Mutual Fund Ratings

Mutual Fund ratings are a way to compare and judge the Best Performing Mutual Funds in the market at a given point of time. It provides investors with a simple method to evaluate the top Mutual Funds. Also, these ratings are a good selling point for distributors to advise the best Mutual Funds to prospective investors. There are various agencies in place to give out the Mutual Fund ratings. CRISIL, ICRA, MorningStar, ValueResearch, etc. are some of the credible rating agencies. Mutual Fund ratings evaluate a Mutual Fund scheme on various parameters – quantitative and qualitative. It collects data and presents it in an orderly fashion to both customers and the mutual fund companies. Mutual Fund ratings are one of the basic parameters used by many investors to select the top performing Mutual Fund in the current market.

Before looking into the other various factors that affect the Mutual Fund ratings, let’s look at the most basic factor that investors consider for selecting the best Mutual Fund. Many investors only look at past returns of the Mutual Fund scheme before selecting it. But the selecting a fund only on the basis of immediate past returns might not be a wise decision. Before knowing the other parameters, let's first look at the top rated Mutual Funds in India.

How to Judge a Top Mutual Fund?

We saw in the above table that just relying on immediate past returns for selecting a Mutual Fund is not wise. So we have to look beyond returns on judging a Mutual Fund. There are other parameters which influence the Mutual Fund ratings. These parameters could be quantitative as well as qualitative. We will look at some of the quantitative factors first.

Mutual Fund Performance

As seen in the above table, just looking at the immediate returns is not a good way to judge a Mutual Fund. A fund may perform just well for a year and but may falter in the long run. You need to check three-year performance and the five-year performance of the fund to get a better understanding of its consistency. Let’s take an example of a Mutual Fund with its one-year, three-year and five-year return tabulated as below:

| 1 Year Return | 3 Year Return | 5 Year Return |

|---|---|---|

| 55% p.a. | 20% p.a. | 12% p.a. |

As we can see, the fund performed exceptionally well for a year generating 55% of returns for the investors. But then for the period of three years, the average annual return fell to 20% p.a. As you go further ahead, for a period of five years, the average annual return is 12%. These numbers need to be compared with other similar funds to get an idea about performance. Also, it would be a good idea to cull out year0wise or even moth-wise performance numbers and then compare them with the peer group. Comparing these with the peer group and getting the fund's rank within the same will give an idea about its performance.

The objective here is to not be technically correct but to emphasise the importance of considering the Mutual Fund performance over the years and the importance of giving consistent returns. The above-mentioned fund can lose money for a year or two but can also significantly bump up the average return with a strong performance in the coming year or two.What needs to be seen is the performance in many periods over a long time.

But only knowing how a fund performs in isolation is not of great help. The performance must be viewed as a relative issue and should be judged against an appropriate benchmark. Assessing how a fund has performed against a benchmark will show whether the fund has really given some "real" returns or not.

Additionally, one can look at some risk-return ratios to also assess fund performance.We will take a look at three major ratios that are commonly used to measure the risk and return of a Mutual Fund scheme.

a. Sharpe Ratio

Sharpe Ratio is named after its founder William F. Sharpe and is used widely to study the risk-adjusted performance of any Mutual Fund scheme. The ratio is the measure of the excess returns of mutual fund scheme (over a risk-free rate) divided by the standard deviation (Volatility) of the Mutual Fund scheme’s return for a given period of time. Standard deviation here is the measure of risk – higher the deviation, higher the risk. In simpler words, Sharpe Ratio shows how the returns from a fund have rewarded an investor for the risk they have taken. If the ratio is higher, better returns are generated for the investor for bearing the added risk.

b. Treynor Ratio

Treynor Ratio is named after Jack L. Treynor and is similar to the Sharpe Ratio that we discussed above. It also measures the excess returns generated by the fund over a risk-free rate. But, unlike Sharpe Ratio, Treynor Ratio uses market risk (beta) instead of the total risk.

c. Alpha

Alpha is the measure of an investment Portfolio’s return against a specific benchmark. If the alpha of an investment is greater than zero or positive, it means that the investment has generated more returns for the given amount of risk. On the other hand, if the alpha is negative, it means that the fund has underperformed for the given benchmark and has earned less money for the risk involved. Higher the alpha, higher the returns generated and better the performance of the fund.

Talk to our investment specialist

Volatility of the Mutual Fund Scheme

A mutual fund scheme is not always stable. The volatility of a Mutual Fund scheme is the fluctuation in its Net Asset Value (NAV). Investors like to choose a scheme which is less volatile and provides the optimal risk-reward combination.

