8 Best International Mutual Funds 2026

Indian investors have traditionally preferred domestic investments like equity Mutual Funds, fixed deposits, and Real Estate. But in today’s interconnected world, relying only on India’s growth story can be limiting. International Mutual Funds give you a chance to invest in global markets — from Silicon Valley’s tech giants like Apple and Microsoft to Europe’s luxury brands and Asia’s fast-growing economies.

With the Indian economy becoming more globalised and investors looking for smarter diversification, International Mutual Funds are emerging as an attractive option in 2026. This guide explains everything — meaning, benefits, risks, taxation, best-performing funds, and whether you should add them to your Portfolio.

What Are International Mutual Funds?

International Mutual Funds are schemes that invest in companies outside India. Instead of buying foreign shares directly (which requires opening a global Trading Account and dealing with complex taxation), you can invest in such companies through Indian AMCs (Asset Management Companies).

Types of Structures

Feeder Funds – Indian AMCs collect money from investors and channel it into an overseas fund. Example: Franklin India Feeder – Franklin U.S. Opportunities Fund.

fund of funds (FoFs) – A fund that invests in another international mutual fund, ETF, or index abroad.

Direct International Equity Funds – A few funds may directly buy foreign stocks (less common).

Why Should Indians Invest in International Mutual Funds?

1. Geographic Diversification

Putting all your money in India means your wealth depends solely on how the Indian economy performs. Global exposure spreads risk. For example, if Indian IT underperforms but U.S. tech thrives, international funds balance your portfolio.

2. Exposure to Global Giants

Think about this: India doesn’t have companies like Apple, Tesla, Microsoft, Amazon, or NVIDIA listed on NSE/BSE. International funds give access to these global leaders.

3. Currency Advantage

If the Indian Rupee depreciates against the U.S. Dollar (which historically it has — from ₹45/USD in 2010 to ~₹83/USD in 2025), your international fund value rises in INR terms.

4. Thematic Opportunities

Global themes like Artificial Intelligence, Electric Vehicles, Green Energy, Biotechnology, and Semiconductors can be tapped into via such funds.

5. Risk Balancing

Different economies move differently. For instance, when India faced COVID shocks in 2020, U.S. tech rallied. This balance helps reduce Volatility.

Risks of International Mutual Funds

Currency Fluctuations – A strong rupee may reduce your returns.

Geopolitical Risks – Wars, trade disputes, sanctions can affect global companies.

Regulatory Risks – India’s RBI and SEBI impose limits under the Liberalised Remittance Scheme (LRS).

Higher Expense Ratios – Because of fund-of-fund structures and foreign management costs.

Concentration Risk – Many funds are U.S.-centric; you may lack true global diversification.

Background of International Mutual Funds in India

With the permission of Reserve Bank of India (RBI), International Mutual Funds opened up in India in 2007. Each fund is allowed to get a corpus of USD 500 million.

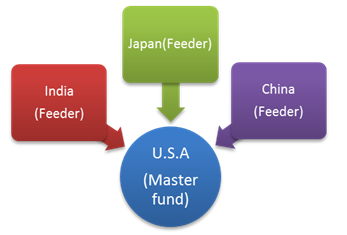

Master-Feeder Structure of International Mutual Funds

International Mutual Funds follow a master-feeder structure. A master-feeder structure is a three-tier structure where investors place their money in the feeder fund which then invests in the master fund. The master fund then invests the money in the market. A feeder fund is based on-shore i.e. in India, whereas, the master fund is based off-shore (in a foreign geography like Luxembourg etc).

A master fund can have multiple feeder funds. For example,

How to Pick an International Mutual Fund?

There are certain things to be kept in mind while choosing a suitable fund.

