Things to Keep in Mind When Executing Company Analysis

Performing a comprehensive company analysis does consume time, of course. Just to name some - you would have to navigate through all of the financial statements, assess heaps of financial ratios, and understand the entire Industry.

To calculate the Intrinsic Value of a specific company, analyzing the fundamental variables help to a great extent. These variables comprise profit margin, sales, Depreciation, Tax Rate, finance sourcing, asset utilization, and more.

In this post, let’s figure out more about how fundamental analysis can be executed and what essential factors should be kept in mind for the same.

How to Assess a Company with Fundamental Analysis?

Here are a handful of things that shouldn’t be missed when examining Capital structure analysis of a company.

The Reality Behind Earnings

In case you are not full time into fundamental analysis but own enough stocks, you must make sure that you constantly keep an eye on real-time data pertaining to the finances of the company. Also, this data is something you must be aware of in terms of authenticity. Don’t forget to compare figures wherever they are repeating just to ensure the similarity.

Evaluating the Company’s Cash

When it comes to the Financial Structure analysis of a company, monitoring this aspect is extremely important. Before you invest even a buck, you want to rest assured that the company has enough, right? Keeping this in mind, concentrate on:

- Company’s cash on the Balance Sheet

- Cash that the company generates

- Cash that the company owes in short and long terms

Keeping a track on these variables will help avert Investing your hard-earned money in a company that may not have enough survival chances.

Talk to our investment specialist

Inspecting the Competition

Often, buying stocks of such a company that is currently doing best could be tempting. However, that is not where your work ends. Considering that companies are evolving and changing, sometimes, a rival may rise from the dust unexpectedly, making more money than expected. Thus, valuating the leaders in the industry, along with their competitors, is something you should not miss.

Ensuring You Don’t Have to Overpay

There are numerous aspects that can help you comprehend the price of a stock. What you must not forget is that stock prices are generally set through trading shares by sellers and buyers until there is a common price everybody settles upon. This is one reason why you should also assess how profitable a company is and if it has enough power to stay in business for a long time. Even if you get positive results with company analysis introduction, make sure that you don’t overpay in any manner.

Management Team and Board Members Evaluation

As an investor, you will be at the mercy of the management team to come up with accurate decisions as far as your money is concerned. You can count upon the board of directors to keep an eye on the management team. However, if you think you will not be able to trust both these teams, you must reassess the decision of investing in that company.

The Difference Between Promise and Delivery

It is completely up to you to verify promises and claims made by the company while navigating through the process of fundamental analysis. If you hear that the company’s products are selling greatly, take some time to evaluate the revenue growth and turnover. This will help you ensure how customers are buying products and paying for them. And, if the company has posted profit records, verify the claims before you make any investment.

Conclusion

Fundamental analysis is indeed powerful. However, there is a huge emphasis on financial statements as well. One weakness that you may experience here is that these financial statements could be historical documents talking about what the company did or has been doing. And, there could be difficulties in finding how the company is going to do.

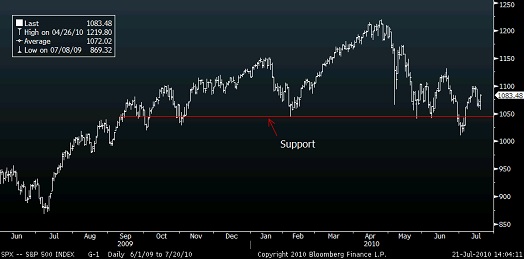

In this way, trend analysis is something you must concentrate upon. However, you must be cautious of technologies and strategies changing how company analysis takes place. So, make sure you don’t use any strategy that is obsolete.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.