Smart Investment Tips: Investing for Beginners Made Easy

Nowadays, as the value of money is increasing, people are seen finding secret mantras of smart investment tips. Are you one of those? But as a matter of fact, Investing smartly is no rocket science and there are no secret mantras for it. You just need to ask yourself a few questions. What are the best ways to invest money? Where to invest money? Why do you want to invest money? Because you need a financial security? And what is the most appropriate way to attain that financial security? It is to save money and make a smart investment for a long period of time so that you have a financial stability in future. So, how to start investing money?

Smart Investment Tips: Know the Best Way to Invest Money

There is a very thin line between investment and smart investment. Therefore, make sure you do it right by choosing a right Investment plan. Below are a few smart investment tips or share market tips mentioned that will help you choose a better investment option for you.

1. Understand Best Money Investments Before Investing

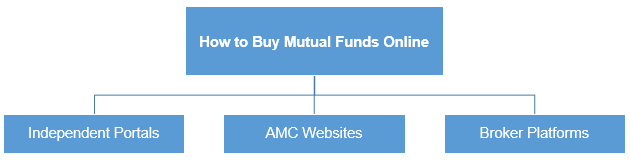

One of the first smart investment tips to follow before you start investing is understanding your investments. One should never invest in instruments we don’t know. So, be it Mutual Funds, gold bonds, Stocks or Fixed Deposits, understand them inside out and then invest. Let’s say, if you are thinking to make a Mutual Fund investment, you must know, what is Mutual Fund, NAV, fund performance, entry and exit load, how are they related, how are Mutual Fund returns affected by taxation and why you should invest in Mutual Funds.

2. Keep Calm & Know Money Investment Options

Once you have invested, patiently wait for your money to grow. For any investment, it takes some time to produce healthy outputs. You will be surprised to know that most of the smart investment vehicles produce substantial returns when invested for a longer duration. So, wait for the markets to rise and see how your money grows.

3. Include Tax Saving Investments

Another important thing to consider before making a smart investment is to include Tax Saving Investment options in your Portfolio. Whether you fall under the tax bracket or not, it is advised to include tax saver since your early earning days. Some of the tax saving investments include-

a. National Pension Plan (NPS)

NPS is open to all but, but is mandatory for all government employees. An investor can deposit a minimum of INR 500 per month or INR 6000 yearly in an NPS plan. It is a good plan for Retirement planning as well because there is no direct tax exemption during the time of withdrawal as the amount is tax-free as per Tax Act, 1961.

b. Public Provident Fund (PPF)

PPF is one of the most popular long term investment instruments in India. Since it's backed by the Government of India, it is a safe investment with an attractive interest rate. Moreover, it offers tax benefits under Section 80C of the income tax Act, and also the interest income is exempted from tax.

c. Equity Linked Savings Schemes (ELSS)

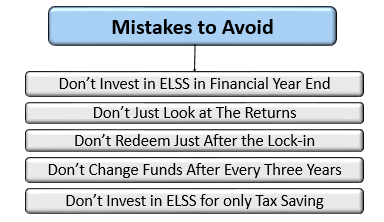

A type of tax saving investment, equity linked savings schemes are an equity diversified fund in which the major part of the fund corpus is invested either in equities or equity-related instruments. Equity linked Savings Schemes (ELSS) principally invest in the equity market by purchasing equity stocks of companies that are listed on the stock exchanges.

Talk to our investment specialist

Fund Selection Methodology used to find 5 funds

Best ELSS Tax Saving Schemes 2026

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Tata India Tax Savings Fund Growth ₹45.8014

↓ -0.43 ₹4,566 -1.3 5.6 17.6 17.1 14.5 4.9 Bandhan Tax Advantage (ELSS) Fund Growth ₹154.123

↓ -1.97 ₹7,060 -2.8 2.6 13.2 16.2 15.7 8 Aditya Birla Sun Life Tax Relief '96 Growth ₹60.91

↓ -0.76 ₹14,993 -3.2 0.6 16.4 16.2 9.7 9.3 DSP Tax Saver Fund Growth ₹142.856

↓ -1.53 ₹17,223 -1.3 4.9 15.6 20.9 17.2 7.5 HDFC Long Term Advantage Fund Growth ₹595.168