Fund Selection Methodology used to find 9 funds

Best International Mutual Funds to Invest in FY 26 - 27

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP World Gold Fund Growth ₹67.9493

↓ -0.10 ₹1,975 500 42.1 90.1 185.1 64.8 32.4 167.1 DSP World Mining Fund Growth ₹33.63

↓ -0.46 ₹181 500 40.2 71.9 110.2 27.7 20.2 79 Edelweiss Emerging Markets Opportunities Equity Off-shore Fund Growth ₹25.158

↑ 0.08 ₹191 1,000 22.4 38.5 58.9 22.4 7 41.1 DSP World Energy Fund Growth ₹26.8335

↓ -0.36 ₹103 500 18.6 27.2 56.4 16.2 12.6 39.2 Kotak Global Emerging Market Fund Growth ₹35.829

↑ 0.27 ₹539 1,000 20 31.2 54.1 22.8 8.9 39.1 Edelweiss Europe Dynamic Equity Off-shore Fund Growth ₹29.9043

↓ -0.05 ₹216 1,000 14.4 20.4 43 23.5 16.7 50 Franklin Asian Equity Fund Growth ₹40.288

↑ 0.27 ₹372 500 16.5 26.1 41.2 16.8 4.1 23.7 Invesco India Feeder- Invesco Pan European Equity Fund Growth ₹24.696

↓ -0.05 ₹165 500 18.3 23.5 40.5 18.2 15.5 42.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 26 Feb 26 Research Highlights & Commentary of 8 Funds showcased

Commentary DSP World Gold Fund DSP World Mining Fund Edelweiss Emerging Markets Opportunities Equity Off-shore Fund DSP World Energy Fund Kotak Global Emerging Market Fund Edelweiss Europe Dynamic Equity Off-shore Fund Franklin Asian Equity Fund Invesco India Feeder- Invesco Pan European Equity Fund Point 1 Highest AUM (₹1,975 Cr). Lower mid AUM (₹181 Cr). Lower mid AUM (₹191 Cr). Bottom quartile AUM (₹103 Cr). Top quartile AUM (₹539 Cr). Upper mid AUM (₹216 Cr). Upper mid AUM (₹372 Cr). Bottom quartile AUM (₹165 Cr). Point 2 Oldest track record among peers (18 yrs). Established history (16+ yrs). Established history (11+ yrs). Established history (16+ yrs). Established history (18+ yrs). Established history (12+ yrs). Established history (18+ yrs). Established history (12+ yrs). Point 3 Rating: 3★ (top quartile). Rating: 3★ (upper mid). Rating: 3★ (upper mid). Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Rating: 3★ (lower mid). Top rated. Rating: 3★ (bottom quartile). Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 32.37% (top quartile). 5Y return: 20.25% (top quartile). 5Y return: 7.00% (bottom quartile). 5Y return: 12.58% (lower mid). 5Y return: 8.87% (lower mid). 5Y return: 16.72% (upper mid). 5Y return: 4.12% (bottom quartile). 5Y return: 15.50% (upper mid). Point 6 3Y return: 64.81% (top quartile). 3Y return: 27.72% (top quartile). 3Y return: 22.44% (lower mid). 3Y return: 16.22% (bottom quartile). 3Y return: 22.79% (upper mid). 3Y return: 23.50% (upper mid). 3Y return: 16.78% (bottom quartile). 3Y return: 18.24% (lower mid). Point 7 1Y return: 185.11% (top quartile). 1Y return: 110.25% (top quartile). 1Y return: 58.89% (upper mid). 1Y return: 56.37% (upper mid). 1Y return: 54.07% (lower mid). 1Y return: 43.01% (lower mid). 1Y return: 41.22% (bottom quartile). 1Y return: 40.52% (bottom quartile). Point 8 Alpha: 2.12 (top quartile). Alpha: 0.00 (top quartile). Alpha: -0.75 (bottom quartile). Alpha: 0.00 (upper mid). Alpha: -1.44 (bottom quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (lower mid). Point 9 Sharpe: 3.41 (top quartile). Sharpe: 3.17 (upper mid). Sharpe: 2.68 (lower mid). Sharpe: 1.88 (bottom quartile). Sharpe: 2.63 (lower mid). Sharpe: 3.87 (top quartile). Sharpe: 2.24 (bottom quartile). Sharpe: 3.20 (upper mid). Point 10 Information ratio: -0.47 (lower mid). Information ratio: 0.00 (top quartile). Information ratio: -0.84 (bottom quartile). Information ratio: 0.00 (top quartile). Information ratio: -0.59 (bottom quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). DSP World Gold Fund

DSP World Mining Fund

Edelweiss Emerging Markets Opportunities Equity Off-shore Fund

DSP World Energy Fund

Kotak Global Emerging Market Fund

Edelweiss Europe Dynamic Equity Off-shore Fund

Franklin Asian Equity Fund

Invesco India Feeder- Invesco Pan European Equity Fund

All the funds mentioned above are ideal, we are giving you detailed analysis of 4 funds.

