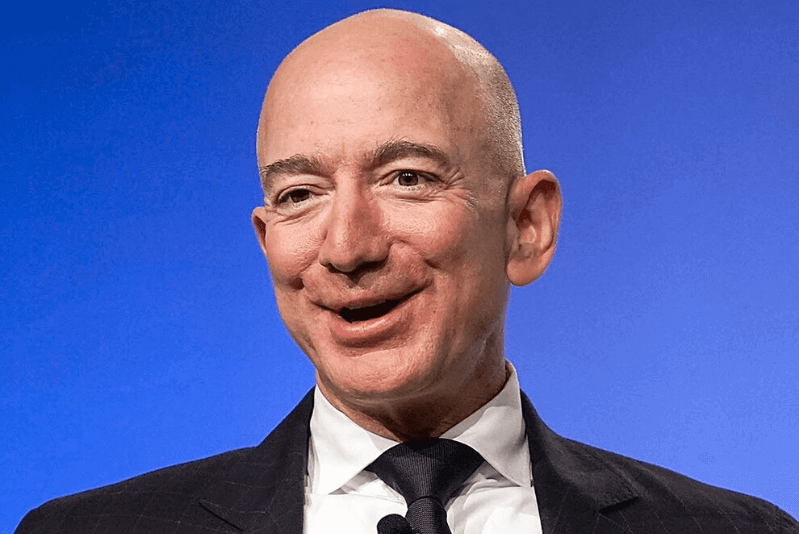

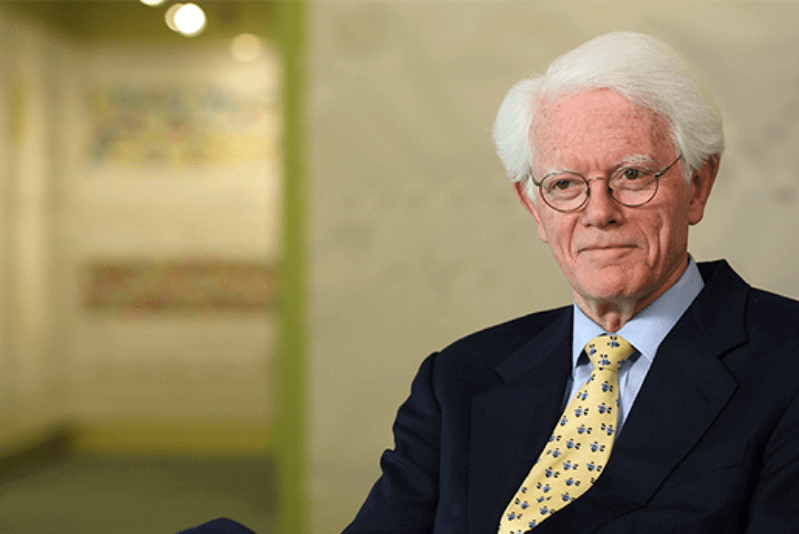

Peter Lynch’s Top 5 Investing Tips for Financial Success

Peter Lynch is an American investor, celebrated mutual fund manager and a philanthropist. He is one of the most successful investors in the world. He is the former manager of the Magellan Fund at Fidelity Investments. During his tenure as a manager between 1977 and 1990, Mr Lynch averaged a 29.2% annual return consistently and made it the best-performing mutual fund in the world. This was more than twice what the S&P 500 earned during that time. In his 13-year tenure, the assets under management increased from $18 million to a whopping $14 billion.

His style of investment has been applauded and described as adaptive to the economic environment at the time.

| Details | Description |

|---|---|

| Birthdate | January 19, 1944 |

| Age | 76 years |

| Birthplace | Newton, Massachusetts, U.S. |

| Alma mater | Boston College (BA), The Wharton School of the University of Pennsylvania (MBA) |

| Occupation | Investor, mutual fund manager, philanthropist |

| Net worth | US$352 million (March 2006) |

Mr Lynch’s first successful investment was in an air-freight company known as the Flying Tiger. This helped him pay for his graduate school. He went on to earn a Masters in Business Administration (MBA) for the Wharton School of Business at the University of Pennsylvania in 1968. One lesser-known fact about this legend is that he served in the army from 1967 through 1969.

