FD Calculator - Fixed Deposit Calculator

Fixed Deposits are long-term investment tool which helps investors save money for the long term. Investors can choose a fixed tenure for which the deposit will be kept with the Bank. In general, FD investments are better for those looking for long-term wealth creation as they offer high interest rates as compared to savings accounts.

How is FD interest Calculated?

Interest on FD is compounded quarterly, in most banks. The formula for this is:

A = P * (1+ r/n) ^ n*t , where

- I = A – P

- A = Maturity value

- P = Principal amount

- r = rate of interest

- t = Number of years

- n = Compounded interest frequency

- I = Interest earned amount

Benefits of FD

- FD can be used as Collateral for taking loans. You can take up to 80-90% loans on your FD amount

- The depositor can choose to transfer the amount at the time of maturity for a further Fixed Deposit.

- The money can be deposited only once. Once deposited, withdrawal of money from the account will accrue a penalty.

- FD schemes are good investment tools for those who have surplus funds and want to earn money from it.

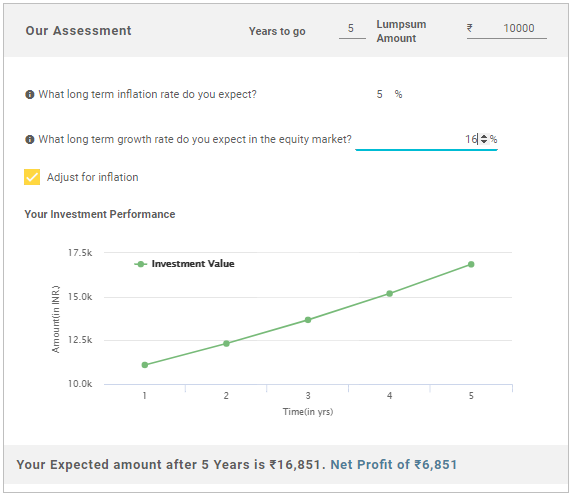

Investment Amount:₹100,000 Interest Earned:₹28,930.22 Maturity Amount: ₹128,930.22Fixed Deposit (FD) Calculator

Talk to our investment specialist

Fund Selection Methodology used to find 5 funds

Tax Benefits on FD

Similar to other personal tax-saving and investment instruments, Fixed Deposits schemes also attract taxes. A TDS of 10% is deducted on the returns accrued from an FD if the total interest exceeds Rs. 10,000 in a single financial year.

Let’s compare this to the SIP scheme and you can see that SIPs are more beneficial for the long term. Since long-term gains from equity are tax-free, any SIP which invests in ELSS (Equity Linked Mutual Funds) is also tax-free after one year.

*Below is the list of fund based on last 1 year performance & having fund age > 1 year.

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP World Gold Fund Growth ₹66.5931

↑ 2.21 ₹1,975 500 52.1 92.7 172.7 62.5 31 167.1 DSP World Mining Fund Growth ₹33.0538

↑ 0.78 ₹181 500 47.9 74.1 101.7 25.4 19.6 79 DSP World Energy Fund Growth ₹27.0424

↑ 0.07 ₹103 500 24.6 29.9 54 15.8 12.9 39.2 Edelweiss Emerging Markets Opportunities Equity Off-shore Fund Growth ₹24.5533

↑ 0.21 ₹191 1,000 23.5 37 51.6 20.6 5.8 41.1 Kotak Global Emerging Market Fund Growth ₹34.9

↑ 0.17 ₹539 1,000 21.5 29.3 47.4 20.9 7.6 39.1 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 23 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP World Gold Fund DSP World Mining Fund DSP World Energy Fund Edelweiss Emerging Markets Opportunities Equity Off-shore Fund Kotak Global Emerging Market Fund Point 1 Highest AUM (₹1,975 Cr). Bottom quartile AUM (₹181 Cr). Bottom quartile AUM (₹103 Cr). Lower mid AUM (₹191 Cr). Upper mid AUM (₹539 Cr). Point 2 Oldest track record among peers (18 yrs). Established history (16+ yrs). Established history (16+ yrs). Established history (11+ yrs). Established history (18+ yrs). Point 3 Top rated. Rating: 3★ (upper mid). Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Rating: 3★ (bottom quartile). Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 31.02% (top quartile). 5Y return: 19.56% (upper mid). 5Y return: 12.90% (lower mid). 5Y return: 5.80% (bottom quartile). 5Y return: 7.60% (bottom quartile). Point 6 3Y return: 62.48% (top quartile). 3Y return: 25.44% (upper mid). 3Y return: 15.78% (bottom quartile). 3Y return: 20.64% (bottom quartile). 3Y return: 20.94% (lower mid). Point 7 1Y return: 172.70% (top quartile). 1Y return: 101.73% (upper mid). 1Y return: 53.96% (lower mid). 1Y return: 51.58% (bottom quartile). 1Y return: 47.40% (bottom quartile). Point 8 Alpha: 2.12 (top quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: -0.75 (bottom quartile). Alpha: -1.44 (bottom quartile). Point 9 Sharpe: 3.41 (top quartile). Sharpe: 3.17 (upper mid). Sharpe: 1.88 (bottom quartile). Sharpe: 2.68 (lower mid). Sharpe: 2.63 (bottom quartile). Point 10 Information ratio: -0.47 (lower mid). Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: -0.84 (bottom quartile). Information ratio: -0.59 (bottom quartile). DSP World Gold Fund

