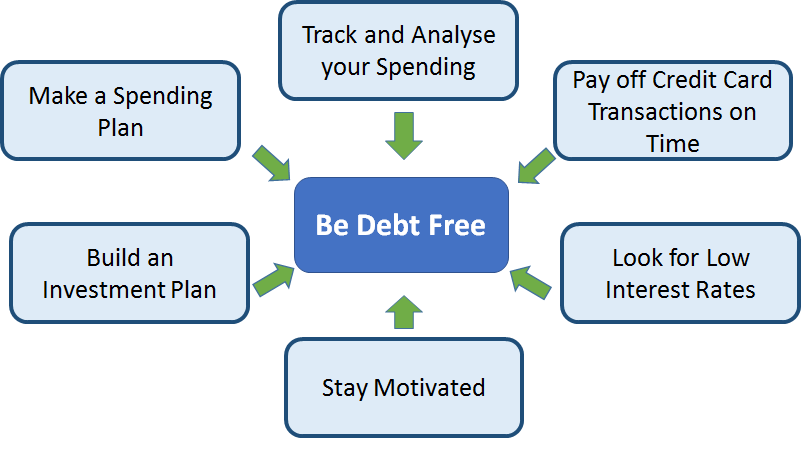

How to be Debt Free?

Want to be debt free? It’s possible by approaching a few disciplined strategies! Here are some the effective ideas that you need to follow to keep yourself debt free!

Best Ways to Become Debt Free

1. Track and Analyse your Spending

‘Tracking your expense’ is the first thing you need to do to make yourself a debt-free person. For a month, keep a check and record on all kinds of expenses you have made. By doing this, you will have an idea about how much you spend and where you need to crunch your expenditure. So, if you want to be debt free, get into a habit of tracking your spending regularly.

2. Make a Spending Plan

This is an important step to keep yourself debt free. A spending plan helps in different ways. It not only controls your expenses but also directs you to save a good amount of money. While making your spending plan think about your monthly expenses like food & rent bills, transports, lifestyle, etc., along with your current debts (any). After you make your expense list make your saving list too! Think of short term and long term goals that you wish you to achieve, following which you can make an Investment plan. But, before Investing, you need to save first!

3. Build an Investment Plan

When you make an investment plan, you not only save for bad times but also intend to secure your future through it. However, many people today still fail to understand the importance of investing. Well, the main idea behind investing or investment is to generate a regular income or returns in a specific period of time. Moreover, it makes you prepare for your future. People do invest their money for various reasons such as for retirement, to make a short term and long term investment (as per their goals), for the purchase of assets, plan for marriage, create an emergency fund, prepare for business or for a world tour, etc.

While making a Financial plan you should also know the various investing avenues and chose appropriately the one/s that best suits your Financial goals. To mention some, there are various Types of Mutual Funds (Bonds, debt, equity), ELSS, ETFs, Money market funds, etc. So, choose the options well and keep yourself debt free!

4. Pay Off Credit Card Transactions on Time

For many people, credit cards are a great option to fulfil their needs, but if not paid on time, it can become a huge liability. If you are using a credit card, make sure you pay your monthly interest on the given date. Unlike other loans, credit cards interest rates are high. They translate to an effective rate of 19.5% to 41.75% annually. If you want to be a debt free person, you can instruct your Bank to pay off the credit card outstanding on the due date, by debiting from your bank account.

Talk to our investment specialist

5. Look for Low-Interest Rates

Nowadays, every bank offers different interest rates on loans and credit cards. Before you make any investments make sure you research well about this. One of the benefits of low interest is that it makes the cost of borrowing cheaper, which will affect good side on your savings!

Debt is never an exciting thing! So whenever you wish to do something on the asset side, make sure you save first. Also, set regular targets, follow a tight budget and spend less!

Also, stay motivated to be a debt free person!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.