Everything About RuPay Credit Card

RuPay’ was an initiative by RBI to create a ‘cashless’ economy. The whole aim was to encourage every Indian Bank and financial institution to become tech-savvy and opt electronic payments over cash.

In the year 2012, NPCI (National Payments Corporation of India) launched a new indigenous card scheme called RuPay. The Rupay credit card was brought into service to create a domestic, affordable and convenient cashless mode of payment for people of India. Even though it’s not currently the most used credit card scheme, it has been gaining popularity over time.

What is a RuPay Credit Card?

The term RuPay to be precise means ‘Rupee’ and ‘Payment’. It is India's own initiative for debit & credit card payments. It is accepted all over India and has a low processing fee than VISA and MasterCard. A RuPay credit card is accepted over 1.4 lakh ATMs in India. It comes with a lot of attractive benefits and offers like cashback, rewards, discounts, fuel surcharge waiver, etc.

Many top banks including State Bank of India, ICICI Bank, Canara Bank, HSBC Bank, Citi Bank and HDFC Bank offer RuPay cards.

RuPay Credit Card Transaction Fee

As it is a domestic card the banks charge a very economical fee on transactions, which benefits both the bank as well as the user. With RuPay, the processing and transaction fees can even be as low as 2/3 the fee charged by other foreign cards.

Benefits of RuPay Credit Card

A RuPay Credit card offers a very minimal processing fee compared to the other credit card schemes. The low RuPay card charges are one of the key reasons why people prefer it over VISA and MasterCard.

RuPay offers an advanced security system for its credit card users in the form of an EMV chip that is embedded in the card. An EMV chip basically offers superior protection for carrying out high-value transactions.

Being a domestic card scheme, RuPay can have a faster processing speed.

Over 700 banks offer RuPay cards in India and an approximate of 1.5 lakh ATMs accept transactions made using it.

Get Best Cards Online

Variants of RuPay Credit Cards

The RuPay credit cards come in three different variants to choose from-

1) RuPay Select Credit Card

These cards are the premium category cards by RuPay. They provide exclusive lifestyle benefits, concierge assistance, and free accident insurance cover worth Rs. 10 lakh.

2) RuPay Platinum Credit Card

You’ll receive attractive welcome gifts from top brands with exciting rewards, offers, discounts and cashback.

3) RuPay Classic Credit Card

These types of credit cards offer discounts and cashback for online shopping. Also, you’ll get a complimentary accidental insurance cover worth Rs. 1 lakh.

What are the RuPay Credit Card Issuing Banks?

Following is a list of banks offering RuPay credit cards-

- Andhra Bank

- Canara Bank

- Central Bank of India

- Corporation Bank

- HDFC Bank

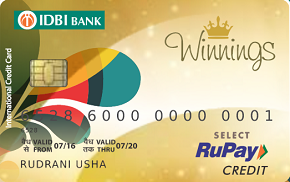

- IDBI Bank

- Punjab & Maharashtra Co-op Bank

- Punjab National Bank

- Saraswat Bank

- Union Bank of India

- Vijaya Bank

Best RuPay Credit Cards

Many banks have started offering RuPay. The launch of different variants has caused an increase in sales.

Here are the top three RuPay credit cards to consider.

| Card Name | Annual Fee |

|---|---|

| HDFC Bharat Card | Rs. 500 |

| Union Bank RuPay Select Card | Nil |

| IDBI Bank Winnings Card | Rs. 899 |

HDFC Bharat Credit Card

- Spend a minimum of Rs. 50,000 annually and get an annual fee waiver.

- Get 1% fuel surcharge waiver at all gas stations in India.

- Earn a 5% cashback for purchases made on fuel, groceries, bill payments, etc.

Union Bank RuPay Select Credit Card

- Get 4 complimentary airport lounge access at over 300 cities across the world.

- Earn up to Rs. 50 cashback every month on payment of utility bills.

- Get a fuel surcharge waiver of Rs. 75 monthly.

IDBI Bank Winnings Credit Card

- Enjoy free airport lounge visits internationally as well as domestically.

- Get 1% fuel surcharge waiver at all gas stations across India.

- Earn a cashback total of up to Rs. 500 on all your purchases within 90 days of receiving your card as a welcome benefit.

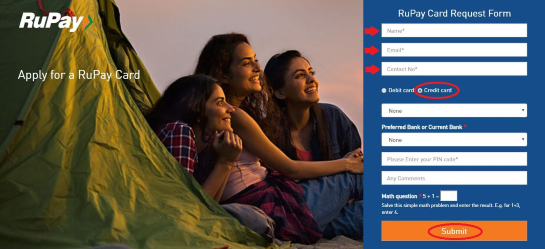

How to Apply for a RuPay Credit Card?

You can apply for a RuPay card online as well as offline

Online

- Go to RuPaY’s official website

- Choose the credit card option and enter the bank you wish to apply for

- Enter your name, phone number and email id

- Click on the ‘Apply Online’ option. An OTP (One Time Password) will be sent to your registered mobile phone.

- Use this OTP to receive a card request form

- Enter your personal details

- Select Apply, and proceed further.

Offline

You can apply offline by simply visiting the nearest respective bank and meeting the credit card representative. The representative will help you complete the application and choose the appropriate card. Your eligibility is checked based on which you'll receive your credit card.

What are the Documents required?

Following are the documents required to get a RuPay credit card-

- An identity proof issued by the government of India like Voter ID, driving license, aadhaar card, passport, ration card, etc.

- Proof of income

- Address proof

- PAN Card

- Passport size photograph

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Helpful page...Descrptive information about Credit Cards...