SBI Paywave International Debit Card

SBI Paywave International Debit Card is actually sbiINTOUCH Tap and Go debit card. This card is an international debit card that comes with contactless technology. Contactless is where you don't have to enter your PIN code upto a certain amount of transactions. So wherever you see the contactless symbol at the merchant location, you can make use of this card for fast and safe transactions.

You can make the payment simply by waving the SBI Paywave International Debit Card near POS terminal instead of dipping or swiping. With this technology, the card will always remain in the customer’s custody, thereby reducing the chances of fraud.

Details about SBI Paywave International Debit Card

- The card works on the principle of Near Field Communication (NFC) technology.

- An embedded antenna is present in the card that transmits purchase information to and from the contactless reader.

- The card also has a chip and a magstripe that can be used to make payment at merchant portals in the absence of contactless payment or where contactless payments are not accepted.

- With this card, customer convenience is very high as compared to traditional card-based transactions.

- The card can be used at the merchant portal where contactless payments are accepted and also at the standard card payments.

- PIN is mandatory for all the payments made above Rs. 2000 at merchant portal (POS).

- Maximum five contactless transactions are permitted during a day.

- You can make a maximum transaction up to Rs. 10,000 daily.

- SBI Paywave International Debit Card comes with a chip, magstripe and NFC antenna for both contactless and standard payment.

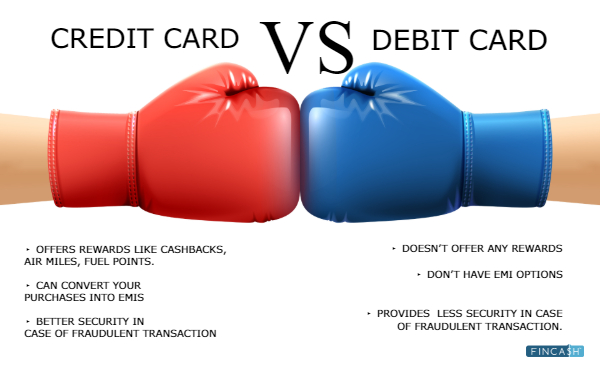

Freedom Rewardz

Following are the attractive rewards points offered by this SBI Debit Card-

- Earn 1 freedom rewardz point for every Rs. 200 spent on shopping, dining out, filling fuel, booking for travel or spending online.

- Following are the bonus points you will earn on transactions made within the first month of card issuance-

- 50 bonus freedom rewardz points on the first transaction

- Additional 50 freedom rewardz points on a second purchase transaction

- On the third transaction, earn 100 bonus freedom rewardz points

These freedom rewardz points can be accumulated, later to be redeemed to get exciting gifts.

Get Best Debit Cards Online

SBI Paywave International Debit Card Benefits

Being a contactless debit card, it comes with various benefits, such as-

- Payment by this card is faster as you don’t have to insert the PIN code.

- The card remains with the customer while making payment, thereby it reduces the chances of fraud.

- Only payments up to Rs. 2000 can be made via contactless mode. This means you don’t have to enter your PIN code, just wave.

- With this card, you can go for both contactless and standard (enter PIN) payment mode.

How does it Work?

sbiINTOUCH Tap & Go Debit Card works in three following steps-

- The customer has to look at contactless payment logo at the merchant’s portal.

- When the merchant enters the amount in the machine, you have to tap the card at the POS terminal.

- A green light at the terminal confirms that payment is successfully made and the transaction is completed.

Risks Involved

- In case if the card is lost or stolen the fraudster may make use of the contactless payment mode at a merchant location for a maximum value of Rs. 2000 per transaction. before the card is blocked and reported.

- The fraudster can do a maximum of five contactless transactions in a day. The maximum value cannot exceed Rs. 10,000 in a day.

- However, the number of fraudulent transactions in a day will differ depending upon how many transactions have already been made by the cardholder before losing the debit card.

