Top 5 Smart Tips to Save Money from Today!

In today's fast-progressing world, savings look like a privilege for many people. But, if you understand a true sense of saving money, you should be able to take some amount every month to your future security. There are some very basic, yet effective ways; using which one could start saving money.

Money Saving Tips

Following are some of the best ways to save money:

1. Record your Expense

Recording your expense is the first basic step you need to do in order to save money. For a month, keep a check and record all kinds of expenses you have made. By doing this, you will have an idea of how much you are spending, and where you need to limit your expenditure.

Following the first step will lead you to the second step that is ‘making a tight budget’.

2. Make a Tight Budget

Start making your monthly budget according to your expenses. The main reason for making a tight budget is to control and curb your spending. One of the best ways to save money is to divide the salaried amount into clear expense heads.

For example, you can divide it into 4 broad categories/ portions - 30% on house and food expense, 30% for lifestyle, 20% for savings and another 20% for debts/credits/loans, etc.

As a thumb rule always endeavour to save 10% - 20% from the salaried amount.

Talk to our investment specialist

3. Spend Less Save More

Savings =Income - Expenses

This evaluation will give you a very simple and easy way to save and spend. One important thing that everyone should practice is to make productive use of their earnings.

Limit all your extra and unnecessary spends. Visualise what all you want to have in next five years, may be a house or a vehicle? And accordingly, start saving with that as an end objective.

4. Start Investing

The next approach to saving money is by Investing! The main idea behind investing is to generate a regular income or returns in a specific period of time. With time, your investment grows and so does your money. For instance, the value of INR 500 will not be same in the next five years (if invested!) and it may grow to more! Hence, investing is very important for everyone. However, before investing, one has to first save money!

One way to get closer to your desired goals is to understand the power of compound interest. Compound interest means an interest which is not only calculated on the initial principal but also takes into consideration the accumulated interest over prior periods.

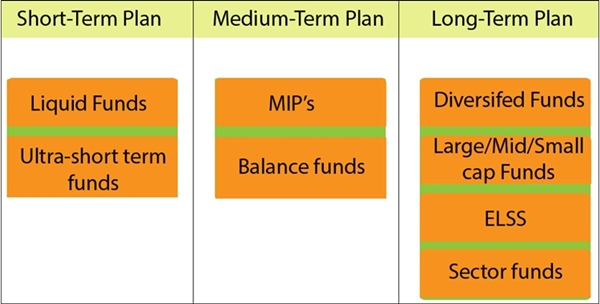

So if you are planning to save money, there are many short-term and long-term investment options that you can consider.

5. Have Financial Goals

Have Financial goals to save money! Financial set-up can be a major backbone to you at all times of your life. Regardless of your age, setting financial goals is very important. You can target your financial goals by categorising into time frames, i.e., short-term, mid-term and long-term goals. This gives a very systematic and realistic approach to your financial goals. So if you want to save money, start setting your goals by dividing them into time frames.

Mutual Fund Options for Short, Mid & Long Term Financial Goals

Best Mutual Funds for Financial Goals

Fund Selection Methodology used to find 5 funds

Best Mutual Funds for Short Term Goals- Up to 1 Year

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Sub Cat. Indiabulls Liquid Fund Growth ₹2,624.69

↑ 0.38 ₹169 1.5 2.9 6.3 6.9 6.6 6.62% 1M 1M Liquid Fund JM Liquid Fund Growth ₹74.0081

↑ 0.01 ₹2,703 1.4 2.9 6.2 6.8 6.4 6.44% 1M 2D 1M 4D Liquid Fund PGIM India Insta Cash Fund Growth ₹353.267

↑ 0.06 ₹546 1.4 2.9 6.3 6.9 6.5 6.43% 26D 29D Liquid Fund Aditya Birla Sun Life Savings Fund Growth ₹571.377

↑ 0.25 ₹22,857 1.3 3 7.2 7.4 7.4 6.81% 5M 19D 6M 11D Ultrashort Bond Invesco India Liquid Fund Growth ₹3,730.05

