Easy Financial Planning for Beginners

financial planning is the need of the hour, especially when you are starting out as an independent individual. The feeling of independence is surreal and might take the best of you when you throw a party. After the mid-month, you’re barely left with any money to survive for the rest of the month.

Why did this happen? Well, you might have exceeded your spending ability. So how do you deal with this?

Financial planning is the best way. It will not only help to balance your spendings, but ensure enough money during an emergency.

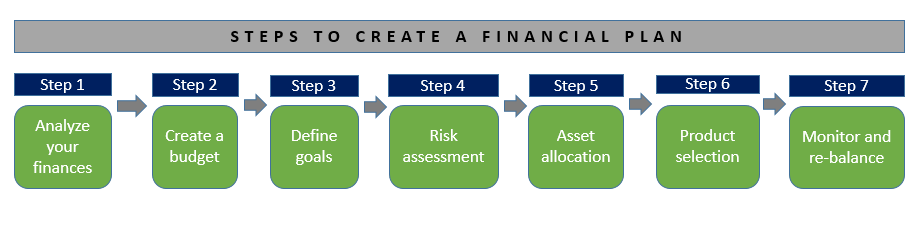

Smart Ways to Make a Financial Plan

1. Understand your Expenses

It is important to understand your income before you spend. Keeping a track of your expenses will help you get a better understanding of your spending capacity. For instance, if your income is Rs. 20,000 a month and your expenses are Rs. 22,000 a month, you are falling into the debt circle. To avoid this, it’s important to identify the extra 2K you’re spending and cut-short on that.

You can then decide what is important and not so important. This will help you plan your finances better and will also help you save money.

2. Set a Budget

Setting a budget is the most important step in creating a great Financial plan. This allows you to understand your income and your expenses. It will help you make smarter spending decisions and better cost control.

Let’s hear from - John. C. Maxwell who says- "Everyone wants to be thin, but nobody wants to diet. Everyone wants to live long, but few will exercise. Everybody wants money, yet seldom will anyone budget or control their spending."

Setting a budget will help you set goals and fund those goals accordingly.

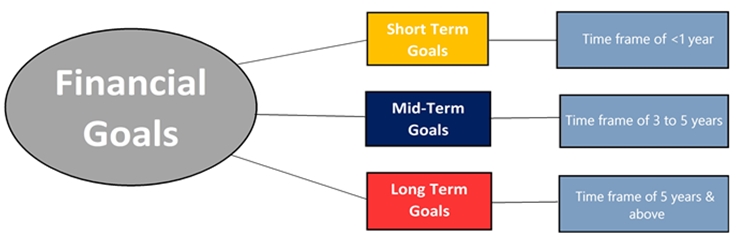

3. Set Personal Goals

Setting a goal will help you understand where you want to reach in the given period. It will encourage you to make the best use of the resources and the finances available with you.

Your personal goals could be anything from buying a bike, travelling, to buying a house.

So first things first, understand and identify your goals before you can start with financial planning. The best way is to segment your goals into short-term, medium-term and long-term. Buying a bike within a year could be a short-term goal, while buying a house is a long-term goal.

Suze Orman, rightly once said, “Every financial worry you want to banish and financial dream you want to achieve comes from taking tiny steps today that put you on a path toward your goals.”

Setting goals based on the estimated time required will help you plan your income better.

Talk to our investment specialist

4. Save money

Saving money involves saving a penny! It could be giving up buying a can of soda to save that Rs. 20. It’s important to keep a track of how much you spend so that you can create a plan to save. There’s a well-known trending concept called the ‘avocado toast’, which simply shows how saving on small things will help you buy a house.

This is not the first time that such a trendy food invoked the importance of financial strategy. Millennial spending habits on expensive coffee and many other things grabbed the attention of financial planners.

You could save tons of money if you adopt the right financial planning. One of the many ways you can start saving is by creating a budget. This will push you to save that designated amount every month.

As John Poole says- "You must learn to save first and spend afterwards."

Likewise, it’s not only important to save money but also help it grow. Since you are starting off with a career you can start Investing. Investing helps you gain more in a fixed period of time. To start off, you can opt for low-risk options.

Here are four of the low-risk options you can opt for:

a. Fixed Deposits (FD)

This is considered one of the popular and safest options to save money in India. You have to save a lump sum of money at once. They offer a higher rate of interest than your regular Savings Account.

b. Public Provident Fund (PPF)

This is another safe investment option since it is a government investment scheme. It has a 15-year lock-in period. It’s a popular scheme in the country because the government guarantees your investment in the scheme.

