Top 5 Best Equity SIP Funds to Invest

If you want your investments to be favored in all market conditions, then take your investments SIP way! Systematic Investment Plans (SIPs) are considered to be the most efficient ways of investing in Mutual Funds. And if you are planning to invest in equities, then SIPs are the best way to make longing returns. Best equity SIP funds can give you the desirable returns in the long-term to fulfill Financial goals. So, let’s see how SIP works, benefits of SIP investment, significant use of a sip calculator along with the best performing SIP funds for equity investments.

Talk to our investment specialist

Systematic Investing for Equity Mutual Funds

Ideally, when investors plan to invest in equities, they often doubt about the stability of returns. This is because they are linked to the market and are often exposed to Volatility. Thus, to balance such volatility and ensure long-term stable returns, SIPs are highly recommendable in equity investments. Historically, in bad market phase, it is noticed that investors who had taken the SIP route earned more stable returns than those who took the lump sum route. SIP’s investment is spread out over time, unlike a lump sum investment which takes place all at once. Therefore, your money in SIP starts growing each day (being invested in the stock market).

A systematic Investment plan is also widely considered to achieve long-term financial goals like Retirement planning, child’s education, purchase of a house/car or any other assets. Before we look at some more benefits of investing in a SIP, let's check some of the best equity SIP funds to invest.

Best SIP Plans for Equity Funds 2026

Fund Selection Methodology used to find 5 funds

Best Large Cap Equity SIP Funds

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Indiabulls Blue Chip Fund Growth ₹42.48

↓ -0.52 ₹129 500 -4.6 -0.4 12.4 13.5 10.8 7.5 Nippon India Large Cap Fund Growth ₹89.2487

↓ -0.95 ₹50,107 100 -5.3 -1.8 11.3 17.6 16.4 9.2 SBI Bluechip Fund Growth ₹91.7862

↓ -1.03 ₹54,821 500 -4.5 -0.1 10.9 13.5 11.6 9.7 ICICI Prudential Bluechip Fund Growth ₹108.85

↓ -1.20 ₹76,646 100 -6.3 -1 10.8 16.7 14.6 11.3 Aditya Birla Sun Life Frontline Equity Fund Growth ₹510.43

↓ -5.53 ₹30,392 100 -6.9 -2.2 8.9 14 12.3 9.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 6 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Indiabulls Blue Chip Fund Nippon India Large Cap Fund SBI Bluechip Fund ICICI Prudential Bluechip Fund Aditya Birla Sun Life Frontline Equity Fund Point 1 Bottom quartile AUM (₹129 Cr). Lower mid AUM (₹50,107 Cr). Upper mid AUM (₹54,821 Cr). Highest AUM (₹76,646 Cr). Bottom quartile AUM (₹30,392 Cr). Point 2 Established history (14+ yrs). Established history (18+ yrs). Established history (20+ yrs). Established history (17+ yrs). Oldest track record among peers (23 yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 10.78% (bottom quartile). 5Y return: 16.42% (top quartile). 5Y return: 11.59% (bottom quartile). 5Y return: 14.65% (upper mid). 5Y return: 12.27% (lower mid). Point 6 3Y return: 13.49% (bottom quartile). 3Y return: 17.62% (top quartile). 3Y return: 13.47% (bottom quartile). 3Y return: 16.73% (upper mid). 3Y return: 14.03% (lower mid). Point 7 1Y return: 12.38% (top quartile). 1Y return: 11.30% (upper mid). 1Y return: 10.93% (lower mid). 1Y return: 10.77% (bottom quartile). 1Y return: 8.92% (bottom quartile). Point 8 Alpha: 0.28 (lower mid). Alpha: 0.30 (upper mid). Alpha: 0.16 (bottom quartile). Alpha: 0.35 (top quartile). Alpha: -0.21 (bottom quartile). Point 9 Sharpe: 0.29 (bottom quartile). Sharpe: 0.30 (top quartile). Sharpe: 0.29 (lower mid). Sharpe: 0.30 (upper mid). Sharpe: 0.26 (bottom quartile). Point 10 Information ratio: -0.32 (bottom quartile). Information ratio: 1.22 (top quartile). Information ratio: -0.33 (bottom quartile). Information ratio: 1.01 (upper mid). Information ratio: 0.31 (lower mid). Indiabulls Blue Chip Fund

