Effective Ways to Create a Financial Plan

A Financial plan helps you make wise and sensible decisions about your personal wealth management. A sound financial plan can help you get through all the good and bad times in your life.

financial planning is a dedicated approach that helps you to achieve your Financial goals. A financial plan is an all-inclusive evaluation of an investor’s present and future financial situation using various factors such as cash flows, Asset Allocation, expenses and budgeting, etc.

To make a thorough financial plan, either you need to do adequate research or you need to have a discussion with your financial advisor or consultant. The planner will help you determine your current net worth, tax obligations, and help you develop a roadmap for your retirement along with other financial goals depending on your profile.

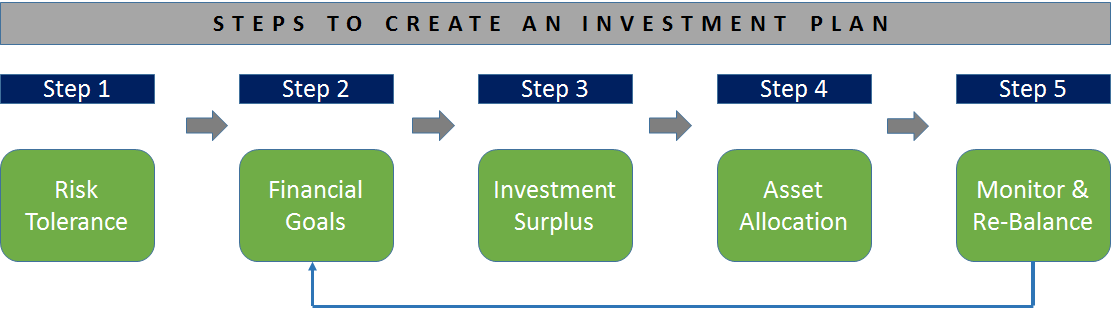

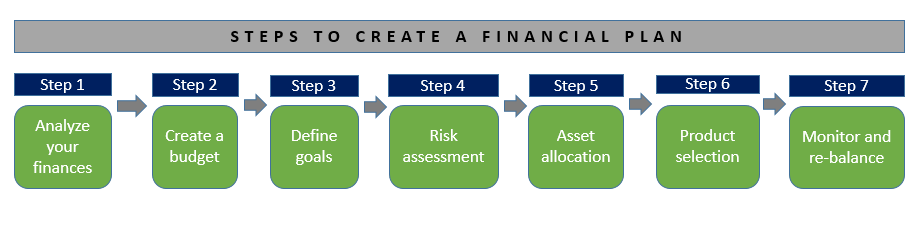

How to Create a Financial Plan?

A good financial plan differs from person to person according to their individual needs, goals and long-term plan. But the steps involved in a creating a sound personal financial plan are by and large similar for all. Let’s look at the steps involved in the creating a plan for yourself:

1. Find out your Current Financial Situation

You should be well aware of your current financial status and net worth before setting out to reach your goals. A discussion with your financial advisor will help you understand your net worth and put a spotlight on your priorities. For example, after the analysing your current financial situation, you discover that planning for the marriage is more important than planning for buying a car. You need to understand your cash flows, income levels, dependants, running loans, liabilities etc. This research will help you prioritise your goals and carve a plan accordingly.

2. Time Frame and Budgeting

For a financial plan to work, it is of utmost importance that a clear timeline is defined. The timeline gives you a direction to reach your set goals. Moreover, the deadlines keep you alert and motivated to reach your goals in time.

Along with this time frame, it is important to have a budget accompanying it. A budget gives you an idea about your expenses, spending, and savings that ultimately help you in reaching your goals.

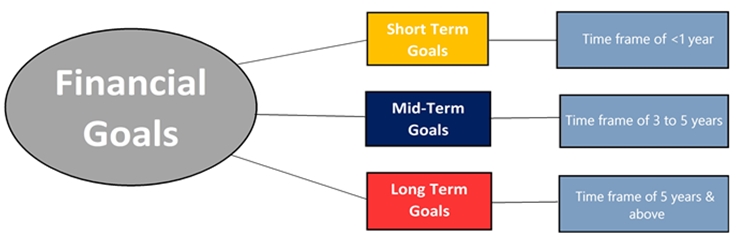

3. Set Goals- Short Term, Mid Term, and Long Term

You must have clear goals in life. The financial plan is the road that leads you to the targets that you have set. Your goals can be either short-term, mid-term or long-term.

