Top 7 Investment Mistakes To Avoid in 2026

Investments have been an integral part of human society since its inception. Everyone invests expecting future returns. You commit your money expecting to get the returns that you could invest in your education, dream vacation, retirement plan, etc. Investments hold the potential to give you more money in the long-term. However, there are a few investment mistakes that you should avoid in your Investing journey.

Know the top 7 mistakes investors usually commit:

1. Failing to have a clear investment plan and goals

While you are investing, make sure you have clear investment goals. Take a moment of your time and plan your Financial goals well. Divide them into three major segments- short-, mid- and long-term goals. For instance- buying a vehicle can be your mid-term goal and planning for your retirement could be your long-term goal.

Goals give your right direction, and investment helps to fulfill them.

2. Confusing past returns with future expectations

Your past experience with investment may not be good, however, this doesn’t mean that your future returns may be bad too. Returns depend on inflation or any other economic changes. The future is likely to be different from your past experiences with investment and this is why you need to plan your investments wisely.

Pick companies that you think are potential to give long-term returns, stick to them. In the long-run, your investment will give good fruits.

3. Being impatient

Impatience is a common trait among investors. This causes quite a lot of panic along with financial losses. Patience is a virtue that comes with time, but should be practised while investing. Don’t compare your losses to others gains and take irrational decisions. Warren Buffet once said, “The stock market is designed to transfer money from the active to the patient.” Comparison births impatience, which can prove fatal for your money.

So, stay cool, and let your investment take time to grow.

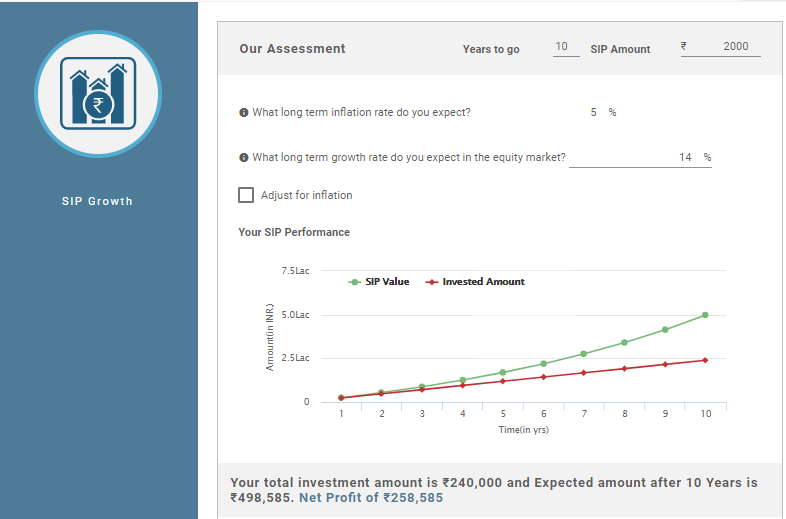

4. Expecting extremely high returns

Many treat buying stocks like buying lottery tickets and expect higher returns. It is true that people have reaped the fruits, but it isn’t the same all the time. This shouldn’t be the main reason for your investment. Sometimes the stocks can give you high returns and sometimes none. This should be borne in mind when investing.

One of the ways of understanding how a company’s stock works, you could do an analysis of the stocks over a time period. Though this isn’t indicative of the outcome it can provide a fair idea.

5. Not Diversifying

Diversification can prove to be a good tool for risk management if you use it well. It is a technique that will help reduce risk in your investment while you allocate it for different categories. Various investment experts agree that this technique helps minimise risk to a large extent.

So spread your Portfolio, invest in various assets like equities, debts, gold, etc. This will spread your returns, and reduce the risk.

Talk to our investment specialist

6. Making emotional decisions

Investing takes skills and not emotion-based decisions. Various factors affect the decision making process and emotions is fairly responsible for the outcome of these decisions. When we make decisions, we tend to make use of emotional filters to understand the situation and predict the outcome. This could also be called ‘shortcuts to making decisions’. This can cause havoc in our financial space.

Moreover, if you have had a good experience with an investment before, we may tend to buy more stock from a particular company or invest there since it gave you good returns, even this is an emotional decision. Therefore, take rational decisions based on opportunities and clear direction. Make use of technical and fundamental analysis, and study the stock of the company well.

Making emotional decisions is risky when it comes to investment.

7. Failing to review investment regularly

You have worked too hard to create your portfolio over time. You must have invested in various assets and it is important to keep a track of the market conditions and review investments from time to time. Since these are in accordance with your financial goals, reviewing your investments helps you to restore the balance for the long-period.

Implementing this habit will bring discipline, which will produce a profit over a period of time.

Conclusion

Start investing today, but make sure to create a plan before and diversify your financial goals into short-term, mid-term and long-term goals. Strike the balance with reviewing your investments from time to time to gain maximum benefits.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.