Nippon India Large Cap Fund

SBI Bluechip Fund

ICICI Prudential Bluechip Fund

Aditya Birla Sun Life Frontline Equity Fund

Best Large & Mid Cap Equity SIP Funds

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Kotak Equity Opportunities Fund Growth ₹344.882

↓ -3.51 ₹29,991 1,000 -2 2.4 15.5 18.5 15.9 5.6 Invesco India Growth Opportunities Fund Growth ₹95.08

↓ -1.20 ₹8,959 100 -6.8 -6.5 13.8 22.8 16.4 4.7 DSP Equity Opportunities Fund Growth ₹610.531

↓ -7.88 ₹17,434 500 -4.6 1.2 10.4 19.1 15.4 7.1 SBI Large and Midcap Fund Growth ₹638.429

↑ 5.88 ₹37,497 500 -1.4 3.1 16.7 18 16.9 10.1 Bandhan Core Equity Fund Growth ₹132.641

↓ -1.31 ₹13,968 100 -5 -0.4 13 22.1 18.1 7.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 6 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Kotak Equity Opportunities Fund Invesco India Growth Opportunities Fund DSP Equity Opportunities Fund SBI Large and Midcap Fund Bandhan Core Equity Fund Point 1 Upper mid AUM (₹29,991 Cr). Bottom quartile AUM (₹8,959 Cr). Lower mid AUM (₹17,434 Cr). Highest AUM (₹37,497 Cr). Bottom quartile AUM (₹13,968 Cr). Point 2 Established history (21+ yrs). Established history (18+ yrs). Oldest track record among peers (25 yrs). Established history (20+ yrs). Established history (20+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 15.91% (bottom quartile). 5Y return: 16.40% (lower mid). 5Y return: 15.45% (bottom quartile). 5Y return: 16.93% (upper mid). 5Y return: 18.14% (top quartile). Point 6 3Y return: 18.51% (bottom quartile). 3Y return: 22.76% (top quartile). 3Y return: 19.08% (lower mid). 3Y return: 18.00% (bottom quartile). 3Y return: 22.11% (upper mid). Point 7 1Y return: 15.53% (upper mid). 1Y return: 13.81% (lower mid). 1Y return: 10.35% (bottom quartile). 1Y return: 16.74% (top quartile). 1Y return: 13.03% (bottom quartile). Point 8 Alpha: 2.61 (upper mid). Alpha: -0.94 (bottom quartile). Alpha: 1.22 (bottom quartile). Alpha: 3.74 (top quartile). Alpha: 1.38 (lower mid). Point 9 Sharpe: 0.44 (upper mid). Sharpe: 0.19 (bottom quartile). Sharpe: 0.34 (bottom quartile). Sharpe: 0.59 (top quartile). Sharpe: 0.36 (lower mid). Point 10 Information ratio: 0.08 (bottom quartile). Information ratio: 0.56 (upper mid). Information ratio: 0.30 (lower mid). Information ratio: -0.27 (bottom quartile). Information ratio: 1.08 (top quartile). Kotak Equity Opportunities Fund

Invesco India Growth Opportunities Fund

DSP Equity Opportunities Fund

SBI Large and Midcap Fund

Bandhan Core Equity Fund

Best Mid Cap Equity SIP Funds

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Kotak Emerging Equity Scheme Growth ₹133.007

↓ -0.79 ₹59,041 1,000 -2.1 -2 17.3 20.3 18.1 1.8 Sundaram Mid Cap Fund Growth ₹1,381.45

↓ -8.42 ₹12,917 100 -3.7 0.2 17.1 23.5 18.4 4.1 Taurus Discovery (Midcap) Fund Growth ₹111.4

↓ -0.62 ₹123 1,000 -8.6 -7.9 6.5 13.8 12.6 0.8 Edelweiss Mid Cap Fund Growth ₹100.672

↓ -0.49 ₹13,802 500 -3.2 0.5 17.7 24.7 20.3 3.8 HDFC Mid-Cap Opportunities Fund Growth ₹194.667