Daily Cash Withdrawal and Transaction Limit

sbiINTOUCH Tap & Go Debit Card can be used anywhere in the world.

The daily withdrawal limit at ATM and at POS for domestic and international is given in the following table:

| sbiINTOUCH Tap & Go debit card | Domestic | International |

|---|---|---|

| Daily Cash Withdrawals at ATM | Rs. 100 to Rs. 40,000 | Varies from country to country, subject to a maximum of USD equivalent to INR 40,000 per day |

| Daily Point of Sales/Online Transaction Limit | Up to Rs. 75,000 | PoS Transaction Limit: Varies from country to country, subject to a maximum of foreign currency equivalent of Rs. 75,000. Online Transaction Limit: Maximum per transaction and per month limit of foreign currency equivalent of Rs. 50,000, available only at select international online websites |

Issuance and Maintenance Charges

You need to pay some issuance and maintenance charges for SBI Paywave International Debit Card.

The following table gives an account of the same:

| Particulars | Charges |

|---|---|

| Issuance Charges | NIL |

| Annual Maintenance Charges | Rs. 175 plus GST |

| Card Replacement Charges | Rs. 300 plus GST |

Note: The above charges are subject to revision from time to time.

How to Apply for SBI Paywave International Debit Card?

If you want to apply for this card, you can call the toll free number 1800 11 2211, 1800 425 3800 or 080-26599990.

Alternatively, you can send an email to contactcentre@sbi.co.in. You can also visit SBI Bank branch and make an application for SBI Paywave International Debit Card.

Conclusion

Contactless Debit Cards are gaining more popularity for its unique feature of simply waving the card. Just as like the advantages, there are risks too, that come with this card. However, more merchants are now keeping the POS terminal that has a contactless logo on it. The biggest advantage of this debit card is you can make contactless payments and also make transactions through the standard mode of payment by inserting PIN.

FAQs

1. What technology does the SBI Paywave debit card use?

A: As the SBI Paywave is a contactless debit card, it uses the Near Field Communication or NFC technology. This means you don't have to swipe the card, in fact the POS terminals will detect the chip embedded in the card by a touch gesture.

2. Can I do all international transactions with the SBI Paywave debit card?

A: Yes, the SBI Paywave debit card is primarily for international transactions. You can use even make online international transactions.

3. Can I activate the international banking facility through a mobile application?

A: You can activate the international banking facility on your SBI Paywave debit card with the SBI Anywhere App. You will have to log in to the app with your user name and password. After that, you will have to click on 'manage debit cards' and select the SBI Paywave debit card. You will then have to turn on the international usage button and enter the ATM limit you wish to set.

4. Can I activate the international banking facility offline?

A: You can activate an international banking facility by visiting your SBI home branch.

5. Can I make domestic transactions with my SBI Paywave debit card?

A: Yes, you can make domestic transactions.

6. Can I earn reward points on my SBI Paywave debit card?

A: Yes, you will earn one reward point for every transaction of Rs.200. You will also gain a bonus of 50 reward points on the first transaction you make within one month of issuance of the card. For the second transaction that you make within a month of issuance of the card, you will earn another bonus of 50 points, and a bonus of 100 reward points will be awarded for the third transaction that you make.

7. Are there any additional charges for activating the international facility?

A: The SBI Paywave debit card is ideally suited for international transactions. Hence, there is no extra charge for the online transaction. However, the maintenance charge is slightly higher compared to other debit cards. The annual maintenance charge is Rs.175 plus GST, and for replacing the card, you will have to pay Rs.300 plus GST.

8. Is there any ceiling limit to the POS transactions that I can make internationally?

A: You can make a maximum transaction of Rs. 75,000 at POS terminals. However, this limit can also vary from country to country.

9. Is there any ceiling limit to the online that I can make internationally?

A: You can make international online transactions worth Rs.50,000 in a month.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You Might Also Like