CAGR Calculator

What is CAGR?

CAGR refers to the mean annual growth of an investment over a specific time duration. It is assumed that the value of investment is compounded over the duration. Unlike absolute return, CAGR takes time value of money into account. As a result, it is able to reflect the true returns of an investment generated over a year.

CAGR (Compound Annual Growth Rate) 20.11% CAGR Calculator

How To Use CAGR Calculator

Where can you use CAGR calculators CAGR is an easy to use tool to analyse your investment decisions. It finds application in the following scenarios:

- You bought some specific units in Equity Funds this year and your fund value increased. With the help of CAGR calculator, you would be able to know the rate of return on your investment

- You want to start Investing and have some specific goals. With the CAGR calculator, you will get to know at what rate you have to grow your money within the time frame

- Consider you have invested in an equity fund whose 3,5, and 10-year returns are 25%, 15% and 10% respectively. You want to know the average rate at which your fund grew annually

- To compare the CAGR of an investment with your expected rate and check for the suitability. Invest only if the CAGR is greater than or equal to your expected rate of return

- CAGR of a Mutual Fund can be compared with a benchmark return

CAGR Formula

The CAGR can be calculated using the mathematical formula

CAGR = [ (Ending value/Beginning Value)^(1/N) ] -1

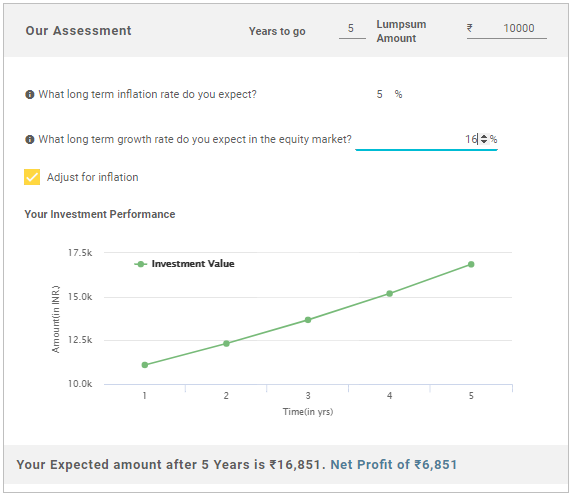

The above formula depends on three variables. Namely, the beginning value, ending value and Number of years (N)

When you input the above three variables, the CAGR calculator would give you the rate of return on investment.

Talk to our investment specialist

Limitations of CAGR

Even though CAGR is a useful concept, it has a lot of limitations. A lack of awareness of these limitations would lead to bad investment decisions. Some of the limitations are:

In calculations related to CAGR, it’s only the beginning and end values. It assumes that the growth is constant over the duration of time and fails to consider the Volatility aspect

It is suitable only for a lump sum investment. As in case of a SIP investment, the systematic investment at various intervals wouldn’t be considered as only the beginning value is considered while calculating the CAGR

CAGR does not account for the risk inherent in an investment. When it comes to equity investment, risk-adjusted returns are more important than CAGR. For these purposes, you need to consider better ratios like Sharpe ratio

Fund Selection Methodology used to find 3 funds

Top Funds with best 3 year CAGR

"The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in units of MLIIF - WGF. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or units of money market/liquid schemes of DSP Merrill Lynch Mutual Fund, in order to meet liquidity requirements from time to time. However, there is no assurance that the investment objective of the Scheme will be realized." Below is the key information for DSP World Gold Fund Returns up to 1 year are on To generate returns that closely correspond to returns generated by Axis Gold ETF. Research Highlights for Axis Gold Fund Below is the key information for Axis Gold Fund Returns up to 1 year are on ICICI Prudential Regular Gold Savings Fund (the Scheme) is a fund of funds scheme with the primary objective to generate returns by investing in units of ICICI Prudential Gold Exchange Traded Fund (IPru Gold ETF).

However, there can be no assurance that the investment objectives of the Scheme will be realized. Research Highlights for ICICI Prudential Regular Gold Savings Fund Below is the key information for ICICI Prudential Regular Gold Savings Fund Returns up to 1 year are on 1. DSP World Gold Fund