↓ -1.64 ₹92,187 300 -4.4 1.4 16.1 24 21.2 6.8 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 6 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Kotak Emerging Equity Scheme Sundaram Mid Cap Fund Taurus Discovery (Midcap) Fund Edelweiss Mid Cap Fund HDFC Mid-Cap Opportunities Fund Point 1 Upper mid AUM (₹59,041 Cr). Bottom quartile AUM (₹12,917 Cr). Bottom quartile AUM (₹123 Cr). Lower mid AUM (₹13,802 Cr). Highest AUM (₹92,187 Cr). Point 2 Established history (18+ yrs). Established history (23+ yrs). Oldest track record among peers (31 yrs). Established history (18+ yrs). Established history (18+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 4★ (lower mid). Rating: 3★ (bottom quartile). Rating: 3★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: High. Risk profile: Moderately High. Point 5 5Y return: 18.10% (bottom quartile). 5Y return: 18.45% (lower mid). 5Y return: 12.64% (bottom quartile). 5Y return: 20.34% (upper mid). 5Y return: 21.19% (top quartile). Point 6 3Y return: 20.30% (bottom quartile). 3Y return: 23.47% (lower mid). 3Y return: 13.79% (bottom quartile). 3Y return: 24.70% (top quartile). 3Y return: 24.00% (upper mid). Point 7 1Y return: 17.25% (upper mid). 1Y return: 17.07% (lower mid). 1Y return: 6.53% (bottom quartile). 1Y return: 17.71% (top quartile). 1Y return: 16.14% (bottom quartile). Point 8 Alpha: -0.96 (bottom quartile). Alpha: 0.78 (lower mid). Alpha: -5.93 (bottom quartile). Alpha: 1.70 (upper mid). Alpha: 3.73 (top quartile). Point 9 Sharpe: 0.18 (bottom quartile). Sharpe: 0.28 (lower mid). Sharpe: -0.09 (bottom quartile). Sharpe: 0.33 (upper mid). Sharpe: 0.49 (top quartile). Point 10 Information ratio: -0.44 (bottom quartile). Information ratio: 0.23 (lower mid). Information ratio: -1.68 (bottom quartile). Information ratio: 0.49 (top quartile). Information ratio: 0.47 (upper mid). Kotak Emerging Equity Scheme

Sundaram Mid Cap Fund

Taurus Discovery (Midcap) Fund

Edelweiss Mid Cap Fund

HDFC Mid-Cap Opportunities Fund

Best Small Cap Equity SIP Funds

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Aditya Birla Sun Life Small Cap Fund Growth ₹81.7082

↓ -0.50 ₹4,778 1,000 -3.5 -2.9 12.3 16.7 13.6 -3.7 SBI Small Cap Fund Growth ₹155.589

↓ -0.30 ₹34,449 500 -7.5 -9.8 2.6 11.7 14.1 -4.9 DSP Small Cap Fund Growth ₹186.927

↓ -0.94 ₹16,135 500 -3.9 -4.6 12.7 18.4 18.4 -2.8 HDFC Small Cap Fund Growth ₹128.818

↓ -0.85 ₹36,941 300 -7.2 -8.9 8.7 16.4 19.2 -0.6 Nippon India Small Cap Fund Growth ₹157.625

↓ -0.54 ₹65,812 100 -4.8 -6.1 8.3 19.2 21.6 -4.7 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 6 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Aditya Birla Sun Life Small Cap Fund SBI Small Cap Fund DSP Small Cap Fund HDFC Small Cap Fund Nippon India Small Cap Fund Point 1 Bottom quartile AUM (₹4,778 Cr). Lower mid AUM (₹34,449 Cr). Bottom quartile AUM (₹16,135 Cr). Upper mid AUM (₹36,941 Cr). Highest AUM (₹65,812 Cr). Point 2 Oldest track record among peers (18 yrs). Established history (16+ yrs). Established history (18+ yrs). Established history (17+ yrs). Established history (15+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 13.56% (bottom quartile). 5Y return: 14.08% (bottom quartile). 5Y return: 18.42% (lower mid). 5Y return: 19.22% (upper mid). 5Y return: 21.58% (top quartile). Point 6 3Y return: 16.68% (lower mid). 3Y return: 11.73% (bottom quartile). 3Y return: 18.37% (upper mid). 3Y return: 16.41% (bottom quartile). 3Y return: 19.22% (top quartile). Point 7 1Y return: 12.26% (upper mid). 1Y return: 2.57% (bottom quartile). 1Y return: 12.71% (top quartile). 1Y return: 8.68% (lower mid). 1Y return: 8.31% (bottom quartile). Point 8 Alpha: 0.00 (top quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Alpha: -0.64 (bottom quartile). Point 9 Sharpe: 0.01 (upper mid). Sharpe: -0.41 (bottom quartile). Sharpe: -0.02 (lower mid). Sharpe: 0.05 (top quartile). Sharpe: -0.19 (bottom quartile). Point 10 Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.00 (bottom quartile). Information ratio: 0.02 (top quartile). Aditya Birla Sun Life Small Cap Fund

