Lumpsum Calculator

Lumpsum calculator helps investors to check how their lumpsum investment grows over a given timeframe. In lumpsum mode of investment, people invest a considerable amount as a one-time down payment in the scheme. Whenever, we talk about Mutual Fund Investment, the first thing that rings on our mind is, “How much amount do we need to invest?” Though there are many questions related to expected returns, risk-appetite, the investment tenure, and so on yet; the first thought that always rings our ears is the investment amount.

So, let us see how the lumpsum calculator helps to assess the growth of one-time investment in Mutual Funds.

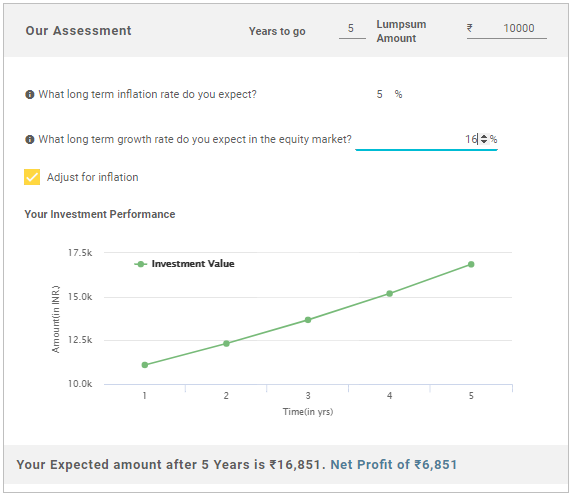

Lumpsum Calculator Illustration

Calculate the returns on your lumpsum investment with the help of the following data.

Investment Tenure: 5 Years

Lumpsum Investment Amount: ₹10,000

Long-term Inflation (%): 5 (approx.)

Long-term Returns (%): 16 (approx.)

Expected Returns as per Lumpsum Calculator: ₹6,851

Total Amount After 5 Years: ₹16,851

Talk to our investment specialist

Fund Selection Methodology used to find 10 funds

Top 10 Performing Mutual Funds in 2018 for Lumpsum Investment

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Sundaram Rural and Consumption Fund Growth ₹92.228

↓ -0.85 ₹1,461 5,000 -7.7 -7.3 3.9 15.4 13.1 -0.1 Franklin Asian Equity Fund Growth ₹39.3892

↑ 0.37 ₹372 5,000 16.3 23.9 35.6 15.3 2.9 23.7 Franklin Build India Fund Growth ₹149.455

↓ -0.70 ₹3,003 5,000 3.9 5.6 22.5 28.7 23.7 3.7 DSP Natural Resources and New Energy Fund Growth ₹108.36

↑ 0.07 ₹1,765 1,000 14.1 21.8 31.7 23.9 21.1 17.5 DSP Equity Opportunities Fund Growth ₹635.72

↓ -3.99 ₹17,434 1,000 0.6 3.9 15.4 21.4 16.5 7.1 DSP US Flexible Equity Fund Growth ₹78.28

↓ -0.12 ₹1,119 1,000 11 18.2 29.4 22.7 17.1 33.8 Bandhan Infrastructure Fund Growth ₹47.595

↓ -0.19 ₹1,428 5,000 -2.2 -4.2 11 24.6 21.4 -6.9 Tata India Tax Savings Fund Growth ₹45.9856

↓ -0.32 ₹4,566 500 0.1 4.8 16.9 17.1 13.9 4.9 Aditya Birla Sun Life Banking And Financial Services Fund Growth ₹64.73

↓ -0.35 ₹3,641 1,000 1.6 7.6 24.8 18.9 12.7 17.5 Aditya Birla Sun Life Small Cap Fund Growth ₹84.5076

↓ -0.67 ₹4,778 1,000 -1.3 -0.6 17.2 18.6 15.3 -3.7 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Feb 26 Research Highlights & Commentary of 10 Funds showcased