↑ 0.28 ₹1,318 1.2 15.4 35.5 20.6 17.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 27 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Tata India Tax Savings Fund Bandhan Tax Advantage (ELSS) Fund Aditya Birla Sun Life Tax Relief '96 DSP Tax Saver Fund HDFC Long Term Advantage Fund Point 1 Bottom quartile AUM (₹4,566 Cr). Lower mid AUM (₹7,060 Cr). Upper mid AUM (₹14,993 Cr). Highest AUM (₹17,223 Cr). Bottom quartile AUM (₹1,318 Cr). Point 2 Established history (11+ yrs). Established history (17+ yrs). Established history (18+ yrs). Established history (19+ yrs). Oldest track record among peers (25 yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Rating: 3★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 14.45% (bottom quartile). 5Y return: 15.72% (lower mid). 5Y return: 9.69% (bottom quartile). 5Y return: 17.18% (upper mid). 5Y return: 17.39% (top quartile). Point 6 3Y return: 17.14% (lower mid). 3Y return: 16.21% (bottom quartile). 3Y return: 16.15% (bottom quartile). 3Y return: 20.86% (top quartile). 3Y return: 20.64% (upper mid). Point 7 1Y return: 17.64% (upper mid). 1Y return: 13.18% (bottom quartile). 1Y return: 16.35% (lower mid). 1Y return: 15.58% (bottom quartile). 1Y return: 35.51% (top quartile). Point 8 Alpha: -0.76 (bottom quartile). Alpha: 0.34 (bottom quartile). Alpha: 3.77 (top quartile). Alpha: 1.75 (upper mid). Alpha: 1.75 (lower mid). Point 9 Sharpe: 0.14 (bottom quartile). Sharpe: 0.21 (bottom quartile). Sharpe: 0.50 (upper mid). Sharpe: 0.33 (lower mid). Sharpe: 2.27 (top quartile). Point 10 Information ratio: -0.35 (bottom quartile). Information ratio: -0.30 (lower mid). Information ratio: -0.43 (bottom quartile). Information ratio: 0.93 (top quartile). Information ratio: -0.15 (upper mid). Tata India Tax Savings Fund

Bandhan Tax Advantage (ELSS) Fund

Aditya Birla Sun Life Tax Relief '96

DSP Tax Saver Fund

HDFC Long Term Advantage Fund

ELSS funds will not only help you save tax in the long run, but will provide significant returns as well.

4. Add Equities

Equity Mutual Funds are another add on to your investment list. The Sensex graph from the past gives a clear picture of why investing in equities is beneficial. Equity markets are seen to provide highly efficient results when invested for a long duration. Further, to make your investment a smart investment, it is advised to invest in equity through a SIP route. This makes sure that the cost of your units is averaged out and the returns are good as well even during volatile financial markets.

Best Equity Mutual Funds to Invest

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Franklin Asian Equity Fund Growth ₹40.288

↑ 0.27 ₹372 16.5 26.1 41.2 16.8 4.1 23.7 DSP Natural Resources and New Energy Fund Growth ₹110.438

↑ 0.34 ₹1,765 15.2 25.4 38.8 25.1 21.5 17.5 DSP US Flexible Equity Fund Growth ₹78.698

↓ -0.52 ₹1,119 5.4 16.9 34.3 23.6 17.2 33.8 Franklin Build India Fund Growth ₹148.681

↓ -1.28 ₹3,003 2.1 6.6 24.2 28.6 24 3.7 Aditya Birla Sun Life Banking And Financial Services Fund Growth ₹63.89

↓ -1.06 ₹3,641 -1.2 8 22.1 18.2 13.4 17.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 26 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Franklin Asian Equity Fund DSP Natural Resources and New Energy Fund DSP US Flexible Equity Fund Franklin Build India Fund Aditya Birla Sun Life Banking And Financial Services Fund Point 1 Bottom quartile AUM (₹372 Cr). Lower mid AUM (₹1,765 Cr). Bottom quartile AUM (₹1,119 Cr). Upper mid AUM (₹3,003 Cr). Highest AUM (₹3,641 Cr). Point 2 Oldest track record among peers (18 yrs). Established history (17+ yrs). Established history (13+ yrs). Established history (16+ yrs). Established history (12+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 5★ (bottom quartile). Rating: 5★ (bottom quartile). Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 4.12% (bottom quartile). 5Y return: 21.46% (upper mid). 5Y return: 17.18% (lower mid). 5Y return: 24.04% (top quartile). 5Y return: 13.43% (bottom quartile). Point 6 3Y return: 16.78% (bottom quartile). 3Y return: 25.07% (upper mid). 3Y return: 23.63% (lower mid). 3Y return: 28.56% (top quartile). 3Y return: 18.25% (bottom quartile). Point 7 1Y return: 41.22% (top quartile). 1Y return: 38.81% (upper mid). 1Y return: 34.28% (lower mid). 1Y return: 24.24% (bottom quartile). 1Y return: 22.11% (bottom quartile). Point 8 Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Alpha: 2.18 (top quartile). Alpha: 0.00 (bottom quartile). Alpha: 0.61 (upper mid). Point 9 Sharpe: 2.24 (top quartile). Sharpe: 1.32 (upper mid). Sharpe: 1.15 (lower mid). Sharpe: 0.21 (bottom quartile). Sharpe: 1.03 (bottom quartile). Point 10 Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: -0.16 (bottom quartile). Information ratio: 0.00 (bottom quartile). Information ratio: 0.25 (top quartile). Franklin Asian Equity Fund

DSP Natural Resources and New Energy Fund

DSP US Flexible Equity Fund

Franklin Build India Fund

Aditya Birla Sun Life Banking And Financial Services Fund

5. Create your own Investment Plan

Lastly, invest according to your needs and desires. Everyone has a different aim to invest money. Just because everyone you know is investing in Fixed Deposits (FDs) does not mean you will also invest in an FD. If you have a better risk appetite, you might invest in Mutual Funds or stock markets instead. So, analyse your needs first and then make a smart investment accordingly.

Conclusion

Now, consider these smart investment tips and before making any investing decisions. Remember, a smart investor always evaluates the pros and cons of a money investment and invests later. So, if you also want to make a smart investment, think before you act. Think smart, invest smart!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.