SBI Small Cap Fund

DSP Small Cap Fund

HDFC Small Cap Fund

Nippon India Small Cap Fund

Best Multi Cap Equity SIP Funds

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Kotak Standard Multicap Fund Growth ₹84.89

↓ -0.72 ₹56,479 500 -2.6 1.6 15.2 16.5 13 9.5 Mirae Asset India Equity Fund Growth ₹109.706

↓ -1.28 ₹40,371 1,000 -7.1 -2.3 8.9 11.8 10.5 10.2 Motilal Oswal Multicap 35 Fund Growth ₹54.936

↓ -0.41 ₹13,180 500 -11.3 -11.9 0.4 19.3 11.3 -5.6 BNP Paribas Multi Cap Fund Growth ₹73.5154

↓ -0.01 ₹588 300 -4.6 -2.6 19.3 17.3 13.6 Aditya Birla Sun Life Equity Fund Growth ₹1,799.17

↓ -11.93 ₹24,700 100 -4.5 1.5 14.2 17.4 13.6 11.2 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 6 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Kotak Standard Multicap Fund Mirae Asset India Equity Fund Motilal Oswal Multicap 35 Fund BNP Paribas Multi Cap Fund Aditya Birla Sun Life Equity Fund Point 1 Highest AUM (₹56,479 Cr). Upper mid AUM (₹40,371 Cr). Bottom quartile AUM (₹13,180 Cr). Bottom quartile AUM (₹588 Cr). Lower mid AUM (₹24,700 Cr). Point 2 Established history (16+ yrs). Established history (17+ yrs). Established history (11+ yrs). Established history (20+ yrs). Oldest track record among peers (27 yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 13.01% (lower mid). 5Y return: 10.45% (bottom quartile). 5Y return: 11.28% (bottom quartile). 5Y return: 13.57% (upper mid). 5Y return: 13.60% (top quartile). Point 6 3Y return: 16.53% (bottom quartile). 3Y return: 11.84% (bottom quartile). 3Y return: 19.30% (top quartile). 3Y return: 17.28% (lower mid). 3Y return: 17.39% (upper mid). Point 7 1Y return: 15.17% (upper mid). 1Y return: 8.88% (bottom quartile). 1Y return: 0.40% (bottom quartile). 1Y return: 19.34% (top quartile). 1Y return: 14.22% (lower mid). Point 8 Alpha: 3.74 (top quartile). Alpha: 0.02 (lower mid). Alpha: -5.98 (bottom quartile). Alpha: 0.00 (bottom quartile). Alpha: 3.72 (upper mid). Point 9 Sharpe: 0.46 (lower mid). Sharpe: 0.27 (bottom quartile). Sharpe: -0.19 (bottom quartile). Sharpe: 2.86 (top quartile). Sharpe: 0.48 (upper mid). Point 10 Information ratio: 0.19 (lower mid). Information ratio: -0.62 (bottom quartile). Information ratio: 0.56 (upper mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.76 (top quartile). Kotak Standard Multicap Fund

Mirae Asset India Equity Fund

Motilal Oswal Multicap 35 Fund

BNP Paribas Multi Cap Fund

Aditya Birla Sun Life Equity Fund

Best Sector Equity SIP Funds

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP Natural Resources and New Energy Fund Growth ₹107.797

↑ 1.36 ₹1,765 500 12.8 19.1 34 23.6 20.5 17.5 Franklin Build India Fund Growth ₹143.766

↓ -0.94 ₹3,003 500 0.8 2.9 17.1 26.2 22.7 3.7 Aditya Birla Sun Life Banking And Financial Services Fund Growth ₹61.22

↓ -1.16 ₹3,641 1,000 -5 3.7 17 15.5 12.1 17.5 ICICI Prudential Banking and Financial Services Fund Growth ₹130.72

↓ -2.37 ₹10,951 100 -6.4 -0.2 12.3 14.2 11.5 15.9 Bandhan Infrastructure Fund Growth ₹45.942