1. Buy What You Know

If you have been following Mr Lynch, you would be familiar with this mantra. He sternly believes that investors can invest well if they are aware of the company, its business model and its fundamentals.

As an investor, if you do your research about the stocks and the company that is offering the stocks, you will be able to think wisely and make the right decisions when it comes to investment and returns.

Talk to our investment specialist

2. Look Beyond What is Visible

Peter Lynch once rightly said, “During the gold rush, most would-be miners lost money, but the people who sold them picks, shovels, tents, and blue-jeans made a nice profit. Today, you can look for non-internet companies that indirectly benefit from internet traffic or you can invest in manufacturers of switches and related gizmos that keep the traffic moving.”

It is important as an investor to look beyond what is visible to the eye. Promising stock ideas are available and visible, but there are other companies working to help that stocks rise. For eg., if you see a successful stock from a particular company in the market, it is visible to everyone. But you should go beyond to see the other companies and outlets responsible for helping that stock become successful in both e-commerce, retail, hardware industry, etc.

Investing in them can prove to be beneficial. However, it is important to your research before investing.

3. Consider Mutual Funds

Mutual Funds are a great alternative when it comes to investments. Peter Lynch once said, “Equity Mutual Funds are the perfect solution for people who want to own stocks without doing their own research.” Maybe you are one of those investors who don’t have the time or interest to do your own research about a company before investing in stocks. Remember, that mutual funds, Magellan, was a Mr Lynch’s trademark success element. Mutual funds have historically outperformed stock mutual funds over a long period of time.

4. Invest for Long Term

One of the many credible advice from Peter Lynch is that long-term investments give higher returns. He once said that "absent a lot of surprises, stocks are relatively predictable over 10-20 years. As to whether they're going to be higher or lower in two or three years, you might as well flip a coin to decide. He made investments and didn’t sell anything before he felt the right time had come.

Also, Peter Lynch did not try to predict the direction of the overall market economy to decide when to sell the stocks. He strongly believes that predicting short-term fluctuations in the market is not worth the time and effort. If the company you are investing in is strong, the value will increase over the period of time.

Therefore, he spent his time in understanding what is needed and finding great companies to invest in.

5. Losses May Come

As an investor, you should never expect only success. Losses are bound to come your way. Peter Lynch once said that in this business if you’re good, you’re right six times out of ten. You are never going to be right nine times out of ten.

Losses do not mean you are a bad investor. It is bound to happen through you are investing in individual stocks, managed stock mutual funds or even Index Funds.

Conclusion

Peter Lynch’s books like ‘Invest in what you know’ and ‘Ten bagger’ are some of the best-selling books worldwide. Investors can take Mr Lynch’s advise seriously and gain high-returns.

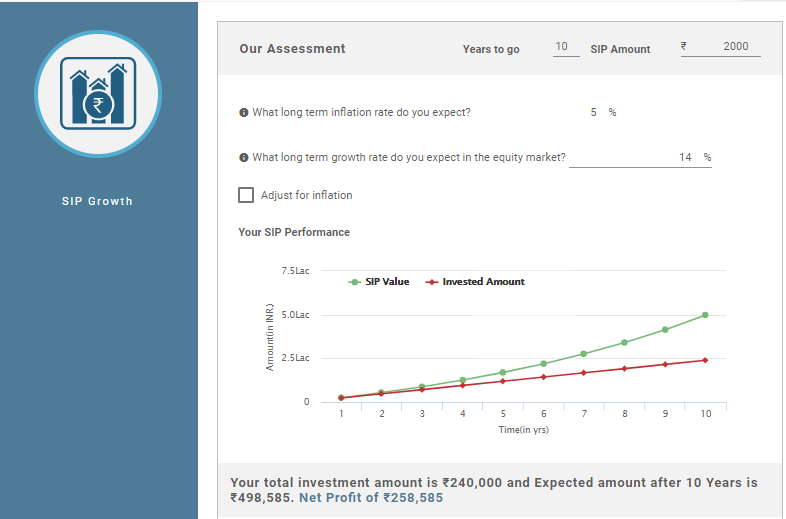

One of the best ways to invest and gain high-returns, in the long run, is to invest in a Systematic Investment plan (SIP). Invest minimum amounts monthly for a long period and gain high returns.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.