Top 5 Tips to Get Best Education Loan in 2020

Education loans are truly a boon to the developing world of opportunities today. Individuals from across the globe are in touch with the internet that has opened an avenue of newfound success. However, education is also quite expensive these days. Education in India and abroad is highly recommended if you wish to excel in career and life.

Banks and other financial institutions offer great education loans these days with a good rate of interest and loan repayment period. If you are looking for an education loan anytime soon, make sure to check the following tips to get the best education loan in 2020. Start planning your career today.

Tips for getting Best Education Loan in India 2020

1. Choose Course with Best Job Security

Before deciding about an education loan, it is important to research whether the course you are wishing to pursue will offer job opportunity at the earliest. No one would want to spend money without wanting to earn back. Taking an education loan is Investing. Choosing a course will lowest job opportunities will only make you end up in a bad place.

Make sure to choose the right course that will offer maximum return on investment. This will help you pay back your loan at the earliest and will not burn a hole in your pocket.

2. Decide about Loan Amount

The first thing to do before applying for an education loan is to decide the amount of loan you require. Make a plan and list down the expenses and the coverage you need. If you are able to meet at least half-of-expenses from your pocket, you will only need the other half.

This can be funded through a loan. The benefits would be that you will experience a lower burden of loan.

However, there is no hard and fast rule. Once you have made a plan, you will be able to gauge how much you need to fund your education. This will help in applying to the best Bank or financial institution that can help you avail the loan the hassle-free way.

3. Research about Banks

Before you can decide on a bank, make sure to conduct the required research. Don’t make an emotional or hasty decision, especially when you are applying for a loan. Conducting thorough research will enable you to understand the various rates of interest, processing fees, terms and conditions, etc. Every bank offers different rates of interest and this determines how much you will need to pay back.

Every point in the rate of interest indicates the amount of money you will have to spend and return. Check whether the interest rate on your loan amount is fixed or floating. It is important to decide between these rates because it majorly affects your loan repayment planning and EMI amount.

Talk to our investment specialist

a. Floating Rate of Interest

A Floating Rate of Interest is subject to quarterly revision. The interest charged on your loan will be pegged to the base rate. If the base rate changes, your interest rate will also vary. This is determined by the Reserved Bank of India (RBI) on various economic factors.

b. Fixed-Rate of Interest

A fixed-rate of interest is generally 1% to 2% higher than the floating rate of interest but the lending rate will be fixed.

4. Choose Longer Repayment Tenure

This is a smart decision to make when applying for a loan. While researching about banks, make sure to check their loan repayment tenure. If you choose an education with a longer repayment tenure, you can pay EMIs with a lower amount.

This means that you will have the advantage to be able to balance your monthly budget and EMI payment well without having to overspend.

However, if you have enough money to be able to pay back your loan fast, you can go for a shorter period. Opting for a loan with a shorter period will also help you save money.

5. Check Coverage

When deciding about an education loan, it is important to make a list of aspects that will need funding. The main ones to look at is Tuition Fees, lab and equipment fees, living costs, etc. If you are planning to study abroad, make sure to check the expenditure based on the currency of the country. You will have to calculate your costs accordingly. If the currency rate is higher than the Indian rupee, you will be spending more. That means your loan amount will be bigger and the money to be paid in the form of rate of interest will be higher.

Calculate your expenses regarding coverage and opt for the right education loan.

Fund your Education the SIP Way!

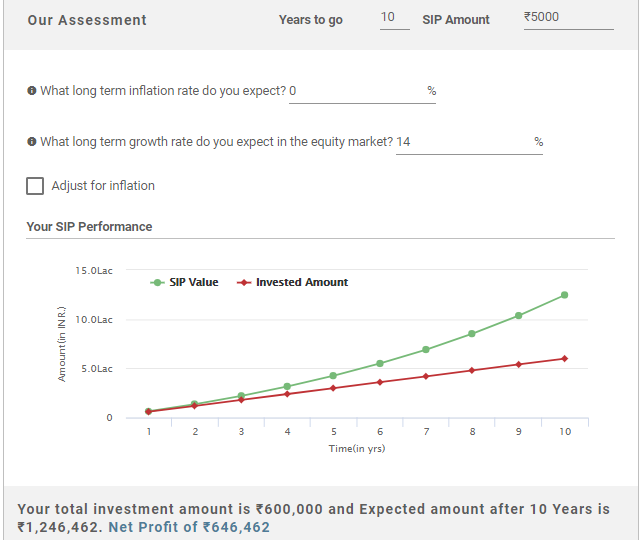

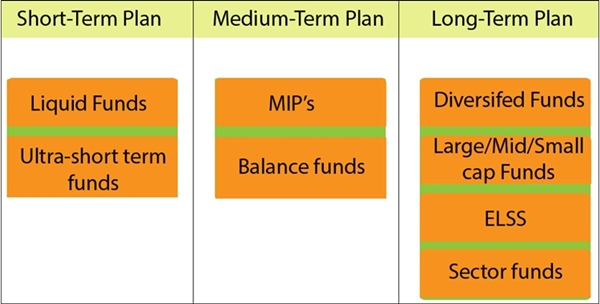

Yes, you can choose to fund your education or that of your child with the Systematic Investment plan (SIP). If you are planning to send your child abroad for higher studies in the near future, start saving with minimum amounts today! Start with as small an amount as Rs. 500 and increase your saving at your convenience.

Conclusion

Choosing the best education loan is the most important decision you will make for the advancement of your career. Make sure to do detailed research about every aspect so that you can experience the thrill of new opportunities the right funding can bring. Read all the necessary terms and conditions laid out by banks and make the right choice.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.