Top 5 Mutual Funds to Invest in 2026

Mutual Funds off late have become a popular mode of investment, and many investors are inclining towards Investing in it. Mutual Funds don’t only offer good returns, but also gives a systematic opportunity to achieve Financial goals, which is of one the reason for their popularity in recent times. However, in order to achieve the desired investment goal or to earn good returns, investing in the right fund is important. That’s why we are here! Investors planning to invest in Mutual Funds, we bring you some of the Best Performing Mutual Funds that you need to consider while investing. These funds have been shortlisted by undertaking important parameters like AUM, NAV, past performances, peer average returns, information ratio, etc.

Talk to our investment specialist

Top 5 Best Performing Mutual Funds in India

Fund Selection Methodology used to find 5 funds

Best Equity Mutual Funds 2026

Fund NAV Net Assets (Cr) Min Investment Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Information Ratio Sharpe Ratio DSP World Gold Fund Growth ₹70.6728

↑ 0.61 ₹1,975 1,000 500 42.7 87.9 203.9 64.5 33.4 167.1 -0.47 3.41 SBI PSU Fund Growth ₹36.7207

↓ -0.38 ₹5,980 5,000 500 9.4 18.5 38.5 34.4 27 11.3 -0.63 0.63 Invesco India PSU Equity Fund Growth ₹67.72

↓ -0.60 ₹1,492 5,000 500 3.6 10.3 37.2 31.5 24.6 10.3 -0.5 0.53 LIC MF Infrastructure Fund Growth ₹49.4807

↓ -1.02 ₹946 5,000 1,000 0.2 2.4 27.2 28.4 23 -3.7 0.29 0.03 Franklin India Opportunities Fund Growth ₹249.235

↓ -4.09 ₹8,271 5,000 500 -4.4 -1.9 17.1 28.1 19.3 3.1 1.66 0.12 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 2 Mar 26 Note: Ratio's shown as on 31 Jan 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP World Gold Fund SBI PSU Fund Invesco India PSU Equity Fund LIC MF Infrastructure Fund Franklin India Opportunities Fund Point 1 Lower mid AUM (₹1,975 Cr). Upper mid AUM (₹5,980 Cr). Bottom quartile AUM (₹1,492 Cr). Bottom quartile AUM (₹946 Cr). Highest AUM (₹8,271 Cr). Point 2 Established history (18+ yrs). Established history (15+ yrs). Established history (16+ yrs). Established history (18+ yrs). Oldest track record among peers (26 yrs). Point 3 Top rated. Rating: 2★ (bottom quartile). Rating: 3★ (upper mid). Not Rated. Rating: 3★ (lower mid). Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: Moderately High. Point 5 5Y return: 33.40% (top quartile). 5Y return: 26.96% (upper mid). 5Y return: 24.60% (lower mid). 5Y return: 23.00% (bottom quartile). 5Y return: 19.30% (bottom quartile). Point 6 3Y return: 64.51% (top quartile). 3Y return: 34.43% (upper mid). 3Y return: 31.47% (lower mid). 3Y return: 28.45% (bottom quartile). 3Y return: 28.05% (bottom quartile). Point 7 1Y return: 203.87% (top quartile). 1Y return: 38.54% (upper mid). 1Y return: 37.22% (lower mid). 1Y return: 27.19% (bottom quartile). 1Y return: 17.10% (bottom quartile). Point 8 Alpha: 2.12 (top quartile). Alpha: 0.05 (upper mid). Alpha: -2.70 (bottom quartile). Alpha: -6.08 (bottom quartile). Alpha: -1.01 (lower mid). Point 9 Sharpe: 3.41 (top quartile). Sharpe: 0.63 (upper mid). Sharpe: 0.53 (lower mid). Sharpe: 0.03 (bottom quartile). Sharpe: 0.12 (bottom quartile). Point 10 Information ratio: -0.47 (lower mid). Information ratio: -0.63 (bottom quartile). Information ratio: -0.50 (bottom quartile). Information ratio: 0.29 (upper mid). Information ratio: 1.66 (top quartile). DSP World Gold Fund

SBI PSU Fund

Invesco India PSU Equity Fund

LIC MF Infrastructure Fund

Franklin India Opportunities Fund

Best Debt Funds 2026

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Franklin India Ultra Short Bond Fund - Super Institutional Plan Growth ₹34.9131

