What is a Trading House?

A trading house is a company that transacts actual commodities and commodity derivatives on behalf of clients. It promotes trade between two nations, i.e., a home nation and a foreign one. It offers a service that lowers trade obstacles for small businesses with limited finances and Import-export capacity to join international markets. Trading companies support imports and exports by acquiring and reselling goods through regional or international sales offices. A trading company can act as an intermediary and promote products and services made locally in other nations.

Types of Trading House

There are five types of trading houses as per their roles, as follows:

Exporter: An export management company helps domestic producers or suppliers enter the global Market easily. They carry out their business as a distributor by acquiring goods in large numbers from the production facilities. Then they give a price to the foreign shop who will buy it. Profits are included in the pricing

Importer: Importers are a different type of trade company that purchases products from international producers. They then sell them to local dealers employed by the company

Buying Agents: These businesses purchase products or services from the global market for In-House producers. A buying agent's duties include choosing overseas suppliers, negotiating prices and contracts, and arranging safe transportation

Selling Agent: To earn brokerage, these Export Management Companies act on behalf of a manufacturer or a supplier. In this case, the manufacturer has complete control over the deal-making process, with the trading company limited to providing advice on export prices

Intermediary: An intermediate is someone who neither exports nor imports goods. They facilitate the trade of commodities or services between internal and external parties and demand a commission in return

Talk to our investment specialist

How do International Trading Houses work?

A trading house encourages the exchange of goods across international borders. It can charge slightly more for the goods than it would if the retailer bought the goods directly from Japan since it acts as an agent for international vendors looking for purchasers in the local market. With a markup approach to pricing, a profit is intended in addition to cost reimbursement.

Dealing with a small number of trading houses rather than many wholesalers benefits the shop because it makes the process of acquiring internationally manufactured goods simpler. Utilising trading houses for exporters also offers them insight and knowledge into the worldwide markets they want to access. Additionally, the companies can obtain vendor financing through direct loans and trade credits.

Benefits of Trading Houses

Here are the benefits associated with trading houses:

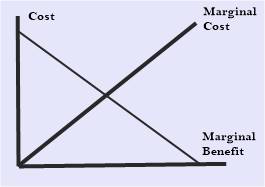

Economies of Scale: Trading houses benefit from Economies of Scale thanks to their extensive clientele. Established trade houses can profit from discounts from manufacturers and suppliers due to their substantial purchasing power. For the benefit of their clients, they can also import goods in large quantities to save money on shipping

Currency Management: Trading firms are well-versed in the knowledge needed to mitigate currency risks. They use various risk management techniques since they frequently transact across international borders to limit their exposure to currency swings. A trading house may utilise a currency forward contract as an example of a hedging strategy to reduce risks in future payments made in a different currency by locking the current exchange rate

International Presence: Trading houses frequently make broad contacts when engaging in foreign business activities, which serve as the foundation for significant business deals and a source of potential new clients. Additionally, trading houses may have an open foreign office with employees who work with customs agents to resolve any legal issues to maintain the Efficiency of their operations

Trading House Example

A trading company that deals in spices can make it possible for a local Singaporean spice merchant to sell in the US. To sell the item to American merchants, the trading company will purchase it from the dealer. Similarly, firms that trade commodities make it easier to trade actual goods.

Conclusion

Trading houses also participate in intermediate services to deliver operational and logistical services as effectively as possible. They also create trading flows by locating markets with specialised goods. In essence, supply and demand determine how a trading house is founded. Large manufacturers may contractually hire their own trade companies. The main advantage of most trading companies is that they take on the role of principals for some items and marketplaces, absorbing and lowering the risks associated with doing business in other countries.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.