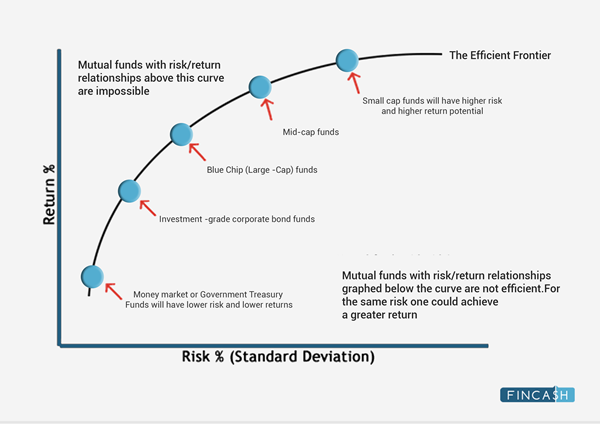

A part of modern portfolio theory gives us the Efficient Frontier – a graph curve that is obtained by plotting return and risk (indicated by the volatility of the scheme) – represented by Standard Deviation.

Efficient Frontier is a set of optimal investment portfolios that generate maximum expected returns for a given level of risk or it is the lowest amount of risk for a specified level of expected returns. Let us look at the efficient frontier graph curve below:

According to the modern portfolio theory, the mutual fund schemes that are on the curve, yield maximum returns that are possible for a given amount of volatility.

To check if the selected Mutual Fund scheme will provide optimal returns for the amount of volatility acquired, you need to analyse the fund’s Standard Deviation.

Standard deviation is an indication of a fund’s volatility which shows fluctuations of the returns(rise or fall) in a short period of time. A scheme that is volatile is considered to be of higher risk as its performance may change quickly in any direction at any time. The Standard deviation of a Mutual Fund scheme calculates the risk by measuring the extent to which the fund NAV fluctuates with respect to its average return over a period of time.

Let’s take an example. Consider a fund scheme that is generating a consistent four-year return of 5% p.a. (every year it has given a perfect 5% return). This means that the average return at any point of time is 5% and thus the standard deviation for this Mutual Fund scheme is zero. On the other hand, consider a fund in the same four-year tenure, that has generated returns of -5%, 15%, 6% and 24%. Thus, it has an average return of 10%. The scheme will also show a high standard deviation because each year the fund return is different from the mean return.

It is advisable to invest in the low fluctuating scheme for fairly consistent returns. This risk-return measurement is very important while selecting a top performing Mutual Fund.

Liquidity of a Mutual Fund Scheme

Liquidity of the scheme is also an important factor. Liquidity is the ability to cash in the investment. It means how fast a fund scheme can be bought or sold in the market without disturbing the asset price. Easy and higher liquidity is always preferable. A fund where money can be withdrawn at one go is always better than those with multiple withdrawals.

Credit Quality for Debt Funds

For debt fund schemes, credit quality is very important. Credit quality is one of the main points to judge a debt fund. It informs the investor about the credit worthiness or risk of default of a debt fund.

A debt fund’s credit quality is determined by independent rating agencies such as CRISIL, ICRA, etc. The credit quality designations range from High Quality (‘AAA to AA’) to Medium Quality (‘A’ to ‘BBB’) to Low Quality (‘BB’, ‘B’, ‘CCC’, ‘CC’ to ‘C’).

It is highly risky to invest in a scheme with high returns but very low credit quality. In the case of default, the issuer would not be able to pay the principal amount and the investor would suffer high losses.

Portfolio Concentration

Portfolio concentration is another important factor in the process of Mutual Fund ratings. The concentration of portfolio measures the risk that arises due to the improper diversification of assets. For equity asset class, there is a diversity score which is used as the parameter to determine the concentration of the company and the industry.

In case of debt funds, the concentration is evaluated at a specific limit of an individual issuer. This limit is linked to the credit rating of the issuer. A high rated issuer will have higher limits and as the rating designations go down, the limit also decreases gradually.A concentrated portfolio can lead to a high risk. Putting all investment in one scheme raises the security factor of the portfolio. Diversification of the portfolio is advisable.

A concentrated portfolio can lead to a high risk. Putting all investment in one scheme raises the risk factor of the portfolio. Diversification of the portfolio is advisable.

Some of the other factors are average AUM(Asset Under Management)turnover of the portfolio etc. All these factors together form a base for Mutual Fund ratings. Rating agencies use these parameters to give out their best performing Mutual Funds.

Fund Selection Methodology used to find 7 funds

Top 7 Best Rated Mutual Funds

Fund NAV Net Assets (Cr) Min Investment Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP World Gold Fund Growth ₹67.9493

↓ -0.10 ₹1,975 1,000 500 42.1 90.1 185.1 64.8 32.4 167.1 SBI PSU Fund Growth ₹37.1063

↓ -0.20 ₹5,980 5,000 500 9.9 21.3 36.4 36.1 28 11.3 Invesco India PSU Equity Fund Growth ₹68.32

↓ -0.70 ₹1,492 5,000 500 4.2 13.1 34.5 32.5 25.8 10.3 LIC MF Infrastructure Fund Growth ₹50.5051

↓ -0.33 ₹946 5,000 1,000 1.6 5.4 26.6 29.6 24 -3.7 Franklin India Opportunities Fund Growth ₹255.45

