Savings Calculator

What is wealth accumulation calculator?

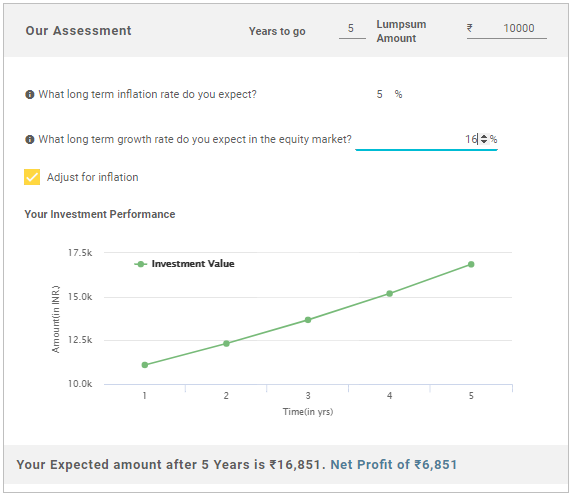

To secure a more financially stable future, one needs to have financial discipline in his younger formative years. Wealth accumulation is one of the most satisfactory things that can be achieved with the money which a person has currently. Suppose, you are 30 now and you have 30 more years to invest towards your retirement. To accumulate wealth for retirement, you need to decide for how long you want to receive the annuities from the plan. Say, you want to receive an annuity of Rs. 50,000 for a period of 30 years – up to age 90 – (50,000*30), you need to calculate how much you must invest as a corpus at the rate of the current interest. This is where a wealth accumulation calculator can help you

Investment Amount:₹400,000 Interest Earned:₹115,720.87 Maturity Amount: ₹515,720.87Savings Calculator

Talk to our investment specialist

Why should you have a financial plan in place

Other than a comprehensive Financial plan, there is no shortcut to secure a comfortable financial future. After working all these years, you deserve that comfort and peace of mind. You can spend your golden years travelling and catch up with your peers or enjoy a laid back life with your loved ones. financial planning is all about chasing your dreams (short or long term) without having to think about the money. Financial planning will prepare you for any emergency (that money can solve) and give you peace that even if something unfortunate happens to you, your family will not suffer.

Analyze your current situation: Do you have your insurances (medical, vehicle or Life Insurance) in place? Are you able to put aside a certain amount regularly after expenses? Do you have a plan B for emergency situations? What about outstanding loans and dues, if any? Answers to these can help you analyze this

Existing Debts: Nothing gives the financially conscientious a bigger nightmare than debts. With credit card companies, banks and NBFCs issuing unsecured loans to people from all income class, people rely a lot on instant loans to take care of their immediate needs. This has to change. Start by paying off a little more than required and close the debts at the earliest

Allocate Assets Wisely: When you choose assets to invest in, understand the purpose of the particular product. For instance, if you balance your equity investments with debt funds or a safer financial tool like FD, it can spread the risks. Balancing is a key step to wealth accumulation

To build wealth or save tax: You must focus on a diversified investment Portfolio that can do both – then only you can accumulate wealth. Do you know which tax slab you belong to and what are the legal options (including 80c deductions) you have to save tax? There are excellent opportunities like ELSS which will help you to build wealth and save tax at the same time

Fund Selection Methodology used to find 2 funds

Top Funds for 2026

*Best funds based on 1 year performance.

"The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in units of MLIIF - WGF. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or units of money market/liquid schemes of DSP Merrill Lynch Mutual Fund, in order to meet liquidity requirements from time to time. However, there is no assurance that the investment objective of the Scheme will be realized." Below is the key information for DSP World Gold Fund Returns up to 1 year are on The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in the units of BlackRock Global Funds – World Mining Fund. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may

constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or money market/liquid schemes of DSP BlackRock Mutual Fund, in order to meet liquidity requirements from time to time. Research Highlights for DSP World Mining Fund Below is the key information for DSP World Mining Fund Returns up to 1 year are on 1. DSP World Gold Fund

DSP World Gold Fund

Growth Launch Date 14 Sep 07 NAV (24 Feb 26) ₹66.2843 ↓ -0.31 (-0.46 %) Net Assets (Cr) ₹1,975 on 31 Jan 26 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.41 Sharpe Ratio 3.41 Information Ratio -0.47 Alpha Ratio 2.12 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹8,807 31 Jan 23 ₹9,422 31 Jan 24 ₹8,517 31 Jan 25 ₹12,548 31 Jan 26 ₹33,170 Returns for DSP World Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Feb 26 Duration Returns 1 Month 1.1% 3 Month 45.3% 6 Month 91.8% 1 Year 176.1% 3 Year 63.5% 5 Year 31% 10 Year 15 Year Since launch 10.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 167.1% 2023 15.9% 2022 7% 2021 -7.7% 2020 -9% 2019 31.4% 2018 35.1% 2017 -10.7% 2016 -4% 2015 52.7% Fund Manager information for DSP World Gold Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.93 Yr. Data below for DSP World Gold Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Basic Materials 95.89% Asset Allocation

Asset Class Value Cash 1.55% Equity 95.89% Debt 0.01% Other 2.56% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Gold I2

Investment Fund | -74% ₹1,458 Cr 1,177,658

↓ -41,596 VanEck Gold Miners ETF

- | GDX25% ₹497 Cr 573,719 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -2% ₹35 Cr Net Receivables/Payables

Net Current Assets | -1% -₹15 Cr 2. DSP World Mining Fund

DSP World Mining Fund

Growth Launch Date 29 Dec 09 NAV (24 Feb 26) ₹33.1134 ↑ 0.06 (0.18 %) Net Assets (Cr) ₹181 on 31 Jan 26 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.14 Sharpe Ratio 3.17 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹11,733 31 Jan 23 ₹14,422 31 Jan 24 ₹12,454 31 Jan 25 ₹12,799 31 Jan 26 ₹25,833 Returns for DSP World Mining Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Feb 26 Duration Returns 1 Month 3.8% 3 Month 43.1% 6 Month 74.4% 1 Year 106.7% 3 Year 27.1% 5 Year 19.2% 10 Year 15 Year Since launch 7.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 79% 2023 -8.1% 2022 0% 2021 12.2% 2020 18% 2019 34.9% 2018 21.5% 2017 -9.4% 2016 21.1% 2015 49.7% Fund Manager information for DSP World Mining Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.93 Yr. Data below for DSP World Mining Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Basic Materials 95.77% Energy 1.05% Asset Allocation

Asset Class Value Cash 3.15% Equity 96.82% Debt 0.02% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Mining I2

Investment Fund | -99% ₹180 Cr 149,227

↓ -1,163 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -1% ₹2 Cr Net Receivables/Payables

Net Current Assets | -0% ₹0 Cr

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Research Highlights for DSP World Gold Fund