Commentary Sundaram Rural and Consumption Fund Franklin Asian Equity Fund Franklin Build India Fund DSP Natural Resources and New Energy Fund DSP Equity Opportunities Fund DSP US Flexible Equity Fund Bandhan Infrastructure Fund Tata India Tax Savings Fund Aditya Birla Sun Life Banking And Financial Services Fund Aditya Birla Sun Life Small Cap Fund Point 1 Lower mid AUM (₹1,461 Cr). Bottom quartile AUM (₹372 Cr). Upper mid AUM (₹3,003 Cr). Lower mid AUM (₹1,765 Cr). Highest AUM (₹17,434 Cr). Bottom quartile AUM (₹1,119 Cr). Bottom quartile AUM (₹1,428 Cr). Upper mid AUM (₹4,566 Cr). Upper mid AUM (₹3,641 Cr). Top quartile AUM (₹4,778 Cr). Point 2 Established history (19+ yrs). Established history (18+ yrs). Established history (16+ yrs). Established history (17+ yrs). Oldest track record among peers (25 yrs). Established history (13+ yrs). Established history (14+ yrs). Established history (11+ yrs). Established history (12+ yrs). Established history (18+ yrs). Point 3 Top rated. Rating: 5★ (top quartile). Rating: 5★ (upper mid). Rating: 5★ (upper mid). Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 5★ (lower mid). Rating: 5★ (bottom quartile). Rating: 5★ (bottom quartile). Rating: 5★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: Moderately High. Risk profile: High. Risk profile: High. Risk profile: Moderately High. Risk profile: High. Risk profile: Moderately High. Point 5 5Y return: 13.10% (bottom quartile). 5Y return: 2.93% (bottom quartile). 5Y return: 23.71% (top quartile). 5Y return: 21.14% (upper mid). 5Y return: 16.54% (upper mid). 5Y return: 17.15% (upper mid). 5Y return: 21.37% (top quartile). 5Y return: 13.89% (lower mid). 5Y return: 12.73% (bottom quartile). 5Y return: 15.31% (lower mid). Point 6 3Y return: 15.43% (bottom quartile). 3Y return: 15.35% (bottom quartile). 3Y return: 28.69% (top quartile). 3Y return: 23.85% (upper mid). 3Y return: 21.36% (upper mid). 3Y return: 22.70% (upper mid). 3Y return: 24.62% (top quartile). 3Y return: 17.08% (bottom quartile). 3Y return: 18.87% (lower mid). 3Y return: 18.61% (lower mid). Point 7 1Y return: 3.87% (bottom quartile). 1Y return: 35.57% (top quartile). 1Y return: 22.49% (upper mid). 1Y return: 31.68% (top quartile). 1Y return: 15.35% (bottom quartile). 1Y return: 29.41% (upper mid). 1Y return: 11.05% (bottom quartile). 1Y return: 16.92% (lower mid). 1Y return: 24.77% (upper mid). 1Y return: 17.18% (lower mid). Point 8 Alpha: -7.86 (bottom quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 1.22 (top quartile). Alpha: 2.18 (top quartile). Alpha: 0.00 (lower mid). Alpha: -0.76 (bottom quartile). Alpha: 0.61 (upper mid). Alpha: 0.00 (bottom quartile). Point 9 Sharpe: -0.56 (bottom quartile). Sharpe: 2.24 (top quartile). Sharpe: 0.21 (lower mid). Sharpe: 1.32 (top quartile). Sharpe: 0.34 (upper mid). Sharpe: 1.15 (upper mid). Sharpe: -0.27 (bottom quartile). Sharpe: 0.14 (lower mid). Sharpe: 1.03 (upper mid). Sharpe: 0.01 (bottom quartile). Point 10 Information ratio: -0.54 (bottom quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (upper mid). Information ratio: 0.30 (top quartile). Information ratio: -0.16 (bottom quartile). Information ratio: 0.00 (lower mid). Information ratio: -0.35 (bottom quartile). Information ratio: 0.25 (top quartile). Information ratio: 0.00 (lower mid). Sundaram Rural and Consumption Fund

Franklin Asian Equity Fund

Franklin Build India Fund

DSP Natural Resources and New Energy Fund

DSP Equity Opportunities Fund

DSP US Flexible Equity Fund

Bandhan Infrastructure Fund

Tata India Tax Savings Fund

Aditya Birla Sun Life Banking And Financial Services Fund

Aditya Birla Sun Life Small Cap Fund

Understanding Lumpsum Calculator

Individuals who are new to investment, find it difficult to understand the concept of lumpsum calculator and its functioning. Therefore, to ease out the complexities, the detailed information about the calculation is given. Go through this information to understand the process. The input data that needs to be fed in the lumpsum calculator includes:

- The tenure of lumpsum investment

- The amount of money is being invested through lumpsum mode

- Expected rate of returns in the long-term from equity markets

- Expected annual inflation rate

How does it Works?

