T.I.G.E.R Fund

Nippon India Power and Infra Fund

HDFC Infrastructure Fund

Franklin Build India Fund

LIC MF Infrastructure Fund

ICICI Prudential Dividend Yield Equity Fund

Canara Robeco Infrastructure

200 Crore in Equity Category of mutual funds ordered based on 5 year calendar year returns.

Final Thoughts

Investing is a journey, and the earlier you start, the more you can benefit from the power of compound interest. By understanding the basics of stocks, mutual funds, and diversification, you can begin building wealth and securing your financial future. Remember, every investment, no matter how small, is a step towards achieving your Financial goals.

Start today, and let time work in your favour.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.