What’s more? You can open an account with them for just Rs. 100 and can invest money through cash, cheque, DD or even online transfer. You need to invest at least Rs.500 every year.

c. National Pension Scheme (NPS)

This scheme is a combination of various investment options like Fixed Deposits, Liquid Funds and Corporate Bonds. This was started to encourage people to save for post-retirement life. An individual can invest a particular amount every month during their working years. This is also backed by the government which makes it a safer option to invest in.

Fund Selection Methodology used to find 5 funds

D. National Savings Certificate (NSC)

This is another safe investment option backed by the government. This is mainly for small to mid-income investors. It’s a savings bond that encourages investors to invest while helping them save on tax. You can start investing with amounts like Rs.100 and increase as and when feasible.

Tip- If you want to earn higher returns by taking a little risk, than Equity Mutual Funds are one of the best options to go for. You can opt for a Systematic Investment plan (SIP) mode, where you can start investing as low as Rs. 500 every month for a defined period. SIP gives you the major benefit of rupee cost averaging and the Power of Compounding. This helps in the long-term growth of your investment.

Here are some of the Best performing SIP plans to invest-

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Franklin Asian Equity Fund Growth ₹38.996

↑ 0.18 ₹315 500 12.5 21.8 36.6 13.7 2.1 23.7 DSP Natural Resources and New Energy Fund Growth ₹107.348

↑ 1.00 ₹1,573 500 10 22.3 35.8 22.9 21.5 17.5 DSP US Flexible Equity Fund Growth ₹76.8065

↓ -1.83 ₹1,068 500 3.4 13 26 21.2 16.3 33.8 Aditya Birla Sun Life Banking And Financial Services Fund Growth ₹65.04

↑ 0.07 ₹3,694 1,000 0.6 8.7 24.5 17.8 12.6 17.5 Franklin Build India Fund Growth ₹148.907

↑ 0.61 ₹3,036 500 1.7 6.5 23 27.8 23.7 3.7 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 16 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Franklin Asian Equity Fund DSP Natural Resources and New Energy Fund DSP US Flexible Equity Fund Aditya Birla Sun Life Banking And Financial Services Fund Franklin Build India Fund Point 1 Bottom quartile AUM (₹315 Cr). Lower mid AUM (₹1,573 Cr). Bottom quartile AUM (₹1,068 Cr). Highest AUM (₹3,694 Cr). Upper mid AUM (₹3,036 Cr). Point 2 Oldest track record among peers (18 yrs). Established history (17+ yrs). Established history (13+ yrs). Established history (12+ yrs). Established history (16+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 5★ (bottom quartile). Rating: 5★ (bottom quartile). Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 2.06% (bottom quartile). 5Y return: 21.51% (upper mid). 5Y return: 16.34% (lower mid). 5Y return: 12.59% (bottom quartile). 5Y return: 23.70% (top quartile). Point 6 3Y return: 13.69% (bottom quartile). 3Y return: 22.95% (upper mid). 3Y return: 21.20% (lower mid). 3Y return: 17.81% (bottom quartile). 3Y return: 27.85% (top quartile). Point 7 1Y return: 36.56% (top quartile). 1Y return: 35.79% (upper mid). 1Y return: 26.03% (lower mid). 1Y return: 24.50% (bottom quartile). 1Y return: 22.96% (bottom quartile). Point 8 Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 2.48 (top quartile). Alpha: -1.32 (bottom quartile). Alpha: 0.00 (bottom quartile). Point 9 Sharpe: 1.54 (top quartile). Sharpe: 0.74 (bottom quartile). Sharpe: 1.20 (upper mid). Sharpe: 0.84 (lower mid). Sharpe: -0.05 (bottom quartile). Point 10 Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: -0.26 (bottom quartile). Information ratio: 0.25 (top quartile). Information ratio: 0.00 (bottom quartile). Franklin Asian Equity Fund

DSP Natural Resources and New Energy Fund

DSP US Flexible Equity Fund

Aditya Birla Sun Life Banking And Financial Services Fund

Franklin Build India Fund

5. Create an Emergency Fund

Setting a particular amount from your income aside for emergency purposes will be of great help when something unprecedented comes up. You can invest your money as an emergency fund, but you should be able to withdraw it during the period of emergency.