Any investment objective always requires an effective planning. Though people may select the best schemes based on its past performance and other related factors however; it is with the help of this lumpsum calculator that helps the people to decide on how their investment grows virtually over a time period. As mentioned previously, the input elements of this calculator includes tenure of investment, amount invested, and others. So, let us see how the calculation works with the example given below.

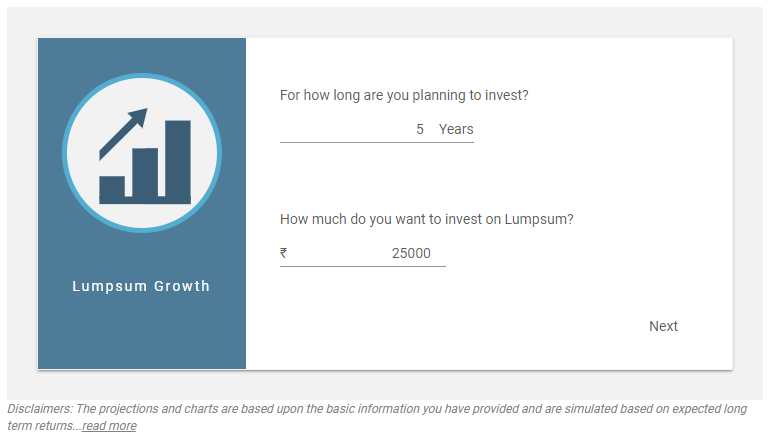

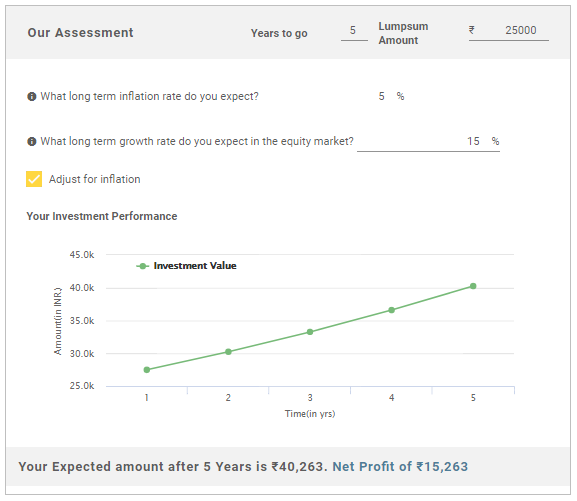

Lumpsum Investment Amount: ₹25,000

Investment Period: 5 Years

Expected Returns (%) (Approx.): 15

Expected Inflation (%) (Approx.): 5

1. Enter Your Lumpsum Investment Amount and Investment Tenure

This is the first question you need to ask, that how much amount do I need to invest so that I can attain my objective. Along with the same, also specify the tenure of investment. So, with the help of amount mentioned about of ₹25,000 and tenure of 5 years, the image is given below as follows. Here, after entering the investment amount and tenure, you need to click on Next Button which is at the bottom of the screen as shown in the image.

2. Enter Expected Long-term Growth on Your Investment

This is the second question you need to answer. Here, you need to enter the expected rate of returns on the lumpsum investment. For example, let’s assume the rate of returns in this case to be 15%. The image for the same is listed below as follows. After, entering the expected rate of returns, you need to click on Next Button which is as shown in the given below.

3. Adjust for Inflation

Once you enter the percentage of returns expected, and click next, then you get the result. Here, you need to select the box near Adjust for Inflation and enter the long-term inflation rate. In our example, we have taken the inflation rate to be 5%. Once you enter the inflation rate then; you the investment value. The image for this step is as follows.

4. End Result

Therefore, we can conclude that, at the end of fifth year, the net profit on the investment is ₹15,263 and the total investment value is ₹40,263.

Thus, from the above mentioned steps, we can see that it is simple to use the Fincash Lumpsum calculator.

In case of further queries, feel free to contact our customer care department.

Top Funds for 2026

*Best funds based on 3 year performance.