↓ -0.03 ₹1,428 100 -4.1 -6.7 6.3 22.5 19.7 -6.9 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 5 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP Natural Resources and New Energy Fund Franklin Build India Fund Aditya Birla Sun Life Banking And Financial Services Fund ICICI Prudential Banking and Financial Services Fund Bandhan Infrastructure Fund Point 1 Bottom quartile AUM (₹1,765 Cr). Lower mid AUM (₹3,003 Cr). Upper mid AUM (₹3,641 Cr). Highest AUM (₹10,951 Cr). Bottom quartile AUM (₹1,428 Cr). Point 2 Oldest track record among peers (17 yrs). Established history (16+ yrs). Established history (12+ yrs). Established history (17+ yrs). Established history (15+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 5★ (bottom quartile). Rating: 5★ (bottom quartile). Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 20.54% (upper mid). 5Y return: 22.67% (top quartile). 5Y return: 12.07% (bottom quartile). 5Y return: 11.53% (bottom quartile). 5Y return: 19.68% (lower mid). Point 6 3Y return: 23.59% (upper mid). 3Y return: 26.21% (top quartile). 3Y return: 15.53% (bottom quartile). 3Y return: 14.20% (bottom quartile). 3Y return: 22.50% (lower mid). Point 7 1Y return: 34.03% (top quartile). 1Y return: 17.13% (upper mid). 1Y return: 17.03% (lower mid). 1Y return: 12.26% (bottom quartile). 1Y return: 6.29% (bottom quartile). Point 8 Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.61 (top quartile). Alpha: -2.00 (bottom quartile). Alpha: 0.00 (bottom quartile). Point 9 Sharpe: 1.32 (top quartile). Sharpe: 0.21 (bottom quartile). Sharpe: 1.03 (upper mid). Sharpe: 0.78 (lower mid). Sharpe: -0.27 (bottom quartile). Point 10 Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.25 (top quartile). Information ratio: -0.01 (bottom quartile). Information ratio: 0.00 (bottom quartile). DSP Natural Resources and New Energy Fund

Franklin Build India Fund

Aditya Birla Sun Life Banking And Financial Services Fund

ICICI Prudential Banking and Financial Services Fund

Bandhan Infrastructure Fund

Best ELSS SIP Funds

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Tata India Tax Savings Fund Growth ₹44.2385

↓ -0.47 ₹4,566 500 -3.9 1.8 11.8 15 13.2 4.9 Bandhan Tax Advantage (ELSS) Fund Growth ₹150.525

↓ -0.83 ₹7,060 500 -5.1 0.2 10.3 14.6 14.6 8 Aditya Birla Sun Life Tax Relief '96 Growth ₹58.98

↓ -0.72 ₹14,993 500 -6 -2.5 11.2 14.4 8.3 9.3 DSP Tax Saver Fund Growth ₹137.34

↓ -2.06 ₹17,223 500 -5 1 9.7 18.5 15.7 7.5 HDFC Long Term Advantage Fund Growth ₹595.168

↑ 0.28 ₹1,318 500 1.2 15.4 35.5 20.6 17.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 6 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Tata India Tax Savings Fund Bandhan Tax Advantage (ELSS) Fund Aditya Birla Sun Life Tax Relief '96 DSP Tax Saver Fund HDFC Long Term Advantage Fund Point 1 Bottom quartile AUM (₹4,566 Cr). Lower mid AUM (₹7,060 Cr). Upper mid AUM (₹14,993 Cr). Highest AUM (₹17,223 Cr). Bottom quartile AUM (₹1,318 Cr). Point 2 Established history (11+ yrs). Established history (17+ yrs). Established history (18+ yrs). Established history (19+ yrs). Oldest track record among peers (25 yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Rating: 3★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 13.19% (bottom quartile). 5Y return: 14.59% (lower mid). 5Y return: 8.26% (bottom quartile). 5Y return: 15.71% (upper mid). 5Y return: 17.39% (top quartile). Point 6 3Y return: 15.04% (lower mid). 3Y return: 14.63% (bottom quartile). 3Y return: 14.43% (bottom quartile). 3Y return: 18.48% (upper mid). 3Y return: 20.64% (top quartile). Point 7 1Y return: 11.78% (upper mid). 1Y return: 10.33% (bottom quartile). 1Y return: 11.22% (lower mid). 1Y return: 9.68% (bottom quartile). 1Y return: 35.51% (top quartile). Point 8 Alpha: -0.76 (bottom quartile). Alpha: 0.34 (bottom quartile). Alpha: 3.77 (top quartile). Alpha: 1.75 (upper mid). Alpha: 1.75 (lower mid). Point 9 Sharpe: 0.14 (bottom quartile). Sharpe: 0.21 (bottom quartile). Sharpe: 0.50 (upper mid). Sharpe: 0.33 (lower mid). Sharpe: 2.27 (top quartile). Point 10 Information ratio: -0.35 (bottom quartile). Information ratio: -0.30 (lower mid). Information ratio: -0.43 (bottom quartile). Information ratio: 0.93 (top quartile). Information ratio: -0.15 (upper mid). Tata India Tax Savings Fund

