Laffer Curve

What is the Laffer Curve?

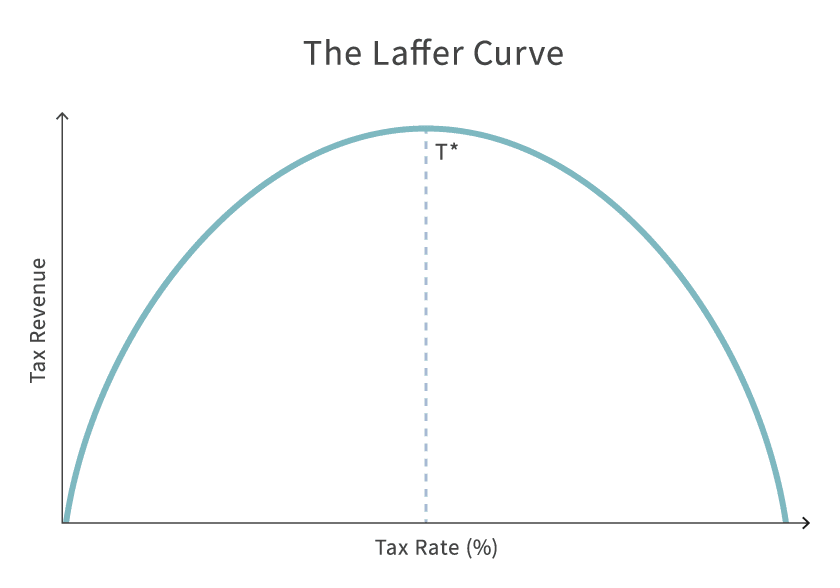

Developed by Arthur Laffer, a supply-side economist, Laffer Curve is a theory that showcases the relation between tax rates and the tax revenue acquired by governments. This curve is used to demonstrate the argument of Laffer that sometimes, cutting down the tax rate can increase the tax revenue.

In 1974, when the author was in conversation with the senior members of President Gerald Ford administration regarding a projected tax rate increase, in the middle of an economic illness that the country was dealing with, the first draft of the Laffer Curve was put forth on a paper napkin.

Explaining the Laffer Curve

At that point in time, most of the people believed that increased tax rates would result in increased tax revenue. However, Laffer contradicted that the more money was being taken from the business out of every additional income in the name of taxes, the less money was willingly invested.

A business tends to discover more ways to safeguard its capital from taxation or to relocate a part or all of the operations overseas. Investors are less willing to risk the capital if a massive percentage of profits is taken.

The foundation of the Laffer Curve is on the economic notion that people will end up adjusting their behaviour in case there are any incentives created through income tax rates. Higher-income tax rates can lead to a decreased incentive to work.

If this impact is massive enough, it means that at some of the tax rate, and an additional rate increase will result in decreased total tax revenue. For every tax type, there is a benchmark rate beyond which, the incentive to create more declines; thus, decreasing the revenue amount that the government receives.

Talk to our investment specialist

For instance, at a tax rate of 0%, the tax revenue will obviously be zero. As the tax rates upsurge from low levels, the tax that is collected by the government also increases. Ultimately, if tax rates have reached 100%, people will not choose to work, considering everything that they will be earning will be going to the government.

Thus, it is necessarily right that at a point, in the range of tax revenue being positive, it must reach its maximum point.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.