"The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in units of MLIIF - WGF. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or units of money market/liquid schemes of DSP Merrill Lynch Mutual Fund, in order to meet liquidity requirements from time to time. However, there is no assurance that the investment objective of the Scheme will be realized." Below is the key information for DSP World Gold Fund Returns up to 1 year are on To generate capital appreciation by investing in Equity and Equity Related Instruments of companies where the Central / State Government(s) has majority shareholding or management control or has powers to appoint majority of directors. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The Scheme does not assure or guarantee any returns. Research Highlights for Invesco India PSU Equity Fund Below is the key information for Invesco India PSU Equity Fund Returns up to 1 year are on The investment objective of the scheme is to provide long term growth from a portfolio of equity / equity related instruments of companies engaged either directly or indirectly in the infrastructure sector. Research Highlights for LIC MF Infrastructure Fund Below is the key information for LIC MF Infrastructure Fund Returns up to 1 year are on 1. DSP World Gold Fund

DSP World Gold Fund

Growth Launch Date 14 Sep 07 NAV (23 Feb 26) ₹66.5931 ↑ 2.21 (3.43 %) Net Assets (Cr) ₹1,975 on 31 Jan 26 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.41 Sharpe Ratio 3.41 Information Ratio -0.47 Alpha Ratio 2.12 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹8,807 31 Jan 23 ₹9,422 31 Jan 24 ₹8,517 31 Jan 25 ₹12,548 31 Jan 26 ₹33,170 Returns for DSP World Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Feb 26 Duration Returns 1 Month 1.6% 3 Month 52.1% 6 Month 92.7% 1 Year 172.7% 3 Year 62.5% 5 Year 31% 10 Year 15 Year Since launch 10.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 167.1% 2023 15.9% 2022 7% 2021 -7.7% 2020 -9% 2019 31.4% 2018 35.1% 2017 -10.7% 2016 -4% 2015 52.7% Fund Manager information for DSP World Gold Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.93 Yr. Data below for DSP World Gold Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Basic Materials 95.89% Asset Allocation

Asset Class Value Cash 1.55% Equity 95.89% Debt 0.01% Other 2.56% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Gold I2

Investment Fund | -74% ₹1,458 Cr 1,177,658

↓ -41,596 VanEck Gold Miners ETF

- | GDX25% ₹497 Cr 573,719 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -2% ₹35 Cr Net Receivables/Payables

Net Current Assets | -1% -₹15 Cr 2. Invesco India PSU Equity Fund

Invesco India PSU Equity Fund

Growth Launch Date 18 Nov 09 NAV (24 Feb 26) ₹68.22 ↓ -0.17 (-0.25 %) Net Assets (Cr) ₹1,492 on 31 Jan 26 Category Equity - Sectoral AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆ Risk High Expense Ratio 2.14 Sharpe Ratio 0.53 Information Ratio -0.5 Alpha Ratio -2.7 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹13,872 31 Jan 23 ₹15,622 31 Jan 24 ₹26,577 31 Jan 25 ₹29,948 31 Jan 26 ₹35,297 Returns for Invesco India PSU Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Feb 26 Duration Returns 1 Month 4.9% 3 Month 4.9% 6 Month 10.9% 1 Year 31% 3 Year 32.5% 5 Year 25.9% 10 Year 15 Year Since launch 12.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 10.3% 2023 25.6% 2022 54.5% 2021 20.5% 2020 31.1% 2019 6.1% 2018 10.1% 2017 -16.9% 2016 24.3% 2015 17.9% Fund Manager information for Invesco India PSU Equity Fund

Name Since Tenure Hiten Jain 1 Jul 25 0.59 Yr. Sagar Gandhi 1 Jul 25 0.59 Yr. Data below for Invesco India PSU Equity Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 31.92% Financial Services 29.89% Utility 18.15% Energy 12.64% Basic Materials 4.19% Consumer Cyclical 1.08% Asset Allocation

Asset Class Value Cash 2.14% Equity 97.86% Top Securities Holdings / Portfolio

Name Holding Value Quantity State Bank of India (Financial Services)

Equity, Since 28 Feb 21 | SBIN9% ₹139 Cr 1,294,989

↓ -92,628 Bharat Electronics Ltd (Industrials)

Equity, Since 31 Mar 17 | BEL9% ₹135 Cr 2,997,692 Indian Bank (Financial Services)

