RuPay Debit Card

RuPay debit cards are currently the most convenient domestic cards to use. It is the first-of-its-kind debit and credit card payment network in India. Basically, RuPay is created by mixing two words - Rupee and Payment. This initiative intends to fulfil RBI’s vision of a ‘less cash’ economy. Presently, RuPay has collaborated with almost 600 international, regional and local banks across the country. The leading promoters are ICICI Bank, HDFC Bank, State Bank of India, Bank of Baroda, Union Bank of India, Punjab National Bank, Canara Bank, Bank of India, etc. Also, it expanded its shareholding in 2016 to 56 banks to bring more banks across sectors under its umbrella.

RuPay is widely accepted at all ATMs, POS devices and e-commerce websites in India. The card has a highly secured network that protects against anti-phishing. You can easily shop, withdraw cash, pay bills, and do so much more with the range of RuPay Debit Cards. Let’s explore more!

Types of RuPay Debit Card

Following are the debit cards offered by RuPay to citizens of India:

1. Rupay Platinum Debit Card

This Debit Card by RuPay encourages you to celebrate the joys of life every day with hassle-free transactions. You get multiple benefits from Rupay Platinum Debit Card, such as -

- A gift voucher from Croma worth Rs.500. Else, you can avail 15% gift voucher from Apollo Pharmacy

- Rupay lightens your travel experience with access to over 20+ domestic lounges two times per calendar quarter per card

- By paying your utility bills, you can earn 5% cashback on your payments capped at Rs.50 per month per card

- You get a personal accident insurance and permanent total disability cover up to Rs. 2 Lakhs

- While travelling, Rupay gives assistance to hotel reservations to Consultancy services

Get Best Debit Cards Online

2. RuPay PMJDY Debit Card

Pradhan Mantri Jan-Dhan Yojana (PMJDY) is a Government of India's initiative towards affordable basic banking services. This scheme ensures access to financial services like - Savings & Deposit Accounts, Remittance, Credit, insurance, Pension in an affordable manner. Under the scheme, a basic savings bank deposit account can be opened in any bank branch or Business Correspondent (Bank Mitra) outlet. RuPay PMJDY Debit Card is issued with accounts opened under PMJDY. You can use the card at all ATMs, POS terminals and e-commerce websites. You also get an added personal accident and Permanent total disability Insurance cover of Rs.1 Lakh.

3. RuPay PunGrain Debit Card

This RuPay debit card has been launched as an initiative of the government of Punjab. PunGrain is basically a grain procurement project of the Punjab Government launched in October 2012. The Arthias are provided with a RuPay Pungrain Card under this account. You can use it at ATMs for cash withdrawal and for the automated grain procurement facility at PunGrain mandis.

4. RuPay Mudra Debit Card

MUDRA loans under pradhan mantri mudra yojana scheme (PMMYS), is an initiative by the Government of India. The objective of the scheme is to work in a sustainable manner by supporting and promoting partner institutions and creating an ecosystem of growth for the micro enterprise sector. RuPay Mudra Debit Card is issued with an account opened under PMMYS. With the Mudra card, you can make effective transactions and keep the interest burden minimum. In order to manage the working capital limit, you can make multiple withdrawal and credit.

5. RuPay Kisan Card

Kisan Credit Card (KCC) is a Government of India scheme which supports farmers with a credit line. The aim of the scheme is to save farmers from high-interest rates usually charged by lenders in the unorganised sector. Farmers under the KCC scheme are issued a RuPay Kisan Card on their account. It aims at providing timely credit support to the farmers for their cultivation needs as well as non-farming activities in a cost-effective manner. You can use the card at both ATMs and POS machines.

6. RuPay Classic Debit Card

With a Classic debit card, you can benefit from a Comprehensive Insurance cover. By availing this, you can always keep yourself and your family safe. The card gives you, an insurance cover of Rs. 1 lakh. Also, celebrate round the year with exclusive domestic merchant offers.

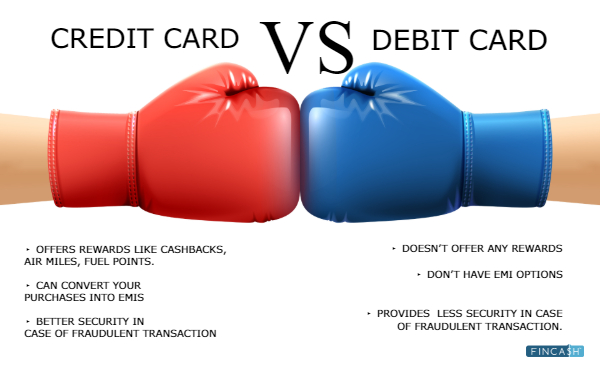

Benefits of RuPay Debit Card

The cost behind transaction becomes affordable as the processing happens domestically. This leads to lower cost of clearing and settlement for each transaction. Some of the other important benefits offered by RuPay are as follows-

- RuPay helps to develop customized product and service offerings for consumers

- As it is a domestic payment network, the information related to customers remains within the country

- RuPay cards are well placed across platforms like ATMs, mobile technology

- It has collaborated with almost 600 international, regional and local banks across the country

- All RuPay ATM-cum-debit cardholders are presently eligible for accidental death and permanent disability insurance coverage. The insurance premium is paid by the National Payments Corporation of India

Documents Required to Apply for a RuPay Debit Card

There are certain documents that you need to furnish as an identity proof to apply for the RuPay debit card. The documents are-

- PAN Card

- Aadhar card

- Passport

- Driving licence

- Voter ID card or any other government-approved document bearing your photograph

How to Apply?

You can visit your bank branch and meet a representative there. You'll get an application form for RuPay debit card, fill all the details and submit it. Ensure, you carry copies of your KYC documents that are needed for verification. Once verification is done, you will receive your debit card within 2-3 days. Sometimes an offline procedure takes more than online mode. You can also apply via online. Visit your bank’s website, check whether RuPay card is offered. If the bank is offering the card, then you can submit your application on the website. The bank representative will get in touch with you for further procedure.

Conclusion

Like international payment gateways - Visa or MasterCard, banks don’t have to pay fees to enter the RuPay network. Also, the transaction charges for RuPay network are low as compared to other payment networks. Since, its launch in 2012, Rupay has seen huge growth and is becoming the favourite payment network of India.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.