↑ 0.60 ₹15,884 1.4 2.9 6.3 6.9 6.5 6.44% 1M 1D 1M 1D Liquid Fund Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 3 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Indiabulls Liquid Fund JM Liquid Fund PGIM India Insta Cash Fund Aditya Birla Sun Life Savings Fund Invesco India Liquid Fund Point 1 Bottom quartile AUM (₹169 Cr). Lower mid AUM (₹2,703 Cr). Bottom quartile AUM (₹546 Cr). Highest AUM (₹22,857 Cr). Upper mid AUM (₹15,884 Cr). Point 2 Established history (14+ yrs). Oldest track record among peers (28 yrs). Established history (18+ yrs). Established history (22+ yrs). Established history (19+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 5★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Low. Risk profile: Low. Risk profile: Low. Risk profile: Moderately Low. Risk profile: Low. Point 5 1Y return: 6.34% (upper mid). 1Y return: 6.20% (bottom quartile). 1Y return: 6.31% (lower mid). 1Y return: 7.17% (top quartile). 1Y return: 6.31% (bottom quartile). Point 6 1M return: 0.48% (upper mid). 1M return: 0.47% (lower mid). 1M return: 0.46% (bottom quartile). 1M return: 0.60% (top quartile). 1M return: 0.46% (bottom quartile). Point 7 Sharpe: 2.72 (lower mid). Sharpe: 2.30 (bottom quartile). Sharpe: 2.89 (upper mid). Sharpe: 2.17 (bottom quartile). Sharpe: 3.09 (top quartile). Point 8 Information ratio: -0.70 (bottom quartile). Information ratio: -1.73 (bottom quartile). Information ratio: -0.09 (lower mid). Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Point 9 Yield to maturity (debt): 6.62% (upper mid). Yield to maturity (debt): 6.44% (lower mid). Yield to maturity (debt): 6.43% (bottom quartile). Yield to maturity (debt): 6.81% (top quartile). Yield to maturity (debt): 6.44% (bottom quartile). Point 10 Modified duration: 0.08 yrs (upper mid). Modified duration: 0.09 yrs (bottom quartile). Modified duration: 0.07 yrs (top quartile). Modified duration: 0.47 yrs (bottom quartile). Modified duration: 0.08 yrs (lower mid). Indiabulls Liquid Fund

JM Liquid Fund

PGIM India Insta Cash Fund

Aditya Birla Sun Life Savings Fund

Invesco India Liquid Fund

Best Mutual Funds for Mid Term Goals- For 3-5 years horizon

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Sub Cat. Edelweiss Arbitrage Fund Growth ₹20.1334

↑ 0.01 ₹15,619 1.5 2.9 6.2 7 6.3 6.67% 4M 24D 5M 1D Arbitrage ICICI Prudential MIP 25 Growth ₹77.3702

↓ -0.23 ₹3,334 -0.7 1.6 8.6 10.2 7.9 8.06% 2Y 8M 5D 5Y 3M 25D Hybrid Debt Kotak Equity Arbitrage Fund Growth ₹38.9599

↑ 0.03 ₹71,931 1.6 3 6.4 7.2 6.4 6.67% 3M 29D 4M 10D Arbitrage Aditya Birla Sun Life Equity Hybrid 95 Fund Growth ₹1,516.13

↓ -15.30 ₹7,334 -3.5 0.4 12.6 14.1 7.2 7.42% 4Y 3M 22D 6Y 5M 5D Hybrid Equity Nippon India Arbitrage Fund Growth ₹27.5769

↑ 0.02 ₹16,390 1.6 3 6.2 6.9 6.2 0% Arbitrage Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 2 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Edelweiss Arbitrage Fund ICICI Prudential MIP 25 Kotak Equity Arbitrage Fund Aditya Birla Sun Life Equity Hybrid 95 Fund Nippon India Arbitrage Fund Point 1 Lower mid AUM (₹15,619 Cr). Bottom quartile AUM (₹3,334 Cr). Highest AUM (₹71,931 Cr). Bottom quartile AUM (₹7,334 Cr). Upper mid AUM (₹16,390 Cr). Point 2 Established history (11+ yrs). Established history (21+ yrs). Established history (20+ yrs). Oldest track record among peers (31 yrs). Established history (15+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 4★ (bottom quartile). Rating: 5★ (lower mid). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderately Low. Risk profile: Moderately High. Risk profile: Moderately Low. Risk profile: Moderately High. Risk profile: Moderately Low. Point 5 5Y return: 5.98% (bottom quartile). 5Y return: 8.63% (upper mid). 5Y return: 6.14% (lower mid). 5Y return: 10.57% (top quartile). 5Y return: 5.86% (bottom quartile). Point 6 3Y return: 7.02% (bottom quartile). 3Y return: 10.16% (upper mid). 3Y return: 7.19% (lower mid). 3Y return: 14.05% (top quartile). 3Y return: 6.90% (bottom quartile). Point 7 1Y return: 6.23% (bottom quartile). 1Y return: 8.61% (upper mid). 1Y return: 6.37% (lower mid). 1Y return: 12.63% (top quartile). 1Y return: 6.19% (bottom quartile). Point 8 1M return: 0.47% (upper mid). 1M return: -0.04% (bottom quartile). 1M return: 0.49% (top quartile). 1M return: -0.62% (bottom quartile). 1M return: 0.47% (lower mid). Point 9 Alpha: -0.54 (bottom quartile). Alpha: 0.00 (top quartile). Alpha: 0.00 (upper mid). Alpha: -0.23 (bottom quartile). Alpha: 0.00 (lower mid). Point 10 Sharpe: 0.72 (upper mid). Sharpe: 0.50 (bottom quartile). Sharpe: 1.01 (top quartile). Sharpe: 0.21 (bottom quartile). Sharpe: 0.58 (lower mid). Edelweiss Arbitrage Fund

ICICI Prudential MIP 25

Kotak Equity Arbitrage Fund

Aditya Birla Sun Life Equity Hybrid 95 Fund

Nippon India Arbitrage Fund

Best Mutual Funds Long Term Goals- For 5 years & above

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Sub Cat. Tata India Tax Savings Fund Growth ₹45.2248