DSP World Mining Fund

DSP World Energy Fund

Edelweiss Emerging Markets Opportunities Equity Off-shore Fund

Kotak Global Emerging Market Fund

Top Funds for 2026

*Best funds based on 1 year performance.

"The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in units of MLIIF - WGF. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or units of money market/liquid schemes of DSP Merrill Lynch Mutual Fund, in order to meet liquidity requirements from time to time. However, there is no assurance that the investment objective of the Scheme will be realized." Below is the key information for DSP World Gold Fund Returns up to 1 year are on The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in the units of BlackRock Global Funds – World Mining Fund. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may

constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or money market/liquid schemes of DSP BlackRock Mutual Fund, in order to meet liquidity requirements from time to time. Research Highlights for DSP World Mining Fund Below is the key information for DSP World Mining Fund Returns up to 1 year are on 1. DSP World Gold Fund

DSP World Gold Fund

Growth Launch Date 14 Sep 07 NAV (23 Feb 26) ₹66.5931 ↑ 2.21 (3.43 %) Net Assets (Cr) ₹1,975 on 31 Jan 26 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.41 Sharpe Ratio 3.41 Information Ratio -0.47 Alpha Ratio 2.12 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹8,807 31 Jan 23 ₹9,422 31 Jan 24 ₹8,517 31 Jan 25 ₹12,548 31 Jan 26 ₹33,170 Returns for DSP World Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Feb 26 Duration Returns 1 Month 1.6% 3 Month 52.1% 6 Month 92.7% 1 Year 172.7% 3 Year 62.5% 5 Year 31% 10 Year 15 Year Since launch 10.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 167.1% 2023 15.9% 2022 7% 2021 -7.7% 2020 -9% 2019 31.4% 2018 35.1% 2017 -10.7% 2016 -4% 2015 52.7% Fund Manager information for DSP World Gold Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.93 Yr. Data below for DSP World Gold Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Basic Materials 95.89% Asset Allocation

Asset Class Value Cash 1.55% Equity 95.89% Debt 0.01% Other 2.56% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Gold I2

Investment Fund | -74% ₹1,458 Cr 1,177,658

↓ -41,596 VanEck Gold Miners ETF

- | GDX25% ₹497 Cr 573,719 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -2% ₹35 Cr Net Receivables/Payables

Net Current Assets | -1% -₹15 Cr 2. DSP World Mining Fund

DSP World Mining Fund

Growth Launch Date 29 Dec 09 NAV (23 Feb 26) ₹33.0538 ↑ 0.78 (2.43 %) Net Assets (Cr) ₹181 on 31 Jan 26 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.14 Sharpe Ratio 3.17 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹11,733 31 Jan 23 ₹14,422 31 Jan 24 ₹12,454 31 Jan 25 ₹12,799 31 Jan 26 ₹25,833 Returns for DSP World Mining Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Feb 26 Duration Returns 1 Month 3.6% 3 Month 47.9% 6 Month 74.1% 1 Year 101.7% 3 Year 25.4% 5 Year 19.6% 10 Year 15 Year Since launch 7.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 79% 2023 -8.1% 2022 0% 2021 12.2% 2020 18% 2019 34.9% 2018 21.5% 2017 -9.4% 2016 21.1% 2015 49.7% Fund Manager information for DSP World Mining Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.93 Yr. Data below for DSP World Mining Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Basic Materials 95.77% Energy 1.05% Asset Allocation

Asset Class Value Cash 3.15% Equity 96.82% Debt 0.02% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Mining I2

Investment Fund | -99% ₹180 Cr 149,227

↓ -1,163 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -1% ₹2 Cr Net Receivables/Payables

Net Current Assets | -0% ₹0 Cr

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Research Highlights for DSP World Gold Fund