"The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in units of MLIIF - WGF. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or units of money market/liquid schemes of DSP Merrill Lynch Mutual Fund, in order to meet liquidity requirements from time to time. However, there is no assurance that the investment objective of the Scheme will be realized." Research Highlights for DSP World Gold Fund Below is the key information for DSP World Gold Fund Returns up to 1 year are on The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in the units of BlackRock Global Funds – World Mining Fund. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may

constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or money market/liquid schemes of DSP BlackRock Mutual Fund, in order to meet liquidity requirements from time to time. Research Highlights for DSP World Mining Fund Below is the key information for DSP World Mining Fund Returns up to 1 year are on The primary investment objective of the Scheme is to seek to provide long term capital growth by investing predominantly in the JPMorgan Funds - Emerging Markets Opportunities Fund, an equity fund which invests primarily in an aggressively managed portfolio of emerging market companies Research Highlights for Edelweiss Emerging Markets Opportunities Equity Off-shore Fund Below is the key information for Edelweiss Emerging Markets Opportunities Equity Off-shore Fund Returns up to 1 year are on The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in the units of BlackRock Global Funds – World Energy Fund and BlackRock Global Funds – New Energy Fund. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities

and/or money market/liquid schemes of DSP BlackRock Mutual Fund, in order to meet liquidity

requirements from time to time. Research Highlights for DSP World Energy Fund Below is the key information for DSP World Energy Fund Returns up to 1 year are on 1. DSP World Gold Fund

DSP World Gold Fund

Growth Launch Date 14 Sep 07 NAV (26 Feb 26) ₹67.9493 ↓ -0.10 (-0.14 %) Net Assets (Cr) ₹1,975 on 31 Jan 26 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.41 Sharpe Ratio 3.41 Information Ratio -0.47 Alpha Ratio 2.12 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹10,843 28 Feb 23 ₹9,241 29 Feb 24 ₹8,778 28 Feb 25 ₹13,911 28 Feb 26 ₹41,909 Returns for DSP World Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month 3.7% 3 Month 42.1% 6 Month 90.1% 1 Year 185.1% 3 Year 64.8% 5 Year 32.4% 10 Year 15 Year Since launch 10.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 167.1% 2023 15.9% 2022 7% 2021 -7.7% 2020 -9% 2019 31.4% 2018 35.1% 2017 -10.7% 2016 -4% 2015 52.7% Fund Manager information for DSP World Gold Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.93 Yr. Data below for DSP World Gold Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Basic Materials 95.89% Asset Allocation

Asset Class Value Cash 1.55% Equity 95.89% Debt 0.01% Other 2.56% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Gold I2

Investment Fund | -74% ₹1,458 Cr 1,177,658

↓ -41,596 VanEck Gold Miners ETF

- | GDX25% ₹497 Cr 573,719 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -2% ₹35 Cr Net Receivables/Payables

Net Current Assets | -1% -₹15 Cr 2. DSP World Mining Fund

DSP World Mining Fund

Growth Launch Date 29 Dec 09 NAV (26 Feb 26) ₹33.63 ↓ -0.46 (-1.34 %) Net Assets (Cr) ₹181 on 31 Jan 26 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.14 Sharpe Ratio 3.17 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹12,307 28 Feb 23 ₹12,279 29 Feb 24 ₹10,745 28 Feb 25 ₹11,677 28 Feb 26 ₹25,661 Returns for DSP World Mining Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month 5.4% 3 Month 40.2% 6 Month 71.9% 1 Year 110.2% 3 Year 27.7% 5 Year 20.2% 10 Year 15 Year Since launch 7.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 79% 2023 -8.1% 2022 0% 2021 12.2% 2020 18% 2019 34.9% 2018 21.5% 2017 -9.4% 2016 21.1% 2015 49.7% Fund Manager information for DSP World Mining Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.93 Yr. Data below for DSP World Mining Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Basic Materials 95.77% Energy 1.05% Asset Allocation

Asset Class Value Cash 3.15% Equity 96.82% Debt 0.02% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Mining I2