↑ 0.04 ₹297 1.3 5.9 13.7 8.8 0% 1Y 15D DSP Credit Risk Fund Growth ₹50.4187

↑ 0.01 ₹217 -0.5 1 13.5 14.1 21 7.67% 2Y 5M 5D 3Y 4M 24D Aditya Birla Sun Life Credit Risk Fund Growth ₹24.382

↑ 0.01 ₹1,138 4.8 7.7 13.4 12.1 13.4 7.96% 2Y 4M 28D 3Y 2M 23D Sundaram Short Term Debt Fund Growth ₹36.3802

↑ 0.01 ₹362 0.8 11.4 12.8 5.3 4.52% 1Y 2M 13D 1Y 7M 3D Sundaram Low Duration Fund Growth ₹28.8391

↑ 0.01 ₹550 1 10.2 11.8 5 4.19% 5M 18D 8M 1D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 7 Aug 22 Research Highlights & Commentary of 5 Funds showcased

Commentary Franklin India Ultra Short Bond Fund - Super Institutional Plan DSP Credit Risk Fund Aditya Birla Sun Life Credit Risk Fund Sundaram Short Term Debt Fund Sundaram Low Duration Fund Point 1 Bottom quartile AUM (₹297 Cr). Bottom quartile AUM (₹217 Cr). Highest AUM (₹1,138 Cr). Lower mid AUM (₹362 Cr). Upper mid AUM (₹550 Cr). Point 2 Established history (18+ yrs). Established history (22+ yrs). Established history (10+ yrs). Oldest track record among peers (23 yrs). Established history (18+ yrs). Point 3 Rating: 1★ (bottom quartile). Top rated. Not Rated. Rating: 2★ (upper mid). Rating: 2★ (lower mid). Point 4 Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderately Low. Risk profile: Moderately Low. Point 5 1Y return: 13.69% (top quartile). 1Y return: 13.48% (upper mid). 1Y return: 13.43% (lower mid). 1Y return: 12.83% (bottom quartile). 1Y return: 11.79% (bottom quartile). Point 6 1M return: 0.59% (upper mid). 1M return: -0.26% (bottom quartile). 1M return: 1.06% (top quartile). 1M return: 0.20% (bottom quartile). 1M return: 0.28% (lower mid). Point 7 Sharpe: 2.57 (top quartile). Sharpe: 1.48 (lower mid). Sharpe: 2.38 (upper mid). Sharpe: 0.98 (bottom quartile). Sharpe: 0.99 (bottom quartile). Point 8 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 0.00% (bottom quartile). Yield to maturity (debt): 7.67% (upper mid). Yield to maturity (debt): 7.96% (top quartile). Yield to maturity (debt): 4.52% (lower mid). Yield to maturity (debt): 4.19% (bottom quartile). Point 10 Modified duration: 0.00 yrs (top quartile). Modified duration: 2.43 yrs (bottom quartile). Modified duration: 2.41 yrs (bottom quartile). Modified duration: 1.20 yrs (lower mid). Modified duration: 0.47 yrs (upper mid). Franklin India Ultra Short Bond Fund - Super Institutional Plan

DSP Credit Risk Fund

Aditya Birla Sun Life Credit Risk Fund

Sundaram Short Term Debt Fund

Sundaram Low Duration Fund

Best Hybrid Funds 2026

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) UTI Multi Asset Fund Growth ₹79.2172

↓ -0.11 ₹6,848 0.3 6.5 18.2 20.2 14.5 11.1 SBI Multi Asset Allocation Fund Growth ₹67.2102

↓ -0.01 ₹14,944 4.7 12.8 25.8 20.2 15 18.6 ICICI Prudential Multi-Asset Fund Growth ₹816.483

↓ -4.34 ₹80,768 0.6 7.1 18.5 19.9 19.1 18.6 ICICI Prudential Equity and Debt Fund Growth ₹402.41

↓ -4.63 ₹49,257 -2.4 2.3 15.7 19 18.2 13.3 BOI AXA Mid and Small Cap Equity and Debt Fund Growth ₹37.88

