Financial Planning for Women

Irrespective of the fact that we live in the 21st century and the world is demanding gender neutrality, financial inequality is still a rampant issue. Somewhere, a majority of people still think that finances and financial planning are the territories of men.

However, the fact that cannot be overlooked is that women can ace any aspect of life if guided well. Thus, with proper assistance in financial planning, women can easily get empowered enough to pay their bills, file taxes on their own, and control their finances. Having said that, in this post, let’s navigate through some of the prevalent and useful financial tips for women.

Why Financial Knowledge is Essential?

Well, why not?

Believe it or not, an array of famous female personalities has expressed concerns pertaining to salary discrimination toward their male colleagues. While the wage gap is a real problem, the focus should also be on the lack of financial planning knowledge and education. So, if you are still wondering, here are some reasons why financial knowledge is essential.

Women are getting way less than male colleagues

In the present era, equality is practiced and discussed in every part of life. However, as far as financial planning is concerned, women are way behind men. Even today, women in every other industry are paid less as compared to men across the world. However, this disparity is not something that you can fix overnight. Hence, it is nothing but practical for every woman to understand financial planning.

Married life and pregnancy can hinder career objectives

Irrespective of the debate around, it is evident that the life of a married woman is different than the life of an unmarried woman. There are thousands of responsibilities lingering over the head of a married woman. Moreover, the moment she becomes pregnant and delivers a child(ren), responsibilities double up manifold. Also, many companies and hiring managers think that post-marriage, the primary focus of a woman is on her family and the child. Thus, planning finances beforehand is extremely important.

Absence of financial literacy

This is sad but correct. Today, women are in every field, running businesses, managing houses, and saving lives. Yet, they cannot plan their finances well and leave it to either their fathers or husbands. To avoid this hindrance, having financial literacy is of utmost importance.

Talk to our investment specialist

Key Components of a Financial Plan

There are two major factors: ignorance and lack of financial awareness that have made women financially dependent. Here are five key components that should be regarded:

Analyse the cash flow

One of the essential parts of financial planning is evaluating the cash flow, also known as working Capital. You must subtract debt or liabilities from the income or current assets to get the cash flow. Ensure your expenditure is less than the income to achieve financial objectives.

Planning taxes

There are several ways to save yourself from paying higher amounts in taxes. The Indian government provides a variety of tax relaxations and reliefs. Ensure that you avail them to maximise savings.

Risk management

Our lives are filled with rainy days and sunshine. When working on financial planning, make sure you consider the rainy days as you never know when they start hovering over your head.

Insurance planning

When stuck in a problematic situation, you must have an emergency fund ready to deal with it. insurance policies can be of utmost help in this scenario. There are three primary insurance types, such as:

Term Insurance: In case you meet with an accident or die in one, term insurance can secure your and your family’s life. It is one of the sought-after and affordable insurance types.

health insurance: If you are sick or don’t have liquid cash to meet urgent health requirements, health insurance protects you considerably.

ULIP: This insurance type lets you earn while safeguarding the family. It provides a tax savings facility, equity income, and life cover.

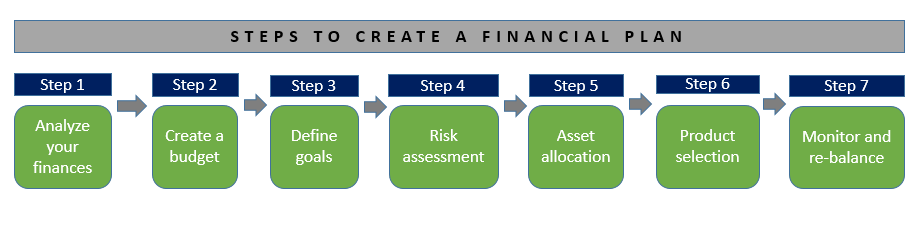

Crucial Steps to Financial Planning

Jotted down below are key steps in your financial planning journey:

Evaluating the Financial Situation

Financial planning objectifies accomplishing financial independence, which stems from financial literacy. Before you plan or do anything, go through your existing cash flow, expenses, liabilities, and assets thoroughly. Some of the key areas to check are:

Household expenditure: Do you have any contribution to household expenditure? If yes, how much is it? What is the amount you are left with each month after taking out this expense?

Lifestyle expenditure: Are you married or single? If married, do you have children? Based on your answer, figure out how much you are spending overall.

Tax situation: What is the amount that you are paying in taxes? How are you managing the overall tax situation?

Existing savings and expenses: Do you have any backup investments? Do you have debts? Figure these things out and note them somewhere to plan finances like a professional.

Financial obligations: Are you saving to purchase a car or a property? Do you have to plan a wedding? Do you have the backup of an emergency fund? How long until you retire? Make sure you include the answers to all these questions in your financial planning.

