All About SBI Debit Card EMI

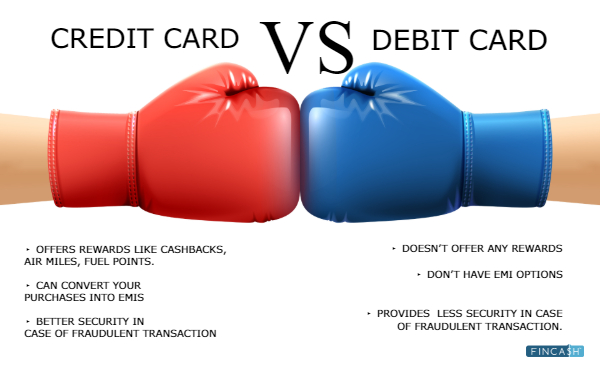

When you set up a new house or move to on an unfurnished rented flat you need some basic things like a sofa set, washing machine, TV set, etc. Some would directly buy from their credit card, while others who are cautions in their spendings would take a safer option of Debit Card EMI.

State Bank of India (SBI), has launched an Equated Monthly Instalments (EMI) facility for its existing debit card customers at POS. It allows cardholders to buy consumer goods in instalments across PAN India without having to pay the entire amount immediately. This EMI facility on the SBI Debit Card comes with zero documentation and no branch visit. You can avail this facility in less than a minute irrespective of the existing saving bank account. The EMI begins in one month after the transaction.

How to Check Eligibility for SBI Debit Card EMI?

To check your eligibility, if you can purchase goods in EMI via debit card, you need to follow these steps-

- Go to the website page from where you are buying the consumer durables goods.

- Enter your mobile number and bank account number

- Click on check eligibility

Alternatively, to verify the EMI offer eligibility, you can send an SMS to DCEMI XXXX(last four digits of your debit card number) to 5676782. You will receive the information about the eligible amount of the loan, its validity and merchant stores where the offer can be availed.

Get Best Debit Cards Online

How to Activate EMI on SBI Debit Card?

You can easily activate SBI Debit Card EMI by following the steps given below:

- Select the product you want to purchase

- Go to debit card EMI option on the payment page

- Select the suitable tenure

- Complete the transaction using your SBI debit card

Flipkart SBI Debit Card EMI

Flipkart is an online platform where there are thousands of consumer durable goods available for you. It has made our lives easier with the EMI facility so that you can buy expensive goods in instalments. With this option, you will definitely not get a huge dent in your wallet.

Steps for Availing Flipkart Debit Card EMI Option

- Select debit card EMI as your payment option on the payment page

- Choose the EMI tenure

- Using OTP/ PIN, authorize the transaction, or else get it navigated to your bank’s net banking page

- Confirm the EMI payment plan

SBI Debit Card EMI & Online EMI - Features

| Features | Details |

|---|---|

| Loan amount | Up to Rs. 1 lakh |

| Flexible tenure | 6/9/12/18 months |

| Rate of interest | 2-Yr MCLR + 7.50% |

| Processing Fee | Zero |

| Pre-payment penalty | 3% of the pre-paid amount |

Other features -

- No blocking of Savings Account balance

- Zero documentation & instant disbursal

- You can avail EMI facility to a maximum of three times within the limit & period communicated via SMS/E-mail

- Avail either Online EMI or DC EMI or both within the given limit

- To check your eligibility, SMS DCEMI to 567676 from your registered mobile no. with us

- The facility is being offered to pre-selected customers of SBI

Conclusion

Enjoy plethora of options when it comes to buying consumer goods online. SBI debit cards have introduced easy buying expirence with EMI facility. Those who don’t want to opt for credit cards, can easily opt for this option.

FAQs

1. Can I get EMIs on my debit card?

A: Send an SMS, DCEMI, with the last four digits of your debit card to 5676782. You will then get the information as to the loan amount for which you are eligible. After that, you will have to check with the merchant whether the EMI facility is available. Once all of these have been evaluated, you can make the purchase. You can use the EMI facility on your debit card.

2. Do I have to pay interest if I make a purchase with the SBI debit card EMI facility?

A: Usually, the rates of interest for EMI payments depend on the merchant. You will also have to pay foreclosure charges and penalties if you are late with the payment of your EMIs.

3. Is EMI available for online transactions?

A: Yes, SBI debit card EMI facilities are available on eCommerce transactions made through portals like Amazon and Flipkart.

4. What is the maximum limit of the pre-approved loan that I can get on an SBI debit card?

A: The bank has put a ceiling limit of Rs.1 lakh for pre-approved loans acquired through the SBI debit card.

6. What is the prepayment penalty?

A: There is no prepayment penalty for transactions for up to Rs.25,000. But for loans above Rs.25,000, you will have to pay a prepayment penalty of 3% on the prepaid amount.

7. Does the loan affect my account balance?

A: No, the loan will not affect your account balance. The debit card is issued only to SBI account holders, yet the loan is given beyond and above your account balance. Hence, your account will not be blocked, and you will be able to make all transactions from your SBI account, despite the loan.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Very useful this page