Best International Travel Insurance 2026

When it comes to travelling abroad, keeping yourself secured is the first thing you should ensure! And to make sure you travel safe, nothing can be better than opting for an 'International Travel Insurance'! Overseas travel insurance plays a vital role for all kinds of travel. But, before buying, compare travel insurance with different Travel Insurance Companies and then choose a cheap travel insurance policy or a good travel insurance policy. Another important thing, during any incident, one should read and follow travel insurance claims thoroughly.

International Travel Insurance

International travel insurance provides protection against unseen emergencies during transit. Considering the fact that while travelling overseas, you will be unacquainted to many things, international travel insurance comes as a helping hand! This policy safeguards against losses such as delay of a flight, loss of baggage, stolen documents, emergency evacuation, medical care, etc.

Knowing the importance of international travel insurance, let's have a look on how to buy a good plan!

Tips for Buying Overseas Travel Insurance

Foreign Travel Insurance – Know the Covers

Overseas travel insurance ensures a safe trip by providing essential benefits in the form of coverage. Basic covers offered by international travel insurance are as follows:

- Trip Cancellation and Trip Interruption Coverage

- Loss of Baggage

- Emergency Medical Treatment or Assistance

- Loss of Important Documents

- Hijack of a Plane

- Personal Accidents

- Emergency Financial Assistance In case if you suffered robbery of theft

Also, overseas travel insurance offers coverage based on – Student Travel, Business Travel and Leisure Travel.

Talk to our investment specialist

Buying Cheap Travel Insurance

When you look for a plan, you should first analyse your needs that you would want while travelling abroad. For example, as per your health conditions, what are the medical coverage you would require? What is the purpose of your travelling? Is it a holiday travel or a business travel? If you are travelling for business purpose you may likely need a cover on important documents (that you would be carrying), and so on. Your international travel premium will only depend on the type of cover you seek for! That is why, choosing the necessary coverage, is very important, as opting for extra covers will only incur you more cost.

Compare Travel Insurance

One essential thing everyone should do is, compare policies! International travel insurance plans offer coverage for all possible emergencies during transit. A quick comparison of your requirements with different insurer's plans and parameters would give you a better idea. It is always better to have several quotations with you, along with their claims, terms & conditions and their advantages. After making a comparison, shortlist the most preferred and opt for one that meets your objective.

Best International Travel Insurance Companies 2026

Before buying a plan, review multiple companies. Here's the list of some top travel insurance plans offered by the top Insurance companies.

1. ICICI Lombard Travel Insurance

With ICICI single trip insurance you can travel USA/Canada, Asia, Schengen and rest of the World. No matter where you are, stay assured of quality healthcare. The insurance plans offer cashless hospitalisation facilities across the globe, so you can be at peace when you travel.

Some of the exclusive coverage offered by ICICI Travel plan are as follows:

- The plan secures you against baggage loss, trip delays, extensions and accidents

- You can travel frequently and conveniently with the Gold Multi-Trip plan and secure up to 30, 45 or 60 days per trip yearly

- Experience more coverage without travel worries

- Secure your travel with an insurance plan that offers you a sum insured of up to $500,000

- There is mo medical test required to secure your travel plans

- The travel plan gives you coverage upto 85 years of age without having to undergo any prior medical tests

- During medical emergency abroad, the plan gives immediate help with cashless facility

- The policy allows you avail cashless hospitalisation facility worldwide

- If you lose luggage, the company will compensate the loss

- The plan offers coverage for total loss of checked-in baggage including handbag

- Get pre-approved cover when you travel to Schengen countries

2. SBI Travel Insurance

The SBI General Travel Insurance policy for business and holiday covers you aganist any medical, non-medical and financial emergencies that you may face during your trip abroad. The policy offers comprehensive coverage to you and your family while you are busy travelling around the globe.

The SBI travel insurance policy covers:

- Treatment while on holiday

- Injury or illness sustained during travel

- Travel support

- Cash advance

- Trip delays

- Period of insurance

- Single Trip- Coverage for a duration of 1 to 180 days

- Coverage upto $ 500,000

- Worldwide Protection

- 24x7 Assistance

- Easy claims settlement

3. TATA AIG International Travel Insurance

With a TATA AIG international travel insurance plan, you can enjoy all the sights and sounds without sweating the small stuff. Our overseas travel insurance policy will help you deal with whatever untoward situations come your way. From delayed luggage to lost passports or being detected with COVID-19*, we’ll be with you at every step of the journey – literally and figuratively!

Following are the features of International Travel Insurance:

- Coverage for accidents and sickness

- Travel assistance

- Baggage loss or delay

- Personal liability

- Hijack cover

- Automatic extensions

4. Bajaj Allianz Travel Insurance

As travel scams are growing everyday in tourist-heavy countries, having a secure back-up like travel insurance will help you travel peacefully. With Bajaj Travel Insurance plan, you’re safeguarding your trip against all the financial losses.

a. International Travel Insurance

International travel insurance cover overseas travel, trip, holiday, family visitation, study, business meetings, and much more. It also covers several factors like medical and dental expenses, loss of baggage and passport, trip cancellation, flight delays, etc.

b. Schengen Travel Insurance

For the people travelling to a Schengen country, a special insurance policy is required, i.e. the Schengen travel insurance policy.

By offerings wide coverage like the medical coverage, loss of passport, delay in check-in baggage arrival, loss of check-in baggage, accidental death and dismemberment, Personal Accident cover and personal liabilities, the plan secures you from any type of financial losses.

5. HDFC ERGO Travel Insurance

HDFC ERGO Travel insurance acts like your buddy by supporting you during uncertain events during travels. It covers you for unforeseen travel emergencies like theft, medical emergencies, luggage related issues, etc.

Following are the coverage offered to you by HDFC ERGO Travel Insurance:

- Emergency medical expenses

- Emergency dental expenses

- Accidental death

- Hospital daily cash allowance

- Personal liability

- Financial emergency assistance

- Hijack distress allowance

- Flight delay

- Loss of baggage & personal documents

- Loss of checked-in baggage

Travel Insurance Claim

For making an international travel insurance claim during an emergency medical treatment, customers have to present the travel insurance documents to the medical service provider. The medical bills are settled directly by the insurer with the medical service provider. This service may count as a cashless service.

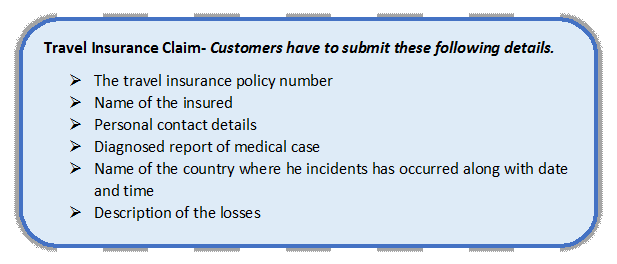

While registering an international travel insurance claim, customers have to submit the following details (refer the image)

Conclusion

Travelling overseas is not less than a dream! But, having a safe and secure trip, always gives you peace of mind. International Travel Insurance goes a long way in making a well-planned, safe and enjoyable trip!

Make great travel memories by travelling often in an insured way!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.