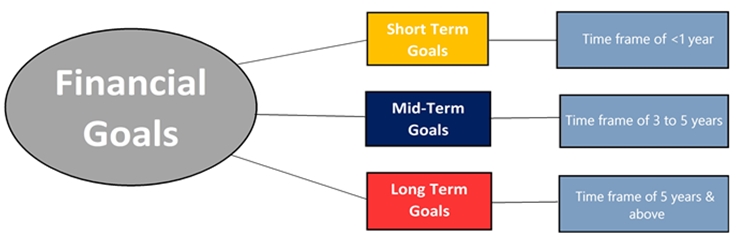

Set Financial Objectives

When planning the finances, set your financial objectives. Define the amount that you will be setting aside for these objectives. How much are you going to invest? How much you will spend each month?

When at it, make sure your financial objectives include the following:

- Getting married (if you are single)

- Retiring with a good amount in savings

- Family planning

- Adhering to tax rules

- Buying a property

- Good and proper education for children

- Buying the dream car

Regardless of the objectives, ensure they are achievable and quantifiable.

Create a Plan and Implement the Same

On the basis of your current financial objectives, cash flow, and liabilities, create a plan that covers investments and a strategy to clear the debt. Make sure that you consider your values and risk tolerance when creating this plan. Once done, now comes the time for implementation, which could be a bit tougher than creating a plan. Regardless of it, make sure you do everything at your own speed and don’t stop anywhere on the way to financial freedom.

Keep Track of the Plan and Review It

A lot of times, people either forget this crucial step or simply overlook it. However, consistent monitoring of your plan and making correct adjustments are crucial for making sure your financial plans are aligned with your objectives and needs. Make a habit of reviewing your plan, at least every six months or a year. If everything is going perfectly, you don’t have to touch it and continue implementing it. However, if over the course of time, your needs have changed, make slight changes to the plan and continue thereafter.

Ultimate Financial Tips for Women

Of course, you cannot become a financially stable woman just overnight when your finances are already over the roof. You will have to take baby steps toward your goals. Sensible and small should be your ultimate methodology to gain the utmost stability. Here are some tips that will help you further:

Create a budget

One of the most important tips that you must be hearing from several financial experts and pundits is to have a budget. After all, your entire planning will be worthless without a budget. On the basis of your annual or monthly income, plan the expense investment-leisure ratio. An accurate way of starting would be with 50-30-20. It means, taking your entire income and spending 50% on living expenditure, 30% on investments, and 20% on leisure.

Use special policies for women

The Indian government has launched a variety of special policies for women. From special rewards to fewer interest rates on loans, you can now avail advantage of an array of benefits. If you would like to get into entrepreneurship, the government has launched a Mudra Loan that is customised for women. Other schemes like Stree Shakti Scheme, Annapurna Scheme, Mahila Udyam Nidhi Scheme, Cent Kalyani Scheme, and more are available for women entrepreneurs as well. There are special premium rates on term Life Insurance and health insurance.

Create a savings account that cannot be touched

While you are Investing and spending money on the basis of your Financial plan, ensure that you have some money parked in a Savings Account. Each month, put a specific amount in this account and don’t touch this money unless there is an extreme situation.

Have a plan for your retirement

Now is the high time that you think of your future. If you don’t take charge today, you will have to depend on other people in your retirement days. So, if possible, start planning for your retirement from today itself. Every penny saved now will be nothing less than gold when you are old. You can invest in Mutual Funds, NPS, and PPF, and don’t withdraw that amount until you are 60 or above years of age. This will ensure you have crores of rupees at the time of retirement.

Cancel credit cards with high-interest

There are a few debts that are good for your financial life, such as a Home Loan as it provides tax relief. However, there are some such debts that are harmful to your financial health, such as credit cards. Generally, these cards charge up to 40% of interest if you have any amount pending on the bill. Falling behind on your credit card payments can affect your Credit Score badly and you may become ineligible for future loans as well. So, figure out if you have such a credit card that charges a bomb and cancel it right away.

Move away from traditional methods for savings

Conventional savings methods, like buying gold, recurring deposits (RD), and Fixed Deposits (FD), are good but they might not yield more than satisfactory returns. Thus, move away from traditional methods and invest your money in Mutual Funds via corporate FDs, SIPs, and Bonds. You can put your money in Sovereign Gold Bonds, gold bonds, and digital gold to get good returns.

Wrapping Up

The bottom line here is that women have to be self-sufficient. Whether you are a homemaker or a working woman, correct financial planning is a must when you are trying to become financially independent. Follow the aforementioned tips and begin your financial journey today.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.