Equity, Since 30 Jun 21 | INDIANB7% ₹106 Cr 1,157,444 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 30 Sep 18 | BPCL7% ₹99 Cr 2,717,009 Hindustan Aeronautics Ltd Ordinary Shares (Industrials)

Equity, Since 31 May 22 | HAL6% ₹87 Cr 187,643

↓ -8,515 NTPC Green Energy Ltd (Utilities)

Equity, Since 30 Nov 24 | NTPCGREEN5% ₹79 Cr 9,129,820 Dredging Corp of India Ltd (Industrials)

Equity, Since 31 Jul 25 | DREDGECORP5% ₹73 Cr 646,300 Bharat Dynamics Ltd Ordinary Shares (Industrials)

Equity, Since 31 May 22 | BDL5% ₹69 Cr 445,685 Bank of Baroda (Financial Services)

Equity, Since 30 Jun 21 | BANKBARODA5% ₹67 Cr 2,244,222 NTPC Ltd (Utilities)

Equity, Since 31 May 19 | NTPC4% ₹64 Cr 1,801,543 3. LIC MF Infrastructure Fund

LIC MF Infrastructure Fund

Growth Launch Date 29 Feb 08 NAV (24 Feb 26) ₹50.2007 ↓ -0.32 (-0.63 %) Net Assets (Cr) ₹946 on 31 Jan 26 Category Equity - Sectoral AMC LIC Mutual Fund Asset Mgmt Co Ltd Rating Risk High Expense Ratio 2.21 Sharpe Ratio 0.03 Information Ratio 0.29 Alpha Ratio -6.08 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹15,011 31 Jan 23 ₹15,567 31 Jan 24 ₹24,683 31 Jan 25 ₹30,671 31 Jan 26 ₹31,739 Returns for LIC MF Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Feb 26 Duration Returns 1 Month 9.5% 3 Month 2.7% 6 Month 3.1% 1 Year 22.4% 3 Year 29.2% 5 Year 23.4% 10 Year 15 Year Since launch 9.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 -3.7% 2023 47.8% 2022 44.4% 2021 7.9% 2020 46.6% 2019 -0.1% 2018 13.3% 2017 -14.6% 2016 42.2% 2015 -2.2% Fund Manager information for LIC MF Infrastructure Fund

Name Since Tenure Yogesh Patil 18 Sep 20 5.38 Yr. Mahesh Bendre 1 Jul 24 1.59 Yr. Data below for LIC MF Infrastructure Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 48.01% Consumer Cyclical 14.5% Basic Materials 9.34% Financial Services 6.56% Utility 6.33% Technology 3.72% Real Estate 3.47% Health Care 3.21% Communication Services 2.91% Asset Allocation

Asset Class Value Cash 1.95% Equity 98.05% Top Securities Holdings / Portfolio

Name Holding Value Quantity Tata Motors Ltd (Consumer Cyclical)

Equity, Since 31 Oct 25 | TMCV5% ₹48 Cr 1,051,964

↓ -36,431 Shakti Pumps (India) Ltd (Industrials)

Equity, Since 31 Mar 24 | SHAKTIPUMP5% ₹43 Cr 686,379 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Apr 09 | LT5% ₹43 Cr 108,403 REC Ltd (Financial Services)

Equity, Since 31 Jul 23 | RECLTD3% ₹33 Cr 901,191 Apollo Hospitals Enterprise Ltd (Healthcare)

Equity, Since 30 Jun 25 | APOLLOHOSP3% ₹30 Cr 43,674 Garware Hi-Tech Films Ltd (Basic Materials)

Equity, Since 31 Aug 23 | 5006553% ₹28 Cr 93,271 Schneider Electric Infrastructure Ltd (Industrials)

Equity, Since 31 Dec 23 | SCHNEIDER3% ₹26 Cr 377,034

↑ 61,173 Bharat Bijlee Ltd (Industrials)

Equity, Since 31 Jul 22 | BBL3% ₹26 Cr 92,624 Avalon Technologies Ltd (Technology)

Equity, Since 31 Jul 23 | AVALON3% ₹25 Cr 289,118 Mahindra Lifespace Developers Ltd (Real Estate)

Equity, Since 30 Jun 24 | MAHLIFE3% ₹24 Cr 659,065

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Research Highlights for DSP World Gold Fund