↓ -0.44 ₹1,329 -0.3 0.8 17.2 18.7 17.5 -0.9 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 2 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary UTI Multi Asset Fund SBI Multi Asset Allocation Fund ICICI Prudential Multi-Asset Fund ICICI Prudential Equity and Debt Fund BOI AXA Mid and Small Cap Equity and Debt Fund Point 1 Bottom quartile AUM (₹6,848 Cr). Lower mid AUM (₹14,944 Cr). Highest AUM (₹80,768 Cr). Upper mid AUM (₹49,257 Cr). Bottom quartile AUM (₹1,329 Cr). Point 2 Established history (17+ yrs). Established history (20+ yrs). Established history (23+ yrs). Oldest track record among peers (26 yrs). Established history (9+ yrs). Point 3 Rating: 1★ (bottom quartile). Top rated. Rating: 2★ (lower mid). Rating: 4★ (upper mid). Not Rated. Point 4 Risk profile: Moderately High. Risk profile: Moderate. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 14.51% (bottom quartile). 5Y return: 15.00% (bottom quartile). 5Y return: 19.08% (top quartile). 5Y return: 18.17% (upper mid). 5Y return: 17.46% (lower mid). Point 6 3Y return: 20.19% (top quartile). 3Y return: 20.16% (upper mid). 3Y return: 19.87% (lower mid). 3Y return: 19.00% (bottom quartile). 3Y return: 18.73% (bottom quartile). Point 7 1Y return: 18.22% (lower mid). 1Y return: 25.82% (top quartile). 1Y return: 18.49% (upper mid). 1Y return: 15.74% (bottom quartile). 1Y return: 17.20% (bottom quartile). Point 8 1M return: 1.73% (lower mid). 1M return: 2.78% (top quartile). 1M return: 1.33% (bottom quartile). 1M return: 0.45% (bottom quartile). 1M return: 1.94% (upper mid). Point 9 Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Alpha: 3.54 (top quartile). Alpha: 0.00 (bottom quartile). Point 10 Sharpe: 0.76 (lower mid). Sharpe: 2.05 (top quartile). Sharpe: 1.48 (upper mid). Sharpe: 0.62 (bottom quartile). Sharpe: 0.08 (bottom quartile). UTI Multi Asset Fund

SBI Multi Asset Allocation Fund

ICICI Prudential Multi-Asset Fund

ICICI Prudential Equity and Debt Fund

BOI AXA Mid and Small Cap Equity and Debt Fund

Best Gold Mutual Funds 2026

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP World Gold Fund Growth ₹70.6728

↑ 0.61 ₹1,975 42.7 87.9 203.9 64.5 33.4 167.1 SBI Gold Fund Growth ₹48.8255

↑ 2.38 ₹15,024 30.9 59.7 94 42.3 28.2 71.5 Axis Gold Fund Growth ₹48.8914

↑ 2.74 ₹2,835 32.1 60.4 95.3 42.3 28.3 69.8 ICICI Prudential Regular Gold Savings Fund Growth ₹51.6533

↑ 2.61 ₹6,338 31.2 59.6 93.9 42.2 28.2 72 IDBI Gold Fund Growth ₹43.3878

↑ 2.31 ₹809 31.8 59.5 93.8 42.1 28.2 79 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 2 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP World Gold Fund SBI Gold Fund Axis Gold Fund ICICI Prudential Regular Gold Savings Fund IDBI Gold Fund Point 1 Bottom quartile AUM (₹1,975 Cr). Highest AUM (₹15,024 Cr). Lower mid AUM (₹2,835 Cr). Upper mid AUM (₹6,338 Cr). Bottom quartile AUM (₹809 Cr). Point 2 Oldest track record among peers (18 yrs). Established history (14+ yrs). Established history (14+ yrs). Established history (14+ yrs). Established history (13+ yrs). Point 3 Top rated. Rating: 2★ (upper mid). Rating: 1★ (lower mid). Rating: 1★ (bottom quartile). Not Rated. Point 4 Risk profile: High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 33.40% (top quartile). 5Y return: 28.22% (lower mid). 5Y return: 28.31% (upper mid). 5Y return: 28.15% (bottom quartile). 5Y return: 28.19% (bottom quartile). Point 6 3Y return: 64.51% (top quartile). 3Y return: 42.32% (upper mid). 3Y return: 42.26% (lower mid). 3Y return: 42.19% (bottom quartile). 3Y return: 42.13% (bottom quartile). Point 7 1Y return: 203.87% (top quartile). 1Y return: 94.00% (lower mid). 1Y return: 95.29% (upper mid). 1Y return: 93.90% (bottom quartile). 1Y return: 93.76% (bottom quartile). Point 8 Alpha: 2.12 (top quartile). 1M return: 14.47% (bottom quartile). 1M return: 19.32% (upper mid). 1M return: 15.47% (lower mid). 1M return: 14.91% (bottom quartile). Point 9 Sharpe: 3.41 (lower mid). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Alpha: 0.00 (bottom quartile). Point 10 Information ratio: -0.47 (bottom quartile). Sharpe: 3.25 (bottom quartile). Sharpe: 3.44 (upper mid). Sharpe: 3.10 (bottom quartile). Sharpe: 3.48 (top quartile). DSP World Gold Fund