Bandhan Tax Advantage (ELSS) Fund

Aditya Birla Sun Life Tax Relief '96

DSP Tax Saver Fund

HDFC Long Term Advantage Fund

Best Value Equity SIP Funds

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Tata Equity PE Fund Growth ₹343.041

↓ -3.38 ₹8,819 150 -5.2 1 10.6 18 15.5 3.7 JM Value Fund Growth ₹88.9187

↓ -0.54 ₹885 500 -7.4 -7.7 2.6 17.2 15.9 -4.4 HDFC Capital Builder Value Fund Growth ₹734.033

↓ -7.24 ₹7,487 300 -4.9 0.9 13.8 18.4 15.6 8.6 Aditya Birla Sun Life Pure Value Fund Growth ₹123.063

↓ -0.90 ₹6,246 1,000 -4 2.7 11.1 19 15.4 2.6 Templeton India Value Fund Growth ₹707.745

↓ -6.66 ₹2,265 500 -3.6 0.9 9.6 16.4 16.6 6.8 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 6 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Tata Equity PE Fund JM Value Fund HDFC Capital Builder Value Fund Aditya Birla Sun Life Pure Value Fund Templeton India Value Fund Point 1 Highest AUM (₹8,819 Cr). Bottom quartile AUM (₹885 Cr). Upper mid AUM (₹7,487 Cr). Lower mid AUM (₹6,246 Cr). Bottom quartile AUM (₹2,265 Cr). Point 2 Established history (21+ yrs). Established history (28+ yrs). Oldest track record among peers (32 yrs). Established history (17+ yrs). Established history (29+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 3★ (lower mid). Rating: 3★ (bottom quartile). Rating: 3★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 15.46% (bottom quartile). 5Y return: 15.87% (upper mid). 5Y return: 15.55% (lower mid). 5Y return: 15.42% (bottom quartile). 5Y return: 16.62% (top quartile). Point 6 3Y return: 17.97% (lower mid). 3Y return: 17.18% (bottom quartile). 3Y return: 18.43% (upper mid). 3Y return: 18.96% (top quartile). 3Y return: 16.38% (bottom quartile). Point 7 1Y return: 10.60% (lower mid). 1Y return: 2.60% (bottom quartile). 1Y return: 13.81% (top quartile). 1Y return: 11.11% (upper mid). 1Y return: 9.58% (bottom quartile). Point 8 Alpha: 0.27 (upper mid). Alpha: -9.27 (bottom quartile). Alpha: 2.68 (top quartile). Alpha: -1.64 (bottom quartile). Alpha: -0.11 (lower mid). Point 9 Sharpe: 0.22 (upper mid). Sharpe: -0.40 (bottom quartile). Sharpe: 0.39 (top quartile). Sharpe: 0.10 (bottom quartile). Sharpe: 0.18 (lower mid). Point 10 Information ratio: 0.89 (upper mid). Information ratio: 0.35 (bottom quartile). Information ratio: 1.10 (top quartile). Information ratio: 0.57 (lower mid). Information ratio: 0.32 (bottom quartile). Tata Equity PE Fund

JM Value Fund

HDFC Capital Builder Value Fund

Aditya Birla Sun Life Pure Value Fund

Templeton India Value Fund

Best Focused Equity SIP Funds

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Axis Focused 25 Fund Growth ₹51.07

↓ -0.68 ₹11,382 500 -8.3 -7.1 5.3 10.9 5.6 2.5 Aditya Birla Sun Life Focused Equity Fund Growth ₹141.628

↓ -1.20 ₹8,068 1,000 -5 1.7 11.9 16.1 13 10.1 Sundaram Select Focus Fund Growth ₹264.968

↓ -1.18 ₹1,354 100 -5 8.5 24.5 17 17.3 Motilal Oswal Focused 25 Fund Growth ₹42.123

↓ -0.03 ₹1,445 500 -3.1 0.4 15.3 9.7 6.9 -1.7 HDFC Focused 30 Fund Growth ₹229.159

