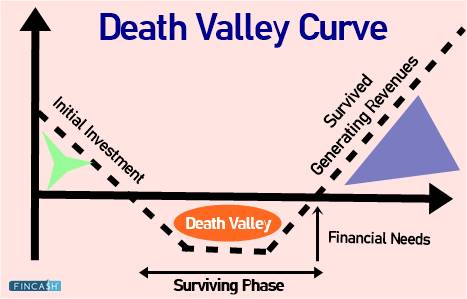

Death Valley Curve

The Death Valley curve is a jargon which describes the financial risk faced by start-up companies to survive the initial years of their business, until they become profitable in the future. The term is commonly used amongst Venture Capital to describe the initial phase of the startup company where it is not generating sufficient revenues to meet the expenses.

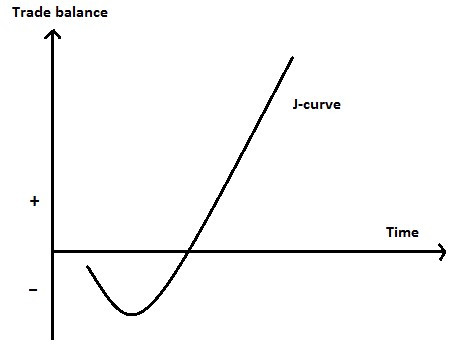

It is likely that the firm may obtain additional funding due to lack of cash flow. The dip of the curve indicates negative values of the balance sheet. Surviving the death valley curve means the start-up is generating sufficient revenue before the initial invested money gets nil.

Startup Death Valley Curve

During the phase where the startup firm is surviving from its initial investments to generate revenue, could be a risky period because it is unlikely that the company can gain additional fundings because it has not yet proven its potential. In most cases, the start-up falls off within a period of three years, mainly due to flawed business strategies. Therefore, a company at the beginning stage should always focus on formulating strategies to survive till the revenue is flowing in.

The startup death valley curve starts with a positive cash balance, but due to continuous expenses on developing its products or services, customer base, office rent, employee's expense, etc., the founders generally run out of cash.

The shape of the startup death valley curve may depend on various factors such as the industry type, business model, product, the amount of equity injected by the founders, etc. Many industries need heavy investment and in-depth research, which may take longer to establish in the market than normal. Hence, the firm might need stronger strategies and business models.

Talk to our investment specialist

How can Start-ups Survive the Death Valley Curve Phase?

Alternative Source of Cash Flow

The founders should have alternative cash flows or accumulate some funds from their side, which can come to great use during emergencies. Also, it can be a plus point for the entrepreneurs to have a job till the start-up becomes stable.

Make Financial Plans Yourself

At the starting phase you might need a professional financier. The founders must follow a strict Financial plan so that the distribution of expenses is disciplined for long-term sustainability. There are many webinars that can also help you to make successful financial plans.

Crowd Funding

This is an emerging area where crowdfunding sites like Ketto, Wishberry, Kickstarter, etc., provide an opportunity to solicit funds online. Once the company starts growing and generating revenues, the investors will be getting returns on their investment.

Bank finance

Financing from the Bank is a good option if the start-up firm has enough Collateral to back the loan.

Attract Required Amount

It is important to attract money according to the business plan and expenses. For instance, your first 12 months revenue comes around Rs. 10 lakhs, then don’t ask investors for Rs. 50 lakhs. Attracting a lot of money initially may dry up quickly in numerous expenses, especially if the strategies are not well planned.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.