Realized Yield

What is Realized Yield?

Realized yield is the actual return earned during the holding period for an investment. It may include interest payments, dividends, and other cash distributions. The realized yield on investments with maturity dates is likely to differ from the stated yield to maturity under most circumstances. It may be applied to a bond sold prior to its maturity date or a dividend-paying security.

Generally speaking, the realized yield on Bonds includes the coupon payments received during the holding period, plus or minus the change in the value of the original investment, calculated on an annual basis. The full amount of profit earned on an investment over a period of time, which may or may not be the same as the maturation period. The realized yield includes the final yield, any coupon payments, gains from reinvested interest, and other income sources related to the investment.

Getting an Understanding of Realized Yield

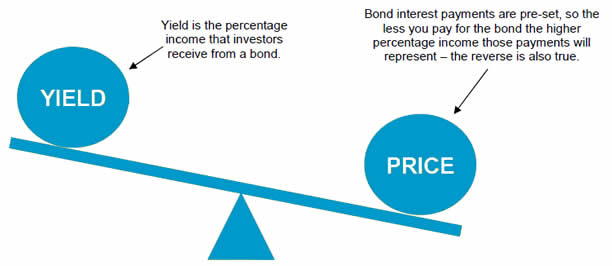

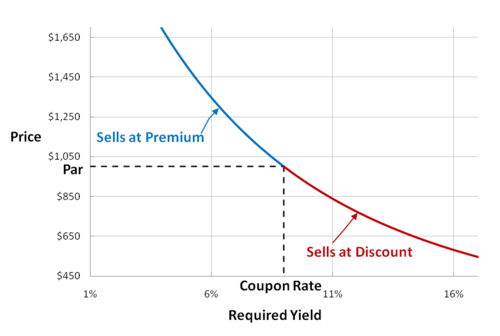

The realized yields on respective investments featuring maturity dates might differ from the one that is stated YTM or Yield to Maturity in most cases. The only exception is known to occur when the bond gets purchased as well as sold at the face value. This also serves to be the redemption price of the given bond during maturity. For instance, a bond having a coupon of 5 percent that gets purchased as well as sold at the face value is known to deliver the realized yield of five percent for the respective holding period.

The same bond when redeemed at the face value upon maturing can help in providing the yield of 5 percent to maturity. In all other cases, realized yields are measured on the basis of the payments received along with the change in the respective principal value relative to the invested amount. The realized yield is something that the participant of the bond market is known to get. This might not necessarily be the stated yield during maturity.

Talk to our investment specialist

As there is the presence of identical credit quality, a bond of one year with the 3 percent coupon along with a principal of INR 100 selling at INR 102 is known to be equivalent to the bond of one year with one percent coupon that sells at its face value. The given equivalence is expressed by stating the fact that both of the given bonds have a yield to maturity at around one percent.

However, let us assume that the interest rate of the market falls around half a percentage later after one month, and the price of one-year bond increase by around 0.5 percent because of the lower rates. In such a case, if the investor would go forward with selling the bond after one month without gathering the coupon payments, then the result appears to be realized yield of more than 6 percent on the yearly basis.

Realized yield also serves to be immensely useful when it comes to evaluating high-yield bonds. The given concept offers the investors an option of dealing with the fact that there are some high-yield bonds that might always be default.

Realized Yields With Bonds

In general, the realized yield is a generic measure of a bond yield as the length of time for which it will be held could be any period during its life. If the bond is held to maturity, the realized yield will equal the yield-to-maturity, and if it is held until the first call date, this yield will be identical to the yield-to-call.

An investor who contemplates selling a bond before redemption date can calculate the realized yield by estimating the price at which the bond will be sold and the length of time it will be held.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.