SBI Gold Fund

Axis Gold Fund

ICICI Prudential Regular Gold Savings Fund

IDBI Gold Fund

Mutual Fund Types: Risk and Return

Before you invest, know the basic risk and average returns of the following Mutual Fund categories:

| Mutual Fund Category | Average Return | Risk | Type of Risk |

|---|---|---|---|

| Equity Funds | 2%-20% | High to Moderate | Volatility Risk, Performance Risk, Concentration Risk |

| Debt/Bonds | 8-14% | Low to Moderate | Interest Rate Risk, Credit Risk |

| Money market funds | 4%-8% | Low | Inflation Risk, Opportunity Loss |

| Balanced Fund | 5-15% | Moderate | Higher exposure to Equity, Debt Holdings |

Mutual Fund Calculator: Pre-Determine Your Investment Returns

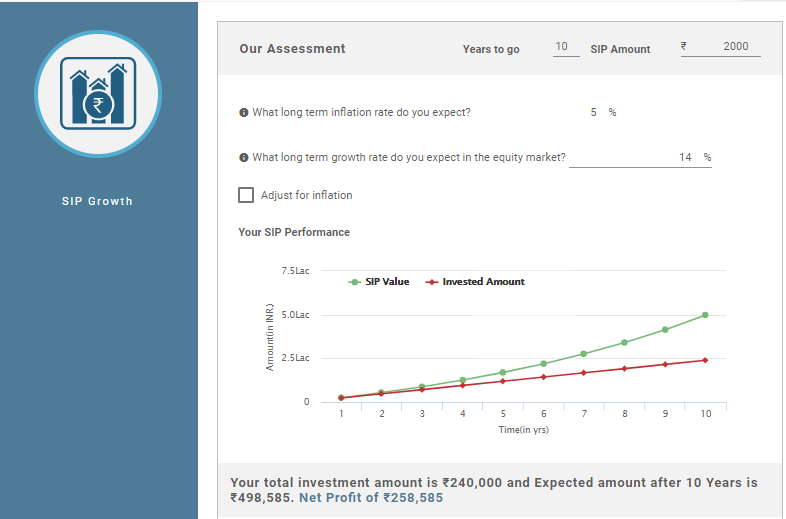

A sip calculator is a smart tool that solves major queries of investors like ‘how much to invest’, ‘how much would I earn’, ‘how much would be my profit’, etc. A mutual fund calculator, more specifically, SIP calculator pre-determines your investment amount for the tenure you would like to invest for. It is also one of the best tools for effective financial planning. Whether one wants to plan to buy a car, house, plan for retirement, a child's higher education or any other financial goal, the SIP calculator can be used for the same. Here’s how the calculator works:

Illustration:

Monthly Investment: ₹ 2,000

Investment Period: 10 years

Total Amount Invested: ₹ 2,40,000

Long-term Inflation: 5% (approx)

Long-term Growth Rate: 14% (approx)

Expected Returns as per SIP Calculator: ₹ 4,98,585

All you need to do in a SIP calculator is enter some basic inputs like investment amount and period of investing (additional inputs like inflation and expected market returns will give a more realistic picture). The output of these entries would be the final amount at maturity and gains made.

A similar calculation with a goal in mind can also be made to determine the amount one should invest to reach the goal. You have to choose a particular goal, like the ones below, and estimate the details using the goal calculator.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.