Short-term goals are those goals that you set for the near future. These goals have specific time frames and an objective that you want to accomplish in say a year or two years’ time. There are a lot of short-term financial goals that can be set as per your wish list. For example, save for a family vacation, buy high-tech gadgets, etc.

Mid-term goals are those goals that you wish to achieve in the next three to four years. It may include important goals like saving up for marriage or higher education, buy a fancy car, paying off previous debts (if any), or to start a business, etc. As you march on to complete your short-term goals, you can start ideating your mid-term goals and also plan on how you can achieve them.

Long term goals are the ones that might take you considerably more time to achieve than the previous two types of financial goals. Planning for long-term goals such as your children's future, their education, your own retirement, etc. takes meticulous planning and organisation. You can start by setting up short-term and mid-term goals, deliver them on time and then build on it to achieve your long-term goals.

Talk to our investment specialist

4. Assess your Risk

Investing plays a big role in your long-term wealth management. It’s never too late to start investing. Any investment comes with a risk factor attached to it. Investing Early gives you the ability to take bigger risks and thus an opportunity to generate higher returns. But before investing, one should assess their own risk-taking ability or do their risk assessment to know their risk appetite. Risk profiling helps you understand how much risk can you take and then invest accordingly. Assessing risk involves many factors such as the ability to tolerate loss, intended holding period, knowledge of investments, current cash flows, dependants etc. Assessment of risk ensures that one stays within the zone defined by risk. This tries to ensure that in the long run, one does not see unexpected action or outcomes in the investment Portfolio.

When an investor undergoes risk profiling, they have to answer a set of questions designed specifically for the purpose. The answers to those questions are recorded and used to calculate their risk appetite. These set of questions differ for different Mutual Fund Houses or distributors. The score of an investor after answering the questions determines their ability to take a risk. An investor can be a high-risk taker, mid-risk taker or can be a low-risk taker.

5. Asset Allocation

You should decide the mix of your asset classes such as debt and equity depending upon the risk appetite that one has. The asset allocation can be aggressive (investing mainly in equity), moderate (more inclined toward debt funds) or it can be conservative (less inclined towards equity). You need to match your risk profile or risk taking capacity with the asset allocation you seek to have in your investment portfolio.

For example:

| Aggressive | Moderate | Conservative | |

|---|---|---|---|

| Annual return (p.a.) | 15.7% | 13.4% | 10.8% |

| Equity | 50% | 35% | 20% |

| Debt | 30% | 40% | 40% |

| Gold | 10% | 10% | 10% |

| Cash | 10% | 15% | 30% |

| Total | 100% | 100% | 100% |

6. Product Selection

You have now created a budget, set clear goals, decided to invest with proper risk profiling and done your asset allocation. These steps make your product selection easier. Your risk profiling gives a clear direction towards choosing right products. From novice to even seasoned investors, Mutual Funds are a preferred route of investment. However, it is critical to ensure that you get the right product in your portfolio. You can consider different quantitative and qualitative factors such as mutual fund ratings, expense ratios & exit loads, the track record of the Asset Management Company, past results of the fund manager, etc. to select a right product for yourself. You need to have a right balance of both qualitative and quantitive factors to choose the best Mutual Fund scheme.

7. Monitor, Review and Re-Balance your Investment Plan

It is necessary to monitor the investments you have made. Regular reviewing and rebalancing of the investments reduce the possibility of risk. You need to have a disciplined approach towards your financial plan and monitor the investment that you have made after every three months. Financial markets are volatile and your investment value may go up & down. You must be firm on the research and efforts you have taken in selecting the Mutual Fund and avoid panicking in case of short-term losses. If you decide to make some changes in the plan, those changes should be made after giving adequate time to the previous plan to perform. The act of rebalancing should not be done before at least one year.

Also, it gives you an idea about your future investments and how far have you come on the road to reach your goals. Many individuals start brightly with a top-class financial plan but very few manage to follow it to the end with proper monitoring and rebalancing. It may not be easy, but the plan must be followed as much as possible.

Benefits of Financial Plan

- You will be well prepared for the future financially.

- Your lifestyle will be better than most people with no financial plan. With a better lifestyle, you can have a stress-free life.