↓ -0.58 ₹4,566 -2.1 4.4 18.1 16.6 13.7 4.9 ELSS Bandhan Infrastructure Fund Growth ₹46.293

↓ -1.04 ₹1,428 -4.9 -6.3 13.5 23.3 20.2 -6.9 Sectoral DSP Natural Resources and New Energy Fund Growth ₹109.755

↓ -0.43 ₹1,765 14.9 23 40.4 24.7 20.7 17.5 Sectoral Sundaram Rural and Consumption Fund Growth ₹89.5719

↓ -1.32 ₹1,461 -10 -9.9 4 14.5 12.1 -0.1 Sectoral Aditya Birla Sun Life Banking And Financial Services Fund Growth ₹63.17

↓ -0.72 ₹3,641 -1.3 8.2 21.7 17.7 12.8 17.5 Sectoral Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 2 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Tata India Tax Savings Fund Bandhan Infrastructure Fund DSP Natural Resources and New Energy Fund Sundaram Rural and Consumption Fund Aditya Birla Sun Life Banking And Financial Services Fund Point 1 Highest AUM (₹4,566 Cr). Bottom quartile AUM (₹1,428 Cr). Lower mid AUM (₹1,765 Cr). Bottom quartile AUM (₹1,461 Cr). Upper mid AUM (₹3,641 Cr). Point 2 Established history (11+ yrs). Established history (15+ yrs). Established history (17+ yrs). Oldest track record among peers (19 yrs). Established history (12+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 5★ (bottom quartile). Rating: 5★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: High. Risk profile: High. Risk profile: Moderately High. Risk profile: High. Point 5 5Y return: 13.67% (lower mid). 5Y return: 20.21% (upper mid). 5Y return: 20.70% (top quartile). 5Y return: 12.08% (bottom quartile). 5Y return: 12.82% (bottom quartile). Point 6 3Y return: 16.59% (bottom quartile). 3Y return: 23.25% (upper mid). 3Y return: 24.73% (top quartile). 3Y return: 14.51% (bottom quartile). 3Y return: 17.65% (lower mid). Point 7 1Y return: 18.08% (lower mid). 1Y return: 13.55% (bottom quartile). 1Y return: 40.42% (top quartile). 1Y return: 4.04% (bottom quartile). 1Y return: 21.67% (upper mid). Point 8 Alpha: -0.76 (bottom quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: -7.86 (bottom quartile). Alpha: 0.61 (top quartile). Point 9 Sharpe: 0.14 (lower mid). Sharpe: -0.27 (bottom quartile). Sharpe: 1.32 (top quartile). Sharpe: -0.56 (bottom quartile). Sharpe: 1.03 (upper mid). Point 10 Information ratio: -0.35 (bottom quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: -0.54 (bottom quartile). Information ratio: 0.25 (top quartile). Tata India Tax Savings Fund

Bandhan Infrastructure Fund

DSP Natural Resources and New Energy Fund

Sundaram Rural and Consumption Fund

Aditya Birla Sun Life Banking And Financial Services Fund

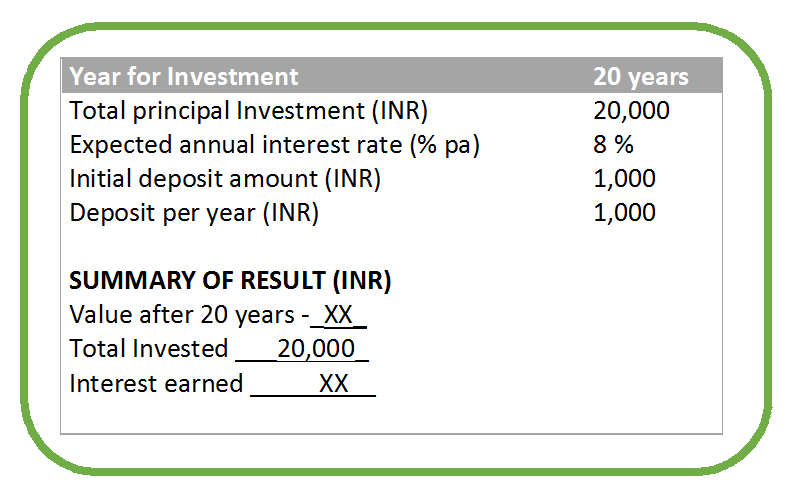

Saving Calculator: Use to Save Money

Two very important thing saving calculator does is-

- It helps you to reach your goals within a defined time

- It assists you to evaluate that how much money you need to save over a specified period

So, this is how the saving calculator works-

Conclusion

You might have always imagined yourself being financially independent or owning a house/car, or traveling to the best places or giving a good lifestyle to your family and so on… But, to fulfill all these desires the most important thing is to save money’. The more you save, the better life you can live thereof. However, many people tend to fail in this exercise due to procrastination. So, stop procrastinating and start saving now!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.