What is the Difference Between CIBIL Rank and CIBIL Score?

If you have just stepped into the credit world, you would have come across the word “CIBIL.” It is quite apparent that you have to keep your CIBIL Score good enough if you wish to take debts or loans. However, a majority of people are totally clueless when it comes to different aspects of CIBIL score.

On top of that, when CIBIL Rank is also added in the same league, the confusion gets heightened even more. Is there even a difference between CIBIL rank and CIBIL score? Of course, there is. Let's figure out the same in this post.

Defining the CIBIL Score and CIBIL Rank

A CIBIL score is a numerical expression that is based on the analysis of your credit files. The score is meant to represent your creditworthiness. Primarily, this score is based on your past debt repayment, Credit Report, and information gathered from Credit Bureaus. This score decides whether you are eligible to get a loan or not.

A CIBIL rank, on the other hand, is a number that summarizes your company credit report (CCR). While a CIBIL score is specifically for individuals, CIBIL rank is for companies. However, this rank is only provided to those companies that have a debt anywhere between 10 lakhs to 50 crores.

Check credit score

Dissimilarities Between CIBIL Score and CIBIL Rank

While gauging the difference, the below-mentioned CIBIL rank and CIBIL score parameters should be kept in mind:

Credit Score Range

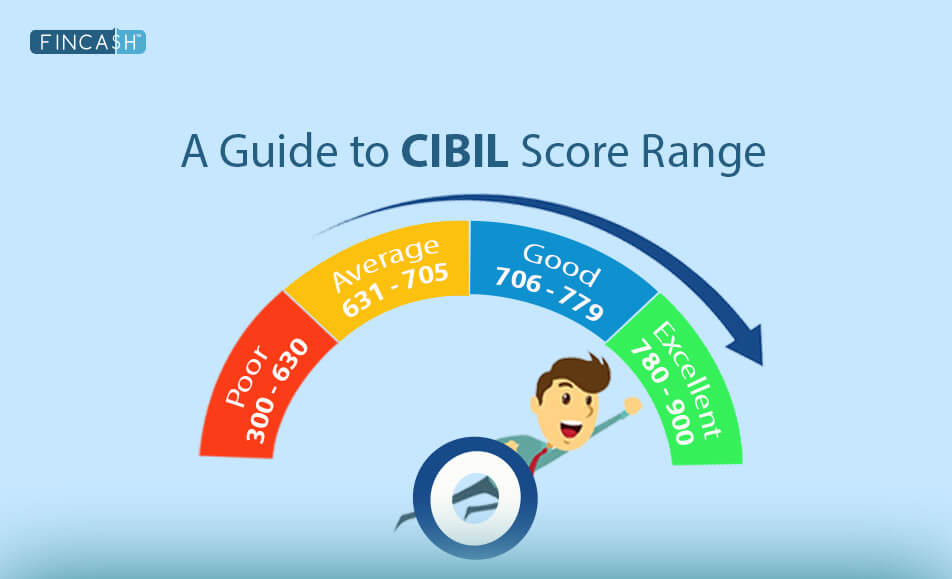

While CIBIL rank is a numeric summary of your company credit report (CCR), CIBIL score is a 3-digit numeric summary of your CIBIL report. CIBIL rank is counted anywhere between 1 to 10, where 1 is considered the best rank.

And, CIBIL score ranges anywhere between 300 to 900. Having a CIBIL score around 700 or more makes you a preferable individual for loans and debts.

Personal & Business Score

Another major credit score and CIBIL score difference is that CIBIL score are available only for individuals. So, in case you are looking forward to taking a personal loan or debt, your CIBIL score will be considered for approval or rejection of the application.

Whereas a CIBIL rank is specifically for companies. Also, the ones who have a loan exposure of Rs. 10 lakhs to 5 crores are provided with this rank.

Conclusion

Though different from the proposition, both CIBIL rank and CIBIL score have the same purpose – to provide the financial report so as to assess the creditworthiness. So, whether you are individual or are an owner of a company, keeping the CIBIL higher and at a good position is an extremely important task. After all, who knows when you feel the need to get a loan?

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.