- You and your family will be financially secured.

- The most important one – you will control your life & your future!

- A financial plan is a key to your future financial stability. It is important that a plan is created with considering all the above-mentioned factors and with realistic targets. Create a financial plan today and secure your future!

Fund Selection Methodology used to find 6 funds

Best Mutual Funds for Aggressive Investors

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Sub Cat. DSP Equity Opportunities Fund Growth ₹610.531

↓ -7.88 ₹17,434 -4.6 1.2 10.4 19.1 15.4 7.1 Large & Mid Cap Aditya Birla Sun Life Small Cap Fund Growth ₹81.7082

↓ -0.50 ₹4,778 -3.5 -2.9 12.3 16.7 13.6 -3.7 Small Cap Kotak Standard Multicap Fund Growth ₹84.89

↓ -0.72 ₹56,479 -2.6 1.6 15.2 16.5 13 9.5 Multi Cap Motilal Oswal Multicap 35 Fund Growth ₹54.936

↓ -0.41 ₹13,180 -11.3 -11.9 0.4 19.3 11.3 -5.6 Multi Cap Invesco India Growth Opportunities Fund Growth ₹95.08

↓ -1.20 ₹8,959 -6.8 -6.5 13.8 22.8 16.4 4.7 Large & Mid Cap Sundaram Mid Cap Fund Growth ₹1,381.45

↓ -8.42 ₹12,917 -3.7 0.2 17.1 23.5 18.4 4.1 Mid Cap Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 6 Mar 26 Research Highlights & Commentary of 6 Funds showcased

Commentary DSP Equity Opportunities Fund Aditya Birla Sun Life Small Cap Fund Kotak Standard Multicap Fund Motilal Oswal Multicap 35 Fund Invesco India Growth Opportunities Fund Sundaram Mid Cap Fund Point 1 Upper mid AUM (₹17,434 Cr). Bottom quartile AUM (₹4,778 Cr). Highest AUM (₹56,479 Cr). Upper mid AUM (₹13,180 Cr). Bottom quartile AUM (₹8,959 Cr). Lower mid AUM (₹12,917 Cr). Point 2 Oldest track record among peers (25 yrs). Established history (18+ yrs). Established history (16+ yrs). Established history (11+ yrs). Established history (18+ yrs). Established history (23+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 5★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 15.45% (upper mid). 5Y return: 13.56% (lower mid). 5Y return: 13.01% (bottom quartile). 5Y return: 11.28% (bottom quartile). 5Y return: 16.40% (upper mid). 5Y return: 18.45% (top quartile). Point 6 3Y return: 19.08% (lower mid). 3Y return: 16.68% (bottom quartile). 3Y return: 16.53% (bottom quartile). 3Y return: 19.30% (upper mid). 3Y return: 22.76% (upper mid). 3Y return: 23.47% (top quartile). Point 7 1Y return: 10.35% (bottom quartile). 1Y return: 12.26% (lower mid). 1Y return: 15.17% (upper mid). 1Y return: 0.40% (bottom quartile). 1Y return: 13.81% (upper mid). 1Y return: 17.07% (top quartile). Point 8 Alpha: 1.22 (upper mid). Alpha: 0.00 (lower mid). Alpha: 3.74 (top quartile). Alpha: -5.98 (bottom quartile). Alpha: -0.94 (bottom quartile). Alpha: 0.78 (upper mid). Point 9 Sharpe: 0.34 (upper mid). Sharpe: 0.01 (bottom quartile). Sharpe: 0.46 (top quartile). Sharpe: -0.19 (bottom quartile). Sharpe: 0.19 (lower mid). Sharpe: 0.28 (upper mid). Point 10 Information ratio: 0.30 (upper mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.19 (bottom quartile). Information ratio: 0.56 (top quartile). Information ratio: 0.56 (upper mid). Information ratio: 0.23 (lower mid). DSP Equity Opportunities Fund

Aditya Birla Sun Life Small Cap Fund

Kotak Standard Multicap Fund

Motilal Oswal Multicap 35 Fund

Invesco India Growth Opportunities Fund

Sundaram Mid Cap Fund

Best Mutual Funds for Moderate Investors

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Sub Cat. Aditya Birla Sun Life Medium Term Plan Growth ₹42.3589