DSP World Gold Fund

Growth Launch Date 14 Sep 07 NAV (23 Feb 26) ₹66.5931 ↑ 2.21 (3.43 %) Net Assets (Cr) ₹1,975 on 31 Jan 26 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.41 Sharpe Ratio 3.41 Information Ratio -0.47 Alpha Ratio 2.12 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹8,807 31 Jan 23 ₹9,422 31 Jan 24 ₹8,517 31 Jan 25 ₹12,548 31 Jan 26 ₹33,170 Returns for DSP World Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Feb 26 Duration Returns 1 Month 1.6% 3 Month 52.1% 6 Month 92.7% 1 Year 172.7% 3 Year 62.5% 5 Year 31% 10 Year 15 Year Since launch 10.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 167.1% 2023 15.9% 2022 7% 2021 -7.7% 2020 -9% 2019 31.4% 2018 35.1% 2017 -10.7% 2016 -4% 2015 52.7% Fund Manager information for DSP World Gold Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.93 Yr. Data below for DSP World Gold Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Basic Materials 95.89% Asset Allocation

Asset Class Value Cash 1.55% Equity 95.89% Debt 0.01% Other 2.56% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Gold I2

Investment Fund | -74% ₹1,458 Cr 1,177,658

↓ -41,596 VanEck Gold Miners ETF

- | GDX25% ₹497 Cr 573,719 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -2% ₹35 Cr Net Receivables/Payables

Net Current Assets | -1% -₹15 Cr 2. Axis Gold Fund

Axis Gold Fund

Growth Launch Date 20 Oct 11 NAV (24 Feb 26) ₹46.0175 ↑ 0.44 (0.97 %) Net Assets (Cr) ₹2,835 on 31 Jan 26 Category Gold - Gold AMC Axis Asset Management Company Limited Rating ☆ Risk Moderately High Expense Ratio 0.5 Sharpe Ratio 3.44 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹9,659 31 Jan 23 ₹11,397 31 Jan 24 ₹12,487 31 Jan 25 ₹16,126 31 Jan 26 ₹29,924 Returns for Axis Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Feb 26 Duration Returns 1 Month 3.1% 3 Month 28.7% 6 Month 58.7% 1 Year 79.7% 3 Year 39.7% 5 Year 26.1% 10 Year 15 Year Since launch 11.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 69.8% 2023 19.2% 2022 14.7% 2021 12.5% 2020 -4.7% 2019 26.9% 2018 23.1% 2017 8.3% 2016 0.7% 2015 10.7% Fund Manager information for Axis Gold Fund

Name Since Tenure Aditya Pagaria 9 Nov 21 4.23 Yr. Pratik Tibrewal 1 Feb 25 1 Yr. Data below for Axis Gold Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 2.53% Other 97.47% Top Securities Holdings / Portfolio

Name Holding Value Quantity Axis Gold ETF

- | -99% ₹2,810 Cr 215,661,784

↑ 19,832,646 Clearing Corporation Of India Ltd

CBLO/Reverse Repo | -1% ₹35 Cr Net Receivables / (Payables)

CBLO | -0% -₹9 Cr 3. ICICI Prudential Regular Gold Savings Fund

ICICI Prudential Regular Gold Savings Fund

Growth Launch Date 11 Oct 11 NAV (24 Feb 26) ₹48.8424 ↑ 0.36 (0.73 %) Net Assets (Cr) ₹6,338 on 31 Jan 26 Category Gold - Gold AMC ICICI Prudential Asset Management Company Limited Rating ☆ Risk Moderately High Expense Ratio 0.38 Sharpe Ratio 3.1 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-15 Months (2%),15 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹9,678 31 Jan 23 ₹11,361 31 Jan 24 ₹12,399 31 Jan 25 ₹16,060 31 Jan 26 ₹31,216 Returns for ICICI Prudential Regular Gold Savings Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Feb 26 Duration Returns 1 Month 2.5% 3 Month 28.1% 6 Month 58.3% 1 Year 80.1% 3 Year 39.6% 5 Year 26% 10 Year 15 Year Since launch 11.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 72% 2023 19.5% 2022 13.5% 2021 12.7% 2020 -5.4% 2019 26.6% 2018 22.7% 2017 7.4% 2016 0.8% 2015 8.9% Fund Manager information for ICICI Prudential Regular Gold Savings Fund

Name Since Tenure Manish Banthia 27 Sep 12 13.36 Yr. Nishit Patel 29 Dec 20 5.1 Yr. Ashwini Bharucha 1 Nov 25 0.25 Yr. Venus Ahuja 1 Nov 25 0.25 Yr. Data below for ICICI Prudential Regular Gold Savings Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 2.73% Other 97.27% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Pru Gold ETF

- | -99% ₹6,265 Cr 448,751,665

↑ 56,893,421 Treps

CBLO/Reverse Repo | -3% ₹174 Cr Net Current Assets

Net Current Assets | -2% -₹101 Cr

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Research Highlights for DSP World Gold Fund