Term Insurance: Everything You Need to Know

What is Term Insurance?

Term insurance is the basic form of insurance. It is the easiest type of Life Insurance policy to understand. There is always an uncertainty about what the future might hold for us and thus, we need to be prepared for all kinds of situations. Having a term life insurance insures you and your family from a financial breakdown if anything unexpected happens to you(insured). The Term plan does not build wealth but it provides the assurance and security of a lump sum amount should some unforeseen event happen. Thus, term insurance plans can be called as an expenditure instead of an investment. Unlike the Whole Life Insurance, term life insurance quotes are more economical and thus, are cheap life insurance plans.

Term insurance, as said above is the simplest form of life insurance. Almost all of the premiums that you pay are used to cover the expenses of the insurance. And this is the reason why term insurance plan holders are ineligible to participate in the profits earned by the life Insurance companies on investments. Moreover, there is no accumulation of money to build up any surrender value. A term insurance plan will not have a paid-up amount if you chose to discontinue the policy.

Types of Term Life Insurance Policy

There are different variations of term policy:

Level Premium Term Insurance

It is the type of term insurance where the premium is the same all through the selected term for a pre-fixed sum assured. So it eliminates the problem of paying premiums that rise every year. The general period of such term policy is from five years to 30 years.

Convertible Term Insurance

In this type of term policy, the insured buys a pure term insurance policy with a choice of converting it into to a plan of their likings such as whole life insurance or endowment. For instance, the insured can convert their term life policy after five years to an Endowment Plan for 20 years. The premiums are then charged as per the new set plan and term.

Term Insurance with Return of Premiums

This term insurance plan has both risk cover and savings element. If the insured person survives the policy term, then the premiums paid are returned to them. Naturally, the premiums charged are higher compared to other types of term insurance policies.

Term Insurance with Guaranteed Renewal

In this term life plan, the insurance policy is renewed for sure after the chosen term ends say five or ten years. The renewal is done without any proof of insurability like a medical examination.

Decreasing Term Insurance

In this life insurance policy, the sum assured gradually decreases per year to match depreciating insurance need. This type of policy is bought when the insured has a large outstanding loan. The risk here is that the insured may die before repaying the loan. Thus, the sum assured of the term policy is usually equal to the amount of loan that is to be repaid. Thus, in the case of a premature death, the sum assured amount will be able to repay the loan.

Term Insurance with Riders

It is a term policy with rider clauses like critical illness rider, accidental death rider, etc. These riders add extra value to the plain term insurance policy in terms of extra premium.

How does a Term Insurance Plan Work?

Term Insurance is the most traditional form of insurance. To understand how it functions, the following factors should be considered:

Affordable Premium

To buy a term insurance policy, there is no need to keep a large amount of money aside. Many insurance companies cover a large sum assured for very affordable premiums.

Premium Frequency

The premiums for the term policy can be paid either per month, per quarter, every six months or once in a year.

Life Cover with No Survival Benefits

There is no maturity benefit in term insurance policy. The main objective of a term plan is to provide life cover and in the case of death of the insured person, the beneficiary receives the promised sum assured.

How to Choose Best Term Insurance Plan?

There are certain guidelines to be followed while choosing the best term life insurance plan:

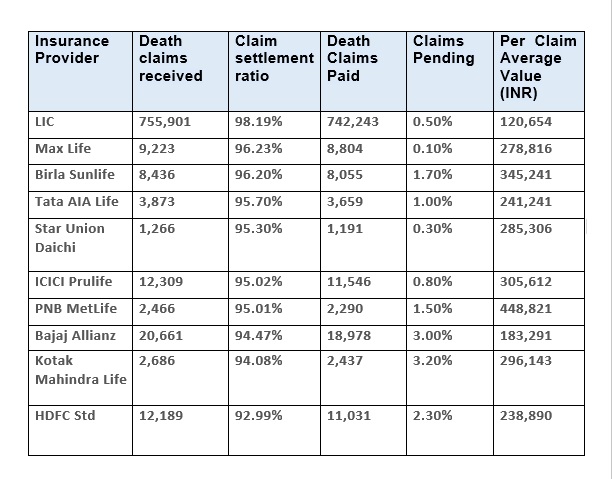

- Compare the Life Insurance companies and check the track record.

- Calculate the cover you need

- What is the claim settlement ratio of the Insurance company?

- Effect of inflation in paying the premium and cover benefits

- Compare and read carefully the various terms and conditions of different Life Insurance companies

- You may opt for two different term life policies from two different companies. This will save you in a case of rejection from one company.

- Look for riders/add-on covers

Benefits and Other Important Aspects of Term Life Insurance Policy

- There is a flexibility in paying the premium for a term insurance policy. Premiums can be limited pay, single pay or regular pay.

- The term insurance quotes are generally lower compared to other insurance plans. They offer large sum assured even for low premiums.

- There is a wide range of insurance plans to choose from. Policyholders can choose between single or joint term plans.

- On the sudden death of the insured, the beneficiary receives the death benefit from the term insurance policy. The beneficiary receives the sum assured as mentioned in the policy contract.

- There is a tax benefit in both paying the premium of the policy and claiming the death benefit of the insured.

Documents Required for Term Insurance

- PAN Card

- Proof of Age (Passport/Birth certificate/ PAN card/ etc.)

- Proof of Address (Passport/Ration Card/Voter ID/etc.)

- Identity Proof (Passport/Voter ID/aadhaar card/etc.)

- Proof of Income (Income Tax Return/Employer’s certificate/income tax assessment order)

- Recent passport sized photographs

Exceptions for Term Insurance Policy Claim

There are certain exceptions in term insurance claim wherein your claim will be rejected:

Suicide

If the insured commits suicide, then the claim for death benefit will not be accepted. And suicide is exempted from all types of term insurance policies.

Death Due to War, Terrorism

The death of insured under acts of war, terrorism or under natural calamities will not be eligible for death benefit claim.

Death Due to Self-imposed Risk

If the insured dies because of the consequences of their own actions (e.g. extreme sports), the claim will not be processed as the insured took a self-imposed risk.

Death Due to Intoxication/Narcotics

If the insured die because of being under the influence of narcotics or some other intoxications, the claim for the term policy will not be processed.

Talk to our investment specialist

Claim Process of a Term Insurance Policy

In the event of the demise of the insured, the family needs to file a claim to receive the death benefit or the sum assured. Following steps must be followed for the claim process:

- After the death of the insured, the insurance company must be notified of the event. Documents mentioned in the insurance contract must be kept ready for verification and submission.

- After informing the company, the claimant must submit the necessary documents like the original insurance contract, proof of claim, death certificate, etc.

- Then the documents are verified and then the insurance company will take a decision on whether the claim is legit or not and should be honoured according to the contract.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.