↑ 0.46 ₹8,271 5,000 500 -2.6 0.4 16.2 29.3 20.6 3.1 Franklin Build India Fund Growth ₹148.681

↓ -1.28 ₹3,003 5,000 500 2.1 6.6 24.2 28.6 24 3.7 HDFC Infrastructure Fund Growth ₹47.49

↓ -0.41 ₹2,366 5,000 300 -1.5 1.2 18.3 28 23.8 2.2 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 26 Feb 26 Research Highlights & Commentary of 7 Funds showcased

Commentary DSP World Gold Fund SBI PSU Fund Invesco India PSU Equity Fund LIC MF Infrastructure Fund Franklin India Opportunities Fund Franklin Build India Fund HDFC Infrastructure Fund Point 1 Lower mid AUM (₹1,975 Cr). Upper mid AUM (₹5,980 Cr). Bottom quartile AUM (₹1,492 Cr). Bottom quartile AUM (₹946 Cr). Highest AUM (₹8,271 Cr). Upper mid AUM (₹3,003 Cr). Lower mid AUM (₹2,366 Cr). Point 2 Established history (18+ yrs). Established history (15+ yrs). Established history (16+ yrs). Established history (18+ yrs). Oldest track record among peers (26 yrs). Established history (16+ yrs). Established history (17+ yrs). Point 3 Rating: 3★ (upper mid). Rating: 2★ (bottom quartile). Rating: 3★ (upper mid). Not Rated. Rating: 3★ (lower mid). Top rated. Rating: 3★ (lower mid). Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: Moderately High. Risk profile: High. Risk profile: High. Point 5 5Y return: 32.37% (top quartile). 5Y return: 27.98% (upper mid). 5Y return: 25.77% (upper mid). 5Y return: 23.97% (lower mid). 5Y return: 20.60% (bottom quartile). 5Y return: 24.04% (lower mid). 5Y return: 23.84% (bottom quartile). Point 6 3Y return: 64.81% (top quartile). 3Y return: 36.09% (upper mid). 3Y return: 32.48% (upper mid). 3Y return: 29.60% (lower mid). 3Y return: 29.31% (lower mid). 3Y return: 28.56% (bottom quartile). 3Y return: 28.02% (bottom quartile). Point 7 1Y return: 185.11% (top quartile). 1Y return: 36.41% (upper mid). 1Y return: 34.54% (upper mid). 1Y return: 26.65% (lower mid). 1Y return: 16.17% (bottom quartile). 1Y return: 24.24% (lower mid). 1Y return: 18.29% (bottom quartile). Point 8 Alpha: 2.12 (top quartile). Alpha: 0.05 (upper mid). Alpha: -2.70 (bottom quartile). Alpha: -6.08 (bottom quartile). Alpha: -1.01 (lower mid). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Point 9 Sharpe: 3.41 (top quartile). Sharpe: 0.63 (upper mid). Sharpe: 0.53 (upper mid). Sharpe: 0.03 (bottom quartile). Sharpe: 0.12 (lower mid). Sharpe: 0.21 (lower mid). Sharpe: 0.06 (bottom quartile). Point 10 Information ratio: -0.47 (lower mid). Information ratio: -0.63 (bottom quartile). Information ratio: -0.50 (bottom quartile). Information ratio: 0.29 (upper mid). Information ratio: 1.66 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). DSP World Gold Fund

SBI PSU Fund

Invesco India PSU Equity Fund

LIC MF Infrastructure Fund

Franklin India Opportunities Fund

Franklin Build India Fund

HDFC Infrastructure Fund

Qualitative Factors Affecting Mutual Fund Ratings

But along with these, there are qualitative factors that also affect the Mutual Fund ratings.

Fund House Reputation

Track record of the Mutual Fund companies is one of the key factors. A proven past and consistent returns give solidity to the Mutual Fund scheme. So instead of Investing in a novice fund house, it is always better to put the money in an established AMC.

Fund Manager Track Record

But with an established AMC, another factor to check is the experience of the fund manager. Experience speaks for itself and it is completely true in this case. An experienced fund manager has a better view and idea about a good Mutual Fund and helps the investor to invest wisely. A number of schemes handled by the manager should be considered as well. Too many schemes can overburden the management team and may lower the efficiency.

Investment Process

One should also make sure that there is an investment process in place.This is will ensure that there is an institutionalised process that takes care of investment decisions. You don’t want to get into a product with key-man risk. If there is an institutionalised investment process in place, this will ensure the scheme is managed well. Even there is a fund manager change. then your investment will be protected.

A good Mutual Fund rating is a combination of both quantitative and qualitative factors. Rating agencies like MorningStar, CRISIL, ICRA use both the factors to give out their ratings for the best performing Mutual Funds which are updated periodically.

Conclusion

An important thing to note is that though highly rated schemes tend to offer higher returns, it may not be always conclusive. To invest in Mutual Funds only on the base of Mutual Fund ratings is generally not a wise decision. The investment should be research-based and well informed. Mutual Fund ratings just show the direction for a good investment.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Excellent information