↓ -3.38 ₹26,332 300 -4.5 -1.1 11.5 19.9 20.3 10.9 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 6 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Axis Focused 25 Fund Aditya Birla Sun Life Focused Equity Fund Sundaram Select Focus Fund Motilal Oswal Focused 25 Fund HDFC Focused 30 Fund Point 1 Upper mid AUM (₹11,382 Cr). Lower mid AUM (₹8,068 Cr). Bottom quartile AUM (₹1,354 Cr). Bottom quartile AUM (₹1,445 Cr). Highest AUM (₹26,332 Cr). Point 2 Established history (13+ yrs). Established history (20+ yrs). Oldest track record among peers (23 yrs). Established history (12+ yrs). Established history (21+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 3★ (lower mid). Rating: 3★ (bottom quartile). Rating: 3★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 5.58% (bottom quartile). 5Y return: 13.03% (lower mid). 5Y return: 17.29% (upper mid). 5Y return: 6.87% (bottom quartile). 5Y return: 20.32% (top quartile). Point 6 3Y return: 10.91% (bottom quartile). 3Y return: 16.08% (lower mid). 3Y return: 17.03% (upper mid). 3Y return: 9.67% (bottom quartile). 3Y return: 19.90% (top quartile). Point 7 1Y return: 5.28% (bottom quartile). 1Y return: 11.86% (lower mid). 1Y return: 24.49% (top quartile). 1Y return: 15.33% (upper mid). 1Y return: 11.52% (bottom quartile). Point 8 Alpha: -3.90 (bottom quartile). Alpha: 3.66 (upper mid). Alpha: -5.62 (bottom quartile). Alpha: -2.93 (lower mid). Alpha: 3.79 (top quartile). Point 9 Sharpe: -0.10 (bottom quartile). Sharpe: 0.49 (lower mid). Sharpe: 1.85 (top quartile). Sharpe: 0.04 (bottom quartile). Sharpe: 0.60 (upper mid). Point 10 Information ratio: -0.76 (bottom quartile). Information ratio: 0.23 (upper mid). Information ratio: -0.52 (lower mid). Information ratio: -0.68 (bottom quartile). Information ratio: 0.98 (top quartile). Axis Focused 25 Fund

Aditya Birla Sun Life Focused Equity Fund

Sundaram Select Focus Fund

Motilal Oswal Focused 25 Fund

HDFC Focused 30 Fund

Taxation on Equity Funds

As per the Budget 2018 speech, a new Long Term Capital Gains (LTCG) tax on equity oriented Mutual Funds & stocks will be applicable from 1st April. The Finance Bill 2018 was passed by voice vote in Lok Sabha on 14th March 2018. Here’s how new income tax changes will impact the equity investments from 1st April 2018. *

1. Long Term Capital Gains

LTCGs exceeding INR 1 lakh arising from redemption of Mutual Fund units or equities on or after 1st April 2018, will be taxed at 10 percent (plus cess) or at 10.4 percent. Long-term capital gains till INR 1 lakh will be exempt. For example, if you earn INR 3 lakhs in combined long-term capital gains from stocks or Mutual Fund investments in a financial year. The taxable LTCGs will be INR 2 lakh (INR 3 lakh - 1 lakh) and tax liability will be INR 20,000 (10 per cent of INR 2 lakh).

Long-term capital gains are the profit arising from selling or redemption of Equity Funds held more than a year.

2. Short Term Capital Gains

If Mutual Fund units are sold before one year of holding, Short Term Capital Gains (STCGs) tax will apply. The STCGs tax has been kept unchanged at 15 percent.

| Equity Schemes | Holding Period | Tax Rate |

|---|---|---|

| Long Term Capital Gains (LTCG) | More than 1 Year | 10% (with no indexation)***** |

| Short Term Capital Gains (STCG) | Less than or equal to a year | 15% |

| Tax on Distributed Dividend | - | 10%# |

*Gains up to INR 1 lakh are free of tax. Tax at 10% applies to gains above INR 1 lakh. Earlier rate was 0% cost calculated as closing price on Jan 31, 2018. #Dividend tax of 10% + Surcharge 12% + Cess 4% =11.648% Health & Education Cess of 4% introduced. Earlier, education Cess was 3%.

