5 Smart Tips for Investing on a Small Budget

There’s a common perception that investments require a huge amount of money to start off. However, the reality is that investments can be started off with a few thousand or even hundreds.

But, first things first, commit yourself to research before you can start Investing in private or public funds.

Small Investment Ideas Right from Scratch

1. Research Investment Options

Before you can begin investing, look into the various options that are available in the market today. These options could paint a clear picture of what and where to invest. Understand why you want to invest in any option that appeals to you. Make a conscious choice before investing any amount anywhere.

2. Invest in Mutual Funds

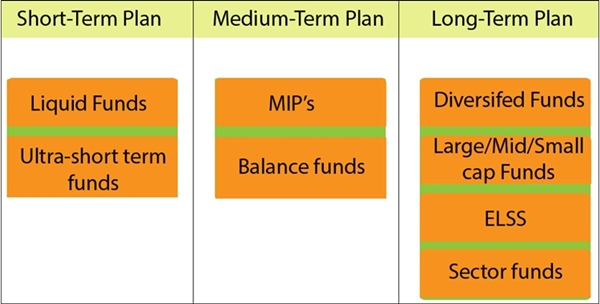

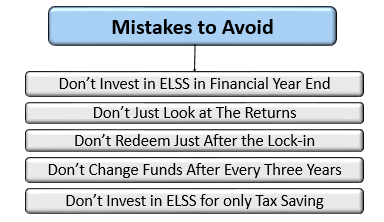

Mutual Funds is becoming people’s choice when it comes to investment. However, it’s crucial to understand the benefits of investing in Mutual Funds before making a decision. One of the reasons investors like investing in mutual funds is the advantage of Portfolio Management. Investors pay a small amount as part of the expense ratio which is used to assign a professional to aid the investor’s financial journey with Bonds, stocks, etc.

Investors are given an option to reinvest their dividend for higher returns. Mutual funds diversification is another major advantage that leads to reduced portfolio risk. You can make a minimum investment in mutual funds. However, returns depend on the fluctuations in the market.

Systematic Investment plan (SIP) is one of the best options in mutual funds if you are looking to make monthly investments. It offers an opportunity to earn high returns in the long-term. One of the advantages of investing in SIPs is the minimum investment amount, that is as low as Rs. 500. You can make regular investments on a weekly, monthly or quarterly basis. It is based on the Principle of compounding, which means regular investments for a long time will yield higher returns in comparison to lump-sum investment. Compounding births snowball effect, which means that little investment accumulates to yield bigger results year after year.

While SIPs promise higher returns, it also makes you disciplined with money. You can become a responsible financial planner and a smart investor. SIP also act as Emergency Funds to help you in your time of crisis. You don’t have a lock-in period in SIP which makes it an extremely convenient option.

Talk to our investment specialist

Fund Selection Methodology used to find 5 funds

Best SIP Funds to Invest in 2026

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP World Gold Fund Growth ₹62.6234

↑ 2.23 ₹1,975 500 39.2 84.2 156.2 58.2 29.3 167.1 SBI PSU Fund Growth ₹36.2959

↓ -0.41 ₹5,980 500 6.6 15.7 30.7 33.8 27.7 11.3 ICICI Prudential Infrastructure Fund Growth ₹196.22

↓ -2.38 ₹8,077 100 -1 0.7 15.8 24.9 26.5 6.7 Invesco India PSU Equity Fund Growth ₹67.82

↓ -1.04 ₹1,492 500 1.8 9.3 29.3 31.5 25.8 10.3 DSP India T.I.G.E.R Fund Growth ₹322.81

↓ -3.55 ₹5,184 500 1.1 2.9 20.2 25.5 24.4 -2.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP World Gold Fund SBI PSU Fund ICICI Prudential Infrastructure Fund Invesco India PSU Equity Fund DSP India T.I.G.E.R Fund Point 1 Bottom quartile AUM (₹1,975 Cr). Upper mid AUM (₹5,980 Cr). Highest AUM (₹8,077 Cr). Bottom quartile AUM (₹1,492 Cr). Lower mid AUM (₹5,184 Cr). Point 2 Established history (18+ yrs). Established history (15+ yrs). Established history (20+ yrs). Established history (16+ yrs). Oldest track record among peers (21 yrs). Point 3 Rating: 3★ (upper mid). Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Rating: 3★ (bottom quartile). Top rated. Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 29.25% (top quartile). 5Y return: 27.74% (upper mid). 5Y return: 26.53% (lower mid). 5Y return: 25.82% (bottom quartile). 5Y return: 24.38% (bottom quartile). Point 6 3Y return: 58.17% (top quartile). 3Y return: 33.84% (upper mid). 3Y return: 24.88% (bottom quartile). 3Y return: 31.51% (lower mid). 3Y return: 25.45% (bottom quartile). Point 7 1Y return: 156.17% (top quartile). 1Y return: 30.67% (upper mid). 1Y return: 15.80% (bottom quartile). 1Y return: 29.25% (lower mid). 1Y return: 20.23% (bottom quartile). Point 8 Alpha: 2.12 (top quartile). Alpha: 0.05 (upper mid). Alpha: 0.00 (lower mid). Alpha: -2.70 (bottom quartile). Alpha: 0.00 (bottom quartile). Point 9 Sharpe: 3.41 (top quartile). Sharpe: 0.63 (upper mid). Sharpe: 0.15 (bottom quartile). Sharpe: 0.53 (lower mid). Sharpe: 0.08 (bottom quartile). Point 10 Information ratio: -0.47 (lower mid). Information ratio: -0.63 (bottom quartile). Information ratio: 0.00 (top quartile). Information ratio: -0.50 (bottom quartile). Information ratio: 0.00 (upper mid). DSP World Gold Fund

SBI PSU Fund

ICICI Prudential Infrastructure Fund

Invesco India PSU Equity Fund

DSP India T.I.G.E.R Fund

200 Crore in Equity Category of mutual funds ordered based on 5 year CAGR returns.

3. Invest in Government Funds

The Indian government has various schemes available for investors who wish to invest and help their wealth grow.

National Pension Scheme (NPS)

It is a retirement saving scheme is extremely popular in the country. The scheme is open to every citizen in India. An investor can allocate funds in equity, corporate bond and government securities.

Public Provident Fund (PPF)

PPF another important scheme offered by the government. It is one of the oldest retirement schemes and the amount invested in the scheme is exempted from tax. It is a safe investment option and a good option for those who have just started working.

National Savings Certificate (NSC)

It is another major option by the government of India and is a fixed income investment scheme. An investor can avail it at the local Post Office. It focuses on the small to mid-income investors. It offers tax deduction and 8% interest p.a. You can start an investment with Rs. 100.

4. Invest in Gold

Possessing gold is one of the best ways for investment. However, possessing gold can bring its own concern regarding safety and high cost. However, amid the global coronavirus pandemic, gold rates have fallen. You can purchase gold coins and can even own gold on paper by gold ETFs. This happens on a stock exchange (NSE or BSE). Another option to own paper-gold is by investing Sovereign Gold Bonds.

Conclusion

Smart investments require focus and dedication. If you have detailed knowledge about the investment you can grow your wealth and fulfil your dreams and desires.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.