Here are 3 steps to create an emergency fund:

- Decide the amount. For instance, you decide you need Rs. 2 lakh as an emergency fund

- Create a separate Bank account to save money

- Decide the amount you want to invest every month and invest

Another great way to create an emergency fund is to invest in Liquid Mutual Funds. It is a better option than investing in savings bank accounts. Here are a few reasons why:

- Liquid Mutual Funds have no lock-in period

- There is no entry or exit load

- Instant redemption

- Higher interest than a bank savings account

- Low-risk

Here are some of the best performing liquid funds to invest-

Fund NAV Net Assets (Cr) 1 MO (%) 3 MO (%) 6 MO (%) 1 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Indiabulls Liquid Fund Growth ₹2,618.95

↑ 0.45 ₹165 0.5 1.5 2.9 6.4 6.6 6.02% 2M 2M 1D PGIM India Insta Cash Fund Growth ₹352.528

↑ 0.06 ₹505 0.5 1.5 2.9 6.4 6.5 5.96% 1M 11D 1M 13D JM Liquid Fund Growth ₹73.8503

↑ 0.01 ₹2,851 0.5 1.5 2.9 6.2 6.4 5.91% 1M 10D 1M 14D Axis Liquid Fund Growth ₹3,015.9

↑ 0.50 ₹35,653 0.5 1.5 3 6.4 6.6 6.06% 1M 28D 2M 2D Tata Liquid Fund Growth ₹4,265.1

↑ 0.72 ₹18,946 0.5 1.5 2.9 6.4 6.5 6.08% 1M 28D 1M 28D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 17 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Indiabulls Liquid Fund PGIM India Insta Cash Fund JM Liquid Fund Axis Liquid Fund Tata Liquid Fund Point 1 Bottom quartile AUM (₹165 Cr). Bottom quartile AUM (₹505 Cr). Lower mid AUM (₹2,851 Cr). Highest AUM (₹35,653 Cr). Upper mid AUM (₹18,946 Cr). Point 2 Established history (14+ yrs). Established history (18+ yrs). Oldest track record among peers (28 yrs). Established history (16+ yrs). Established history (21+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Low. Risk profile: Low. Risk profile: Low. Risk profile: Low. Risk profile: Low. Point 5 1Y return: 6.38% (upper mid). 1Y return: 6.36% (bottom quartile). 1Y return: 6.25% (bottom quartile). 1Y return: 6.39% (top quartile). 1Y return: 6.36% (lower mid). Point 6 1M return: 0.54% (upper mid). 1M return: 0.53% (lower mid). 1M return: 0.53% (bottom quartile). 1M return: 0.54% (top quartile). 1M return: 0.53% (bottom quartile). Point 7 Sharpe: 3.18 (lower mid). Sharpe: 3.16 (bottom quartile). Sharpe: 2.52 (bottom quartile). Sharpe: 3.47 (top quartile). Sharpe: 3.23 (upper mid). Point 8 Information ratio: -0.71 (bottom quartile). Information ratio: -0.10 (lower mid). Information ratio: -1.88 (bottom quartile). Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Point 9 Yield to maturity (debt): 6.02% (lower mid). Yield to maturity (debt): 5.96% (bottom quartile). Yield to maturity (debt): 5.91% (bottom quartile). Yield to maturity (debt): 6.06% (upper mid). Yield to maturity (debt): 6.08% (top quartile). Point 10 Modified duration: 0.17 yrs (bottom quartile). Modified duration: 0.11 yrs (upper mid). Modified duration: 0.11 yrs (top quartile). Modified duration: 0.16 yrs (lower mid). Modified duration: 0.16 yrs (bottom quartile). Indiabulls Liquid Fund

PGIM India Insta Cash Fund

JM Liquid Fund

Axis Liquid Fund

Tata Liquid Fund

6. Avoid Debts

Debts are one of the most common ways people end up in bankruptcy. They spend more than they earn and end up taking debts, loans or overusing credit cards. Unpaid debts can prove fatal to anyone’s financial standing. Therefore, avoid debts.

Here 5 are ways to avoid debts:

- Don’t spend more than you earn

- Avoid impulse spending

- Avoid using a credit card unless it is absolutely necessary

- Compare prices before making purchases

- Pay with cash whenever possible

Conclusion

Financial planning is the first step to increase wealth. Therefore, if you are in your 20’s starting out with our career, make sure you plan your finances well before jumping anywhere further.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.