Benefits of SIP Investment

Some of the important Benefits of Systematic Investment Plans are:

Rupee Cost Averaging

One of the biggest advantages that a SIP offer is Rupee Cost Averaging, which helps an individual to average out the cost of an asset purchase. While making a lump sum investment in a mutual fund a certain number of units are purchased by the investor all at once, in the case of a SIP the purchase of units is done over a long period and these are spread out equally over monthly intervals (usually). Due to the investment being spread out over time, the investment is made into the stock market at different price points giving the investor the benefit of averaging cost, hence the term rupee cost averaging.

Power of Compounding

SIPs offer the benefit of the Power of Compounding. Simple interest is when you gain interest on only the principal. In the case of compound interest, the interest amount is added to the principal, and interest is calculated on the new principal (old principal plus gains). This process continues every time. Since the mutual funds in the SIP are in instalments, they are compounded, which adds more to the initially invested sum.

Affordability

SIPs are very affordable. The monthly minimum investment amount in SIP can be as low as INR 500. Some fund houses, even offer something called a “MicroSIP” where the ticket size is as low as INR 100. This gives a good option for young people to start their long-term investment at an early stage of life.

SIP Calculator

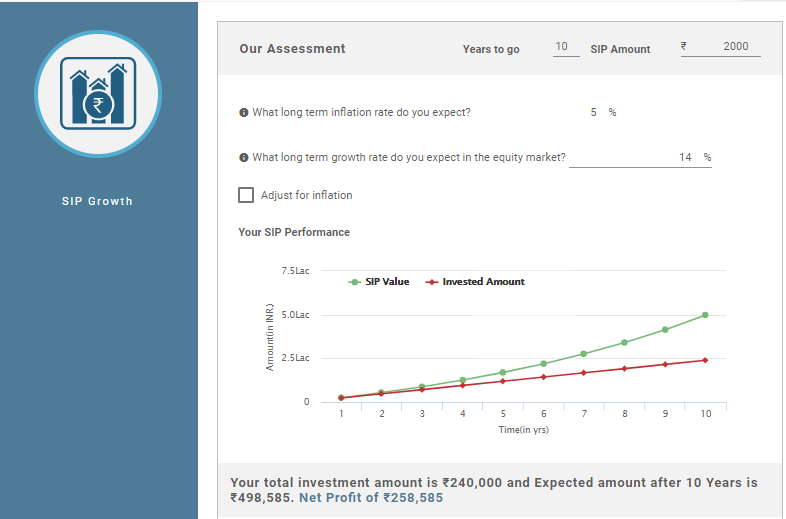

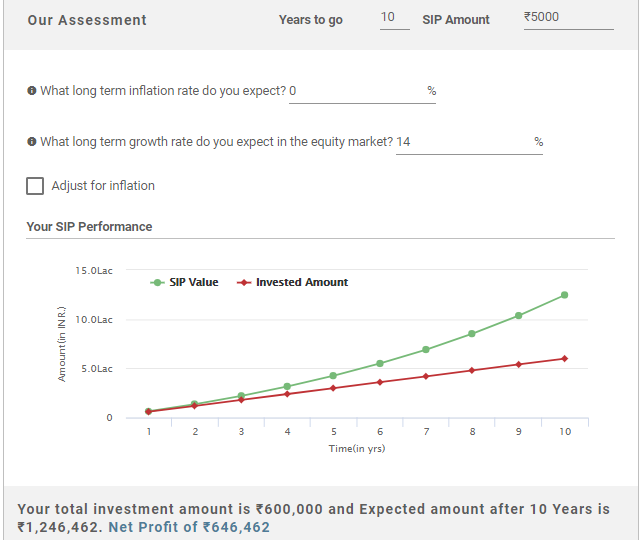

SIP calculator can be the most useful tool in your investment. It estimates the growth for your SIP investment till the time you would want to stay invested. So, before even Investing in a fund, one can predetermine their total SIP earnings via SIP calculator. The calculators normally take inputs such as the SIP investment amount one seeks to invest, the tenure of investing, expected inflation rates (one needs to account for this). The illustration of this is given below:

Let’s suppose, if you invest INR 5,000 for 10 years, see how your SIP investment grows-

Monthly Investment: INR 5,000

Investment Period: 10 years

Total Amount Invested: INR 6,00,000

Long-term Growth Rate (approx.): 14%

Expected Returns as per SIP calculator: INR 12,46,462

Net Profit: INR 6,46,462

The above calculations show that if you invest INR 5,000 monthly for 10 years (a total of INR 6,00,000) you will earn INR 12,46,462 which means the net profit you make is INR 6,46,462. Isn’t it great!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.