↓ -0.01 ₹2,982 2.7 5 10.2 10 12 10.9 Medium term Bond Nippon India Strategic Debt Fund Growth ₹16.407

↓ -0.01 ₹136 1.1 3 9.5 8.5 9.1 9.6 Medium term Bond Axis Strategic Bond Fund Growth ₹29.2304

↓ -0.01 ₹2,044 1.2 3.2 8 8.1 6.9 8.2 Medium term Bond ICICI Prudential Gilt Fund Growth ₹105.334

↓ -0.11 ₹9,240 1 1.9 6.1 7.5 6.4 6.8 Government Bond UTI Gilt Fund Growth ₹64.148

↓ -0.08 ₹521 1 2.5 5.3 7 5.6 5.1 Government Bond SBI Magnum Gilt Fund Growth ₹67.0453

↑ 0.09 ₹10,552 0.7 1.6 4.7 7.2 6.1 4.5 Government Bond Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 6 Mar 26 Research Highlights & Commentary of 6 Funds showcased

Commentary Aditya Birla Sun Life Medium Term Plan Nippon India Strategic Debt Fund Axis Strategic Bond Fund ICICI Prudential Gilt Fund UTI Gilt Fund SBI Magnum Gilt Fund Point 1 Upper mid AUM (₹2,982 Cr). Bottom quartile AUM (₹136 Cr). Lower mid AUM (₹2,044 Cr). Upper mid AUM (₹9,240 Cr). Bottom quartile AUM (₹521 Cr). Highest AUM (₹10,552 Cr). Point 2 Established history (16+ yrs). Established history (11+ yrs). Established history (13+ yrs). Oldest track record among peers (26 yrs). Established history (24+ yrs). Established history (25+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 4★ (upper mid). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Point 5 1Y return: 10.23% (top quartile). 1Y return: 9.45% (upper mid). 1Y return: 8.02% (upper mid). 1Y return: 6.08% (lower mid). 1Y return: 5.28% (bottom quartile). 1Y return: 4.75% (bottom quartile). Point 6 1M return: 0.70% (bottom quartile). 1M return: 0.82% (upper mid). 1M return: 0.75% (bottom quartile). 1M return: 0.82% (lower mid). 1M return: 0.87% (upper mid). 1M return: 0.99% (top quartile). Point 7 Sharpe: 2.33 (top quartile). Sharpe: 1.03 (upper mid). Sharpe: 1.06 (upper mid). Sharpe: 0.16 (lower mid). Sharpe: -0.28 (bottom quartile). Sharpe: -0.38 (bottom quartile). Point 8 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 7.78% (upper mid). Yield to maturity (debt): 7.10% (lower mid). Yield to maturity (debt): 8.16% (top quartile). Yield to maturity (debt): 7.38% (upper mid). Yield to maturity (debt): 6.72% (bottom quartile). Yield to maturity (debt): 6.45% (bottom quartile). Point 10 Modified duration: 3.40 yrs (upper mid). Modified duration: 3.58 yrs (upper mid). Modified duration: 3.22 yrs (top quartile). Modified duration: 8.27 yrs (bottom quartile). Modified duration: 5.70 yrs (bottom quartile). Modified duration: 5.46 yrs (lower mid). Aditya Birla Sun Life Medium Term Plan

Nippon India Strategic Debt Fund

Axis Strategic Bond Fund

ICICI Prudential Gilt Fund

UTI Gilt Fund

SBI Magnum Gilt Fund

Best Mutual Funds for Conservative Investors

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Sub Cat. Aditya Birla Sun Life Savings Fund Growth ₹571.703

↑ 0.19 ₹22,857 1.3 3 7.2 7.4 7.4 6.81% 5M 19D 6M 11D Ultrashort Bond Indiabulls Liquid Fund Growth ₹2,625.79

↑ 0.39 ₹169 1.4 2.9 6.3 6.9 6.6 6.62% 1M 1M Liquid Fund PGIM India Insta Cash Fund Growth ₹353.4

↑ 0.05 ₹546 1.4 2.9 6.3 6.9 6.5 6.43% 26D 29D Liquid Fund JM Liquid Fund Growth ₹74.0336

↑ 0.01 ₹2,703 1.4 2.8 6.2 6.8 6.4 6.44% 1M 2D 1M 4D Liquid Fund UTI Ultra Short Term Fund Growth ₹4,401.87