Investment Fund | -99% ₹180 Cr 149,227

↓ -1,163 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -1% ₹2 Cr Net Receivables/Payables

Net Current Assets | -0% ₹0 Cr 3. Edelweiss Emerging Markets Opportunities Equity Off-shore Fund

Edelweiss Emerging Markets Opportunities Equity Off-shore Fund

Growth Launch Date 7 Jul 14 NAV (26 Feb 26) ₹25.158 ↑ 0.08 (0.31 %) Net Assets (Cr) ₹191 on 31 Jan 26 Category Equity - Global AMC Edelweiss Asset Management Limited Rating ☆☆☆ Risk High Expense Ratio 1.04 Sharpe Ratio 2.68 Information Ratio -0.84 Alpha Ratio -0.75 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹8,328 28 Feb 23 ₹7,601 29 Feb 24 ₹7,963 28 Feb 25 ₹8,664 28 Feb 26 ₹13,980 Returns for Edelweiss Emerging Markets Opportunities Equity Off-shore Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month 8.8% 3 Month 22.4% 6 Month 38.5% 1 Year 58.9% 3 Year 22.4% 5 Year 7% 10 Year 15 Year Since launch 8.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 41.1% 2023 5.9% 2022 5.5% 2021 -16.8% 2020 -5.9% 2019 21.7% 2018 25.1% 2017 -7.2% 2016 30% 2015 9.8% Fund Manager information for Edelweiss Emerging Markets Opportunities Equity Off-shore Fund

Name Since Tenure Bhavesh Jain 9 Apr 18 7.82 Yr. Bharat Lahoti 1 Oct 21 4.34 Yr. Data below for Edelweiss Emerging Markets Opportunities Equity Off-shore Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Technology 27.66% Financial Services 24.86% Consumer Cyclical 12.11% Communication Services 11.31% Industrials 5.06% Energy 4.92% Basic Materials 2% Real Estate 1.66% Utility 1.05% Consumer Defensive 0.96% Health Care 0.94% Asset Allocation

Asset Class Value Cash 6.29% Equity 93.03% Other 0.4% Top Securities Holdings / Portfolio

Name Holding Value Quantity JPM Emerging Mkts Opps I (acc) USD

Investment Fund | -97% ₹185 Cr 96,682 Clearing Corporation Of India Ltd.

CBLO/Reverse Repo | -3% ₹7 Cr Net Receivables/(Payables)

CBLO | -0% -₹1 Cr Accrued Interest

CBLO | -0% ₹0 Cr 4. DSP World Energy Fund

DSP World Energy Fund

Growth Launch Date 14 Aug 09 NAV (26 Feb 26) ₹26.8335 ↓ -0.36 (-1.33 %) Net Assets (Cr) ₹103 on 31 Jan 26 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆ Risk High Expense Ratio 1.18 Sharpe Ratio 1.88 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹10,595 28 Feb 23 ₹11,615 29 Feb 24 ₹11,727 28 Feb 25 ₹11,250 28 Feb 26 ₹17,970 Returns for DSP World Energy Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month 5.9% 3 Month 18.6% 6 Month 27.2% 1 Year 56.4% 3 Year 16.2% 5 Year 12.6% 10 Year 15 Year Since launch 6.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 39.2% 2023 -6.8% 2022 12.9% 2021 -8.6% 2020 29.5% 2019 0% 2018 18.2% 2017 -11.3% 2016 -1.9% 2015 22.5% Fund Manager information for DSP World Energy Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.93 Yr. Data below for DSP World Energy Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 34.4% Technology 27.82% Utility 24.89% Basic Materials 9.25% Asset Allocation

Asset Class Value Cash 3.62% Equity 96.36% Debt 0.02% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF Sustainable Energy I2

Investment Fund | -98% ₹101 Cr 417,038 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -2% ₹2 Cr Net Receivables/Payables

Net Current Assets | -0% ₹0 Cr

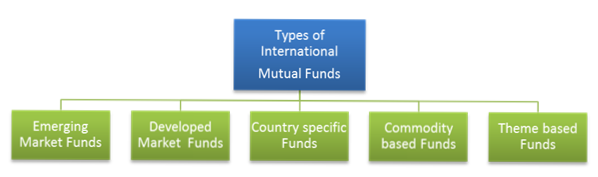

Types of International Mutual Funds

1. Emerging Market Funds

These invest in developing economies such as China, Brazil, South Korea, Taiwan and India. Emerging markets offer faster growth potential, young demographics and rising consumption — but also carry higher volatility and political risk. Examples: Franklin Asian Equity FoF, Kotak Global Emerging Market Fund.