↑ 0.68 ₹3,751 1.3 2.7 6.4 6.8 6.6 7.21% 4M 29D 5M 30D Ultrashort Bond Axis Liquid Fund Growth ₹3,023.66

↑ 0.43 ₹39,028 1.4 2.9 6.3 7 6.6 6.5% 27D 30D Liquid Fund Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 6 Mar 26 Research Highlights & Commentary of 6 Funds showcased

Commentary Aditya Birla Sun Life Savings Fund Indiabulls Liquid Fund PGIM India Insta Cash Fund JM Liquid Fund UTI Ultra Short Term Fund Axis Liquid Fund Point 1 Upper mid AUM (₹22,857 Cr). Bottom quartile AUM (₹169 Cr). Bottom quartile AUM (₹546 Cr). Lower mid AUM (₹2,703 Cr). Upper mid AUM (₹3,751 Cr). Highest AUM (₹39,028 Cr). Point 2 Established history (22+ yrs). Established history (14+ yrs). Established history (18+ yrs). Oldest track record among peers (28 yrs). Established history (22+ yrs). Established history (16+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderately Low. Risk profile: Low. Risk profile: Low. Risk profile: Low. Risk profile: Moderately Low. Risk profile: Low. Point 5 1Y return: 7.16% (top quartile). 1Y return: 6.33% (lower mid). 1Y return: 6.30% (bottom quartile). 1Y return: 6.19% (bottom quartile). 1Y return: 6.40% (upper mid). 1Y return: 6.33% (upper mid). Point 6 1M return: 0.52% (top quartile). 1M return: 0.46% (upper mid). 1M return: 0.44% (bottom quartile). 1M return: 0.44% (bottom quartile). 1M return: 0.45% (upper mid). 1M return: 0.45% (lower mid). Point 7 Sharpe: 2.17 (bottom quartile). Sharpe: 2.72 (upper mid). Sharpe: 2.89 (upper mid). Sharpe: 2.30 (lower mid). Sharpe: 1.15 (bottom quartile). Sharpe: 3.16 (top quartile). Point 8 Information ratio: 0.00 (top quartile). Information ratio: -0.70 (bottom quartile). Information ratio: -0.09 (lower mid). Information ratio: -1.73 (bottom quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (upper mid). Point 9 Yield to maturity (debt): 6.81% (upper mid). Yield to maturity (debt): 6.62% (upper mid). Yield to maturity (debt): 6.43% (bottom quartile). Yield to maturity (debt): 6.44% (bottom quartile). Yield to maturity (debt): 7.21% (top quartile). Yield to maturity (debt): 6.50% (lower mid). Point 10 Modified duration: 0.47 yrs (bottom quartile). Modified duration: 0.08 yrs (upper mid). Modified duration: 0.07 yrs (top quartile). Modified duration: 0.09 yrs (lower mid). Modified duration: 0.41 yrs (bottom quartile). Modified duration: 0.07 yrs (upper mid). Aditya Birla Sun Life Savings Fund

Indiabulls Liquid Fund

PGIM India Insta Cash Fund

JM Liquid Fund

UTI Ultra Short Term Fund

Axis Liquid Fund

Common Mistakes to Avoid

Let’s look at some of the common mistakes that happen while creating a financial plan:

1. Setting unrealistic goals

Many times people set goals that are very unrealistic to achieve. This happens because they lack in-depth knowledge of their present financial situation.

2. Making rash decisions

Executing a financial plan is a work of patience. People sometimes tend to lose the patience and make certain decisions instinctively. Those decisions might look correct at that point of time but it may have a negative impact in the future.

3. Financial Planning is not just investing

Financial planning is not just about investing. It also involves other critical affairs such as wealth management, Tax Planning, insurance, and Retirement planning. Investing is one aspect of a sound financial plan.

4. Neglecting to evaluate the plan periodically

This is one of the most common mistakes that people make while executing the plan. Reviewing your financial plan from time to time gives you an idea of your current progress. It also allows you re-check and re-balance your plan according to your present situation keeping the long-term goals intact.

5. Only rich people do financial planning

Another common mistake while making a plan. Financial planning is for everyone irrespective of their financial situations.

6. Wait for a crisis

It is better to set up a financial plan to tackle a crisis than waiting for such event to arise and then act on it.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.