Talk to our investment specialist

2. Developed Market Funds

These invest in stable economies like the US, Japan and Europe. Developed markets tend to be more resilient during global uncertainty and provide access to global leaders (Apple, Microsoft, Toyota, Nestlé, etc.). Examples: Motilal Oswal S&P 500 Index FoF, Nippon India Japan Equity Fund.

3. Country Specific Funds

Focused on one nation’s equity market. These are higher risk since all exposure is tied to a single economy, but can deliver strong returns if that market performs well. Examples: Kotak US Equity FoF, Mirae Asset China Advantage Fund.

4. Commodity Based Funds

Invest in commodities like gold, silver, energy or agriculture. They provide an inflation hedge and low correlation with equity. Examples: DSP World Gold Fund, Kotak Global Energy FoF.

5. Theme-Based Funds

Target a global theme — e.g., technology, healthcare, energy, real assets, or ESG. Broader than sector funds, thematic funds spread investments across multiple industries tied to the same theme. Examples: Edelweiss US Technology Equity FoF, L&T Global Real Assets Fund.

Why Invest Abroad? Main benefits

Geographic diversification — Over-concentration in any single economy raises risk; global fund spread it.

Access to global leaders & themes — Apple, Microsoft, Nvidia, Tesla, advanced semiconductor firms and global biotech companies are easier to access via international funds.

Currency hedge — If INR weakens vs USD, overseas investments gain in INR terms (on top of market returns).

Participation in long-term megatrends — AI, EVs, cloud, green energy and semiconductors have most depth outside India today.

Portfolio smoothing — Different economies and sectors often move out of sync, reducing portfolio volatility.

Key Risks to Keep in Mind

- Currency risk — A strengthening INR can erode returns in INR terms.

- Geopolitical & regulatory risk — Sanctions, trade wars or local rules can hit sectors or countries you’ve invested in.

- Higher costs — FoFs/feeder funds often carry two layers of fees (Indian AMC + overseas fund).

- SEBI / RBI caps & flow limits — At times, AMCs may pause new inflows if industry/AMC overseas headroom is full.

How Much of Your Portfolio Should Be International?

Common planner guidance for retail investors: 5–15% of total investible assets in international equities/FoFs. For more aggressive investors or HNIs who already have large domestic exposure, this can be higher. Keep the bulk in Indian equity + debt for local goals and stability. (This is a rule of thumb — adapt to risk appetite and Financial goals.)

How to Invest in International Mutual Fund Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

According to experts, an investor should have around 10-12% of the portfolio invested in international mutual funds. So with the basics covered now, start building up that portfolio with international mutual funds today.

Conclusion

International mutual funds are a convenient, regulated route for Indian investors to own global companies and themes. They provide diversification, access to non-Indian market leaders, and an effective currency hedge — but they come with tax, currency and theme-concentration risks. For most retail investors, a measured exposure (5–15%) combined with SIP discipline and a long-term view will work well.

FAQs

1. Are international mutual funds taxed like equity or debt?

A: Many international FoFs are treated as “specified mutual funds” under Section 50AA; units acquired on/after 1 April 2023 are typically taxed as short-term gains at slab rates. Check the AMC factsheet and AMFI guidance for specifics.

2. Can an Indian investor buy US ETFs directly?

A: Yes — via international brokers (Vested, INDmoney, Hatch) or by Investing in India-domiciled FoFs/ETFs that replicate US ETFs. Direct purchases are subject to LRS limits and additional compliance.

3. Which is better: NASDAQ FoF or S&P 500 FoF?

A: Nasdaq is tech-heavy (higher growth, higher volatility). S&P 500 is broader and less concentrated. Choose based on risk tolerance and time horizon.

4. Will SEBI/RBI restrict new international fund flows?

A: SEBI sets industry-level overseas headroom (historically adjustments in 2020/2021 and temporary pauses in 2022). AMCs may pause inflows if headroom is exhausted. Always check AMC notices.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Very good article I got all the required information.